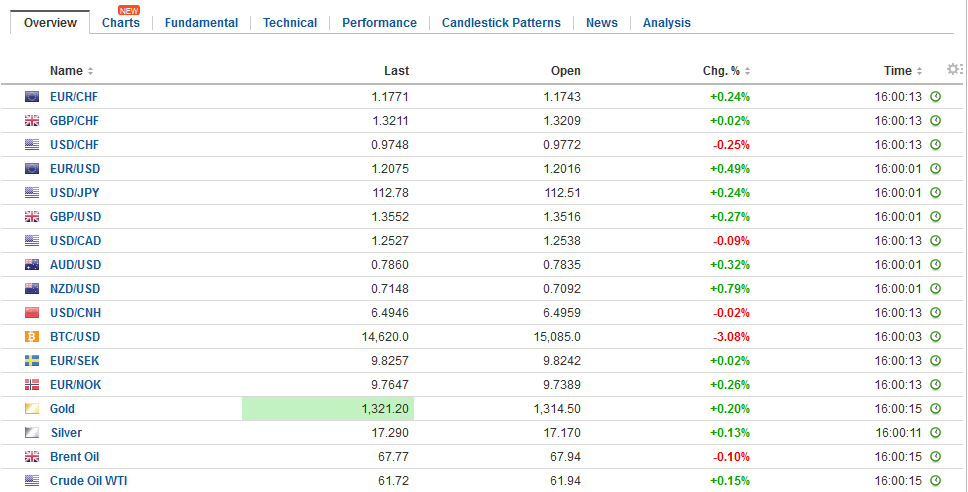

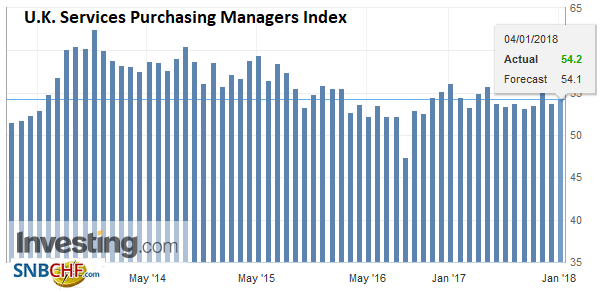

Swiss Franc The Euro has risen by 0.37% to 1.1755 CHF. EUR/CHF and USD/CHF, January 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is sporting a softer profile across the board, though remaining largely in the ranges seen over the past couple of sessions. At the same time, the news stream suggests that the global synchronized growth cycle strengthened late last year and is bound to carry over into the New Year. The mostly firm manufacturing PMIs are being joined by the service sector surveys. Moreover, the details are often stronger than the favorable headline optics. China’s Caixin service PMI rose to 53.9 from 51.9. The Bloomberg median forecast had

Topics:

Marc Chandler considers the following as important: AUD, CAD, China Caixin Services PMI, EUR, EUR/CHF, Eurozone Markit Composite PMI, Eurozone Services PMI, Featured, FX Trends, GBP, Germany Composite PMI, Germany Services PMI, Italy Services PMI, Japan Manufacturing PMI, JPY, newslettersent, Spain Services PMI, TLT, U.K. Services PMI, U.S. Crude Oil Inventories, U.S. Initial Jobless Claims, U.S. Markit Composite PMI, U.S. Services PMI, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has risen by 0.37% to 1.1755 CHF. |

EUR/CHF and USD/CHF, January 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

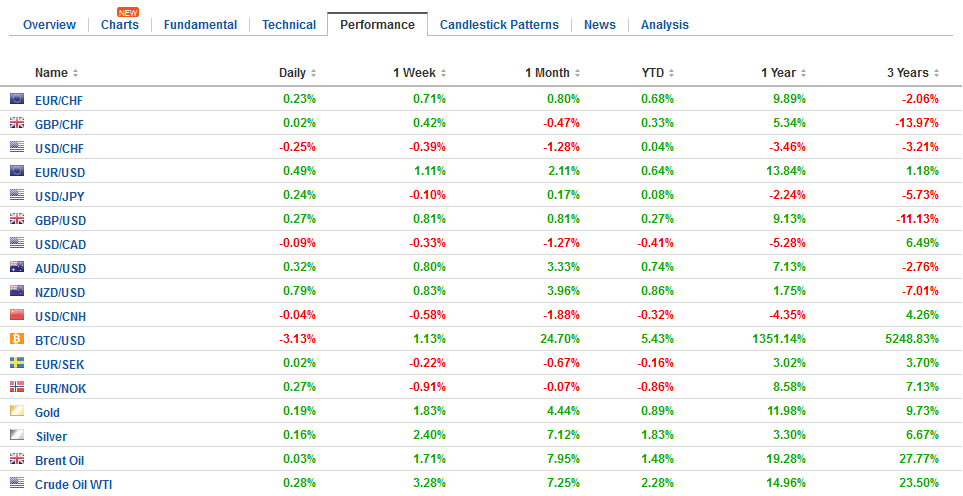

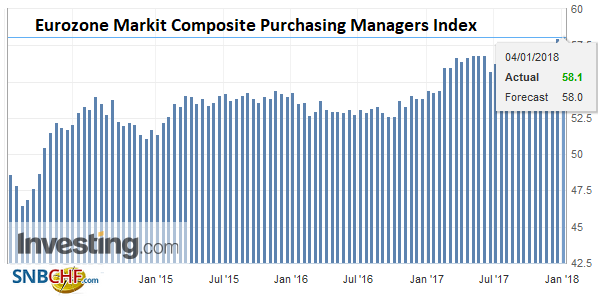

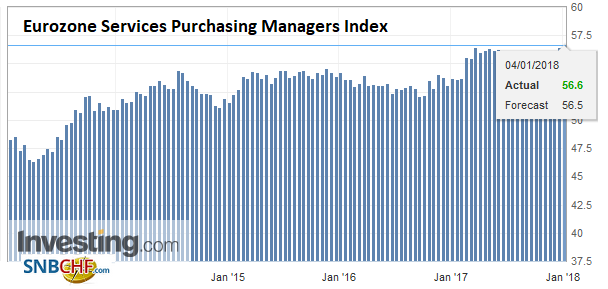

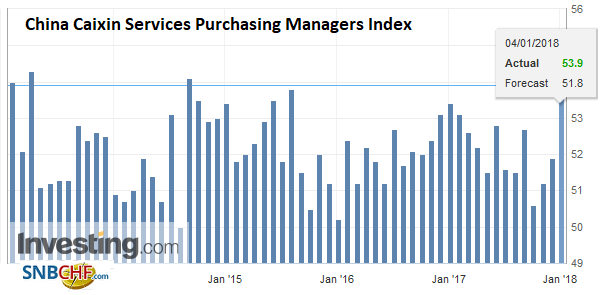

FX RatesThe US dollar is sporting a softer profile across the board, though remaining largely in the ranges seen over the past couple of sessions. At the same time, the news stream suggests that the global synchronized growth cycle strengthened late last year and is bound to carry over into the New Year. The mostly firm manufacturing PMIs are being joined by the service sector surveys. Moreover, the details are often stronger than the favorable headline optics. China’s Caixin service PMI rose to 53.9 from 51.9. The Bloomberg median forecast had expected a small decline. It is the highest since August 2014. New business was the best since May 2016. The eurozone followed suit. The service reading ticked up to 56.6 from the flash reading of 56.5 and 56.2 in November. In turn the composite reading rose to 58.1 from the flash report of 58.0 and November’s 57.5. The strength of the new orders component points to the momentum and the strength of employment suggest the virtuous cycle remains intact. |

FX Daily Rates, January 04 |

| The euro has carved out a shelf above $1.20, and only a convincing break now will dissuade a push higher. Sterling briefly slipped below its shelf at $1.35 yesterday but rebounded is now in the middle of the one cent range than extends to $1.36. Arguably with the rise of US yields in response to a somewhat more hawkish set of FOMC minutes helped lift the dollar to almost JPY112.80 as Japan’s markets reopened. The dollar had found support near JPY112, which corresponds to the 100-day moving average earlier in the week. There only notable option expiring today is $414 mln struck at JPY112.45. A move above JPY112.80 is needed to lift the tone. The Australian dollar is extending its gains. After validating support near $0.7800, the Aussie is pushing through $0.7850. Recall that it began last month near $0.7500. Unless the US dollar can resurface above CAD1.2560, it may have to fall toward CAD1.2430-CAD1.2450. |

FX Performance, January 04 |

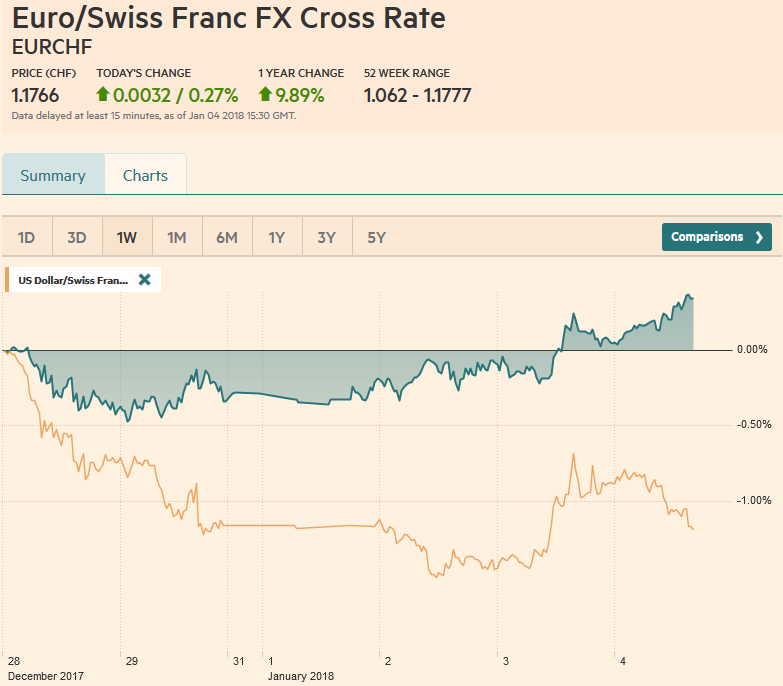

United KingdomAfter reporting disappointing manufacturing and construction PMI, the UK was redeemed with a stronger than expected service PMI today. It rose to 54.2 from 53.8. The median forecast was for a rise to 54.0. The composite stands at 54.9, which would have been unchanged, but the November reading was pared to 54.8. The UK also reported a host of other data and the take away message is constructive. Nationwide’s home price index rose more than expected in December, making for a 2.6% year-over-year rise. Consumer credit rose GBP1.4 bln in line with expectations, though net mortgage lending and approvals increased more than expected. |

U.K. Services Purchasing Managers Index (PMI), Dec 2017(see more posts on U.K. Services PMI, ) Source: Investing.com - Click to enlarge |

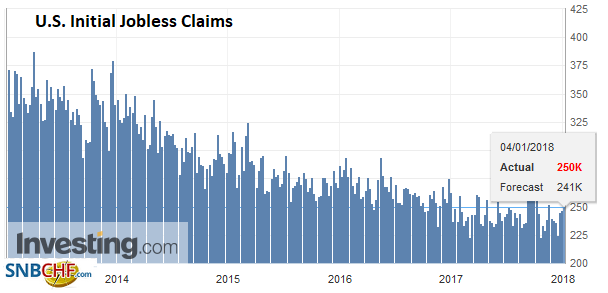

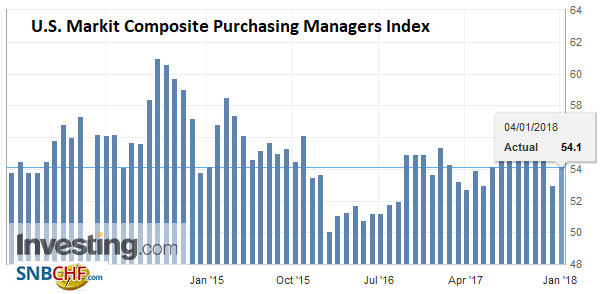

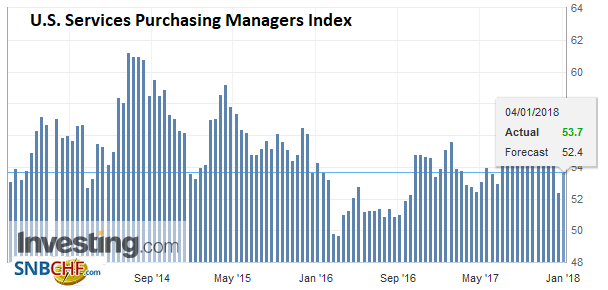

United StatesYesterday the US reported stronger than expected construction spending, ISM manufacturing (with a jump in new orders to its highest level since 2004), and stronger than expected auto sales. Canada also reported healthy car sales. Canadian auto sales rose 4.6% in 2017, the eighth annual increase and the fifth consecutive record high. Last year’s sales topped two million for the first time. Today, the US reports ADP jobs estimate (~190k, same as November), weekly initial jobless claims, and the Markit Services PMI (flash fell to 42.4 from 54.5, and the risk seems to be on the upside. |

U.S. Initial Jobless Claims, 4 January(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

U.S. Markit Composite Purchasing Managers Index (PMI), Dec 2017(see more posts on U.S. Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

|

U.S. Services Purchasing Managers Index (PMI), Jan 2018(see more posts on U.S. Services PMI, ) Source: Investing.com - Click to enlarge |

|

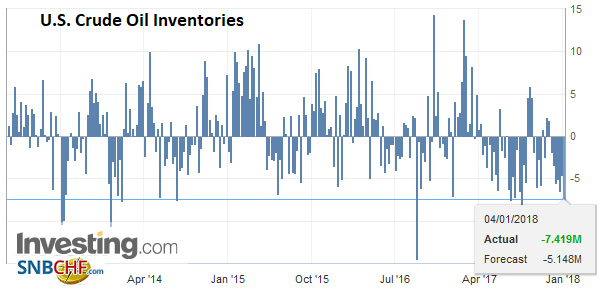

U.S. Crude Oil Inventories, January 2017(see more posts on U.S. Crude Oil Inventories, ) Source: Investing.com - Click to enlarge |

|

EurozoneEuropean shares are broadly higher. German, Spanish and Italian markets are up over 1%, while the Dow Jones Stoxx 600 is about 0.5% higher. Energy, materials, industrials and financials are leading the most. |

Eurozone Markit Composite Purchasing Managers Index (PMI), Jan 2018(see more posts on Eurozone Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

| Health care, telecom, consumer staples, and real estate are nursing small losses. Industrial commodities, including oil, continue to trend higher. |

Eurozone Services Purchasing Managers Index (PMI), Jan 2018(see more posts on Eurozone Services PMI, ) Source: Investing.com - Click to enlarge |

| The global expansion is not yet producing strong price pressures. This was the cloud in the silver lining of the European PMI. Prices eased for the first time in five months. Longer-term inflation expectations, judging from the 10-year breakevens are on the rise. |

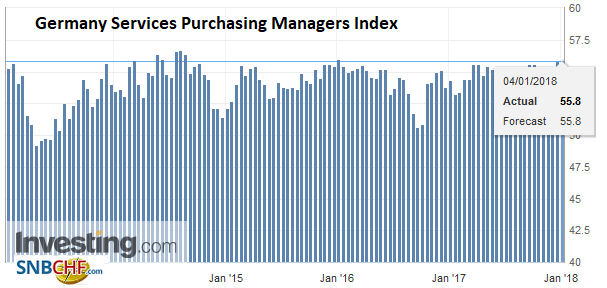

Germany Services Purchasing Managers Index (PMI), Jan 2018(see more posts on Germany Services PMI, ) Source: Investing.com - Click to enlarge |

| The German 10-year breakeven is near 1.32%, up from 0.95% six months ago and approaching last year’s high set in February near 1.35%. As we have noted, the US 10-year breakeven has pushed through the 2% threshold for the first time in nine months. |

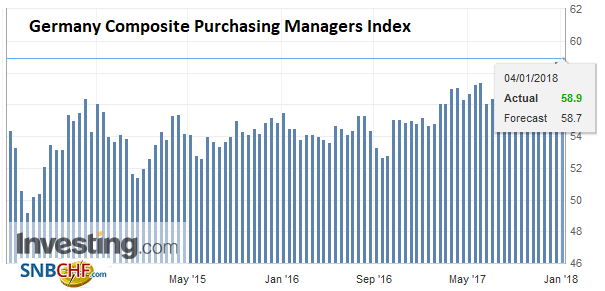

Germany Composite Purchasing Managers Index (PMI), Jan 2018(see more posts on Germany Composite PMI, ) Source: Investing.com - Click to enlarge |

| Benchmark 10-year bond yields are mostly firmer today. Core yields are mostly one-two basis points higher in Europe. |

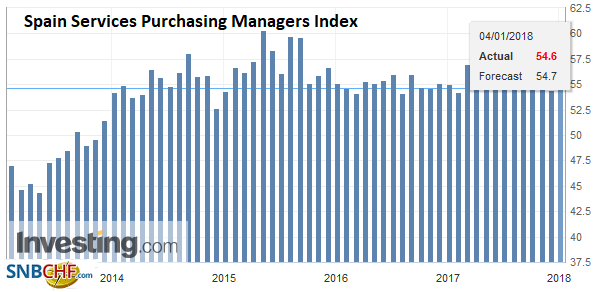

Spain Services Purchasing Managers Index (PMI), Dec 2017(see more posts on Spain Services PMI, ) Source: Investing.com - Click to enlarge |

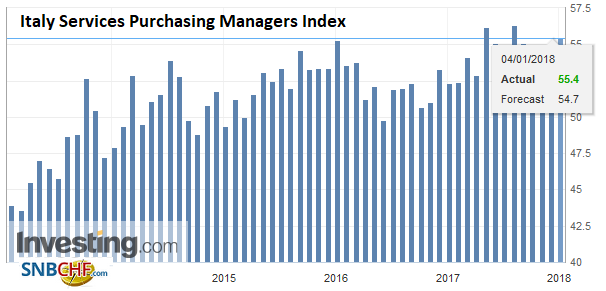

| The 10-year Gilt yield is up three basis points. Peripheral bond markets are well bid. Italy’s 10-year yield is off nearly three basis points, while similar Spanish and Portuguese yields are off closer to five basis points. |

Italy Services Purchasing Managers Index (PMI), Dec 2017(see more posts on Italy Services PMI, ) Source: Investing.com - Click to enlarge |

China |

China Caixin Services Purchasing Managers Index (PMI), Dec 2017(see more posts on China Caixin Services PMI, ) Source: Investing.com - Click to enlarge |

Japan |

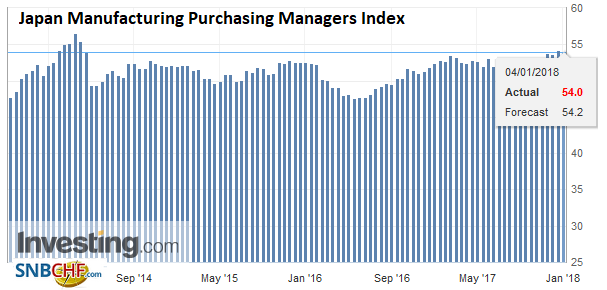

Japan Manufacturing Purchasing Managers Index (PMI), Jan 2018(see more posts on Japan Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

Many investors, looking for the best way to capitalize on the synchronized global economic strength see the most attractive opportunities outside the US. MSCI Asia Pacific Index rose 1.2% to a record close. In the first three sessions this year it is up 2.5%. Tokyo returned from the extended holiday and the Topix played catch-up, rising 2.5% to its best level since 1991. The Nikkei added 3.25%. Profit taking was seen in Korea. MSCI Emerging Markets Index is up about 0.5% and about 2.8% over the past three sessions. It has only fallen twice since December 15.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,$TLT,China Caixin Services PMI,EUR/CHF,Eurozone Markit Composite PMI,Eurozone Services PMI,Featured,Germany Composite PMI,Germany Services PMI,Italy Services PMI,Japan Manufacturing PMI,newslettersent,Spain Services PMI,U.K. Services PMI,U.S. Crude Oil Inventories,U.S. Initial Jobless Claims,U.S. Markit Composite PMI,U.S. Services PMI,USD/CHF