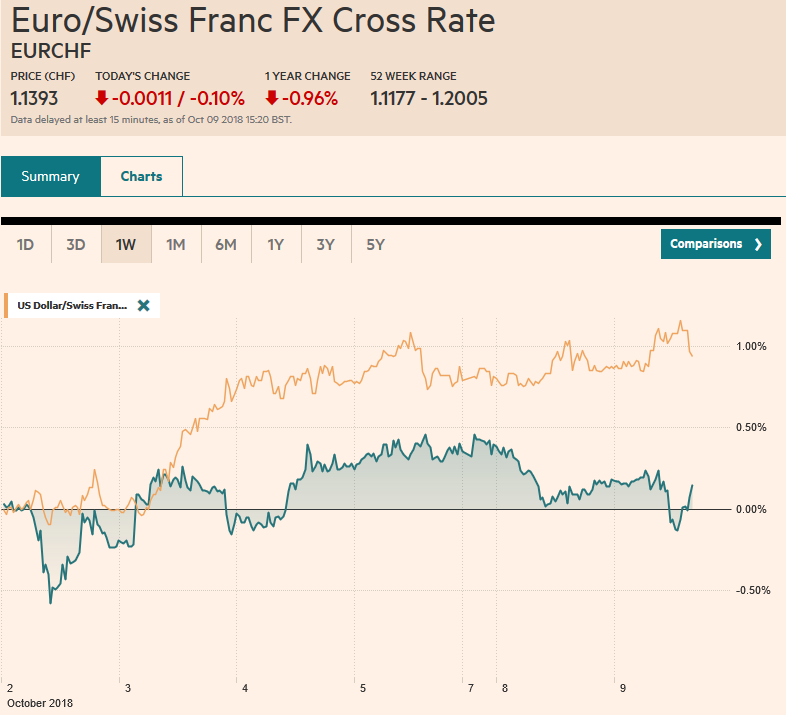

Swiss Franc The Euro has fallen by 0.10% at 1.1393 EUR/CHF and USD/CHF, October 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The small gains in China’s Shanghai Composite and the yuan is helping sentiment today. News that Italy’s budget watchdog may reject the government’s fiscal plans has helped stabilize Italian assets initially, but renewed pressure quickly materialized. Most Asian equities retreated while Europe’s Dow Jones Stoxx 600 is struggling to snap a three-day slide. US shares are trading heavily in Europe. US 10-year yields are a little higher today after yesterday’s holiday. European bond yields are mostly one-to-three basis points

Topics:

Marc Chandler considers the following as important: $CNY, $INR, 4) FX Trends, AUD, brl, CAD, EUR, Featured, GBP, JPY, newsletter, TLT, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.10% at 1.1393 |

EUR/CHF and USD/CHF, October 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

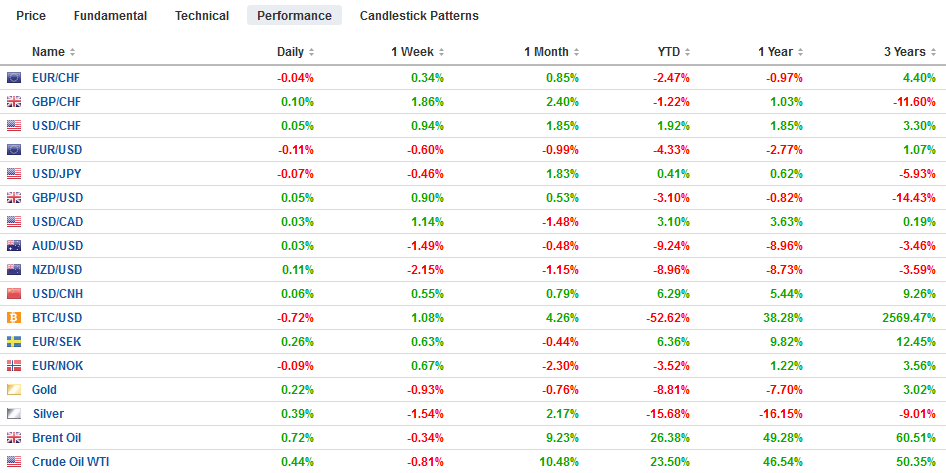

FX RatesOverview: The small gains in China’s Shanghai Composite and the yuan is helping sentiment today. News that Italy’s budget watchdog may reject the government’s fiscal plans has helped stabilize Italian assets initially, but renewed pressure quickly materialized. Most Asian equities retreated while Europe’s Dow Jones Stoxx 600 is struggling to snap a three-day slide. US shares are trading heavily in Europe. US 10-year yields are a little higher today after yesterday’s holiday. European bond yields are mostly one-to-three basis points higher, with the 10-year Italian bond jumping more than 10 bp near midday in Rome. The 10-year JGB is at 15 bp, creeping closer to the upper end of the +/- 20 bp. The 30-year JGB yield is approaching 1%, and this level had been identified earlier this year by domestic asset managers as a possible inducement to keep more funds at home. Japanese banks bought a record amount of foreign bonds last month, and insurance companies bought the most in two years. The greenback is firm but mostly consolidating within yesterday’s ranges. The Dollar Index has been knocking on 96.00 for the past few sessions, and while intraday penetration has occurred, it has failed to close above that threshold. If satisfaction is not seen shortly, it may need to set back to get a running start, as it were. The euro is pinned near yesterday’s lows, near $1.1460 in the European morning. The bears want to push it through $1.1450, were stops and optionality may force additional sales. On the upside, there is a 1.6 bln euro option at $1.15 that expires today. The upper end of the consolidative range is seen around $1.1550. The dollar held above yesterday’s low just ahead of JPY112.80. Resistance is seen by yesterday’s North American high close to JPY113.40. There is a $415 mln option at JPY113 and $1.1 bln at JPY113.25 that are expiring today. Sterling is also having an inside day and appears comfortable in a $1.30-$1.31 range. Options with a $1.30 strike for GBP325 mln will be cut today. The Australian dollar, which we thought was the most likely to lead a recovery, extended yesterday’s gains but faltered in front of $0.7100. Provided support holds near $0.7060, our favorable near-term outlook remains intact. The US dollar is firm against its northern neighbor, after CAD1.2950 support, where an $815 mln expiring option is struck. Yesterday’s greenback high of CAD1.3010 looks likely to hold today. |

FX Performance, October 09 |

Today’s North American economic calendar is light. It features Canada’s September housing starts, which fell in July and August. A small gain is expected Canada’s housing starts. Despite the month-to-month volatility, note that the year-to-date average is almost identical to where it was last August (~217k). There are no US economic reports of note, but three Fed officials (Kaplan, Harker, and Williams) present. Also, a heavy week of Treasury supply begins today. There are $130 bln in T-bills that will come to market today, and this will be followed by coupon auctions for another $100 bln Wednesday and Thursday.

The nervous calm at the start of the Italian session quickly evaporated. Investors seemed to initially pin their hopes today that group of centrist forces could get the 5-Star Movement and the League to reconsider the 2.4% budget deficit projected for next year. The centrists include the President, Prime Minister, Finance Minister, and a few others. The way, it is thought, to avoid an escalating conflict with the EC is to provide some check domestically.

This does not strike us as particularly likely. From their vantage point, the M5S and the League have already compromised with the choice of finance minister itself and in the budget projections for 2020 and 2021. They received a popular mandate for change and have an eye toward next spring’s parliamentary elections. A climax and resolution do not appear close. At the same time, the latest opinion polls suggest one possible scenario. Both the M5S and the League have seen their support wane. It is too early to expect a change in the government’s stance, but if it were to continue, some course adjustment would seem necessary.

For the first time in a couple of years, the IMF has reduced its world growth forecasts. Its track record and precision suggests that the 0.2% cut in this year and next year’s growth is more indicative that exact. It projections see the world economy expanding by 3.7% for 2018 and 2019. However, growth was not cut everywhere. In particular, we note that the US and China forecasts for this year were unchanged at 2.9% and 6.6% respectively. Growth in the eurozone was shaved to 2.0% from 2.2%. It is not surprising as economic data has consistently surprised on the downside. Growth in emerging markets was also taken down 0.2% to 4.7%. Next year, the IMF anticipated slower US growth and shaved its previous forecast by 0.2%, citing trade headwinds. The IMF also cut next year’s growth forecast for China to 6.2% from 6.4%.

The consensus seems to be that after sparring and exchanging some proverbial shots across the bow, the US and China will reach an accommodation as early as next month when the two presidents can meet on the sidelines of the G20 summit. Yet this view seems naive and more wishful thinking than a close reading of the signals that each side is sending. Moreover, it is being speculated that the US might cite China as a currency manipulator in this month’s Treasury report amid concern about the yuan’s recent weakness, even though the PBOC may have intervened to strengthen the yuan rather than weaken it. From the US, the rhetoric against China appears to have grown more confrontational. NAFTA 2.0, in which the US has introduced some new principles, is to be the template for agreements with Europe and Japan.

Only after these are settled will the Trump Administration turn to China, and that could very well be next year after the 10% tariffs on $200 bln of Chinese goods becomes 25%. One of the relevant clauses is about trade agreements with non-market economies (aka, China). Striking a trade agreement with a non-market economy could be grounds for the US to pull out of its agreement. Others have to choose. Privileged access to the US market requires that countries do not reach trade agreements with China. Of course, there is little chance of Mexico or Canada negotiating a free-trade agreement with China, but the clause is likely to prove a prototype for future deals.

Most economic models suggest China will be hit harder by the trade conflict than the US, but it may be hasty to conclude that this means it will capitulate. China is taking steps to offset the impact of the tariffs. It announced today it will boost tax breaks for exports. It is providing monetary and fiscal stimulus and can provide more. Chinese officials have suggested it would not allow the dollar to rise through CNY7.0, but that was before the surge in US rates. The CNY7.15 area corresponds to a 50% retracement of the yuan’s appreciation since the peg was abandoned in 2005. China is also reducing tariffs to encourage alternative sourcing of products that were previously bought from the US. The lesson China may draw from this experience, including the US demand that it fundamentally changes its developmental model, is to turn more inward.

Among emerging markets today, the eastern and central European currencies, including the Turkish lira, are leading. However, there is one Asian currency among the five weakest EM performers today, and that is the Indian rupee, which fell to new record lows as the dollar pushed above INR74.25. The IMF kept this fiscal year’s GDP forecast for India at 7.3% while shaving next year’s to 7.4% from 7.5%. While foreign investors were heavy sellers of Indian assets last week, another source of pressure is coming from domestic-based companies hedging the currency risk, according to reports.

Brazil’s real rallied strongly, extending its recent gains in response to the election results. The dollar gapped lower and fell to BRL3.71 before reversing high to close at session highs. A gap remains and is found between yesterday’s high (~BRL3.7830) and the pre-weekend low (~BRL3.8380). The greenback spent the entire session yesterday below the lower Bollinger Band. The strong dollar sell-off ahead of the weekend election and yesterday’s gain leaves the technical indicators over-extended, and the upside gap could draw prices.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$CNY,$EUR,$INR,$JPY,$TLT,brl,Featured,newsletter