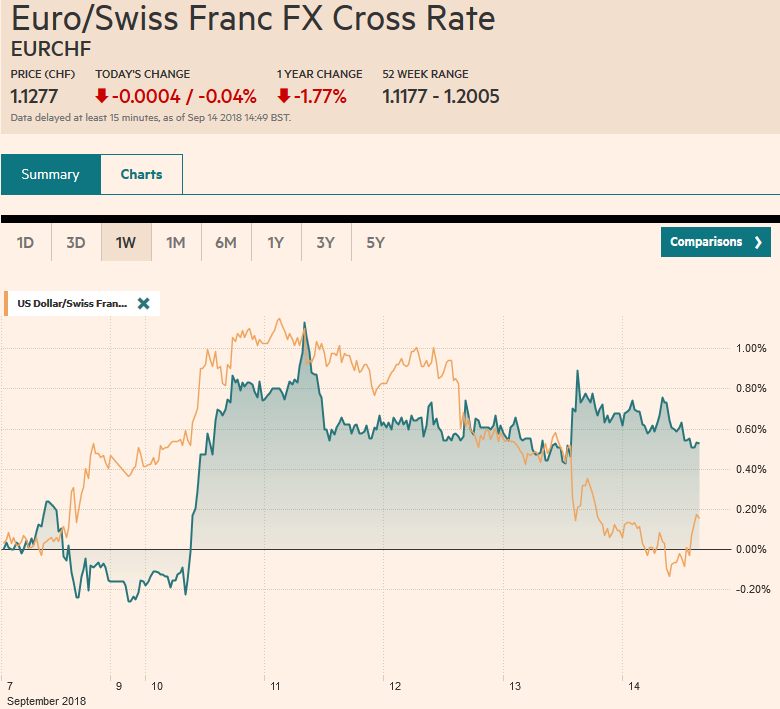

Swiss Franc The Euro has fallen by 0.04% at 1.1277 EUR/CHF and USD/CHF, September 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The dollar traded above JPY112 in early Asia, for the first time since early August but it could not take out the high recorded then (~JPY112.10) and has come off a bit in Europe. There is a 3 mln option struck at JPY112 that will expire today in North America. The Australian dollar was unable to rise through yesterday’s high (~%excerpt%.7230). Still, the Australian dollar is threatening to advance each session this week for the first time this year. There is an A.5 bln option at %excerpt%.7200 that will expire today. However, it is being

Topics:

Marc Chandler considers the following as important: $TRY, 4) FX Trends, AUD, CAD, China Industrial Production, China Retail Sales, EUR, Featured, FX Daily, GBP, JPY, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.04% at 1.1277 |

EUR/CHF and USD/CHF, September 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe dollar traded above JPY112 in early Asia, for the first time since early August but it could not take out the high recorded then (~JPY112.10) and has come off a bit in Europe. There is a $493 mln option struck at JPY112 that will expire today in North America. The Australian dollar was unable to rise through yesterday’s high (~$0.7230). Still, the Australian dollar is threatening to advance each session this week for the first time this year. There is an A$1.5 bln option at $0.7200 that will expire today. However, it is being challenged, and support in the $0.7175 area may have to be tested. European equities are mostly firmer, and the Dow Jones Stoxx 600 is recovering yesterday’s modest decline and is poised to close higher for the first week in three (currently ~ 0.85%). Most sectors but healthcare and consumer staples are edging higher, led by energy and consumer discretionary. Bond yields are edging slightly higher in Europe, but Italy’s bank index is steady to firmer and set to finish the week up over 2% to extend last week’s nearly 6% advance. The euro has also risen every session this week for the first time since last September. The 1.3% gain this week has brought it toward last month’s high (~$1.1735). The $1.1780 area is the 38.2% retracement of this year’s euro decline, and it has not traded above $1.18 since the mid-June ECB meeting. |

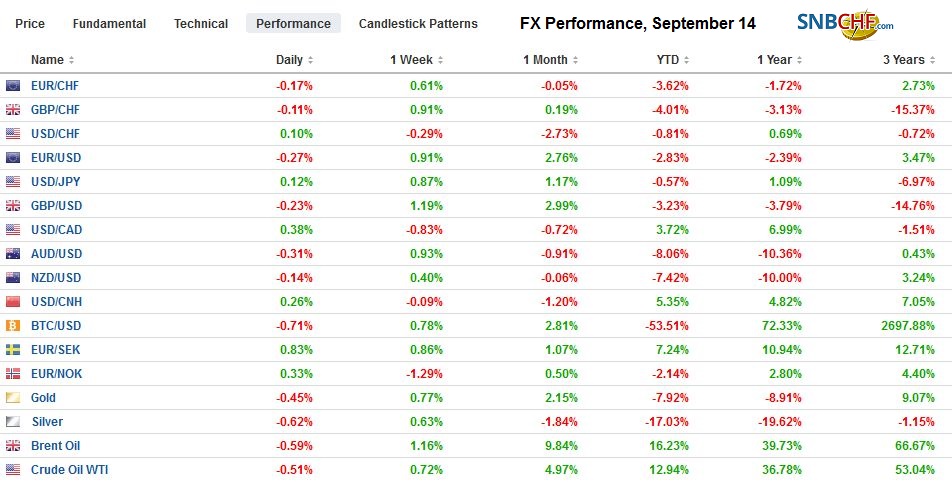

FX Performance, September 14 |

The US dollar remains on the defensive after retreating yesterday. Its losses against the most of the major and emerging market currencies are being extended today. The combination of softer US inflation coupled with a less dovish than expected ECB, a Bank of England lifting growth forecasts, while warning that a Brexit without an agreement could spur higher mortgage rates, and a more aggressive rate hike by Turkey conspired to force the dollar lower.

A weaker than expected CPI report plays into the hands of the doves at the central bank who are reluctant to remove the proverbial punch bowl and offer a contrast to it neighbors in Norway, who are expected to hike rates next week. Sweden’s headline and underlying rate eased by 0.2%. The median forecast in the Bloomberg survey was for a flat report.

The rally in US shares yesterday and the dollar’s pullback is helping lift global equities today. Relatively cheap valuations given the recent sell-off spurred bargain-hunters. The MSCI Asia Pacific Index ended its 10-day slide yesterday with a 0.9% gain and is up another 1.2% today. The 1.3% gain for the week is the most since late July. China is not participating in the broad market moves. The yuan is a little weaker, and this ensures it will post its third consecutive weekly decline. Indeed, since the middle of April, the yuan has risen in only three weeks. China’s Shanghai Composite and the Shenzhen Composite were off 0.2% and 0.8% respectively today (bringing the weekly loss to 0.75% and 2.1%).

ChinaChina reported sequentially better retail sales and industrial production in August. Retail sales rose 9.0% year-over-year, after an 8.8% pace in July. |

China Retail Sales YoY, Oct 2013 - Sep 2018(see more posts on China Retail Sales, ) Source: investing.com - Click to enlarge |

| Industrial output rose 6.1% after 6.0% in July. If there was some disappointment it came from the 5.3% rise in fixed investment is the slowest pace since before 2000. |

China Industrial Production YoY, Oct 2013 - Sep 2018(see more posts on China Industrial Production, ) Source: investing.com - Click to enlarge |

The substance of Draghi’s comments did not boost investors’ information set. However, his tone remained more constructive and largely neutralized the downward revision to the staff forecasts for growth this year and next. He argued that wage growth and the improvement in the labor market will offset the headwinds from abroad.

The Turkish lira rallied in response to yesterday’s surprising 625 bp rate in the one-week repo rate to 24% yesterday. It is little changed today as the positive impact of a smaller current account deficit is offset by Erdogan’s comments which are critical of the central bank’s decision and implicit threatened to overrule it in the future. The sharp depreciation of the lira is helping to produce a rapid adjustment in its external account. Exports are more competitive while domestic demand is compressed. The current account deficit fell to $1.75 bln in July from $3.04 bln in June and a peak this year near $7 bln in January.

Sterling had edged higher to trade at its best level since August 1 when it recorded a high $1.3145. Near $1.3130 in late morning activity in London, it is up 1.6% this week, the most since January. The heavier dollar tone in general coupled with some optimism on Brexit (where we think the market may be getting ahead of itself what is helping bridge the gap with the EU appears to be undermining May within her party), and some stronger than expected UK data. That said, a break below $1.3080 now would weaken the technical tone. Meanwhile, the euro continues to consolidate its losses against the sterling. This is the third consecutive week that the euro has fallen against sterling which is the longest losing streak in six months.

In the US, Hurricane Florence made landfall and has been downgraded to a Category 1 storm. The US data highlights include retail sales, industrial/manufacturing output, and the University of Michigan’s consumer confidence and inflation expectation survey. We look for the retail sales report to confirm that the US consumption may be slowing after rising at a 3.8% annualized pace in Q2. Headline retail sales have averaged a monthly gain of 0.4% gain this year through July. This is the same as the 2017 average. Economists expect a similar rise in August, which would bring the three-month average below three month average below the Q2 average of 0.6%. Softer auto sales may dampen the headline, but a 0.4% increase in the components that are used for GDP would bring that three-month average below 0.3%.

The US industrial sector is a source of strength. Output is expected to have risen by 0.3% after a soft 0.1% rise in July. Manufacturing is forecast to match July’s 0.3% increase. The risk is on the downside. Recall that the August employment data showed the first decline in manufacturing jobs since July 2017 and the July manufacturing job growth was halved in the revision (18k rather than 37k). The market will look closely at those sectors, like metal fabrication, to try to tease out some of the impact of the tariffs. The preliminary University of Michigan’s consumer confidence reading for September may draw some attention, but what we will focus on is the long-term (5-10 year) inflation expectations. In August, the 2.6% pace expected matches the highs over the past two and a half years. An increase above would underpin US interest rates.

Canada’s economic calendar is sparse today. Next week it reports August CPI and July retail sales. The US dollar is consolidating this week’s % losses against its Canadian counterpart and is straddling the CAD1.30 area. Short-term participants will likely go in the direction of the break of the CAD1.2980-CAD1.3020 range.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,$TRY,China Industrial Production,China Retail Sales,Featured,FX Daily,newsletter