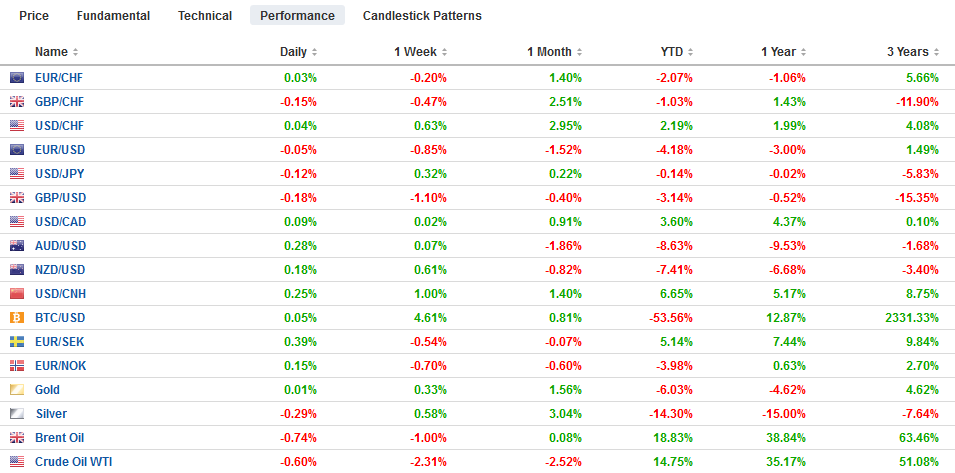

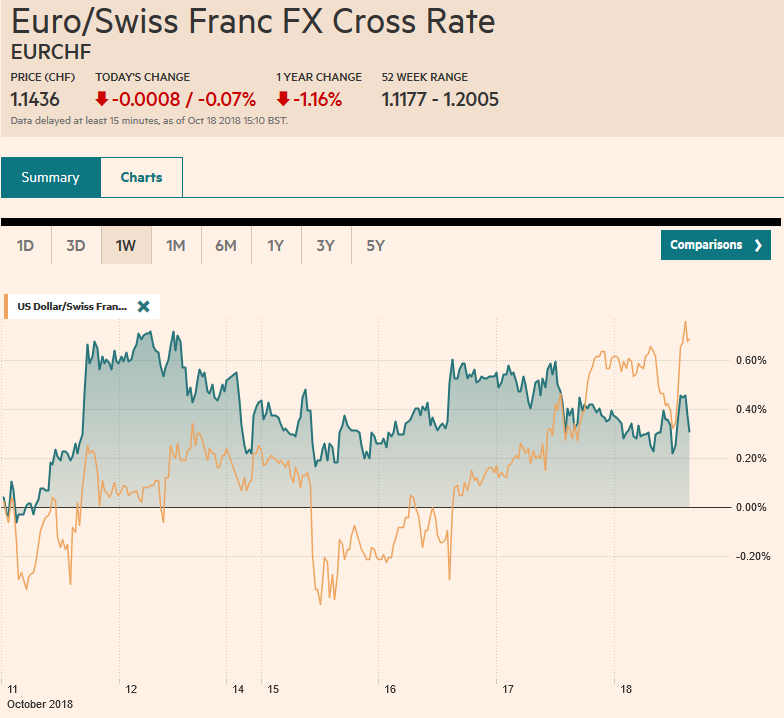

Swiss Franc The Euro has fallen by 0.07% at 1.1436 EUR/CHF and USD/CHF, October 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Asian equities were lower, led by a nearly 3% drop in Shanghai, while European shares shrugged it off and the Dow Jones Stoxx 600 is up about 0.4% in late morning turnover. The S&P 500 is off by about 0.25%. Global bond yields were dragged higher by US Treasuries where the 10-year yield is straddling 3.20% after rising four basis points yesterday. The dollar is narrowly mixed. Among the majors, the optics of a strong employment report lifted the Australian dollar after it posted an outside down day yesterday. The Canadian dollar

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, AUD, EUR, EUR/CHF and USD/CHF, Featured, GBP, newsletter, SPX, TLT, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.07% at 1.1436 |

EUR/CHF and USD/CHF, October 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Asian equities were lower, led by a nearly 3% drop in Shanghai, while European shares shrugged it off and the Dow Jones Stoxx 600 is up about 0.4% in late morning turnover. The S&P 500 is off by about 0.25%. Global bond yields were dragged higher by US Treasuries where the 10-year yield is straddling 3.20% after rising four basis points yesterday. The dollar is narrowly mixed. Among the majors, the optics of a strong employment report lifted the Australian dollar after it posted an outside down day yesterday. The Canadian dollar and sterling were nursing minor loss. The euro recovered by above $1.15 after initially falling to almost $1.1480, a seven-day low. The dollar initially rose in Tokyo to nearly JPY112.75, a new six-day high before backing off to find support near JPY112.45. |

FX Performance, October 18 |

China Macro: The US did not cite China as a currency manipulator in the Treasury’s semi-annual report. Although much ink was spilled as nearly all observers agreed that China’s currency management did not reach the threshold of manipulation. Take a step back and consider macro-developments for China in recent years. The current account surplus has been dramatically reduced and in fact, China recorded a current account deficit in H1 18. The currency has appreciated by nearly a third in real terms. In recent years, its reserves have fallen by a trillion dollars. The economy has slowed.

The main US argument against China is that its interventions are not transparent. To the extent that it has intervened, it appears to be to slow even if not reverse the yuan’s decline. The PBOC has eased financial conditions by cutting reserve requirements and not following the Fed in raising rates. It has also appeared to have shifted its priorities toward supporting the economy rather than focusing on financial imbalances. The strength of the US economy and Fed tightening stand in sharp contrast with Chinese developments. The dollar rose to new highs against the yuan today a little above CNY6.94. Officials had drawn the line at CNY7.0, which we suspect will be eventually challenged and violated.

Chinese Equities: When Chinese shares sold off hard in August 2015, it sent shock waves through the global capital markets and may have even led to the Fed delaying the first hike from September that year until December. The world appears to have grown less sensitive to Chinese equity developments. The fear among many participants is the link in China between the stock market and credit. Specifically, reports indicate that more than $600 bln of stock (10%+ market cap) is used as collateral for loans. Sharp declines in equities (new four-year lows were recorded today) may spur a systemic margin call, could trigger more equity market losses.

Australia: Market participants seemed to focus on the decline in Australia’s September unemployment rate to 5.0% from 5.3%. The Australian dollar is firm, and the local stock market bucked the regional tide lower. However, the decline in the unemployment rate reflected a decline in the participation rate to 65.4% from 65.7%. Moreover, job growth of 5.6k was a third of what economists forecast, though full-time positions increased by a little more than 20k. Full-time positions increased by an average of 13.6k through August. The apparent strength of the labor market is offset by concern about falling house prices and household indebtedness. Yesterday’s high near $0.7160 may provide a sufficient cap today.

Japan: A combination of typhoons and earthquakes took a toll on Japanese exports in September, which fell (1.2% year-over-year) for the first time in nearly two years. Imports were halved. This resulted in the first Japanese trade surplus since June. The US Treasury report continued to express concern about Japan’s bilateral surplus with the US. Separately, and ahead of tomorrow’s CPI report, BOJ Governor Kuroda tweaked the inflation assessment saying that it is running around 1.0% a year. A couple months ago he was quoted saying it was in a 0.5%-1.0% range. Although the US dollar is trading slightly heavier against the yen as North American dealers return to their posts, there are $1.53 bln in maturing options between JPY112.00 and JPY112.15, which will likely offer support. Also, note that a JPY112.50 option for $1.1 bln expires tomorrow.

UK: Retail sales in September fell twice what economists had expected. The 0.8% decline including and excluding petrol was the largest decline of the year. In Q3, retail sales rose an average of 0.3% a month. In Q2, the average was 0.7%. Separately, UK Prime Minister May reportedly is considering extending the transition period by several months to increase the likelihood of reaching a trade agreement that would resolve the Irish border. Again, we are struck by the fact that the closer May move to the EU, the more she faces an uphill battle within her party and Parliament. Sterling made a marginal new low for the week near $1.3075 but has since recovered to session highs near $1.3120 and resistance is seen near $1.3150.

Italy: The EU may not have yet rejected the Italian budget proposal but the initial assessment was not favorable. On the face of it, it is clear: the 2.4% deficit projected for 2019 is three times the projection of the previous government. EC Minister of Economic and Financial Affairs Moscovici is in Rome meeting with Italy’s Finance Minister Tria and central bank Governor Visco today and tomorrow.

The next step comes next week (October 22) when the EC will likely formally communicate its misgivings to the Italian government. If the Italian government does not respond in a satisfactory fashion, on October 29, EC will likely formally conclude that a revision is necessary. This would be unprecedented. Italy would have three weeks (November 19) to respond and then the EU has three weeks (~December 10) to give an opinion about the new proposal.

The point is that this is going to be a drawn-out affair over the next several months. It means that the first move to sanctions may take place in late Q1 19 or early Q2 and could become a campaign issue for the European Parliament elections in May 2019. Italy may be the most extreme, but Spain and France are also proposing fiscal slippage. The Socialist government in Spain has proposed a 1.8% deficit next year up from 1.3% this year. France’s Macron has proposed a 2.8% shortfall from 2.6% this year. Greece is trying to avoid the pension cuts that it previously agreed to, arguing it can meet its fiscal targets without it.

Euro: The euro fell to nearly $1.1480, a new seven-day low in Asia but has recovered in the European morning to $1.1530. Intraday technical readings are getting stretched. There are large options maturing at $1.1450 (1.3 bln euros), $1.15 (1.2 bln euros) and $1.1550 (1.3 bln euros) today. Tomorrow, a 1.1 bln euro option at $1.15 and a 1.7 bln euro option at $1.14 expires.

Oil: As Saudi Arabia is awkwardly seeking to minimize the loss of its international prestige, the fear that it would use oil as a weapon has diminished. Such thinking was bolstered by assurances from OPEC’s Secretary General that the oil market will remain well supplied. Also, the EIA reported that US oil inventories rose almost 6.5 mln barrels. The Bloomberg survey produced a median forecast of fewer than one million barrels, and API estimated a drawdown.

The four-week moving average is a little more than 5 mln barrels and that is the highest since Q1 17. The price of WTI for November delivery dipped below $70 for the first time since in nearly a month. The contract posted a bearish outside down day and has seen follow through selling today. The next target technical target is $68.00-$68.75. The 100-day moving average is found near the bottom of that range. It probably takes a break of $65 to spur talk that a top may be in place.

S&P 500: We thought the pullback in stocks last week was a hiccup and not a reaction to a fundamental change in the investment climate. The technical indicators that we use have not all turned, but they are in the process, suggesting that buying should be seen on dips now. The market is poised for such a pullback in the early going. Look for the 2775 area to hold. The next mile-marker in the recovery is 2825 which is where the next retracement objective and 100-day moving average can be found. Above there, look for a push to through 2850.

The US economic calendar features the October Philadelphia Fed survey and weekly initial jobless claims. The Fed’s Bullard and Quarles present, but the prospects for Fed funds rate that moves above the long-term equilibrium rate are the main talking points today. That said, the FOMC minutes added some color but did not provide new direction. The implied yield of the December 2019 fed funds futures contract was 2.935% before the equity swoon last week. Today, the implied yield is 2.895%, which is the middle of the recent range. The current average effective fed funds rate is 2.18%.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CNY,$EUR,$TLT,EUR/CHF and USD/CHF,Featured,newsletter,SPX