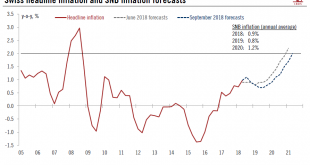

The Swiss National Bank has revised down its medium-term forecast for consumer inflation. We still expect a first SNB rate hike in September 2019. At the end of its quarterly monetary assessment meeting, the Swiss National Bank (SNB) left its main policy rates unchanged. Also unchanged from the last quarterly meeting in June was the central bank’s assessment of the Swiss franc as “high valued” and its characterisation...

Read More »Cut to Swiss inflation forecast

The Swiss National Bank has revised down its medium-term forecast for consumer inflation. We still expect a first SNB rate hike in September 2019.At the end of its quarterly monetary assessment meeting, the Swiss National Bank (SNB) left its main policy rates unchanged. Also unchanged from the last quarterly meeting in June was the central bank’s assessment of the Swiss franc as “high valued” and its characterisation of the situation on foreign exchange as “fragile”. The SNB emphasized that...

Read More »Buying more time

Switzerland: monetary policy At its quarterly monetary policy assessment last week, the Swiss National Bank (SNB) kept unchanged the target range for the three-month Libor at between -1.25% and -0.25% and the interest rate on sight deposits at a record low of -0.75%. The SNB reiterated its willingness to intervene in the foreign exchange market if needed. The central bank’s assessment of the Swiss franc also remained...

Read More »Too early for Switzerland’s central bank to change policy…

…but it could start tightening at the end of this yearAt its latest quarterly monetary policy assessment unveiled today, the Swiss National Bank (SNB) maintained its accommodative monetary policy. The target range for the 3-month Libor was kept between -1.25% and -0.25%, the interest rate on sight deposits with the SNB was maintained at a record low of -0.75%, and the central bank reiterated its willingness to intervene in the foreign exchange market if needed.Importantly, the central...

Read More »Too early for Switzerland’s central bank to change policy…

…but it could start tightening at the end of this year. At its latest quarterly monetary policy assessment unveiled today, the Swiss National Bank (SNB) maintained its accommodative monetary policy. The target range for the 3-month Libor was kept between -1.25% and -0.25%, the interest rate on sight deposits with the SNB was maintained at a record low of -0.75%, and the central bank reiterated its willingness to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org