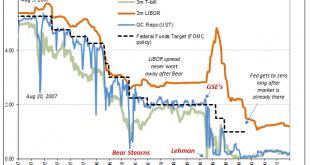

It used to be that at each quarter’s end the repo rate would rise often quite far. You may recall the end of 2018, following a wave of global liquidations and curve collapsing when the GC rate (UST) skyrocketed to 5.149%, nearly 300 bps above the RRP “floor.” Chalked up to nothing more than 2a7 or “too many” Treasuries, it was to be ignored as the Fed at that point was still forecasting inflation and rate hikes. Total financial resilience otherwise. Yesterday was,...

Read More »Tidbits Of Further Warnings: Houston, We (Still) Have A (Repo) Problem

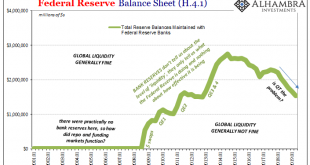

Despite the name, the Fed doesn’t actually intervene in the US$ repo market. I know they called them overnight repo operations, but that’s only because they mimic repo transactions not because the central bank is conducting them in that specific place. What really happened was FRBNY allotting bank reserves (in exchange for UST, MBS, and agency collateral) only to the 24 primary dealers. These were repos only between those entities and the Federal Reserve. It had...

Read More »Head Faking In The Empty Zoo: Powell Expands The Balance Sheet (Again)

They remain just as confused as Richard Fisher once was. Back in ’13 while QE3 was still relatively young and QE4 (yes, there were four) practically brand new, the former President of the Dallas Fed worried all those bank reserves had amounted to nothing more than a monetary head fake. In 2011, Ben Bernanke had admitted basically the same thing. But who was falling for it? The stock market, sure. Investors on Wall Street are still betting as if it will work any day...

Read More »What’s The Verdict On This Week?

Jay Powell’s disastrous week is coming to a close, not yet his long nightmare. He has been battling fed funds (meaning repo) for his entire tenure dating back to February 2018. This week wasn’t the conclusion to the contest, just the latest and biggest round of it. According to DTCC, the GC repo (UST) rate came back down to 1.975% today. That’s much less than the 3.000% yesterday and 6.007% on Tuesday. As yesterday, today’s unscheduled overnight repo operation...

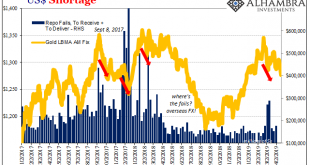

Read More »COT Blue: Distinct Lack of Green But A Lot That’s Gold

Gold, in my worldview, can be a “heads I win, tails you lose” proposition. If it goes up, that’s fear. Nothing good. If it goes down, that’s collateral. In many ways, worse. Either way, it is only bad, right? Not always. There are times when rising gold signals inflation, more properly reflation perceptions. Determining which is which is the real challenge. Corroboration and consistency are paramount. Gold had been...

Read More »Phugoid Dollar Funding

On August 12, 1985, Japan Airways flight 123 left Tokyo’s Haneda Airport on its way to a scheduled arrival in Osaka. Twelve minutes into the flight, the aircraft, a Boeing 747, suffered catastrophic failure when an aft pressure bulkhead burst. The airplane had been improperly repaired from a tailstrike (the tail of the aircraft actually hitting the runway pavement) seven years earlier, and therefore wasn’t sufficiently...

Read More »The Real End of the Bond Market

These things are actually quite related, though I understand how it might not appear to be that way at first. As noted earlier today, the Fed (yet again) proves it has no idea how global money markets work. They can’t even get federal funds right after two technical adjustments to IOER (the joke). But as esoteric as all that may be, recent corporate statements leave much less doubt at least as to the primary effect....

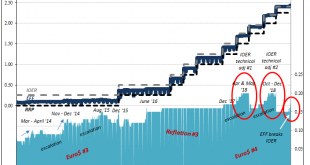

Read More »Make Your Case, Jay

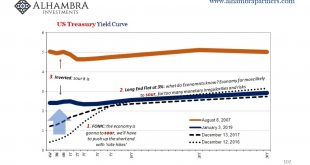

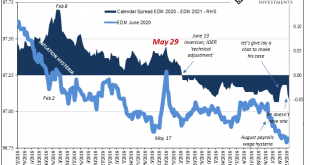

June 13 sticks out for both eurodollar futures as well as IOER. On the surface, there should be no bearing on the former from the latter. They are technically unrelated; IOER being a current rate applied as an intended money alternative. Eurodollar futures are, as the term implies, about where all those money rates might fall in the future. Still, the eurodollar curve inverted conspicuously starting June 13. That was...

Read More »Anticipating How Welcome This Second Deluge Will Be

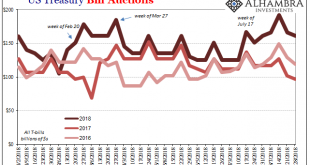

Effective federal funds (EFF) was 1.92% again yesterday. That’s now eight in a row just 3 bps underneath the “technically adjusted” IOER. If indeed the FOMC has to make another one to this tortured tool we know already who will be blamed for it. The Treasury Department announced yesterday that it will be auctioning off $65 billion in 4-week bills this week (today). The results showed that dealers submitted $152 billion...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org