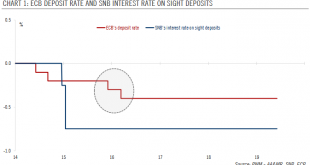

With the ECB and the Fed both signalling their readiness to provide further stimulus, the Swiss National Bank is unlikely to have smooth sailing over the coming months. How the Swiss National Bank (SNB) reacts to further stimulus by its US and European counterparts will be the key focus of the coming months for investors. We believe that the Swiss central bank will be reluctant to cut rates in direct response to the...

Read More »Swiss monetary policy – it’s (almost) all about the Swiss franc

With the ECB and the Fed both signalling their readiness to provide further stimulus, the Swiss National Bank is unlikely to have smooth sailing over the coming months.How the Swiss National Bank (SNB) reacts to further stimulus by its US and European counterparts will be the key focus of the coming months for investors. We believe that the Swiss central bank will be reluctant to cut rates in direct response to the ECB, especially in the case of a small 10 basis point deposit rate cut by the...

Read More »Swiss Policy Mix Review

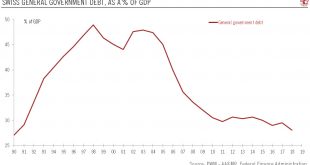

Despite a record of federal budget surpluses, don’t count on fiscal policy to relieve pressure on the SNB The Swiss federal budget is governed by a strict expenditure rule, which is enshrined in the Constitution. Since its introduction, the ratio of public debt-to-GDP has been significantly reduced, falling back to its early-90’s level. At the close of 2018, the Swiss federal budget registered a significant surplus of...

Read More »Swiss policy mix review

Despite a record of federal budget surpluses, don't count on fiscal policy to relieve pressure on the SNBThe Swiss federal budget is governed by a strict expenditure rule, which is enshrined in the Constitution. Since its introduction, the ratio of public debt-to-GDP has been significantly reduced, falling back to its early-90’s level. At the close of 2018, the Swiss federal budget registered a significant surplus of CHF 2.9 billion, compared with budget projections for a surplus of CHF 295...

Read More »Surprise contraction in Swiss Q3 GDP

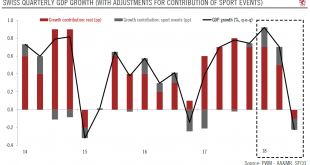

Switzerland’s growth unexpectedly contracted in the third quarter, pushing down our GDP growth forecast. Recent softening in the euro area also casts doubts about the pace of monetary tightening by the SNB.The strong growth enjoyed by the Swiss economy since Q1 2017 came suddenly to an end in Q3 18, when real GDP shrank unexpectedly by 0.2% q-o-q (-0.9% q-o-q annualised). This is much lower than consensus expectations of +0.4% and is down from an average of +0.8% in H1 2018.Details show that...

Read More »Surprise contraction in Swiss Q3 GDP

Switzerland’s growth unexpectedly contracted in the third quarter, pushing down our GDP growth forecast for 2018. Recent softening in the euro area also casts doubts about the pace of monetary tightening by the SNB. The strong growth enjoyed by the Swiss economy since Q1 2017 came suddenly to an end in Q3 18, when real GDP shrank unexpectedly by 0.2% q-o-q (-0.9% q-o-q annualised). This is much lower than consensus...

Read More »Cut to Swiss inflation forecast

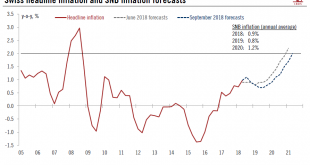

The Swiss National Bank has revised down its medium-term forecast for consumer inflation. We still expect a first SNB rate hike in September 2019. At the end of its quarterly monetary assessment meeting, the Swiss National Bank (SNB) left its main policy rates unchanged. Also unchanged from the last quarterly meeting in June was the central bank’s assessment of the Swiss franc as “high valued” and its characterisation...

Read More »Cut to Swiss inflation forecast

The Swiss National Bank has revised down its medium-term forecast for consumer inflation. We still expect a first SNB rate hike in September 2019.At the end of its quarterly monetary assessment meeting, the Swiss National Bank (SNB) left its main policy rates unchanged. Also unchanged from the last quarterly meeting in June was the central bank’s assessment of the Swiss franc as “high valued” and its characterisation of the situation on foreign exchange as “fragile”. The SNB emphasized that...

Read More »Too early for Switzerland’s central bank to change policy…

…but it could start tightening at the end of this yearAt its latest quarterly monetary policy assessment unveiled today, the Swiss National Bank (SNB) maintained its accommodative monetary policy. The target range for the 3-month Libor was kept between -1.25% and -0.25%, the interest rate on sight deposits with the SNB was maintained at a record low of -0.75%, and the central bank reiterated its willingness to intervene in the foreign exchange market if needed.Importantly, the central...

Read More »Too early for Switzerland’s central bank to change policy…

…but it could start tightening at the end of this year. At its latest quarterly monetary policy assessment unveiled today, the Swiss National Bank (SNB) maintained its accommodative monetary policy. The target range for the 3-month Libor was kept between -1.25% and -0.25%, the interest rate on sight deposits with the SNB was maintained at a record low of -0.75%, and the central bank reiterated its willingness to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org