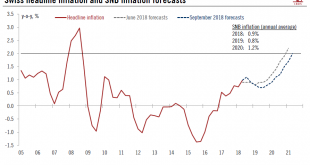

The Swiss National Bank has revised down its medium-term forecast for consumer inflation. We still expect a first SNB rate hike in September 2019. At the end of its quarterly monetary assessment meeting, the Swiss National Bank (SNB) left its main policy rates unchanged. Also unchanged from the last quarterly meeting in June was the central bank’s assessment of the Swiss franc as “high valued” and its characterisation...

Read More »Cut to Swiss inflation forecast

The Swiss National Bank has revised down its medium-term forecast for consumer inflation. We still expect a first SNB rate hike in September 2019.At the end of its quarterly monetary assessment meeting, the Swiss National Bank (SNB) left its main policy rates unchanged. Also unchanged from the last quarterly meeting in June was the central bank’s assessment of the Swiss franc as “high valued” and its characterisation of the situation on foreign exchange as “fragile”. The SNB emphasized that...

Read More »Europe chart of the week – Swiss franc

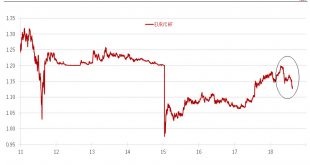

Recent foreign exchange movements pave the way for a cautious SNB monetary policy.In April, the EUR/CHF rate (1 euro in Swiss franc) hit its highest level since the Swiss National Bank (SNB) decided to lift its exchange rate floor in January 2015. Since then, the Swiss franc has appreciated by 5.8% against the euro, mainly driven by political uncertainty in Italy and concerns that Turkey’s economic troubles could impact European banks.Movements in the foreign exchange (FX) markets are...

Read More »The ‘Frankenshock’, two years on

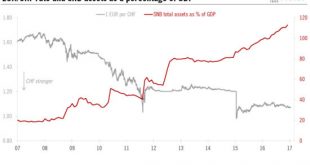

The Swiss economy has proved more resilient than expected to the sudden appreciation of the Swiss franc in January 2015, but negative deposit rates could remain in place through 2017.On 15 January 2015, the Swiss National Bank (SNB) decided to discontinue the minimum exchange rate of CHF1.20 per euro introduced in September 2011. The SNB’s announcement came as a shock for the Swiss economy, and resulted in a sharp appreciation of the Swiss franc. But two years later, the Swiss economy has...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org