This is a brief preview of our annual Gold Outlook Report. Every year we take an in-depth look at the market dynamics and drivers and finally, give our predictions for gold and silver prices over the coming year. Click here to download a free copy of the full Gold Outlook Report 2024. The talking heads are talking about recession, unemployment, and inflation. The same as they’ve always done, though now perhaps with a bit more urgency. Most people have...

Read More »Silver Fever, or Silver Fading?

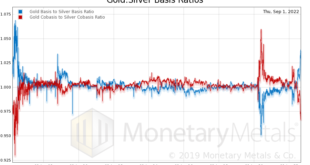

We finally had a resolution, of sorts, in silver. Since April 13, we have had a falling price of silver (indicated as a rising price of the dollar, as measured in silver). And along with this price trend, a growing scarcity of the metal to the market (i.e. the cobasis, the red line). Indeed, the price (of the dollar) and silver scarcity move with uncanny coordination. Almost as if they are linked. ? Silver Basis and the Dollar This graph goes back one year, through...

Read More »Silver Update: Scarcity Gets More Extreme

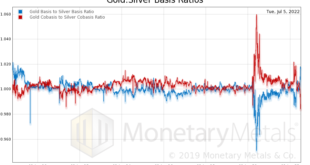

Since our last silver article, the price of silver has dropped. With due respect to Frederic Bastiat, the price is the seen. The basis mostly goes unseen. We will take a look at the market data, revised for a few more days of trading. Warren Buffett, 2008, and the Cobasis But first, let’s look at a chart we have discussed a few times over the years. It shows two ratios: gold basis to silver basis, and gold cobasis to silver cobasis. It shows a measure of gold’s...

Read More »The Silver Phoenix Market

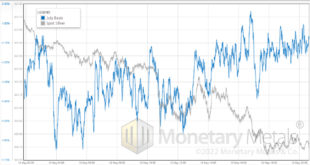

Listen to the audio version of this article here. The price of silver hit a peak over $26.50 on March 8. It spent about a month and a half breaking down, and then the bottom fell out. It’s currently down from that peak almost 8 bucks. Breaking Down Fundamental Silver Prices However, the opposite has been happening to silver’s scarcity. First, let’s look at a chart of the silver market price and the silver fundamental price. The market price is down a lot since that...

Read More »Buy Gold, Because…

The coin which helped win the gold vs bitcoin debate at the Soho Forum Photo credit: the author It’s pretty, isn’t it? Gold, Liquid Gold, and Inflation Gold has a unique appearance. It is also astonishingly heavy—much heavier than it has any right to be. It’s just an inch and a quarter in diameter yet weighs 0.075 pounds. Everyone should hold one in his hand (and own a few). But that’s not why many gold analysts today are saying you should buy gold. They are saying...

Read More »What the Heck Is Happening to Silver?!

The dollar rose this week, from 17.87mg gold to 18.24mg (that’s “gold fell from $1,740 to $1,705” in DollarSpeak), a gain of 2.1%. In silver terms, it rose from 1.61g to 1.67g (in DollarSpeak, “silver dropped from $19.24 to $18.64), or 3.7%. As always, we want to look past the market price action. Two explanations are hot today. Let’s look at them first, before moving on to our unique analysis of the basis. JP Morgan and Motte and Bailey JP Morgan’s manipulation of...

Read More »Rare Gold-Silver Crystal Sighting

Something has happened which has not occurred since 2009. The silver basis—our measure of abundance of the metal to the market—has gone way under the gold basis. This means silver is less abundant to the market than gold. Here is the picture. The blue line is the ratio of the gold basis to the silver basis (and red is the ratio of the gold cobasis—scarcity—to the silver cobasis). This condition has not occurred in recent years, because the trend has been a rising...

Read More »Will Interest Rate Hikes Fix Inflation?

Senator Elizabeth Warren and President Joe Biden claim that inflation[i] is caused by greedy corporations. And they propose to solve this problem by making the corporations pay. Whether it’s extracting a “windfall profits” tax, crushing them under even more regulation, or attacking them with antitrust enforcement, the idea is the same. They propose to harm the corporations which produce the things we need such as energy and food, which will somehow cause prices to...

Read More »The Silver Chart THEY Don’t Want You to See!

On Thursday May 12, the price of silver fell about a buck. As with every one of these big price moves, the question is: what really happened? Below is a chart of the day’s action, with price overlaid with basis. Basis = future – spot. It is a great (i.e. the only) indicator of abundance or scarcity of metal to the market. However, here we are using it for a different, simpler purpose. We want to see the relative moves in the spot price and the near futures contract...

Read More »Forensic Analysis of Fed Action on Silver Price

The last few days of trading in silver have been a wild ride. On Wednesday morning in New York, six hours before the Fed was to announce its interest rate hike, the price of silver began to drop. It went from around $22.65 to a low of $22.25 before recovering about 20 cents. At 2pm (NY time), the Fed made the announcement. The price had already begun spiking higher for about two minutes. As an aside, we wonder a bit about how they keep privileged traders from peeking...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org