Overview: We came into this week expecting the dollar to rise on the back of a recovery in rates. The two-year note has risen from 4.40% after the jobs report to 4.60%. The dollar's rise has been less impressive. The Dollar Index had begun with week with a six-day fall in tow. Today is it is rising for the third session. However, the gains have been a modest 0.80% off the pre-weekend lows. The dollar broadly is consolidating in narrow ranges thus far today in quiet...

Read More »The Dollar Comes Back Bid

Overview: It has taken some time, but the dollar has found better traction. It traded above JPY135 for the first time since mid-March and yesterday's setback has been mostly recouped against the other G10 currencies. Sterling is the most resilient after higher-than-expected inflation. Equities are lower. Japan's Nikkei snapped an eight-day advance and most of the other large bourses in the region (except Australia and South Korea) fell. Europe's Stoxx 600 is off by...

Read More »Weekly Market Pulse: Look Up In The Sky! It’s A UFO! Or Not!

As I sit here writing this Sunday afternoon, the US has just shot down a third UFO in the last 3 days in addition to the Chinese “weather” balloon last week. I have no insight into what these things might be but I do wonder if we haven’t declared war on the National Weather Service. The federal government has become so sprawling that it could easily be the case that NORAD has no idea what the NWS has up in the air. And with all the UFO shooting going on, the NWS...

Read More »FX Daily, June 02: The Dollar Snaps Back

Swiss Franc The Euro has risen by 0.13% to 1.0965 EUR/CHF and USD/CHF, June 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar is enjoying broad, even if not large, gains today following yesterday’s recovery from three-year lows against sterling and four-year lows against the Canadian dollar. The greenback is firmer against all the major currencies. The Australian and New Zealand dollars the...

Read More »FX Daily, February 18: Markets Chill

Swiss Franc The Euro has risen by 0.14% to 1.0831 EUR/CHF and USD/CHF, February 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The bout of profit-taking in equities continued today, and most markets in Asia Pacific and Europe are lower. China’s markets re-opened but struggled to sustain early gains. However, the Shanghai Composite rose by about 0.5%, and a smaller increase was recorded in Taiwan and an even...

Read More »FX Weekly Preview: Fed’s Mid-Course Correction to be Challenged while ECB Resumes Bond Purchases

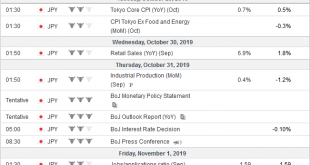

The week ahead will help shape the investment climate for the remainder of the year. The highlights include three central bank meetings (Federal Reserve, Bank of Japan, and the Bank of Canada). Among the high-frequency data, the US and the eurozone report the first estimates of Q3 GDP, and the US October jobs data and auto sales will be released. Investors will also get the preliminary Oct CPI for EMU. A few hours before the FOMC meeting concludes on October 30,...

Read More »FX Daily, May 17: China Questions US Sincerity

Swiss Franc The Euro has risen by 0.04% at 1.1285 EUR/CHF and USD/CHF, May 17(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Since the presidential tweets on May 3, the US had the initiative in the negotiations with China, but today, China has pushed back. It is cool to the idea promoted by the US that trade talks will resume shortly. Now it may take the...

Read More »New Patterns of Disturbance

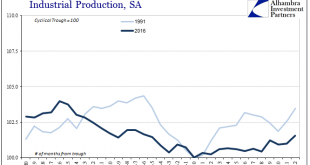

Having finally established that the economy of the “rising dollar” was appreciably worse than first estimated, we can turn our attention back toward figuring out what that means for the near future and beyond. According to the latest estimates for Industrial Production, growth has returned but in the same weird asymmetric sort of way that is actually common for the past decade. Year-over-year IP expanded by 1.5% in...

Read More »Market Impact of a Trump Presidential Win

The probability of Republican Donald Trump winning the U.S. presidential election on November 8 seems remote at the moment—economists on Credit Suisse’s Global Markets team put it at less than 10 percent. So if it did happen, it would come as a major surprise for financial markets. The last time that kind of seemingly low-likelihood event came to pass—during last June’s Brexit vote—most investors were caught wrong-footed. So how might they best prepare for something as unexpected as President...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org