Claudio Grass in Conversation with Todd “Bubba” Horwitz Todd Horwitz is known as Bubba and is chief market strategist of Bubba Trading.com. He is a regular contributor on Fox, CNBC, BNN, Kitco, and Bloomberg. He also hosts a daily podcast, ‘The Bubba Show.’ He is a 36-year member of the Chicago exchanges and was one of the original market makers in the SPX. Before you listen to the podcast, I would like to provide some additional context and background to the discussion, that could offer a deeper understanding and highlight further aspects of the positions and arguments that we will elaborate on with Todd Horwitz. “The idea that man can shape the world around him according to his wishes is what I call the fatal

Topics:

Claudio Grass considers the following as important: 6) Gold and Austrian Economics, 6b) Austrian Economics, 7) Markets, Featured, newslettersent, On Economy, Precious Metals, Todd Horwitz

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Claudio Grass in Conversation with Todd “Bubba” HorwitzTodd Horwitz is known as Bubba and is chief market strategist of Bubba Trading.com. He is a regular contributor on Fox, CNBC, BNN, Kitco, and Bloomberg. He also hosts a daily podcast, ‘The Bubba Show.’ He is a 36-year member of the Chicago exchanges and was one of the original market makers in the SPX. Before you listen to the podcast, I would like to provide some additional context and background to the discussion, that could offer a deeper understanding and highlight further aspects of the positions and arguments that we will elaborate on with Todd Horwitz.

|

The Tail is Wagging the Dog

Some time ago, I read an interesting study entitled: “Who sets the price of gold? London or New York?”, written by Martin Hauptfleisch, Tālis J. Putniņš and Brian Lucey. One of the most interesting findings was the following:

“A striking result of our analysis is that although the volume of gold traded in the UK OTC spot market is more than ten times higher than that of the US futures market (78.0% market share compared to 7.7%), the futures market tends to play a more important role in incorporating new information about the value of gold. This result highlights the importance of market structure and instrument type. Our results support the notion that the centralization and relatively transparency of the futures market contribute to its disproportionately large role in price discovery. It is also likely that the low transaction costs, inbuilt leverage and ability to avoid dealing with the underlying asset, make futures contracts an attractive option for those that trade gold as a financial asset, and such trades contribute disproportionately to price discovery.”

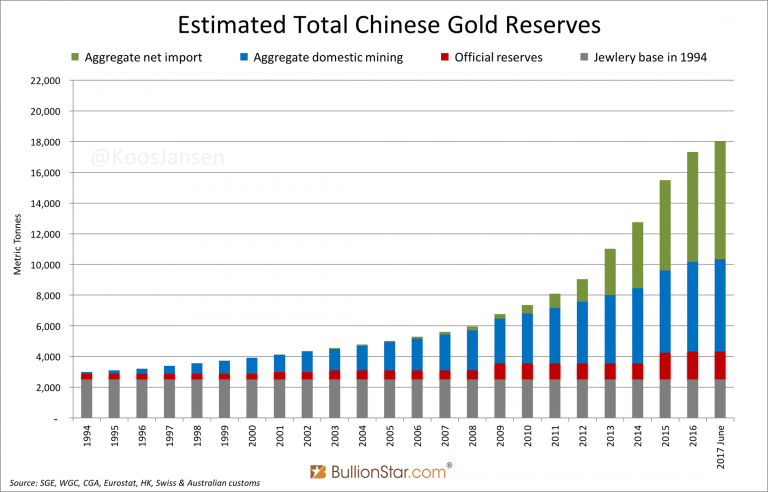

To me, this just confirms what I have observed though my experience in the gold industry, that consumers in the western world could easily live without physical gold. We have largely forgotten gold and this is the main reason why we see such huge paper leverage today.

In addition, this is only possible as long as the market players respect the unwritten rule to limit physical delivery to as little as possible. When you look at this issue from that perspective, you also understand why we had up to 500 paper claims at the Comex for every single ounce readily available for delivery in the past.

The authors of the paper also describe the current situation as follows:

“According to the Loco London Liquidity Survey (Murray, 2011), the daily turnover on the London gold spot market alone is in excess of $216 billion, which is comparable in value to US- Australian and US-Canadian dollar foreign exchange settlements (based on 2010 data in Bank for International Settlements, 2011), as well as the daily turnover of all stock exchanges in the world. The average daily dollar volume of the front futures contract over the same period is approximately $22 billion, illustrating the size disparity between our markets.”

The world is changing and let us not forget that the Soviet Union did not collapse because people suddenly changed their mind overnight. It failed only because of the inevitable realization that the centrally planned communist system was no longer sustainable.

You can only go into debt up to a certain level, however one fine day you will either have to repay or default. When I look at global debt and its growth, I think it should be obvious that we have reached a level where repayment is no longer an option. Also, this time “it is not different”.

That is why we saw dozens of hyperinflation episodes globally in the past century, which proved that governments can indeed go broke. We have reached a peak point of leverage and the day of reckoning is fast approaching. At the same time, a large part of the global population is apparently preparing for this day.

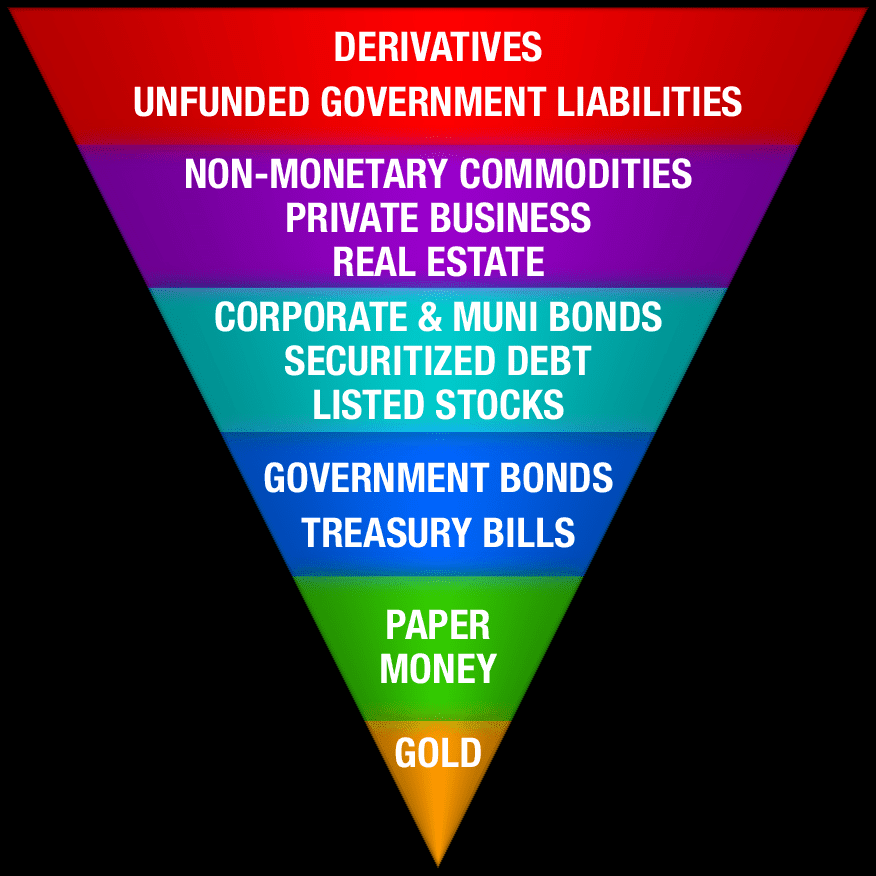

Keep in mind that in a deflationary environment, people will want to shift their investments to high quality assets with little or no counter-party risk. In short, it is a flight to quality and the hardest currency for the past few thousand years has been and still is gold. Conversely, in a boom, or inflationary environment, people will tend to move their money toward high-risk assets.

I truly believe we are standing at the end of a long-term debt cycle and that brings me back to that 0.3% figure I mentioned at the beginning. It is clearly time to act.

I hope you will enjoy the podcast. Start listening now!

Tags: Featured,newslettersent,On Economy,Precious Metals,Todd Horwitz