The week ahead will help shape the investment climate for the remainder of the year. The highlights include three central bank meetings (Federal Reserve, Bank of Japan, and the Bank of Canada). Among the high-frequency data, the US and the eurozone report the first estimates of Q3 GDP, and the US October jobs data and auto sales will be released. Investors will also get the preliminary Oct CPI for EMU. A few hours before the FOMC meeting concludes on October 30, the US will publish its first estimate of Q3 GDP, and two days later, October jobs data and auto sales will be reported. Federal Reserve Chairman Powell has acknowledged that some of the downside risks have already materialized. Still, he has also stuck to his framing of the challenge as a mid-course

Topics:

Marc Chandler considers the following as important: 4) FX Trends, 4.) Marc to Market, autos, Brexit, Canada, ECB, Featured, Federal Reserve, GBP, Japan, jobs, newsletter, USD

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

The week ahead will help shape the investment climate for the remainder of the year. The highlights include three central bank meetings (Federal Reserve, Bank of Japan, and the Bank of Canada). Among the high-frequency data, the US and the eurozone report the first estimates of Q3 GDP, and the US October jobs data and auto sales will be released. Investors will also get the preliminary Oct CPI for EMU.

A few hours before the FOMC meeting concludes on October 30, the US will publish its first estimate of Q3 GDP, and two days later, October jobs data and auto sales will be reported. Federal Reserve Chairman Powell has acknowledged that some of the downside risks have already materialized. Still, he has also stuck to his framing of the challenge as a mid-course correction. We expect that assessment to be increasingly challenged by the economic data.

The US economy bounced back in Q1 19 to 3.1% annualized growth after a disappointing 1.1% pace in Q4 18. It slowed to 2.0% in Q2. It looks as if activity softened more in Q3. Both the Atlanta and NY Fed sees the economy tracked a little less than 2% growth, but private-sector economists see it closer to 1.5%. The weak momentum seen at the end of Q3 and some preliminary data warn that growth may slow toward 1.0% here in Q4.

The Federal Reserve is widely expected to deliver a 25 bp rate hike, the third this year. Previously, we thought the Fed would devote this meeting to addressing the plumbing issues and the transmission of policy. Instead, it made the announcement about its T-bill purchases between meetings. In our minds, this freed up the meeting to address monetary policy proper. The rate cut will likely be explained as the previous two–an insurance policy to extend the expansion made affordable by the below-target inflation.

If negative rates have not prevented Germany, the world’s fourth-largest economy, from contracting or Japan, the world’s third-largest economy, then optimism that the US can avoid an economic downturn with low(er) interest rates seems misplaced. After this week’s cut, we would look for two more by the middle of next year, when the Fed may move to the sidelines ahead of the elections.

The Federal Reserve may also still opt to introduce a permanent repo facility. That would seem to be preferable to the present ad hoc approach. It has a reverse repo facility to defend the lower end of the target range, and symmetry requires a way to inject funds into the market to protect the upper end. This is most certainly not an innovation as the Fed regularly conducted overnight repos before 2008. The same is true of the Fed’s balance sheet, which steadily grew over the past century, and none called in QE.

The US economic expansion is making two interrelated records. The duration is a record length, and in terms of robustness, it has been the weakest expansion. This performance why we think that what economists have called the” Great Moderation” is still intact: flatter and longer business cycles. This does not mean the business cycle has been repealed, and indeed the risk is that what the Fed has called “mid-course” really marks the end expansion that began ashes of the recession associated with the Great Financial Crisis.

Using a 12-month moving average of non-farm payrolls and auto sales to minimize the noise, it is clear the peak has long passed. The 12-month average of non-farm payrolls peaked in February 2015. It now stands at 179k and falling. This year’s average through September is 161k, a quarter lower than the average for the year-ago period. The median forecast in the Bloomberg survey anticipates a subdued 90k increase. We suspect the risk is on the downside, partly due to distortions by the strike against GM, which will particularly weigh on manufacturing employment.

A 12-month moving average of US auto sales peaked in February 2016 a little below 17.6 mln vehicles. The average this year through September is just below 17.0 mln, a touch slower than the year-ago period. The Bloomberg survey showed a median expectation that auto sales were around average in October. It has held up better than employment growth, but the peak is clearly in the rear-view mirror.

II

The Bank of Canada will meet earlier on October 30 before the FOMC meeting concludes. There is little chance of a move. Bank of Canada Governor Poloz has clearly signaled a steady policy. Previously, many observers, including ourselves, thought the Bank of Canada would have rates already, given the slowdown and rate cuts in the US and the other risks emanating from trade and geopolitics. We still expect these considerations to impinge on the Bank of Canada, but that might be an H1 20 story if we are right about the US economy and the Fed’s reaction function.

Investors did not appear put off by the Canadian election results in which Trudeau’s Liberals won a plurality but failed to secure a majority of seats in Parliament. We had thought a coalition government would be necessary, but Trudeau has signaled his intention to govern with a minority on a case-by-case basis. The campaign promises would imply some fiscal expansion.

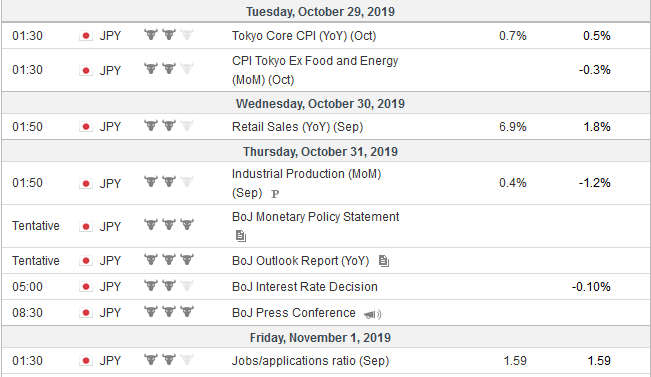

| The Bank of Japan meets the day after the Bank of Canada and the Federal Reserve. Of the three major central bank meetings, it is the most difficult to call. Between the decline in world trade, the slow down of China and the US, and the typhoon, the backdrop for what nearly everyone outside of Japan regards as folly, namely the hike in the sales tax from 8% to 10% is poor.

BOJ Governor Kuroda had seemed to signal the likelihood of action at this meeting. He admitted a few weeks ago, he was leaning closer to stimulus, and that would likely be lowering short-term rates, which is also part of the BOJ’s yield curve control strategy. However, the Tankan survey showed large business sentiment is holding up, the financial markets are relatively calm, The Nikkei and Topix are set the highs for the year last week. The market’s conviction that the BOJ would deliver a 10 bp rate cut has waned. A fortnight ago, the derivatives market appeared to have the cut fully discounted. Now, with the help of press reports suggesting that some BOJ officials are skeptical that a rate cut would have much impact, the odds have been scaled by to about 65% chance. The lack of action risk yen appreciation and the BOJ may seek to check it by altering its forward guidance. Currently, it pledges to keep rates extremely low until next spring. With inflation nowhere close its target, shifting the forward guidance from date specific to data specific is of little cost (but also likely of limited impact). |

Economic Events: Japan, Week October 28 |

| III

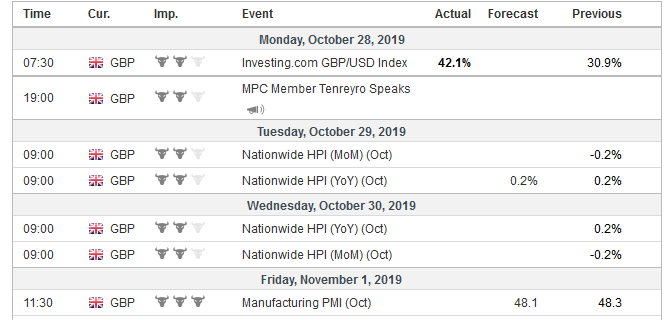

Brexit remains an open sore. The sense of fatigue is palpable, but even if the withdrawal could be agreed, there is going to be another year of negotiating the new trade relationship. Without such a new trade deal, the UK would still leave the EU with only the WTO tariff schedule, which is what has been meant by a hard Brexit. The pattern remains intact. The closer the UK government moves to a deal with the EU, the further it gets from House of Commons and vice versa. Prime Minister Johson, like his predecessor, reached an agreement with the EU, but Parliament is balking. The deal Johnson struck was only possible by offering a customs border in the Irish Sea. It did manage to pass the second reading in the House of Commons with the help of Labour MPs. The defectors, however, made it clear that their votes tactical to get the bill to a position where it could be amended. Johnson, frustrated by the House of Commons, is pushing for a snap election. His previous two efforts to get an election have been rebuffed. It needs to secure a 2/3 majority, and the Tories do not even have a simple majority. Labour leader Corbyn refuses to support Johnson’s call for snap elections until the risk of a no-deal Brexit is removed. Without the EU granting an extension, the default is for the UK to leave on October 31 with no agreement. For its part, the EU will not decide about another delay until after the UK decides about an election, a classic Catch-22. Reports indicate that France, which had blocked a different Tory-led government from joining the EU, now is the only one that wants to grant a short one-month extension rather than three that the Johnson was forced to request. Reports indicate that the Tories will seek a December 12 vote. Some Conservatives appear to have a fantasy that the Withdrawal Bill and the bill that implements it in UK statutes, can be struck before the election. This seems to be a dubious strategy as the amendments to the bill, including a possible confirming referendum or one that insists on the UK staying in the EU customs union with Northern Ireland (which was the ostensible issue that led to Johnson’s resignation as Foreign Secretary in the previous government). The opposition may also force the government to conduct an analysis of the economic impact on the belief it will show that the UK will be economically (GDP per capita) worse off. |

Economic Events: United Kingdom, Week October 28 |

| The optimism and position adjustments that fueled the surge in sterling from $1.22 on October 10 to above $1.30 on October 21 is exhausted. Sterling was near one-week lows (~$1.28) before the weekend, and further losses are likely next week. We suspect there is potential toward $1.26. Similarly, the euro appears to have carved out a bottom against sterling near GBP0.8575. A move above GBP0.8675 targets the GBP0.8800 area.

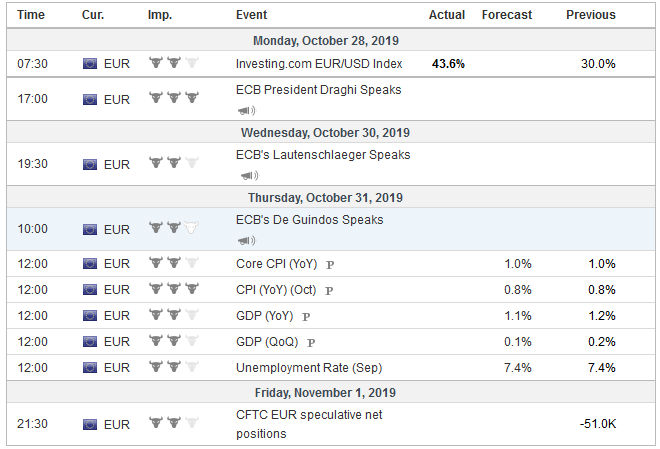

Three eurozone developments will be on investors’ radar screens next week. On October 31, Q3 GDP and the preliminary October CPI will be reported. The data are expected to be soft. Growth was halved in Q2 from the 0.4% pace in Q1. It is expected to be halved again in Q3 to 0.1%. Many economists, including the Bundesbank itself, anticipates the second consecutive quarterly contraction in Europe’s largest economy (German GDP is not reported until November 14). The year-over-year pace may slow to 1.1%, which would be the weakest since Q4 2013. Price pressures in the eurozone of muted. Headline inflation is expected to have slowed in October to a 0.7% year-over-year pace from 0.9%. This would be a fresh three-year low. The target is close to 2%. The base effect suggests favorable year-over-year comparisons for the November-January period. The ECB does talk about underlying inflation and the core, which excludes food and energy, is a reasonable proxy. The core may be steady at 1.0%, which is also a three-year low. The ECB’s new policy initiatives begin being implemented next week. This includes the resumption of purchases of sovereign bonds. The euro-system will begin its 20 bln euro purchases a month on October 30. Given the two-day settlement, the ECB’s balance sheet will start expanding on November 1. It will also introduce the tiering of the negative 50 bp deposit rate, which means in practice that about 800 bln euros on deposit at the ECB will no longer be subject to negative interest rates. At his last press conference, Draghi reinforced the assessment provided by the ECB chief economist Lane, that the self-imposed limits on holdings will not be bumped up against for at least a year. Lastly, we note a couple of local elections that may influence sentiment. In Germany, the junior coalition party, the SPD, which has seen in fortunes in the national elections suffer, is going to begin its leadership contest. This is potentially important because what could be a growing faction wants to leave the coalition and see to rebuild its connection with its base. There is a state election in Thuringia, where a center-left coalition governs (the Left Party, the SPD, and Greens). The CDU and AfD are running neck-to-neck, according to the polls. Italy’s Umbria also holds elections. It is interesting because it will be the first local election since the new 5-Star Movement-Democrat Party national coalition was formed. Umbria has only been governed by the left in some fashion since regional elections began nearly half a century ago. League leader Salvini, who seemingly overplayed his hand and pulled out for the government and unsuccessfully pushed for national elections, is expected to do well. Recent polls showed the League with a few percentage point lead. |

Economic Events: Eurozone, Week October 28 |

Tags: #GBP,#USD,autos,Brexit,Canada,ECB,Featured,federal-reserve,Japan,jobs,newsletter