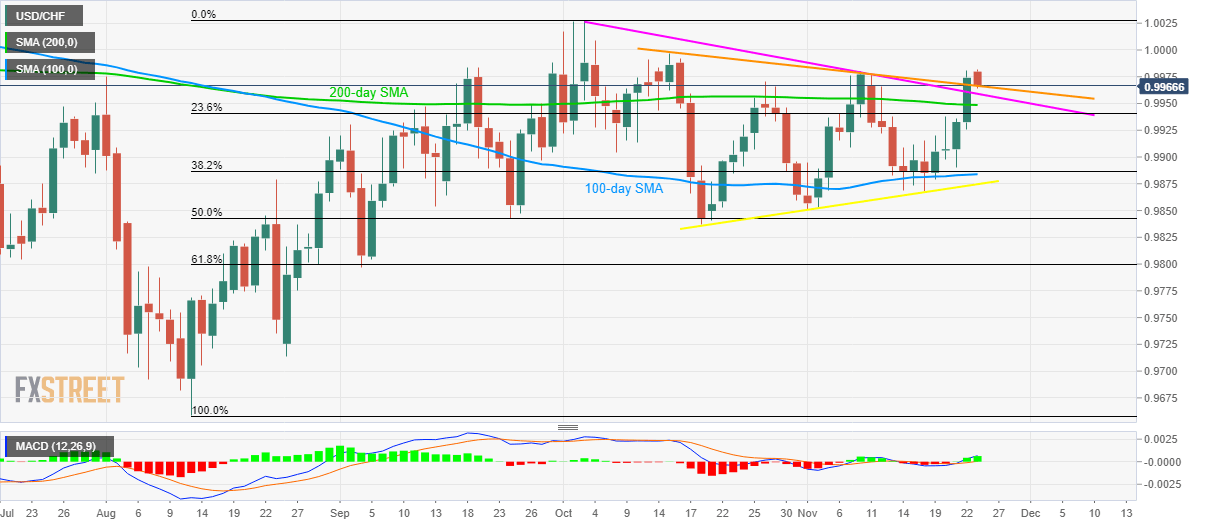

USD/CHF pulls back from six week high. Falling trend line since early October, 200-day SMA keeps buyers hopeful. An upside beyond mid-October high could escalate pair’s run-up towards the previous month high. USD/CHF fails to hold the recent trend line breakout while declining to 0.9970 during early Monday. Even so, the quote stays beyond a multi-week-old falling support-line, at 0.9960, while also trading above 200-day Simple Moving Average (SMA) level of 0.9948. As a result, buyers can still wait for an upside break of 1.0000 mark before liquidating their longs. In that case, October month high around 1.0030 and late-May top near 1.0100 will be on their radars. On the downside, pair’s declines below 200-day SMA level of 0.9948 will target 0.9900 round-figure

Topics:

Anil Panchal considers the following as important: 1.) FXStreet on SNB&CHF, 1) SNB and CHF, Featured, newsletter, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- USD/CHF pulls back from six week high.

- Falling trend line since early October, 200-day SMA keeps buyers hopeful.

- An upside beyond mid-October high could escalate pair’s run-up towards the previous month high.

| USD/CHF fails to hold the recent trend line breakout while declining to 0.9970 during early Monday.

Even so, the quote stays beyond a multi-week-old falling support-line, at 0.9960, while also trading above 200-day Simple Moving Average (SMA) level of 0.9948. As a result, buyers can still wait for an upside break of 1.0000 mark before liquidating their longs. In that case, October month high around 1.0030 and late-May top near 1.0100 will be on their radars. On the downside, pair’s declines below 200-day SMA level of 0.9948 will target 0.9900 round-figure whereas a confluence of 100-day SMA and 38.2% Fibonacci retracement of August-October upside, around 0.9987/83, could keep further declines limited. If bears dominate below 0.9983, an upward sloping trend line since October 18, at 0.9875 will be the key as a break of which could recall the previous month low near 0.9835 to the charts. |

USD/CHF daily chart(see more posts on USD/CHF, ) |

Trend: Pullback

Tags: Featured,newsletter,USD/CHF