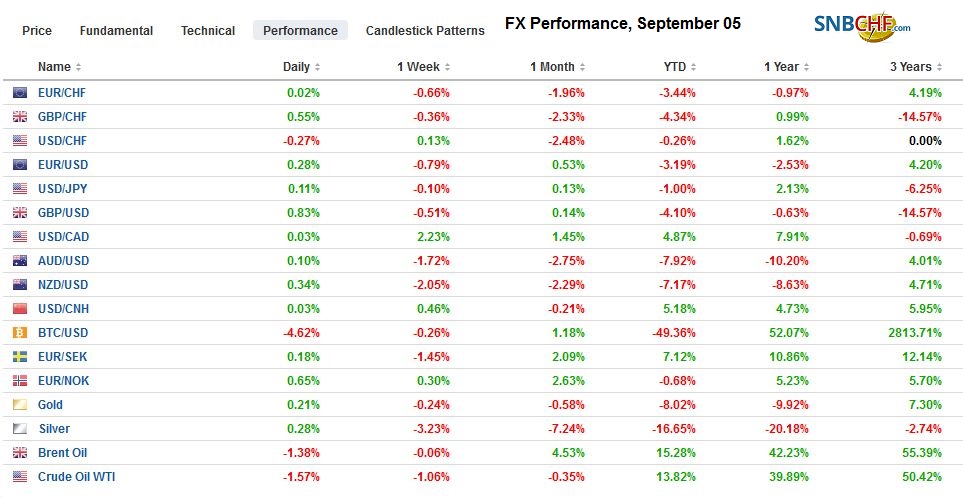

Swiss Franc The Euro has risen by 0.20% at 1.1305. EUR/CHF and USD/CHF, September 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The dollar is posting gains against most of the emerging market and major currencies. The MSCI Emerging Markets Index is off 1.6% and extending the drop to a sixth consecutive session. Indonesia’s bourse saw the largest decline (~3.75%) in the region. In part, it reflects concern that the rupiah’s weakness (falling now nine of the past 10 sessions) will boost corporate debt servicing costs. Another source of pressure on some emerging markets is reflected in the Philippines today. In part reflecting the weakness of the peso, Philippines

Topics:

Marc Chandler considers the following as important: 4) FX Trends, AUD, CAD, China Caixin Services PMI, EUR, EUR/CHF, Eurozone Markit Composite PMI, Featured, FX Daily, GBP, Italy, JPY, newsletter, U.K. Services PMI, U.S. Trade Balance, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.20% at 1.1305. |

EUR/CHF and USD/CHF, September 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

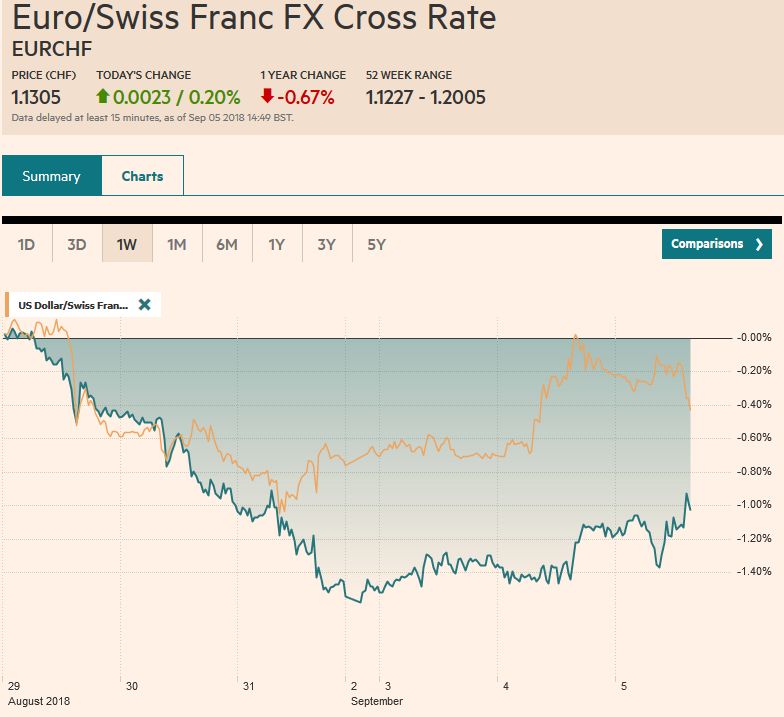

FX RatesThe dollar is posting gains against most of the emerging market and major currencies. The MSCI Emerging Markets Index is off 1.6% and extending the drop to a sixth consecutive session. Indonesia’s bourse saw the largest decline (~3.75%) in the region. In part, it reflects concern that the rupiah’s weakness (falling now nine of the past 10 sessions) will boost corporate debt servicing costs. Another source of pressure on some emerging markets is reflected in the Philippines today. In part reflecting the weakness of the peso, Philippines inflation is rising. The August report released today showed a surged to 6.4% from 5.7% in July. The Bloomberg median forecast was for a 5.9% pace. It has more than doubled since the start of the year and is at nine-year highs. Rising inflation increases the pressure on the central bank to raise interest rates, but as Argentina so aptly demonstrates, rising rates may not be sufficient to stop the currency from falling. |

FX Performance, September 05 |

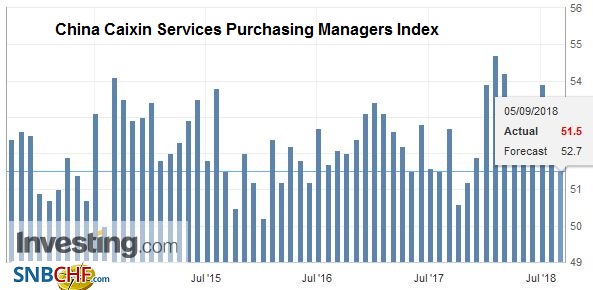

ChinaWhile the trade tensions were cited for disappointment in the manufacturing PMIs, today’s service PMIs were also mostly disappointing. China’s Caixin’s services PMI eased to 51.5 from 52.8. This was a larger decline than expected. |

China Caixin Services Purchasing Managers Index (PMI), Oct 2013 - Sep 2018(see more posts on China Caixin Services PMI, ) Source: investing.com - Click to enlarge |

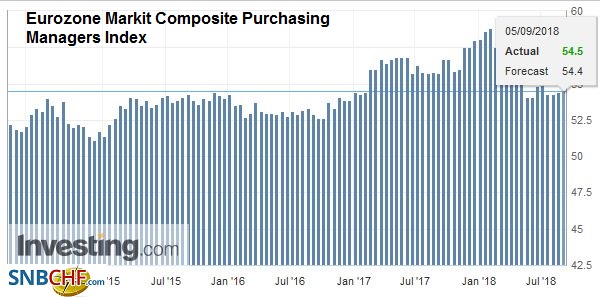

EMU’s services PMI matched the flash estimate of 54.4 (54.2 in July) though this conceals small downward revisions in Germany (55.0 from the 55.2 flash) and in France (55.4 from 55.7 flash). Spain was an exception. It reported outright albeit small improvement (52.7 from 52.6) contradicting expectations for a decline.

Italy disappointed. The service PMI fell to 52.6 from 54.0. It matches the lowest reading since last October. The manufacturing PMI also disappointed. It appears the economy downshifted over the summer. This coupled with the sharp rise in yields and sell-off in the bank shares may be a warning shot to the new government. The message may not have been lost, as League leader Salvini appears to have softened his rhetoric in recent days. The 10-year yield had approached 3.25% at the end of last week and fell to nearly 2.90% today, the lowest in about a month (August 10). The two-year yield, which was pushing toward 1.50% last week approached 1.0% today.

Other European bond yields are rising a little today (one-two basis points). Similarly, in equities, Italy is faring best. The FTSE-Milan is flat to slightly higher, while the other main equity markets are registering 0.5%-1.0% pullbacks. The Dow Jones Stoxx 600 is off 0.7% in early afternoon turnover in Europe. It has fallen in four of the past five weeks, and today’s losses bring it to levels not seen in two months.

EurozoneGrowth in EMU overall seems fairly steady. Over the past three months, the composite PMI has averaged 54.6 after 54.7 in Q2. It has averaged 55.5 this year. In the same year-ago period, the average was 56.0. |

Eurozone Markit Composite Purchasing Managers Index (PMI) , Oct 2013 - Sep 2018(see more posts on Eurozone Markit Composite PMI, ) Source: investing.com - Click to enlarge |

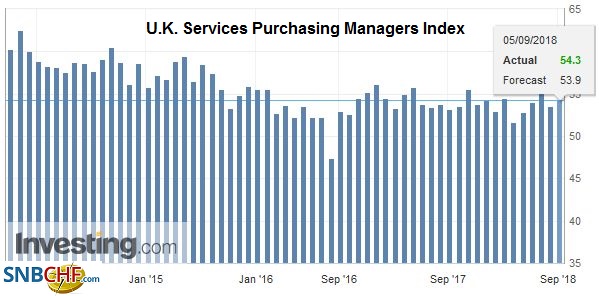

United KingdomThe UK manufacturing and construction PMIs had disappointed, but the service PMI made up for it. It rose to 54.3 from 53.5 to come in well above expectations, and, in turn, this helped lift the composite reading to 54.2 from a revised 53.5 (initially 53.6). It has averaged 54.3 over the past three months, the same as in Q2. Separately, we note that car registrations surged 23.1% year-over-year in August, the most since 2010. |

U.K. Services Purchasing Managers Index (PMI), Oct 2013 - Sep 2018(see more posts on U.K. Services PMI, ) Source: investing.com - Click to enlarge |

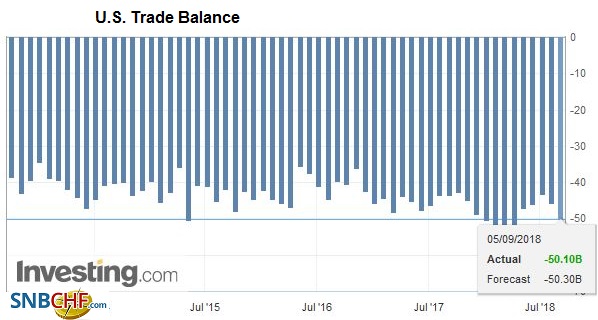

United StatesThe US reports its July trade balance. Growth differentials and the unwinding of the adjustments made before the tariffs and counter-tariffs point to a widening of the trade deficit. The trade deficit averaged $48.54 bln in H1 compared with $45.28 bln in H1 17. |

U.S. Trade Balance, Oct 2013 - Sep 2018(see more posts on U.S. Trade Balance, ) Source: investing.com - Click to enlarge |

Neither the better data nor signals that BOE Governor Carney is likely to stay in his post another year (mid-2020) to help the transition out of the EU could do much for sterling. It slipped to almost $1.28, the low from August 24 before steadying around $1.2825. There are GBP1.3 bln in maturing options struck at $1.2845-$1.2850. The euro is trading inside yesterday’s range. It is the fourth consecutive session of lower highs. It was initially bid through $1.16 in Asia before selling off to almost $1.1540 in early Europe. Expiring options ($1.1610 and $1.1625 strikes for 690 mln and 1.3 bln euros respectively) may help cap the upside.

Australia reported softer PMI services and composite, but Q2 GDP surprised on the upside with a 0.9% quarter-over-quarter increase and 3.4% year-over-year pace (from 3.2% in Q1, initially 3.1%). The Australian dollar was sold to new two-year lows (~$0.7145). There is an A$824 mln option struck at $0.7150 that expires today.

Despite weaker equities and pressure on emerging market, the US dollar made more headway against the yen, rising to JPY111.70. That is a big figure higher from last Friday’s low print. So far, the greenback has held below last week’s high near JPY111.85. There is an $816 bln option struck at JPY111.50 that will be cut today.

The Bank of Canada meets today, and it is widely expected to keep its overnight rate steady at 1.50%. A rate hike next month, however, is seen as very likely (~80%+). Canada reports July merchandise trade and Q2 labor productivity. The trade figures will be scrutinized to see the impact from the US tariffs. The US dollar is consolidating at the upper end of yesterday’s ranges near CAD1.32, which corresponds to a 6.18% retracement of the decline from the late June high (~CAD1.3385). NAFTA talks resume, and Prime Minister Trudeau has made two demands-maintain anti-dumping panels and preserve exemptions for “cultural markets.”

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,China Caixin Services PMI,EUR/CHF,Eurozone Markit Composite PMI,Featured,FX Daily,Italy,newsletter,U.K. Services PMI,U.S. Trade Balance,USD/CHF