The bond market is allegedly populated by the “smart” set, whereas those trading equities derided as the “dumb” money (not without some truth). I often wonder if it’s either/or. The fixed income system just went through this scarcely three years ago, yet all signs and evidence point to another repeat. So, how smart can Eurobond agents really be if they’ve gone and done it again? What is it? Let’s roll the clock back to the landmine of 2018. Collateral shortage,...

Read More »Collateral Shortage…From *A* Fed Perspective

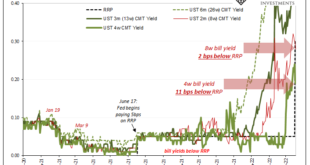

It’s never just one thing or another. Take, for example, collateral scarcity. By itself, it’s already a problem but it may not be enough to bring the whole system to reverse. A good illustration would be 2017. Throughout that whole year, T-bill rates (4-week, in particular) kept indicating this very shortfall, especially the repeated instances when equivalent bill yields would go below the RRP “floor” and often stay there for prolonged periods. There was, as I wrote...

Read More »Yield Curve Inversion Was/Is Absolutely All About Collateral

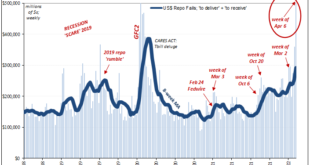

If there was a compelling collateral case for bending the Treasury yield curve toward inversion beginning last October, what follows is the update for the twist itself. As collateral scarcity became shortage then a pretty substantial run, that was the very moment yield curve flattening became inverted. Just like October, you can actually see it all unfold. According to the latest FRBNY data taken from Primary Dealers, repo fails during the week of April 6 (most...

Read More »The Fed Inadvertently Adds To Our Ironclad Collateral Case Which Does Seem To Have Already Included A ‘Collateral Day’ (or days)

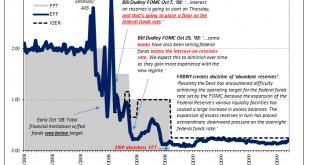

The Federal Reserve didn’t just raise the range for its federal funds target by 25 bps, upper and lower bounds, it also added the same to its twin policy tools which the “central bank” says are crucial to maintaining order in money markets thereby keeping federal funds inside the band where it is supposed to be. The FOMC voted to increase IOER from 15 bps to 40 bps, and the RRP from 5 bps to 30 bps. That RRP, or reverse repo program, is meant to be something of a...

Read More »There Is An Absolutely Solid Collateral Case For What’s Driving Curve Inversion(s) [Part 2]

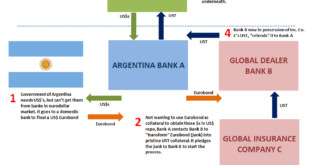

Securities lending as standard practice is incredibly complicated, and for many the process can be counterintuitive. With numerous different players contributing various pieces across a wide array of financial possibilities, not to mention the whole expanse of global geography, collateral for collateral swaps have gone largely unnoticed by even mainstream Economics and central banking. This despite the fact, yes, fact, securities lending was the epicenter of the 2008...

Read More »There Is An Absolutely Solid Collateral Case For What’s Driving Curve Inversion(s) [Part 1]

With the 7s10s already inverted, and the 5s today mere bps away, making a macro case for the distortion isn’t too difficult. Despite China’s “upside” economic data today, even the Chinese are talking more about their downside worries (shooting/hoping for “stability”) than strength. In the US or Europe, no matter the CPIs in either place there are cyclical (not just inventory) warning signs all over the place. Aside from these economic concerns, is there a pure money...

Read More »So Much Fragile *Cannot* Be Random Deflationary Coincidences

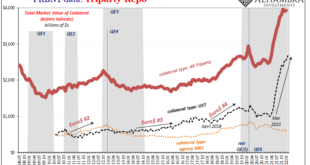

At first glance, or first exposure to this, there doesn’t seem to be any reason why all these so many pieces could be related. Outwardly, from the mainstream perspective, anyway, you’d think them random, and even if somehow correlated they’re supposed to be in the opposite way from what’s happened. Too much money, they said. It began with the Fed’s Reverse Repo (RRP) use suddenly going nuts. From seemingly out of nowhere, this was mid-March last year, and, from what...

Read More »The Curve Is Missing Something Big

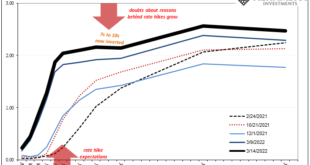

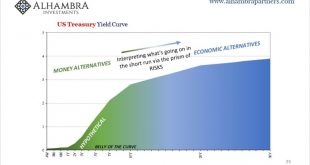

What would it look like if the Treasury market was forced into a cross between 2013 and 2018? I think it might be something like late 2021. Before getting to that, however, we have to get through the business of decoding the yield curve since Economics and the financial media have done such a thorough job of getting it entirely wrong (see: Greenspan below). And before we can even do that, some recent housekeeping at the front of the curve where bill lives. Treasury...

Read More »CPI’s At Fives Yet Treasury Auctions

A momentous day, for sure, but one lost in what would turn out to be a seemingly endless sea of them. October 8, 2008, right in the thick of the world’s first global financial crisis (how could it have been global, surely not subprime mortgages?) the Federal Reserve took center stage; or tried to. Having bungled Lehman, botched AIG, and then surrendered to Treasury which then screwed up TARP, the world’s entire financial edifice was burning down while US...

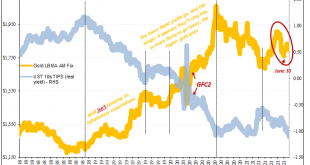

Read More »Golden Collateral Checking

Searching for clues or even small collateral indications, you can’t leave out the gold market. We’ve been on the lookout for scarcity primarily via the T-bill market, and that’s a good place to start, yet looking back to last March the relationship between bills and bullion was uniquely strong. It’s therefore a persuasive pattern if or when it turns up again. To recap the main push of last year’s acute dollar shortage: Over the past several dreadful weeks of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org