Interview with Jayant Bhandari: Part I Following the publication of our last conversation with Jayant Bhandari, I received a lot of interesting feedback and remarks. The common denominator of all those comments was the astonishment of many Western readers at the real conditions and dynamics on the ground in India. In fact, I was surprised myself by how little we actually know and understand about a country so vast, so populous and so potentially influential on the world’s...

Read More »Reject the “Next Generation EU Plan”

The Václav Klaus Institute urging the Czech Government to reject the dangerous Ursula von der Leyen´s plan It is rather rare that I share articles on my channel that are not from my own pen. The following article is therefore an exception and for good reason. It is written by none other than the former President of the Czech Republic Václav Klaus, with whom I have a long-standing relationship, based on great respect and many shared values. The arguments he presents...

Read More »Reject the “Next Generation EU Plan”

The Václav Klaus Institute urging the Czech Government to reject the dangerous Ursula von der Leyen´s plan It is rather rare that I share articles on my channel that are not from my own pen. The following article is therefore an exception and for good reason. It is written by none other than the former President of the Czech Republic Václav Klaus, with whom I have a long-standing relationship, based on great respect and many shared values. The arguments he presents here are not...

Read More »Open Letter to John Taft, Report 17 Dec

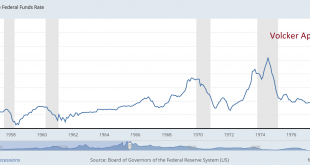

Dear Mr. Taft: I eagerly read your piece Warriors for Opportunity on Wednesday, as I often do about pieces that argue that capitalism is not working today. You begin by saying: “Financial capitalism – free markets powered by a robust financial system – is the dominant economic model in the world today. Yet many who have benefited from the system agree it’s not working the way it ought to.” Leaving aside that our financial system is not robust—the interest rate is...

Read More »Targeting nGDP Targeting, Report 3 Nov

Not too long ago, we wrote about the so called Modern Monetary so called Theory (MMT). It is not modern, and it is not a theory. We called it a cargo cult. You’d think that everyone would know that donning fake headphones made of coconut shells, and waving tiki torches will not summon airplanes loaded with cargo. At least the people who believe in this have the excuse of being illiterate. You’d think that everyone would know that printing fake money and waving bogus...

Read More »Treasury Bond Backwardation, Report 22 Sep

Something happened in the credit market this week. A Barron’s article about it began: “There have been disruptions in the plumbing of U.S. markets this week. While the process of fixing them was bumpy, it was more of a technical mishap than a cause for investor concern.” Keep Calm and Carry On So, before they tell us what happened, they tell us it’s just plumbing, it’s been fixed, and that we should not be concerned. The article asserts that the reasons for the...

Read More »Directive 10-289, Report 25 Aug

Everyone must ask himself the question. Do you want the world to move to an honest money system, or do you just want gold to go up (we italicize discussion of apparent moves in gold, because it’s the dollar that’s moving down—not gold going up—but we sometimes frame it in mainstream terms). Gold’s Going Up We have written about the tension between these two goals before. Many people start with the former. They come to gold, as they begin to realize that the dollar...

Read More »GDP Begets More GDP (Positive Feedback), Report 30 June

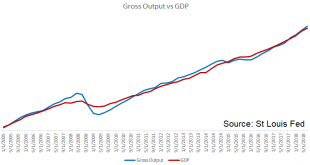

Last week, we discussed the fundamental flaw in GDP. GDP is a perfect tool for central planning tools. But for measuring the economy, not so much. This is because it looks only at cash revenues. It does not look at the balance sheet. It does not take into account capital consumption or debt accumulation. Any Keynesian fool can add to GDP by borrowing to spend. But that is not economic growth. Borrowing to Consume Today,...

Read More »What Gets Measures Gets Improved, Report 23 June

Let’s start with Frederic Bastiat’s 170-year old parable of the broken window. A shopkeeper has a broken window. The shopkeeper is, of course, upset at the loss of six francs (0.06oz gold, or about $75). Bastiat discusses a then-popular facile argument: the glass guy is making money (to which all we can say is, “plus ça change, plus c’est la même chose”). Bastiat says it is true, and this is the seen. The glazier does...

Read More »Is Capital Creation Beating Capital Consumption? Report 3 Mar

We have written numerous articles about capital consumption. Our monetary system has a falling interest rate, which causes both capital churn and conversion of one party’s wealth into another’s income. It also has too-low interest, which encourages borrowing to consume (which, as everyone knows, adds to Gross Domestic Product—GDP). What Is Capital At the same time, of course entrepreneurs are creating new capital. Keith...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org