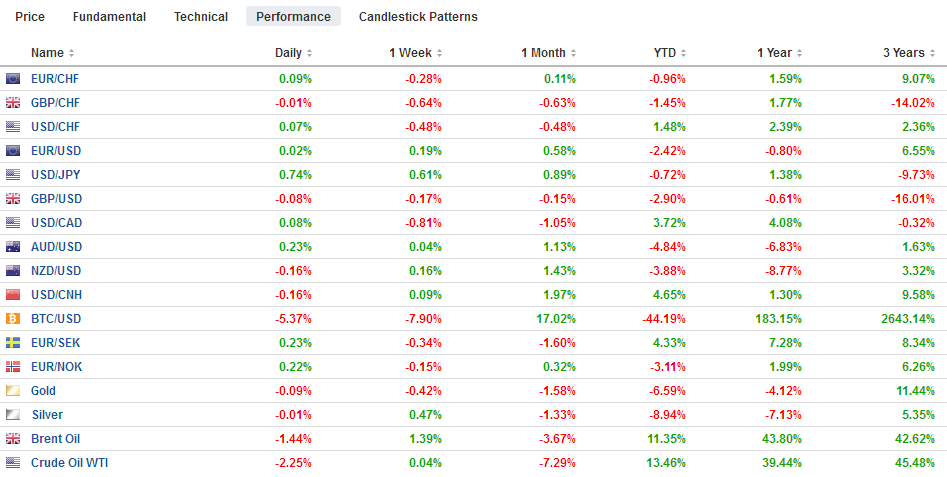

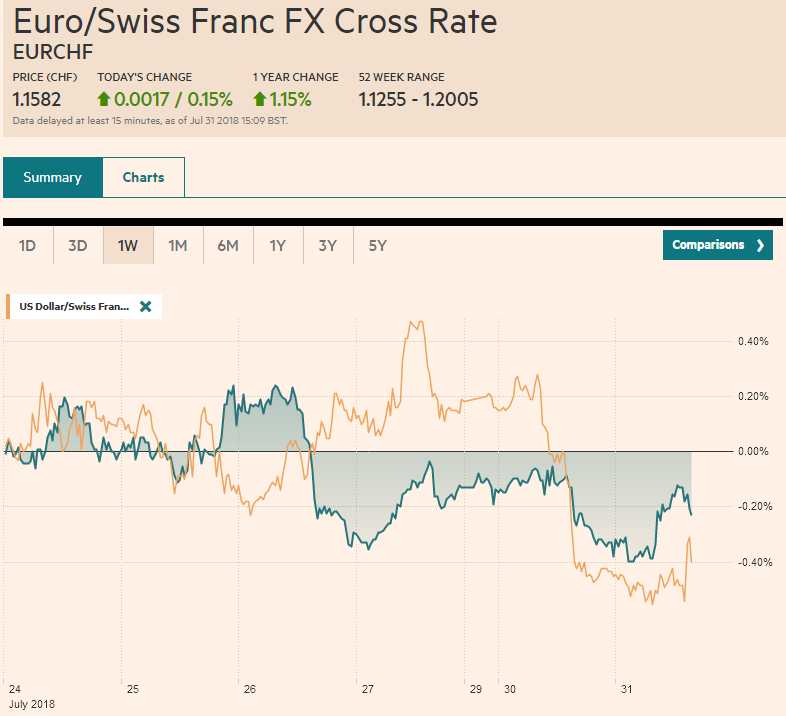

Swiss Franc The Euro has risen by 0.15% to 1.1582 CHF. EUR/CHF and USD/CHF, July 31(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The Japanese yen has been sold following the adjustments to policy and outlook by the BOJ that will allow the unconventional policies continue for an “extended period of time.” Cross rate pressure and month-end demand have lifted the euro and sterling through yesterday’s highs. A disappointing Q2 GDP report from the eurozone (0.3% instead of 0.4%) helped slow the euro’s gains, while the preliminary CPI was firm. Reports that Canadian team was not invited to US-Mexico NAFTA talks today may be weighing on the Canadian dollar a little.

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, Bank of Japan, China Manufacturing PMI, EUR, Eurozone Consumer Price Index, Featured, JPY, newslettersent, SPX, TLT, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has risen by 0.15% to 1.1582 CHF. |

EUR/CHF and USD/CHF, July 31(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe Japanese yen has been sold following the adjustments to policy and outlook by the BOJ that will allow the unconventional policies continue for an “extended period of time.” Cross rate pressure and month-end demand have lifted the euro and sterling through yesterday’s highs. A disappointing Q2 GDP report from the eurozone (0.3% instead of 0.4%) helped slow the euro’s gains, while the preliminary CPI was firm. Reports that Canadian team was not invited to US-Mexico NAFTA talks today may be weighing on the Canadian dollar a little. There had been much speculation in recent days over the BOJ’s course, and it turns out that much of what was discussed found its way into policy. The BOJ announced several steps, each small, but together are a significant adjustment to policy. The zero target for the 10-year yield remains, but greater latitude was signaled, and rather than move in a +/-10 bp, a 20 bp movement will be tolerated. The negative rate will be applied to a smaller part of bank deposits at the BOJ. The ETF buying will continue, but as had been floated, the buying will shift more to the Topix from the Nikkei. The BOJ cuts its inflation forecasts. This year’s projection was reduced to 1.1% from 1.3%. Next year’s inflation forecast was trimmed to 1.5% from 1.8% and in 2020 1.6% from 1.8%. Although the BOJ provided some explanation for the weakness in price pressures, like the entry of women and elderly into the workforce, the risk is that it still is too optimistic about inflation. The BOJ updated its forward guidance. It indicated that the extraordinary policies are will be in place for an “extended period of time.” This is a key way what the BOJ is doing is different than the Fed or ECB. The BOJ is not modifying its measures to gradually bring them to a halt. To the contrary, it is to allow them to be sustained for longer. The statement was issued under a title which sums up our assessment: “Strengthening the Framework for Continuous Powerful Monetary Easing.” The yen has been sold to its lowest level since July 20. The greenback has pushed a little above JPY111.50 in the European morning. A $456 mln option struck there is expiring today. There another $965 mln option at JPY112.00 and about $800 mln at JPY111.00. The euro has approached JPY131, which is an important retracement of the recent decline. |

FX Performance, July 31 |

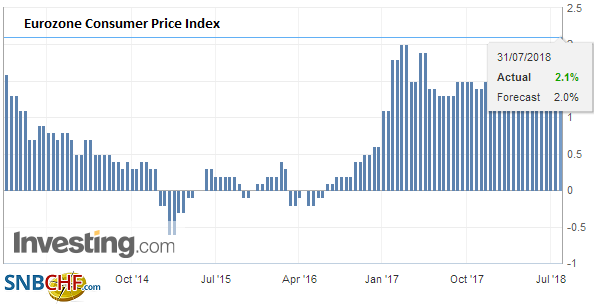

EurozoneEMU economic news was mixed. The unemployment rate looked to have slipped to 8.3%, but the May estimate was reduced to 8.3% from 8.4%. Inflation was a touch firmer than expected. The headline rose to 2.1% from 2.0%, and the core rate rose to 1.1% from 0.9%. Disappointingly, GDP expanded by 0.3% in Q2, a little softer than the 0.4% seen in Q1. The year-over-year pace slowed to 2.1% from 2.5%. While the euro is firmer, it continues to trade within the range seen last week on the day the ECB met. The high then was just shy of $1.1745. The euro has not been above $1.1750 since July 11. In addition to cross rate demand from the yen, we also see two other forces impacting the euro. First, month-end position and hedge adjustment are thought to be euro friendly. Second, and pointing in the opposite direction is the effect of today’s Treasury redemptions, which the Fed uses to shrink its balance sheet. On such days, the euro has typically traded heavier. |

Eurozone Consumer Price Index (CPI) YoY, July 2018 (flash)(see more posts on Eurozone Consumer Price Index, ) Source: Investing.com - Click to enlarge |

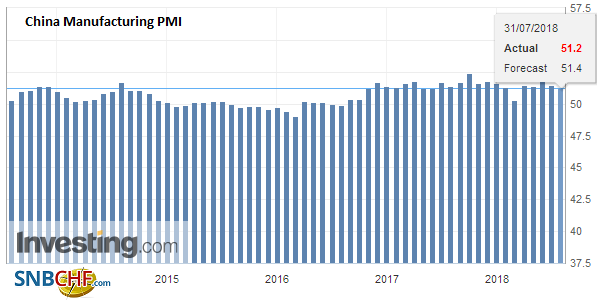

ChinaThe other economic data to note is from China. The official PMI was softer. The manufacturing PMI eased to 51.2 from 51.5 in June. The service PMI slowed to 54.0 from 55.0. Chinese stocks were narrowly mixed. The yuan softened. The data is old in the sense that the government’s recently announced new fiscal measures and an easing of its de-leveraging campaign. |

China Manufacturing PMI, July 2018(see more posts on China Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

Canada

News that the US and Mexico will hold talks today and that it was made clear to Canada either by admission or omission that it was not invited weighed on the Canadian dollar a little. Recall that yesterday’ the US dollar briefly traded below CAD1.30 for the first time since mid-June. The greenback recovered and approached CAD1.31 when the news initially broke. The fear is that the new Mexican government seems eager to reach a deal and the US would be able to use such an agreement to pressure Canada. Until now, Canada and Mexico were preventing a “divide and conquer” strategy by the US. However, a falling out of Trudeau and Trump and Freeland and Lighthizer has strained the bilateral relationship while the new Mexican government has domestic reasons to reach an early deal.

Separately, Canada report May GDP figures today. A 0.3% expansion after 0.1% in April is expected. Monthly GDP has averaged 0.2% this year. The average was twice as high in the first four months of 2017. It averaged 0.3% for all of last year.

United States

The US reports personal income and consumption data for June. There is no news in these reports as the data was incorporated into last week’s estimate of Q2 GDP. Still, some attention may be paid to the core PCE deflator especially if there is an unexpected push above 2%. Alternatively, the Employment Cost Index for Q2 does contain new information. It is a broader measure of labor costs that wages. It includes other payments and benefits.

As the anticipation of BOJ grew, the pressure on the JGBS appears to spill over to the other major bond markets. The pullback in Japanese yields today may be helping. Despite yesterday’s news that the US Treasury had previously under-estimated its borrowing needs for the three months that begins tomorrow by around $44 bln to $329 bln, the US 10-year yield is pulling back after approaching 3.0%. Benchmark yields in Europe are also a little softer. The US deficit for the first nine months of the current fiscal year (ending September 30) is $607 bln, which compares with $523 bln for the same year-ago period.

Equity markets are mixed. Asian equities slipped with the MSCI Asia Pacific index off 0.60%. It gained about 0.6% in July, after losing 4.7% over the past two months. Excluding Japan, the benchmark was off less than 0.2% on the day and up almost 0.6% on the month. European shares are mixed, and the Dow Jones Stoxx 600 is flat in late European morning dealing. Financials, energy, and utilities are leading the gaining sectors, while information technology, consumer discretionary and health care are the largest drags. The Dow Jones Stoxx 600 is up a little less than 3% this month, snapping a two-month losing streak during which it shed about 1.4%. US NASDAQ had one of its worst three-session runs in years on disappointing earnings/guidance. The S&P 500 has retreated to test the breakout near 2800. US stocks are trading firmer, and a higher opening is expected.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,$EUR,$JPY,$TLT,Bank of Japan,China Manufacturing PMI,Eurozone Consumer Price Index,Featured,newslettersent,SPX