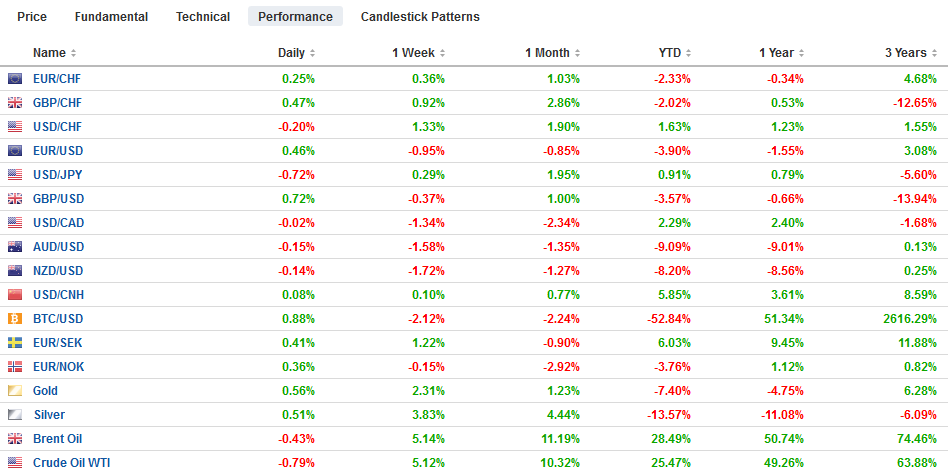

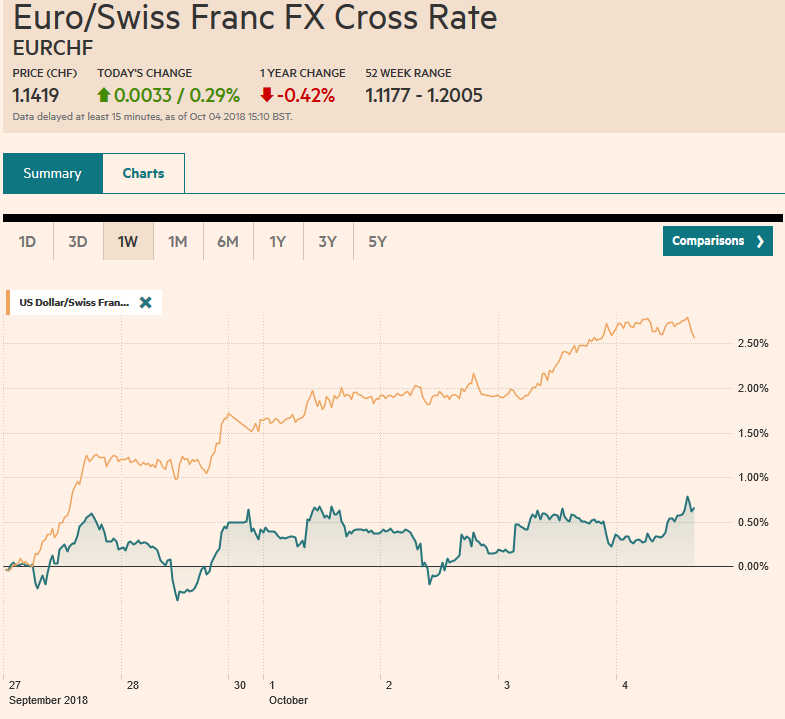

Swiss Franc The Euro has risen by 0.29% at 1.1419 EUR/CHF and USD/CHF, October 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is consolidating yesterday’s gains against most of the major currencies, though the dollar bloc is underperforming. Bond yields are moving higher, and equities are lower. With a light data and events stream, the price action itself is the news. US yields: The main force is the rise in US yields. At the short end, the market has begun pricing in a small chance of a third hike next year, having been comfortable with two for some time. It has taken a modest bite from the apple and appears to be discounting almost a one-in-four

Topics:

Marc Chandler considers the following as important: 4) FX Trends, AUD, CAD, EUR, Featured, GBP, JPY, newsletter, TLT, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.29% at 1.1419 |

EUR/CHF and USD/CHF, October 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe US dollar is consolidating yesterday’s gains against most of the major currencies, though the dollar bloc is underperforming. Bond yields are moving higher, and equities are lower. With a light data and events stream, the price action itself is the news. US yields: The main force is the rise in US yields. At the short end, the market has begun pricing in a small chance of a third hike next year, having been comfortable with two for some time. It has taken a modest bite from the apple and appears to be discounting almost a one-in-four chance that the Fed maintains its one hike a quarter pace through Q3 19. This expectation, of course, has been encouraged by the Fed’s latest projections but also by yesterday’s data showing more private sector employment than expected (ADP) ahead of tomorrow’s government report. Also, the non-manufacturing ISM report signaled the strongest business activity since 2004, with the employment sub-index at a record high, and new export orders at a five-month high. Merchandise trade is more affected by the trade conflict than services trade. Yields at the long-end of the curve are rising partly as a result of the short-end and partly as a function of rising term premium. Some attribute this to the Fed seemingly eschewing the r* anchor on monetary policy. Rising oil prices suggest a role for inflation expectations as well. Moreover, the 2-10-year curve is steepening. US yields are a couple basis points firmer, and the yield curve is also continuing to steepen. Now, now at 33 bp, it is up about eight basis points for the week and at levels not seen since early August. Cross-currency swaps push up the cost of hedging dollar exposure, but the steepening of the yield curve may blunt it. |

FX Performance, October 04 |

Oil: The loss of Iranian output seems to be a major consideration behind the rally in oil prices, which are consolidating today after yesterday’s 1.50%-1.75% gain. The US sanctions, which for oil do not go into effect until next month, has been more effective than anticipated and this has prompted many to reconsider the loss of supply. It is now thought that it could remove as much as 1.5 mln barrels day. Bloomberg’s oil tanker traffic data indicates that OPEC is struggling to off the loss of supply, and suggest OPEC (including Iran) last month may have shipped the least amount of oil this year. Saudi output is near a record, though it says it has more capacity. Russian output is reportedly reaching levels not seen since the Soviet era. The unexpectedly large build in the US (EIA 8 mln barrels) was insufficient to offset the larger supply issue. There is some concern of pipeline bottlenecks and the limitations on refinery capacity to handle the shale product in lieu of the heavier crude. Tomorrow’s US rig count, which has edged lower over the past two weeks, will attract attention.

Equities: Equities are struggling to the higher interest rate environment. That said, the S&P 500 closed less than 0.5% from its record high yesterday, though the poor close yesterday is fueling follow through selling today. Note that Q3 earnings season formally begins tomorrow and many companies have lowered their guidance. Support is seen near 2900. Still, some worry of a deeper pullback amid signs that the leadership has lost momentum. It is now a month since any of the FANG shares made new 52 week highs. The MSCI Asia Pacific Index is off for the fourth consecutive session. Australia’s stocks are the notable exception, helped perhaps by the weakening currency and the larger than expected trade surplus (A$1.6 bln vs.A$1.55 bln in July and expectations for a decline). Although Chinese markets are closed this week for a national holiday, the dollar’s strength and equity losses warn of the risk of a dramatic start to trading next week. Hong Kong shares were off 1.7%, but the H-shares index was off 2.2% today and off 4% this week. The offshore yuan is about 0.3% weaker this week. European equities are weaker as well, though there Spain appears to be holding its own. Europe’s Dow Jones Stoxx 600 is off 0.6%, with gains in only the financial and energy sectors. Since the middle of last week, it has been alternating between gains and losses. Over these six sessions, it is off net-net about 0.8%, which given the rise in yields, seems minor.

Bonds: The yield of the benchmark 10-year JGB rose to almost 15 bp today. The generic yield is a little firmer is at its highest level since early 2016. Recall that under the “Yield Curve Control” initiative, the 10-year yield is allowed to trade +/- 20 bp of zero. In the recent past, the BOJ had bought bonds before the limit was reached. Today, nothing. If it does not show its hand tomorrow, some investors will suspect a tolerance of this and suspect “stealth tapering.” In Europe, the core bonds are underperforming the periphery. Italy’s budget revision to show a 2.4% deficit next year, 2.1% in 2020 and 1.8% in 2021 may still not be to the EU’s liking, but it is not as disturbing for investors, who had been pricing in worse. Core bond yields are up five-to-eight basis points, while Italy is up three basis points, and Spain and Portugal are up less than two. Italy, Spain, France, and the UK brought new supply to the market today. Concern about Greek banks and non-performing loans are weighing on the sovereign bond market. The 10-year yield is up more than 10 bp, which brings the five-day climb to almost 50 bp.

Euro and Sterling: The euro and sterling marginally extended yesterday’s losses in Asia but has returned better bid in Europe. The euro traded below $1.15 for the first time since August 21. Still, the follow-through selling after yesterday’s outside down day is disappointing to the momentum traders. Support has been found in front of $1.1450, where a 2.2 bln euro option expires tomorrow. Today, the expiry of a $1.1480 strike (for ~565 mln euros) is still in play. US participants seem more bullish the dollar than Europe and they may look to sell into gains toward $1.1520. Sterling is recovering from the push toward $1.2920. It has not been below $1.29 in about a month. A move above $1.3025 would lift the technical tone or at least neutralize some of the technical negativity. There are about GBP685 mln in options struck at $1.2980 and $1.3000 that are on the bubble today.

Yen: Rising US yields weigh on the yen, but the market has turned more cautious. The dollar edged to a new high (~JPY114.55) in Asia, but it has been consolidating mostly between JPY114.20 and JPY114.40. The market does not appear done with the upside today, and JPY115 is the next important chart point. Separately, note that for the first time in ten weeks, foreign investors were net buyers of Japanese shares (in the week through last Friday). They have sellers into the rally that lifted the Nikkei from around 22.600 to last week’s high near 24,300. Meanwhile, Japanese investors bought foreign bonds for six consecutive weeks through the end of September. It is the longest buying spree in a little more than two years.

Dollar-Bloc Currencies: The Australian dollar fell to almost $0.7065 today, its lowest level since Q1 16. It recorded the low early in the European morning. Technically, it looks poised to consolidate and pare its earlier loss in North America. A move above $0.7100 would help improve the technical tone. The New Zealand dollar is being pushed through $0.6500 for the first time in two and a half years. The US dollar continues to recovery from the new NAFTA enthusiasm that had seen it slip below CAD1.28 earlier in the week. There is a rare gap in the charts from the start of the week that is found between CAD1.2887 and CAD1.2907. The gap has been entered by not closed. If it is, the buying could carry it back toward CAD1.2930.

North American Data: Canada reports the IVEY survey, though outside of headline risk, it is often not a market mover. The US reports weekly jobless claims and Challenger lay-offs. Neither report will have much bearing on expectations for tomorrow’s non-farm payroll report, where job growth may have slowed a bit, and average earnings are unlikely to have sustained the 2.9% year-over-year pace. The preliminary August durable goods orders report already showed a recovery from the decline in July. This will be picked up by the factory goods orders report and confirmed by the final durable goods orders.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,$TLT,Featured,newsletter