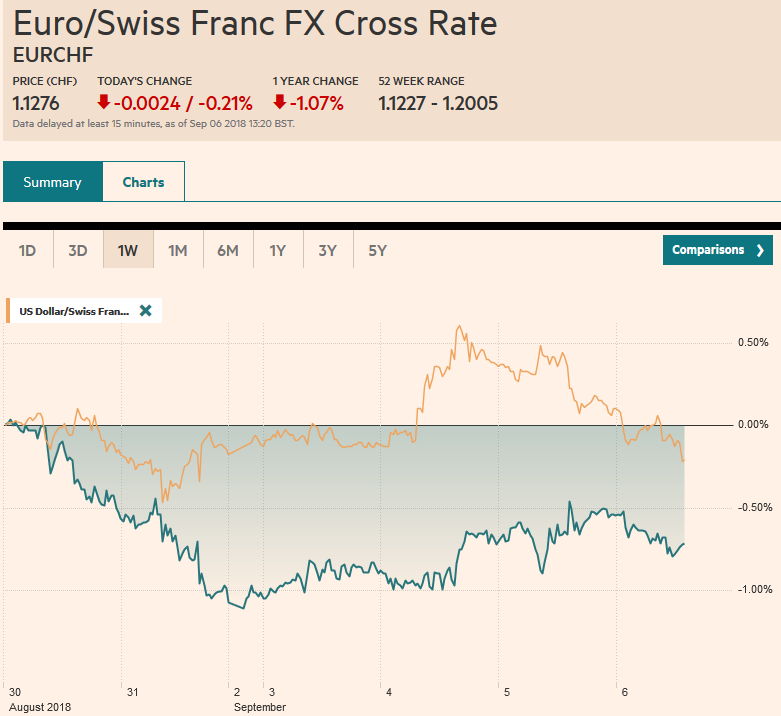

Swiss Franc The Euro has fallen by 0.21% at 1.1276 EUR/CHF and USD/CHF, September 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The euro set a new high for the week in Asia earlier today near .1660. It subsequently was sold off to .1615 before rebounding. There is a 1.6 bln euro option struck at .16 that will be cut today. That it remains firm is impressive given the disappointing news from Germany. Factory orders, which had been expected to rebound after a 4% drop in June, fell again (0.9%). German factory orders have fallen every month this year but May. Survey data had given hope that a stronger recovery would be after the soft patch at the start of the

Topics:

Marc Chandler considers the following as important: 4) FX Trends, AUD, EUR, Featured, FX Daily, GBP, JPY, newsletter, SEK, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.21% at 1.1276 |

EUR/CHF and USD/CHF, September 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe euro set a new high for the week in Asia earlier today near $1.1660. It subsequently was sold off to $1.1615 before rebounding. There is a 1.6 bln euro option struck at $1.16 that will be cut today. That it remains firm is impressive given the disappointing news from Germany. Factory orders, which had been expected to rebound after a 4% drop in June, fell again (0.9%). German factory orders have fallen every month this year but May. Survey data had given hope that a stronger recovery would be after the soft patch at the start of the year. The dollar was again turned back against the yen when it pushed through JPY111.50. It was sold to almost JPY111.15 in Asia before finding a good bid. Two developments that might have weighed on the yen in a different time. First, the BOJ again responded to ideas that the reduced number of days that it will purchases bonds is a stealth tapering. Like it did earlier for short-term bonds, it indicated it will increase the amount of 5-10 year bonds that is will buy this month. Second, foreign investors continued to sell Japanese bonds. Foreign investors have been sellers for four of the past five weeks. Over this stretch, foreign investors sold more Japanese bonds than any five-week period since February (JPY1.425 trillion or ~$12.8 bln). Given the yield and the limits on capital appreciation potential, foreign investors often buy Japanese bonds to express a bullish view of the yen. |

FX Performance, September 06 |

The global capital markets are calmer today. This is not preventing the MSCI Emerging Market Index from extending its drop into the seventh consecutive session, but there has been a respite in the sell-off of emerging market currencies, where the Mexican peso, South African rand, Turkish lira, and Indonesian rupiah are modest, modest gains. At the same time, the Philippine peso, Korean won, and Indian rupee continued to weaken.

Against the major currencies, the greenback is narrowly mixed. The Swedish krona is the weakest, off about 0.45% (~SEK9.0960). The Riksbank kept rates steady as expected and continued to signal a rate hike either late this year or early next year. However, the sub-text was dovish as the central bank saw excessive low inflation as a risk even though the underlying inflation (CPIF) have been above the 2% target for three months.

Although the gains in euro and sterling modest, their resilience in the face of negative developments is noteworthy. We quickly dismissed yesterday’s report of a shift in UK and German Brexit negotiating tactics but pulling back a cent on the denial, sterling remains resilient. It is the strongest of the majors today, establishing a foothold above $1.29 in early European activity today, after closing above the previous session’s high.

The weakness may reflect the changing trade climate. Export orders were off 3.4%, and non-EMU orders were down 4%. Roughly two-thirds of the decline is concentrated in autos and auto parts. Some reports link this holding back in the anticipation of lower auto tariffs in China. The weakness in factory orders poses a downside risk for the industrial production figures due out tomorrow.

A theme that has emerged this week, and which is also supportive for the euro is the recovery in Italy. Italian bonds continue to outperform, and the 10-year yield is off 2.5 bp, while Spain and Portugal’s benchmark yields are one-two basis points higher. Core yields, including Treasuries, Gilts and Bunds are slightly softer. Italian equities are also leading the eurozone bourses with a 0.6% gain (Dow Jones Stoxx 600 is up about 0.15% near midday in Europe), helped by the continued recovery by the banking sector, bringing this week’s gains to more than 9%.

Options struck at JPY111.40 (~$550 mln), and JPY111.75 (~$390 mln) expire today. There is a two and a half week trendline coming in near JPY111.00 today, and the 20-day moving average is found just below the figure.

The Australian dollar is trading sideways and is well within the range seen this week. Following last week’s variable rate mortgage increase by one of the country’s largest banks, a couple more followed suit today. Given the prevelance of variable rate mortages, the rate hikes are seen as doing some heavy lifting for the central bank as rising funding costs are transmitted to households. On the other hand, Australia’s trade surplus held up better than expected in July. The surplus eased to A$1.55 bln from a revised A$1.94 bln in June. However, exports were off 1%, while imports were flat. Of note, year-to-date, Australia is enjoying a record trade surplus with China, running at a nearly A$42 bln annual rate. The Australian dollar is struggling to establish a foothold above $0.7200, where an A$525 mln option expires today.

The US economic calendar is chock full today. The August ADP private sector jobs estimate ahead of tomorrow’s national report is the early highlight, but later the PMI and ISM reports and factory/durable goods orders will command attention. In terms of the survey data, the ISM was more upbeat than the PMI for manufacturing, and this pattern may repeat itself in the services reading today. July durable goods orders were weighed down by the transportation in the preliminary report. Many look at these time series for signs that the tax cuts are stimulating new capex. Thus far, the oil and gas industry appears to be the main driver.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$EUR,$JPY,Featured,FX Daily,newsletter,SEK