Scottsdale, Ariz, January 6, 2021—Monetary Metals® is pleased to announce the issuance of a bond paying principal and interest in gold. The term is one year, and the interest rate on invested gold is 13%. According to company CEO Keith Weiner, Ph.D., it is the first proper gold bond in 87 years. The proceeds fund a loan to Western Australia gold-mining company Shine Resources, enabling the firm to put its Chameleon project into production. Monetary Metals has...

Read More »Reflections Over 2020

Wow, it has been a heckuva year! One thought leads to another on this sunny-but-cool January 1. Having watched a few seasons of Forged in Fire, I’ve gained an appreciation of how difficult it is to pound and grind a lump of steel into a blade, even with power tools. There are many ways for it to go wrong. And “wrong” generally means catastrophic failure—a crack in the metal that will cause it to break into pieces when hit. That led to thoughts regarding an...

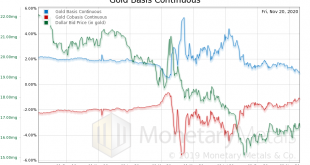

Read More »That Precious Metals Rumor Mill, 30 November

We are hearing rumors this week of a shortage of the big silver bars, the thousand-ouncers. No, we don’t refer to bullion banks saying this. Nor big dealers, who are happy to sell us as many of these as we can buy. Nor our peeps in high places (we don’t claim to have any such peeps). We refer to the usual suspects. We talk about abundance and scarcity of the metals in nearly every one of these reports, in terms of the spread between spot and futures prices. Some...

Read More »The Great Reset, 23 November

There are now two entirely different notions of a coming “reset”. One has been popular among those who speculate on the gold price. They expect a revaluation of the dollar. However, the government does not set the value of the dollar. So there is no way to reset the value. Indeed, the government has been trying to push down the value of the dollar for over a decade, and mostly failing (because increasing quantity is not the same thing as decreasing value). But that...

Read More »Yes, Virginia, There Is An Alternative, 11 November

On Monday the dollar had a ferocious rally, moving up from 15.87mg gold to 16.77mg and from 1.21g silver to 1.32g. In mainstream terms, the price of gold dropped about a hundred bucks, and the price of silver crashed $2.20. One notion we’re hearing a lot now is, “there is no alternative to stocks.” Certainly, stocks have been rallying. They were up in Sunday evening (as we reckon it here in Arizona) trading. Then Pfizer announced good news for its COVID vaccine, and...

Read More »Recovery: GDP vs MPoD, 2 November

On Wednesday last week, the price of silver dropped from over $24.25 to just a bit over $23 before bouncing back to around $23.50. The next day, the price dropped again, briefly to around $22.60 before mostly recovering (but a dime to a quarter down). Let’s look at the graph of the price and basis (i.e. abundance) action for 28 and 29 October. At the end of the day (second day), the price is about a buck lower. And the basis (i.e. abundance) is about 50bps lower....

Read More »Why These Gold Standardites Are Wrong, 13 October

On Friday, the price of silver went up from $24.25 to $25.20, or +4%. Let’s look at the graph of the price and basis (i.e. abundance) action. For the first part of the day, the action is from speculators, for the most part. Then around the time that the US west coast comes online, we see a continued rise in price but a drop in basis back to where we started. Folks, this is what buying of physical metal looks like: prices rises by about 30 cents accompanied by a drop...

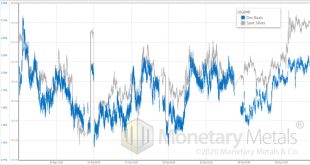

Read More »Silver Falls, We’ve Got #$*&! Mail

There was a big drop in the price of silver last Wednesday. Then the price moved up, and down, but mostly up. Let’s look at a graph of the silver price and basis showing Sep 30 through Oct 5, with intraday resolution. Let’s take a look: It’s remarkable how the basis tracks the price, until Oct 5. When basis tracks price, this means the action is primarily in the futures market. At times when the price is rising, the basis is rising—which simply means that the spread...

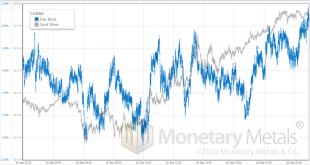

Read More »Silver Rises, JP Morgan Manipulates!

While the silver price was dropping recently, we published analyses here and here. At that time, we saw a basis that fell with price, but which recovered during “off” days. In short, there was not much of a decrease in abundance of the metal to the markets commensurate with the price drops. On Monday, the price went up from about $22.95 to about $23.70, a gain of 3.3%. Let’s look at the intraday price and basis action. There are several trends. The day begins with...

Read More »And Silver Crashes Some More! 24 Sept

A few days ago, we wrote about a big silver crash. The price dropped around 7.5%. And the basis dropped from around 2% to 0.6%. At the end, we said: “The key question is: what is the follow-through? If the price stays down and the basis goes back up, that will be a bearish signal. If the basis stays down, that means the silver market is markedly tighter at $24.50 than it was at $26.75.” Which this brings us to yesterday’s silver dive. Here’s the graph of the day’s...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org