If Mario Draghi wanted to wow them, this wasn’t it. Maybe he couldn’t, handcuffed already by what seems to have been significant dissent in the ranks. And not just the Germans this time. Widespread dissatisfaction with what is now an idea whose time may have finally arrived. There really isn’t anything to this QE business. But we already knew that. American officials knew it in June 2003 when the FOMC got together to savage the Bank of Japan for their lack of results. It was decided then that what the Japanese got wrong was the execution part of QE; the idea was sound, especially when anyone might be confronted by the zero lower bound, so they decided instead that what must have gone wrong was a whole host of Japan-specific missteps. There was just brief

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, 5) Global Macro, currencies, ECB, economy, EuroDollar, Featured, Federal Reserve/Monetary Policy, Mario Draghi, Markets, Monetary Policy, money printing, newsletter, NIRP, QE, ZIRP

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| If Mario Draghi wanted to wow them, this wasn’t it. Maybe he couldn’t, handcuffed already by what seems to have been significant dissent in the ranks. And not just the Germans this time. Widespread dissatisfaction with what is now an idea whose time may have finally arrived.

There really isn’t anything to this QE business. But we already knew that. American officials knew it in June 2003 when the FOMC got together to savage the Bank of Japan for their lack of results. It was decided then that what the Japanese got wrong was the execution part of QE; the idea was sound, especially when anyone might be confronted by the zero lower bound, so they decided instead that what must have gone wrong was a whole host of Japan-specific missteps. There was just brief consideration to the only other possibility – that QE doesn’t really work at all. Maybe the Japanese failed because the whole theory is flawed, therefore predicting how it would go elsewhere by establishing a track record that would get duplicated and replicated time and again across all geographical boundaries. |

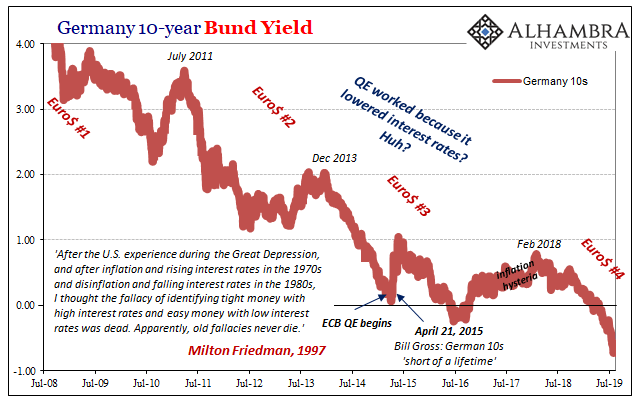

Germany 10-year Bund Yield, 2008-2019 |

| QE is the most empirically tested monetary program in history. The most its supporters can say is that maybe it reduced the so-called term premiums on bond yields. And even that little isn’t at all clear and easy; there’s more evidence against the position since bond yields don’t ever behave the way central bankers want them to.

But what else can a guy like Mario Draghi do? Europe has never left the zero lower bound, the floor of its money corridor has remained sunk underneath it for the last half decade. This already proposes failure on the part of QE and everything else that has come with it. If you can’t ever get off zero, none of this stuff works. It doesn’t keep them from trying, though. Right around the corner, any day now, they’re bound to discover that magic number, the mythical right combination of ingredients and factors that will, just in time, save the day. In the end, QE has become the same joke as socialism. |

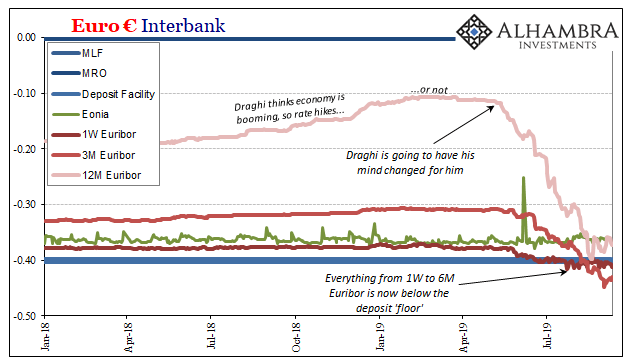

Euro Interbank, 2018-2019 |

| The proponents of the latter are fond of dismissing its massive and deadly failures as not being “real” socialism. Real socialism, they claim, has never actually been tried.

That’s what Mario Draghi is attempting to say now. He is hard at work struggling to rescue his own legacy and reputation by discovering the “real” QE. The zero lower bound will not slow this guy down. He’s already done NIRP (before QE, actually) and there’s more that can be done. His toolkit, Draghi will tell you, is far from empty. Which is already an odd proposition. NIRP was supposed to enhance QE; the latter created bank reserves or what people still call “base money” (it isn’t) and the former forced banks to use them. The entire point of the negative interest rate imposed upon the banking system was to harm banks just enough so that they have little other choice but to lend and buy risky securities in order to make back their profits. |

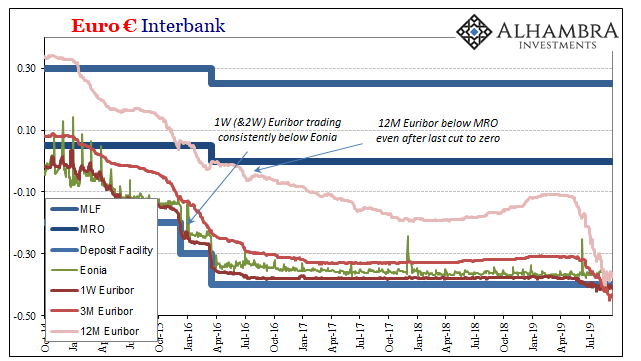

Euro Interbank, 2015-2019 |

| But banks are not entirely out of choices in that situation, however, as they have clearly demonstrated since the middle of 2014. They can simply choose not to do anything and just pay the NIRP penalty; which is just what they’ve done. What Mario Draghi and those like him, such as Christine Lagarde, never ask is why.

That might make things too uncomfortable, to hear back from the system that you’ve done such a poor job global banks in Europe and elsewhere are refusing to act because of it. So, what does the ECB do instead? They make NIRP more NIRPy by reducing the deposit floor another 10 bps, to -50 bps, but creating tiers so that banks aren’t harmed as much as they would otherwise have been without this new arrangement. |

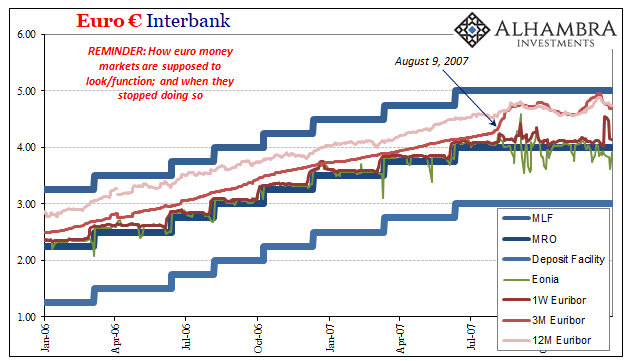

Euro Interbank, 2006-2007 |

How does that make any sense? It is plainly absurd, as I wrote several months ago:

|

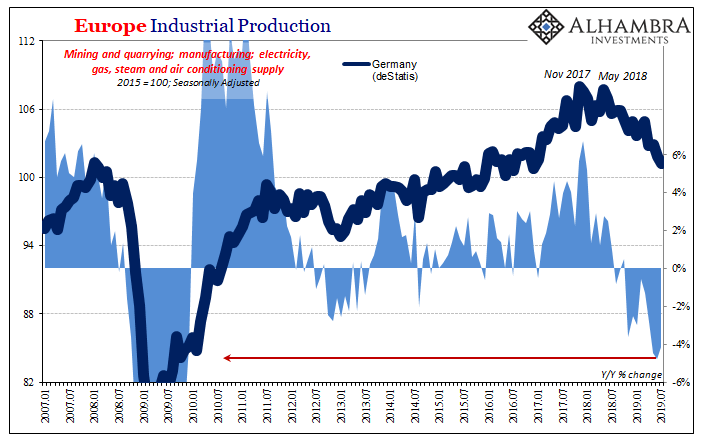

Europe Industrial Production, 2007-2019(see more posts on Eurozone Industrial Production, ) |

| They didn’t lend, so now we won’t penalize them as much because maybe our harm is too harmful, and by reducing the penalty that will get lending going again!

Just in time for another prospective recession. What’s really going on is very simple and actually straightforward. QE is nothing other than a puppet show. The overarching aim of the performance is to get you (Europeans) to believe that the ECB is actively and substantially helping the banking system. And by helping the banking system, that will mean banks will lend, create money, extend credit, buy and package risky securities, etc. All the things that would be required to get you thinking about an economic recovery. Whether or not they happen is entirely another matter. That’s it. If you believe in this scenario, as you are expected to, then the ECB actually thinks that’s where the recovery will come from. |

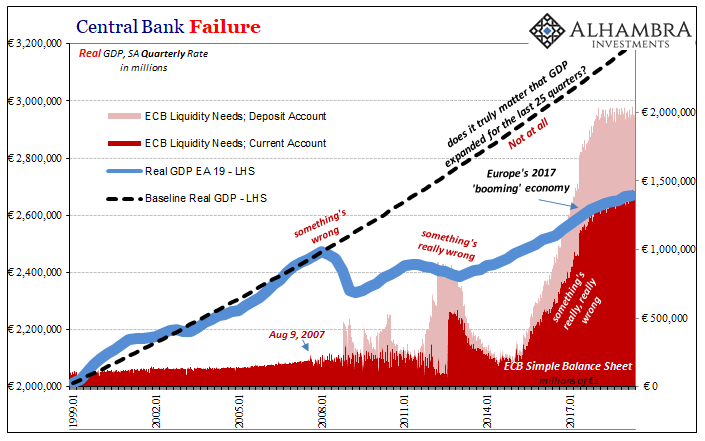

Central Bank Failure, 1999-2017 |

Monetary policy is if not a puppet show than a parlor trick, a sleight of hand. You believe in it enough so that the ends come about through nothing more than belief and acting on the belief.

To make their performance more believable policymakers think they need sound and fury, the occasional shock and awe. A whole bunch of stuff which while functionally absurd and irrelevant, to the man on the street the complexities seem impressive. More NIRP, tiers, T-LTRO’s with a reset premium, it all sounds like a lot.

And if you are impressed by all that, then QE has done its job no matter what really happens in money and banking. The only thing really going for it right now, though, is that the financial media will play it up. This stuff, no matter how ridiculous and illogical, wasteful and useless, it will be uniformly described as tremendous “accommodation” and occasionally as a “flood of money.” If nothing else, Draghi can count on his parrots.

Monetary policy is the most powerful stuff ever invented. And if you fiscal gov’t jerks had only stood with us and done something, it would’ve worked, too. https://t.co/5ymMSol8NM

— Jeffrey P. Snider (@JeffSnider_AIP) September 12, 2019

The real news today comes not from the QE part of things but in Mario Draghi seconding Christine Lagarde’s plea for a bigger boat. It’s really powerful, this monetary easing and money printing, but what Europe could really use is some major Keynes. Huh?

In view of the weakening economic outlook and the continued prominence of downside risk, governments with fiscal space should act in an effective and timely manner.

I’ve always said that if you have to repeat it, the program cannot have worked. It certainly wasn’t “quantitative” if you figure out after its over there remains a requirement for more quantity. The problem isn’t the zero lower bound, it’s that central banks are so incompetent they can never figure out they are right now powerless to get off zero. QE repeats for that reason alone. Keep doing what cannot possibly work such that the results are so poor something more will always needs to be done.

That’s Europe today.

QE is the most powerful thing a central bank has ever invented. And some day it just might work. Some day. Probably too late for Euro$ #4, though, thus the bigger boat.

Tags: currencies,ECB,economy,EuroDollar,Featured,Federal Reserve/Monetary Policy,Mario Draghi,Markets,Monetary Policy,money printing,newsletter,nirp,QE,ZIRP