Jay Powell’s disastrous week is coming to a close, not yet his long nightmare. He has been battling fed funds (meaning repo) for his entire tenure dating back to February 2018. This week wasn’t the conclusion to the contest, just the latest and biggest round of it. According to DTCC, the GC repo (UST) rate came back down to 1.975% today. That’s much less than the 3.000% yesterday and 6.007% on Tuesday. As yesterday, today’s unscheduled overnight repo operation received more than billion in bids, the central bank handing out the full amount of billion in reserves to the primary dealers. And because of this, the FOMC will surely declare the operations a complete success. They were not. If anything, they exposed even more flaws and fault lines, a potentially

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, 7) Markets, bonds, Collateral, currencies, economy, EFF, Featured, Federal funds, Federal Reserve/Monetary Policy, gc repo rate, jay powell, Markets, newsletter, Repo

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Jay Powell’s disastrous week is coming to a close, not yet his long nightmare. He has been battling fed funds (meaning repo) for his entire tenure dating back to February 2018. This week wasn’t the conclusion to the contest, just the latest and biggest round of it.

| According to DTCC, the GC repo (UST) rate came back down to 1.975% today. That’s much less than the 3.000% yesterday and 6.007% on Tuesday. As yesterday, today’s unscheduled overnight repo operation received more than $80 billion in bids, the central bank handing out the full amount of $75 billion in reserves to the primary dealers.

And because of this, the FOMC will surely declare the operations a complete success. They were not. If anything, they exposed even more flaws and fault lines, a potentially meaningful example for the global system to ponder as it evaluates what just happened. |

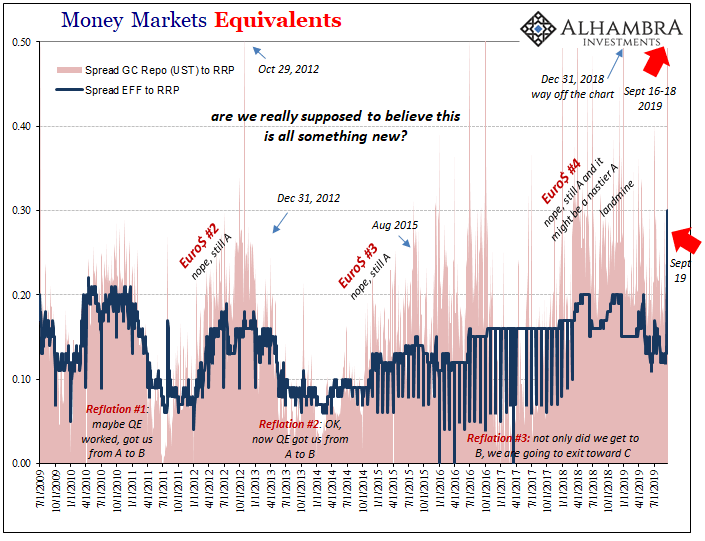

Money Markets Equivalents, 2009-2019 |

| When the chips were down and things at the most extreme, the Open Market Desk response was…lacking. That’s what participants will take away from this episode. Yet another example of why you cannot count on the Fed to provide an emergency backstop. It just doesn’t exist.

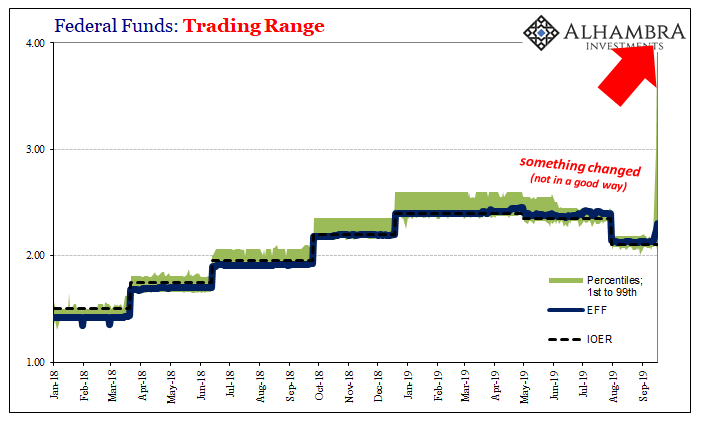

To begin with, the repo rate while lower is still elevated; it just isn’t as ridiculously elevated as it had been the past three days before today. Even at 1.975%, it remains 27.5 bps above the RRP floor – a floor that, lost in all the noise, the FOMC suddenly decides needed to be moved down. While IOER got its fourth “technical adjustment” starting today, the RRP was given its first. It was set 5 bp below the fed funds range. The lower bound of that policy range is no longer the floor for money markets. Huh? If you didn’t realize before just how much of a mess there is, that pretty well sums up the situation. Once you scroll past the platitudes and denial, you really do appreciate that what policymakers did this week was throw sh** at the wall and hope something sticks. It doesn’t quite conjure the carefully cultivated image of dispassionate, competent technocrats coolly operating the right levers at the right moments in the right amounts. |

Federal Funds: Trading Range, 2018-2019 |

They were bailed out by the mere fact this wasn’t a systemic breakdown; it was only a seasonal bottleneck.

That’s why it can be so damaging moving forward though it may not seem like it right now. Dealers have to be asking themselves, what if? As in, what if it had been a real event?

And we also cannot forget what those overnight repo operations really were. I know I’ve alternated between calling them reborn TAF and a mimic of China’s RRR’s, but systemically they are like the latter while functionally the former.

In other words, just as TAF was a bypass of the Discount Window so, too, were these overnight repo operations. The Discount Window, or what’s now called Primary Credit, still exists and like those repo operations it requires eligible collateral. Just like in 2007. And nobody will ever use it no matter how bad things get.

As I recounted earlier this summer, on August 9 of all days:

The same day the Committee voted to reduce the Primary Credit rate August 17, 2007, the old Discount Rate, officials at the central bank held a teleconference with several large supposedly rock-solid institutions proposing that they kick things off by voluntarily accessing the window. It would show the world, they actually believed, how there was nothing unusual about borrowing here…

No one cared. Despite the big show made of it, the Discount Window remained a suicidal option in the perception of the marketplace. You went there because you had to and when you did everyone would immediately know who and for how much. Transparency was supposed to be a positive, an aspect of shame as a control lever, but it had turned the emergency policy into a virtual no-go zone.

That’s ultimately what TAF was – a way to do the Discount Window without having anyone show up there. TAF was left anonymous for years for that reason along. Stigma.

The overnight repo operations this week are similarly opaque and open only to the same rock-solid institutions, primary dealers, to make a big show of everything. The FOMC presumes that the same dealers will have then offered the funds acquired, at a slight premium, to the rest of the system which really needed them.

By giving funds to the dealers only, it intends to avoid any stigma on both ends; we are assured it is big name banks who are very clearly not in trouble that are taking up these “excess” reserves, and further we will never, ever know who the dealers might have further redistributed them to on an ad hoc emergency basis.

And, also like TAF, the overnight repo operations were conducted at rates substantially below Primary Credit – in order to better insure there was sufficient profit motive for the dealers to deal in that fashion.

Except, the evidence suggests they didn’t. Again, the fed funds range. The extreme ranges this week have indicated there may be some stigma out there already; why were some firms on Tuesday, for example, bidding for fed funds up to as high as 4% even though the $53.15 billion in repos had been done beforehand? It’s not likely that was a voluntary choice.

The range yesterday, despite the full $75 billion, was still up to 2.50%.

When the music almost stopped, we don’t know who was left wondering if they had a chair available. The market does, though.

In other words, this week left everyone with far, far more questions than answers; for policymakers, too, though they will never admit it in public. That’s the big takeaway here.

Leading up to 2008, there were a series of similar small events like this (and let me be clear, I’m not claiming this is like 2008 or that this suggests a repeat) which exposed more flaws and deeper fissures with each one. And afterward, they left everyone wondering rather than being reassured especially in any official capacity of the central bank’s ability to step in as needed, when needed.

That’s why it got progressively worse; a new problem shows up, the Fed proves it can’t help, and everyone is left dazed, scratching their head thinking, what now? You begin to factor this into your practices, an itchier trigger finger and the exits which begin to look smaller and more dangerously narrow.

The next few weeks will be very interesting. How will system participants digest these events? These were further flaws merely exposed by a seasonal bottleneck everyone knew sits right on this part of the calendar. And it still happened. And still the Fed failed to account.

It was severe enough that it meant a serious amount should’ve been funneled through the Discount Window. Can you imagine what the headlines would’ve looked like on Tuesday and Wednesday if it had been?

Amid Global Recession Worries and Fed Rate Cuts, $80 billion Drawn at Discount Window!

And that’s just what the FOMC was hoping to avoid with the repo operation(s). But while they may have fooled the public into thinking these were no big deal, they sure didn’t fool anyone on the inside. System participants know exactly what went down. I have to believe that, right now, they are adjusting accordingly.

Tags: Bonds,collateral,currencies,economy,EFF,Featured,federal funds,Federal Reserve/Monetary Policy,gc repo rate,jay powell,Markets,newsletter,repo