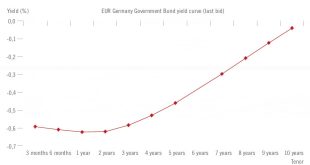

European investment opportunities remain, despite financial repression in the region. The European Central Bank (ECB) surprised market watchers with its dovish turn in January, wiping out any prospect of an interest-rate rise this year and revising its growth projections for the euro area downward for 2019. With Europeans set to live with interest rates at zero (or negative) for longer, many are wondering if Europe now...

Read More »Is Europe turning Japanese?

European investment opportunities remain, despite financial repression in the region.The European Central Bank (ECB) surprised market watchers with its dovish turn in January, wiping out any prospect of an interest-rate rise this year and revising its growth projections for the euro area downward for 2019. With Europeans set to live with interest rates at zero (or negative) for longer, many are wondering if Europe now faces “Japanisation”, meaning that it is stuck in a low-growth and...

Read More »A successful bank should be boring

The main risk facing ECB watchers is that the next few meetings of the Governing Council will be increasingly boring and predictable. However, from the central bankers’ perspective, this may considered a sign of success, “like a referee whose success is judged by how little his or her decisions intrude into the game itself”, to quote former BoE Governor Mervyn King. Back to the economy, downside risks stemming from...

Read More »A successful bank should be boring

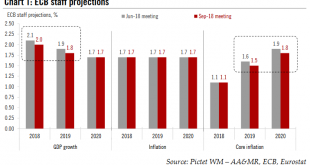

No changes to the ECB’s monetary stance and policy guidance mean we are holding to our forecasts for quantitative easing and rate hikes.The ECB made no change to its monetary stance and policy guidance at its 13 September meeting. The end of quantitative easing (QE) was confirmed for after December, following a final reduction in the pace of net asset purchases to EUR15bn per month in Q4 2018.Much of the focus was on the updated ECB staff projections. In the end, downward revisions were...

Read More »Headline prices rise in the euro area, but core inflation still subdued

With the ECB still concerned about weak dynamics in core prices and wages, we believe a 6-month extension of QE will be announced in December, with asset purchases of EUR80 bn per month.Euro area flash HICP inflation rose from 0.4% year on year (y-o-y) in September to 0.5% in October, while core inflation remained stable at 0.8%. Both figures were in line with market expectations. However, the details behind the core inflation figure were slightly weaker than expected.Euro area inflation is...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org