There is clearly a common denominator in the kind of “solutions” that the State comes up with to deal with the problems that it caused (and that’s most problems). Not only are these remedies worse than the disease, but they are always extremely simplistic, reductionist and they never, ever, take into account anything else apart from the political “optics” and the populistic value of each new measure or piece of legislation. There is no consideration about the impact down the line,...

Read More »Debt cancellation: the new panacea?

There is clearly a common denominator in the kind of “solutions” that the State comes up with to deal with the problems that it caused (and that’s most problems). Not only are these remedies worse than the disease, but they are always extremely simplistic, reductionist and they never, ever, take into account anything else apart from the political “optics” and the populistic value of each new measure or piece of legislation. There is no consideration about...

Read More »Nine Percent of GDP Fiscal, Ha! Try Forty

Fear of the ultra-inflationary aspects of fiscal overdrive. This is the current message, but according to what basis? Bigger is better, therefore if the last one didn’t work then the much larger next one absolutely will. So long as you forget there was a last one and when that prior version had been announced it was also given the same benefit of the doubt. Most people don’t like looking to Japan mainly because it is too depressing; unless one is an Economist who...

Read More »Miracles Aren’t Shovel-Ready

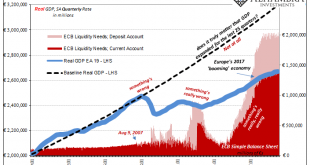

The monetary mouse. After years of Mario Draghi claiming everything under the sun available with the help of QE and the like, Christine Lagarde came in to the job talking a much different approach. Suddenly, chastened, Europe’s central bank needed assistance. So much for “do whatever it takes.” They did it – and it didn’t take. Lagarde’s outreach was simply an act of admitting reality. Having forecast an undercurrent of worldwide inflationary breakout (how...

Read More »European Data: Much More In Store For Number Four

It’s just Germany. It’s just industry. The excuses pile up as long as the downturn. Over across the Atlantic the situation has only now become truly serious. The European part of this globally synchronized downturn is already two years long and just recently is it becoming too much for the catcalls to ignore. Central bankers are trying their best to, obviously, but the numbers just aren’t stacking up their way. We’ve seen all this before, repeatedly. Part of the...

Read More »QE by any other name

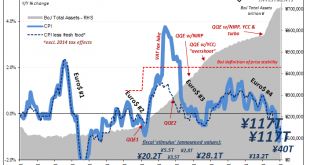

“The essence of the interventionist policy is to take from one group to give to another. It is confiscation and distribution. “ – Ludwig von Mises, Human Action In less than a year, we have witnessed an unprecedented monetary policy rollercoaster by the Federal Reserve, which began with a momentous U-turn in the central bank’s guidance in January, and has continued to escalate ever since. It is easy to forget that less than a year ago, all official statements and...

Read More »QE by any other name

“The essence of the interventionist policy is to take from one group to give to another. It is confiscation and distribution. “ – Ludwig von Mises, Human Action In less than a year, we have witnessed an unprecedented monetary policy rollercoaster by the Federal Reserve, which began with a momentous U-turn in the central bank’s guidance in January, and has continued to escalate ever since. It is easy to forget that less than a year ago, all official statements and market expectations...

Read More »QE by any other name

“The essence of the interventionist policy is to take from one group to give to another. It is confiscation and distribution. “ – Ludwig von Mises, Human Action In less than a year, we have witnessed an unprecedented monetary policy rollercoaster by the Federal Reserve, which began with a momentous U-turn in the central bank’s guidance in January, and has continued to escalate ever since. It is easy to forget that less than a year ago, all official statements and market expectations...

Read More »No Longer Hanging In, Europe May Have (Been) Broken Down

Mario Draghi can thank Jay Powell at his retirement party. The latter being so inept as to allow federal funds, of all things, to take hold of global financial attention, everyone quickly shifted and forgot what a mess the ECB’s QE restart had been. But it’s not really one or the other, is it? Once it actually finishes, the takeaway from all of September should be the world’s two most important central banks each botching their “accommodations.” It’s only a little...

Read More »The Obligatory Europe QE Review

If Mario Draghi wanted to wow them, this wasn’t it. Maybe he couldn’t, handcuffed already by what seems to have been significant dissent in the ranks. And not just the Germans this time. Widespread dissatisfaction with what is now an idea whose time may have finally arrived. There really isn’t anything to this QE business. But we already knew that. American officials knew it in June 2003 when the FOMC got together to savage the Bank of Japan for their lack of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org