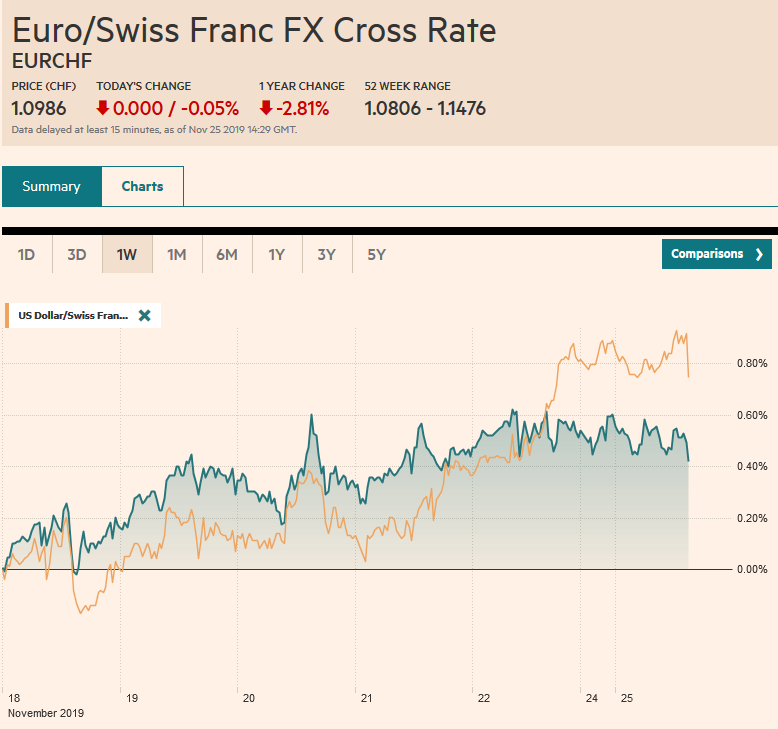

Swiss Franc The Euro has risen by 0.18% to 1.0997 EUR/CHF and USD/CHF, November 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The combination of the victory of the pro-democracy movement in Hong Kong and an apparent concession by China on intellectual property rights is helping bolster risk appetites to start the week. Equities are higher. Hong Kong’s Hang Seng led Asia Pacific equities with a 1.5% gain, the second biggest this month. Korea and India’s bourses also gained more than 1%. Europe’s Dow Jones Stoxx 600 is up about 0.75% through the morning sessions, and US shares are also trading with an upside bias. Core benchmark 10-year bond yields have edged higher, as have Chinese and Korean yields.

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, China, Currency Movement, EUR/CHF, Featured, FX Daily, Germany, Hong Kong, newsletter, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.18% to 1.0997 |

EUR/CHF and USD/CHF, November 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The combination of the victory of the pro-democracy movement in Hong Kong and an apparent concession by China on intellectual property rights is helping bolster risk appetites to start the week. Equities are higher. Hong Kong’s Hang Seng led Asia Pacific equities with a 1.5% gain, the second biggest this month. Korea and India’s bourses also gained more than 1%. Europe’s Dow Jones Stoxx 600 is up about 0.75% through the morning sessions, and US shares are also trading with an upside bias. Core benchmark 10-year bond yields have edged higher, as have Chinese and Korean yields. Japan and the Antipodean yields eased. The dollar is mixed. Sterling is leading the major advancers, gaining around 0.4% (~$1.2880). The dollar-bloc currencies and the Swedish krona are firmer, while the euro, yen, and Norwegian krone are nursing small losses. Oil is steady. Gold is heavy and looks poised to test the month’s low near $1445. |

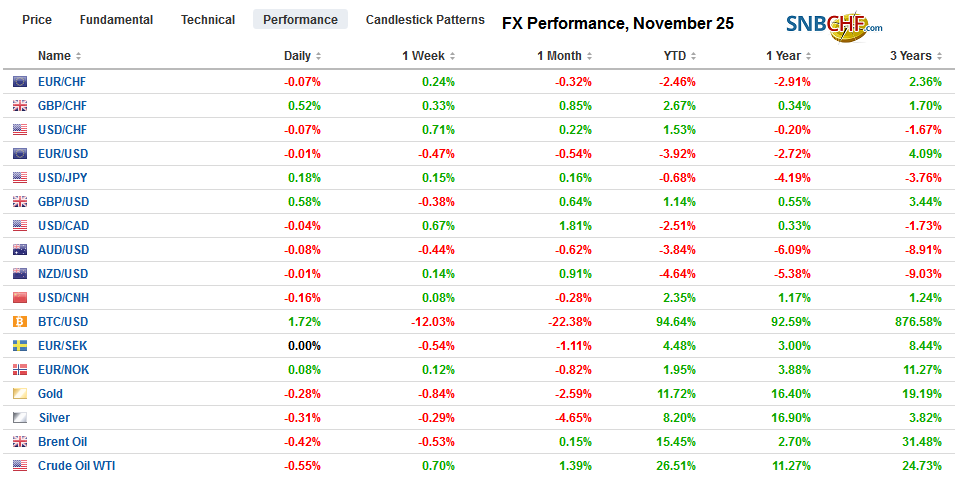

FX Performance, November 25 |

Asia Pacific

Beijing announced it would raise the penalties on violations of intellectual property. It is also into lowering thresholds for criminal punishments for such violations and making it easier for the victims to receive compensation. On the surface, this may look like a concession to the US, which has been pressing hard for greater protection is intellectual property rights. Yet, the problem is often not that China has the wrong laws, but that the laws are not enforced. The contradiction is between the declaratory policy (what it says) and operational policy (what it does).

Hong Kong’s pro-democracy forces scored a stunning victory in yesterday’s election. It appears to have won about 85% of the 452 seats that were contested compared with about a quarter in the last election in 2015. There was a recover voter turnover, nearly twice the 2015 turnout. While this is clearly a rebuke of the HK government and China, the district council seats are not sufficient in themselves to enact fundamental change. It nevertheless lays the foundation for next year’s Legislative Council elections, for which the popular vote selects half the members.

The IMF called on the Japanese government and the Bank of Japan to step-up their cooperation while endorsing Prime Minister Abe’s fiscal plans (supplemental budget in light of the sales tax increase and typhoon). It suggested that the BOJ target shorter-term rates while cutting its purchases of longer-term bonds to steepen the yield curve. The IMF also suggested the central bank adopt a target-range for inflation as opposed to a point-target to enhance its flexibility, and repeated its call for structural reforms. It shaved this year’s GDP forecast to 0.8% from 0.9%. The IMF forecasts 2020 growth of 0.5%, which is what it estimates trend growth.

The dollar firmed to five-day highs against the yen near JPY108.90 in Asia before consolidating in the European morning. The intraday technicals are a bit stretched, and it is not clear the market is ready to challenge the month’s high set near JPY109.50 on November 7. The Australian dollar is also in a narrow range. t tried pushing above $0.6800 but was turned back and is quiet near $0.6785. The November low is near $0.6770. The Chinese yuan edged a little higher, but the greenback remained on the CNY7.03-handle.

Europe

The November German IFO survey lends support to ideas that the world’s fourth-largest economy has begun stabilizing. The overall assessment by investors ticked up to 95.0 from a revised 94.7 (was 94.6) in October. It has not fallen since August, though gains are modest. The expectations component rose to 92.1 from 91.6 (revised from 91.5). It is the second consecutive month of improvement, something not seen since 2017. The assessment of the current conditions, however, remains in the trough. It stands at 97.9, having bottomed in August at 97.4.

With little fanfare, Moody’s downgraded the outlook for German banks from stable to negative. It warned that profitability and overall creditworthiness are likely to weaken further over the next 12-18 months. Its concerns are widely shared. A day before Moody’s announcement, the ECB identified weak bank profitability as one of the biggest threats to EMU growth. Moody’s recognized that the weak trade outlook had knock-on effects for several key industries, including autos, parts, ad chemicals. On the same day, Moody’s report, the German Bundesbank, cautioned that credit risks were being underestimated.

Half a dozen polls show the Tories with at least a ten percentage point lead over Labour as the campaigns turn to the homestretch ahead of the December 12 election. The Liberal Democrats and Brexit have generally seen their support slip. Labour appears to be counting on a strong turnout of young first-time voters. However, the markets are anticipating that Johnson remains the Prime Minister. A Tory victory is expected to lift sterling toward $1.35 or so. We remain concerned that a no-deal Brexit at the end of next year remains a distinct possibility. Separately, Uber was denied an operating license in London. It was denied a license in September 2017 and engaged in a protracted struggle before winning a reprieve. In September is was granted a two-month extension that expires today. The ride-hailing service will continue to operate as it appeals today’s decision. The ostensible problem is with uninsured and unauthorized drivers.

The euro has marginally extended the pre-weekend losses and is edging closer to the chart support around $1.10. The low for the month was set on November 14, near $1.0990. There is a 565 mln euro option struck at $1.1035, just above the session high, which expires today. Sterling, on the other hand, is firm, but within the range set before the weekend. The pre-weekend high was set near $1.2930. The intraday technicals are stretched as sterling approaches the $!.29 area where a GBP323 mln option is struck, which also expires today.

America

President Trump has an important decision to make this week. Will he sign the Hong Kong bills that passed Congress with near unanimity? If he vetoes them and Congress overrides the veto, will China still recognize it as crossing a redline? Ironically, China is defending the special trade privileges that the US grants the Special Administrative Region. It does not accept that the mainland’s relations with Hong Kong are a fair reason to abrogate the deal, which incidentally generated a $38 bln trade surplus for the US last years. Trump has another decision to be made in the coming weeks, and that is what do about the roughly $160 bln of imports from China that are threatened with a 15% tariff on December 15. Last month’s tariffs were suspended, and Trump has both suggested that the December 15 tariffs could be suspended and that if not agreement is reached, he will hike the tariffs.

Canada’s rail strike that began last Tuesday involving 3200 conductors and yard operators is starting to paralyze economic activity. Wheat, oil, and aluminum that move by rail are being stymied. This is impacting exports as well as shipments of propane, used for heat, domestically. The union argues that the railways were engineering the propane shortage to force the government to intervene. If the strike lasts until the end of next week, when Parliament returns, the strike could shave a quarter of one percent off Q4 GDP according to some estimates. Roughly a fifth of Canada’s exports, which are around 30% of GDP is carried by rail.

The US reports the Chicago Fed’s National Activity Index and the Dallas Fed’s manufacturing survey. Both are expected to have improved sequentially but still be in contracting mode. Federal Reserve Chairman Powell speaks after the US market close, but before Tokyo opens on Tuesday. Powell’s views are clear, and no one really expects the Fed to change rates at next month’s FOMC meeting (December 11). It is a holiday-shortened week for US markets, though a rather busy week after today for high-frequency economic reports. Canada’s wholesales trade (September) does not move the markets. The highlight of the week is Q3 GDP at the end of the week. The median forecast in the Bloomberg survey is for a 1.3% annualized expansion, down from 3.7% in Q2. Mexico reports its final estimate of Q3 GDP today. It had previously estimated growth of 0.1% quarter-over-year and minus 0.4% year-over-year (not seasonally adjusted). Mexico’s central bank has cut rates three times here in the second half. It meets again on December 19. Many are looking for another cut, but it is a close call.

The US dollar recovered from about CAD1.3255 to CAD1.3300 before the weekend. It is hovering around that high today. Last week’s high was near CAD1.3330, and we look for a push above there to test last month’s high close to CAD1.3350. That said, the technical indicators are getting stretched. The dollar has slipped to a four-day low near MXN19.3150 against the Mexican peso. In Europe, it has climbed back to MXN19.3830. The intraday technicals are extended, and initial resistance near MXN19.40 may keep the greenback in check, pending other developments. The Dollar Index is consolidating near its pre-weekend highs around 98.30. The 98.50 area was the best it has seen this month. Above there, resistance is seen near 98.70.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,China,Currency Movement,EUR/CHF,Featured,FX Daily,Germany,Hong Kong,newsletter,USD/CHF