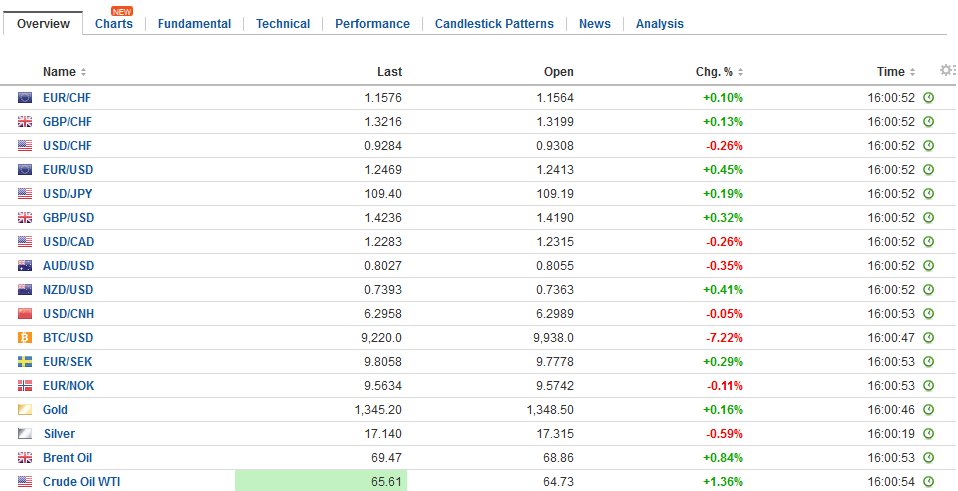

Swiss Franc The Euro has risen by 0.10% to 1.1578 CHF. EUR/CHF and USD/CHF, February 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The Yellen Fed ended on a high note. She took over the reins the of Federal Reserve an implemented a strategic normalization process monetary policy, and helped engineer not only the first post-crisis rate hikes but also the beginning of unwinding its balance sheet. Most reckon she has done an admirable job at the Federal Reserve, not only in terms of the economic performance on her watch but also the nimble execution policy. Her final FOMC statement was not celebratory in any overt way, but it expressed confidence in the trajectory

Topics:

Marc Chandler considers the following as important: AUD, CAD, China Caixin Manufacturing PMI, EUR, EUR-GBP, EUR/CHF, Eurozone Manufacturing PMI, Featured, FX Trends, Germany Manufacturing PMI, Italy Manufacturing PMI, Japan Manufacturing PMI, JPY, newsletter, Spain Manufacturing PMI, U.K. Manufacturing PMI, U.S. Initial Jobless Claims, U.S. ISM Manufacturing Employment, U.S. ISM Manufacturing PMI, U.S. Manufacturing PMI, U.S. Nonfarm Productivity, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.10% to 1.1578 CHF. |

EUR/CHF and USD/CHF, February 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe Yellen Fed ended on a high note. She took over the reins the of Federal Reserve an implemented a strategic normalization process monetary policy, and helped engineer not only the first post-crisis rate hikes but also the beginning of unwinding its balance sheet. Most reckon she has done an admirable job at the Federal Reserve, not only in terms of the economic performance on her watch but also the nimble execution policy. Her final FOMC statement was not celebratory in any overt way, but it expressed confidence in the trajectory or growth and inflation, both of which appeared to have been upgraded, even though the risk assessment was unchanged from balanced. There is little doubt the Fed will raise rates in March. That will be Powell’s first meeting as chair. A rate hike at his first meeting makes for good optics for the central bank’s credibility. The members’ economic forecasts will be updated and the risk on the upside. The rate hike may be backed up by a change in the risk assessment. |

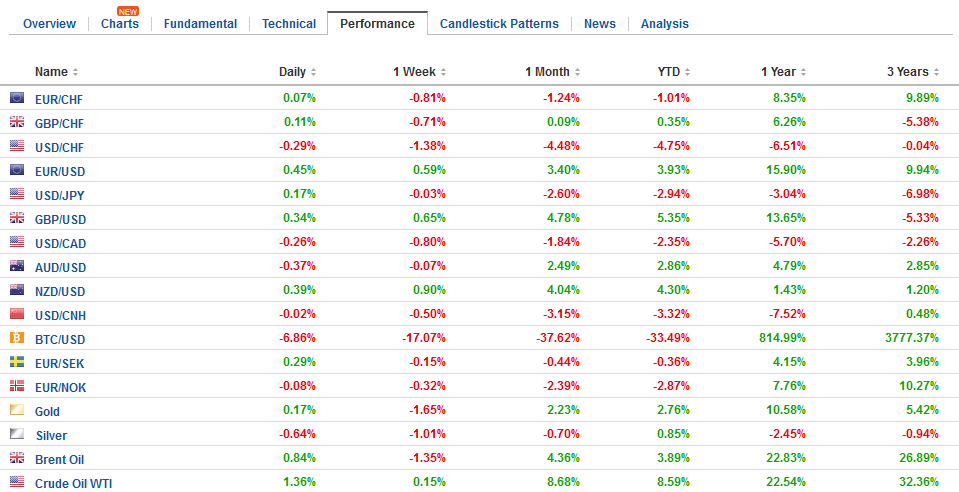

FX Daily Rates, February 01 |

| There is some talk that perhaps the Fed would raise rates more than the three times suggested by the December forecasts. That is rich. The market had to be taken by the hand last year and essentially told the Fed would likely raise interest rates before investors were convinced. The Fed funds futures strip implies two rate hikes appear fully discounted, but not a third this year.

We have often argued that the Fed needs to either have press conferences after every meeting, like other central banks, such as the ECB and BOJ or demonstrate it can raise rates without a press conference. Otherwise, it needlessly ties its hands and limits the number of live meetings (where policy can be changed) to four, or half of its eight gatherings. We suspect this is a course Powell may consider in the early part of this tenure. |

FX Performance, February 01 |

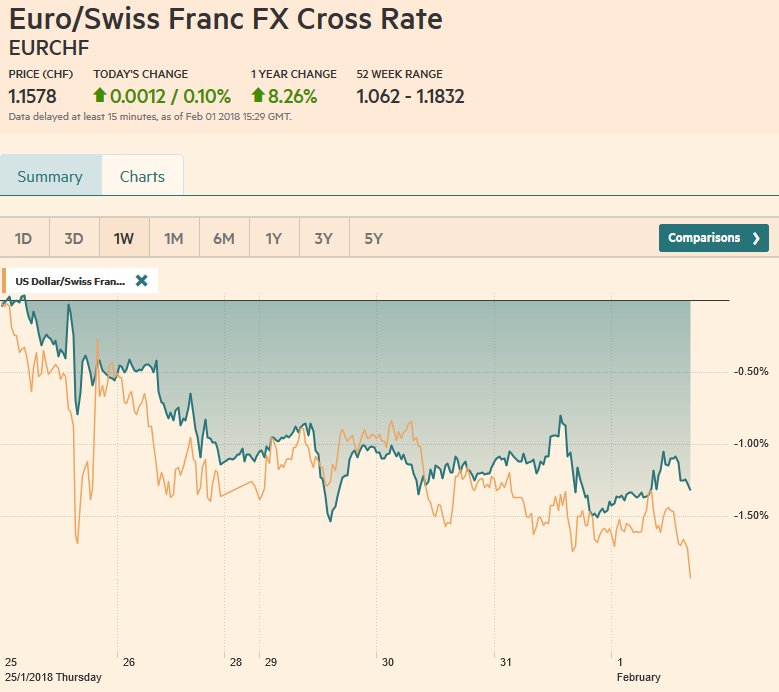

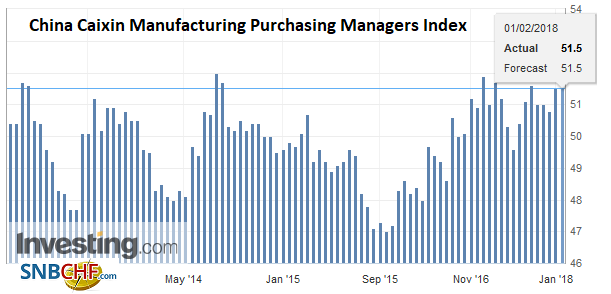

ChinaChina’s Caixin manufacturing PMI slipped to 51.3 from 51.5 in December. Recall that the official measure eased to 51.3 from 51.5. |

China Caixin Manufacturing Purchasing Managers Index (PMI), Jan 2018(see more posts on China Caixin Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

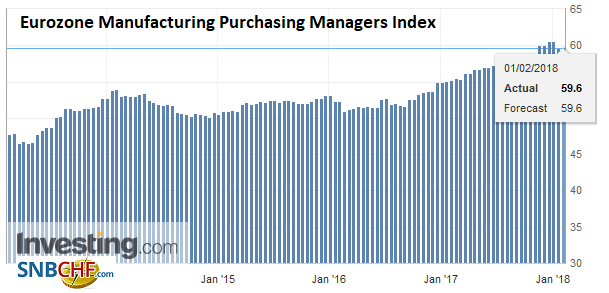

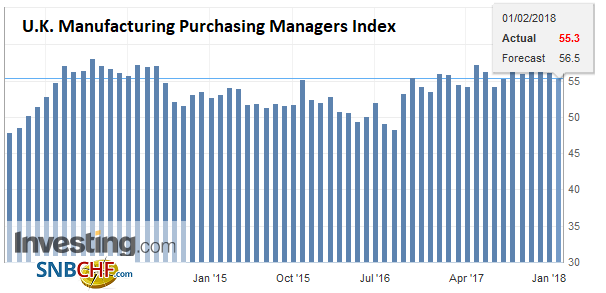

EurozoneThe eurozone reports the final January manufacturing PMI today. The flash report showed it slipped to 59.6 from 60.6 in December. Last year it averaged 57.4 and in Q4 it averaged 59.7. The UK’s Nationwide has already reported a larger than expected rise in house prices (3.2% vs. 2.6%) and will report the manufacturing PMI shortly. It is expected to tick up to 56.5 from 56.3, though we suspect the risk is to the downside. |

Eurozone Manufacturing Purchasing Managers Index (PMI), Feb 2018(see more posts on Eurozone Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

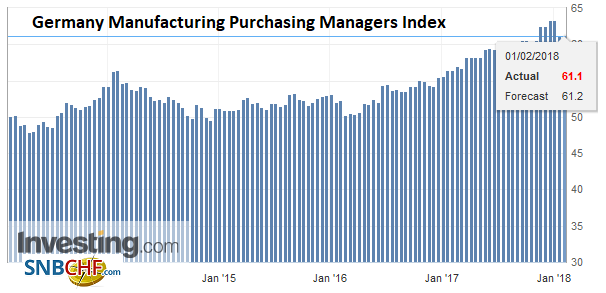

Germany |

Germany Manufacturing Purchasing Managers Index (PMI), Feb 2018(see more posts on Germany Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

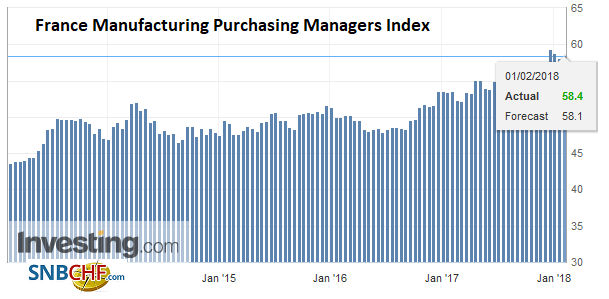

France |

France Manufacturing Purchasing Managers Index (PMI), Feb 2018(see more posts on France Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

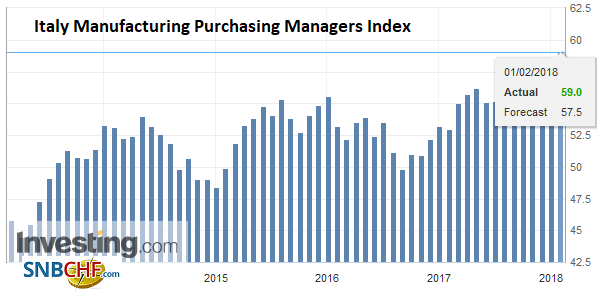

Italy |

Italy Manufacturing Purchasing Managers Index (PMI), Jan 2018(see more posts on Italy Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

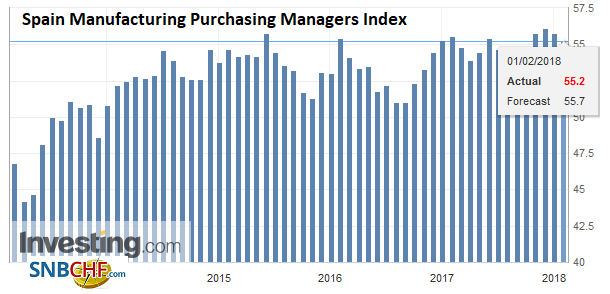

Spain |

Spain Manufacturing Purchasing Managers Index (PMI), Jan 2018(see more posts on Spain Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

United KIngdom |

U.K. Manufacturing Purchasing Managers Index (PMI), Jan 2018(see more posts on U.K. Manufacturing Purchasing Managers Index, ) Source: Investing.com - Click to enlarge |

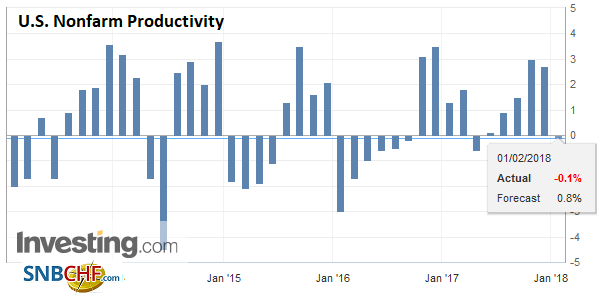

United StatesThe US session features non-farm productivity and unit labor costs. These are derived from Q4 GDP and typically are not market movers. |

U.S. Nonfarm Productivity QoQ, Q4 2017(see more posts on U.S. Nonfarm Productivity, ) Source: Investing.com - Click to enlarge |

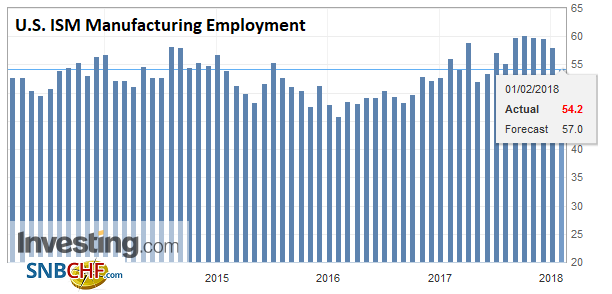

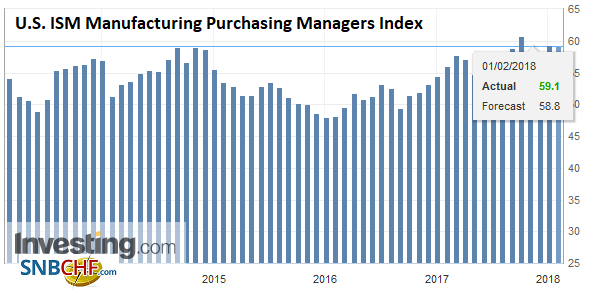

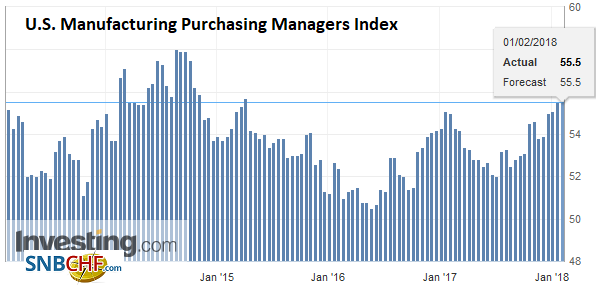

| The US also reports PMI and ISM manufacturing. The flash PMI rose, but the median expectation is for a softer ISM report. |

U.S. ISM Manufacturing Employment, Jan 2018(see more posts on U.S. ISM Manufacturing Employment, ) Source: Investing.com - Click to enlarge |

U.S. ISM Manufacturing Purchasing Managers Index (PMI), Jan 2018(see more posts on U.S. ISM Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

|

U.S. Manufacturing Purchasing Managers Index (PMI), Feb 2018(see more posts on U.S. Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

|

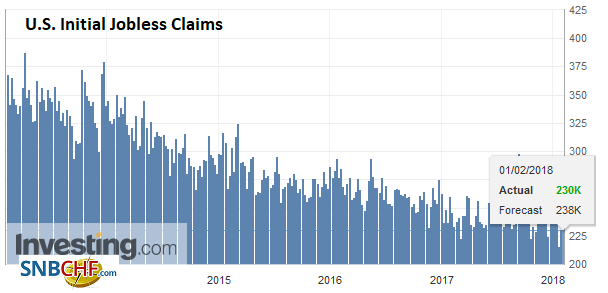

| Weekly initial jobless claims are of little importance ahead of tomorrow national jobs report. Auto sales for January will be reported. They are expected to slow sequentially to around 17.2 mln SAAR from 17.7 mln. |

U.S. Initial Jobless Claims, February 1(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

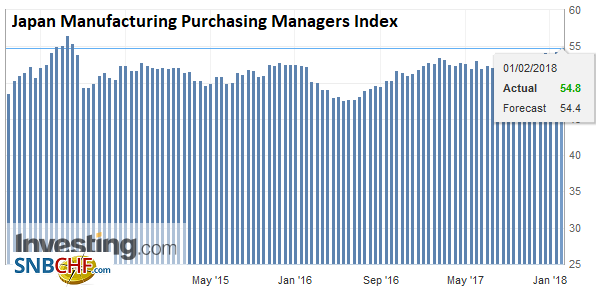

Japan |

Japan Manufacturing Purchasing Managers Index (PMI), Feb 2018(see more posts on Japan Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

The US dollar strengthened in response to the FOMC statement yesterday and it is firmer in the Asian session. The Antipodeans and yen are leading on the downside. The softer than expected inflation data by Australia earlier this week dampened ideas that the central bank can raise rates in coming months and its interest rate support has been declining. Note that the US two-year yield is around 17 bp more in Australia’s and the US five-year yield offers about a 15 bp premium. Australia offers a seven basis point premium to the US, but it seems to be a matter of time before it too disappears. The Australian dollar is at its lows for the week just above $0.8000. A break of $0.7970 may bolster confidence that a high of some import is in place.

Rising US rates coupled with more convincing signals that the BOJ is not on the verge of pulling back from its extraordinary monetary policy (including increasing shorter-date coupon purchases) has kept the yen on the defensive. The US dollar is at its best levels of the week, above JPY109.50 in early European turnover. Resistance is seen in the JPY109.75-JPY109.80 area, and then near JPY110.25.

The MSCI Asia Pacific Index has snapped a three-day drop in the wake of the stronger performance in the US yesterday. It is up about 0.35% in late turnover, led by the resurging Japanese stock market, which was up 1.7%-1.8%. Of note, profit-taking continued in China.

Economic news from the region including firm South Korean and Taiwanese manufacturing PMIs. South Korea bounced back from the December dip below the 50 boom/bust level to 50.7 in January. On the other hand, CPI was reported on the soft side at 0.4% compared to expectations for a 0.7% increase. Taiwan’s manufacturing PMI edged higher to 56.9 from 56.6. It reported a stronger than expected Q4 GDP of 3.28%. The median forecast from the Bloomberg survey expected a slowing to 2.50% from 3.10% in Q3 18.

The euro has found support near $1.2380. The week’s low was set near $1.2335 and a break of $1.2300 is probably needed to begin getting the substantial bears to rethink the near-term outlook. The euro peaked intraday yesterday a little above the $1.2460 level we identified as a potential swing level. The euro is off about a 0.25% this week. It is threatening to end a six-week rally. Note that there are roughly 3.7 bln euros in options struck between $1.2400 and $1.2425 that are expiring in NY today.

Sterling is little changed on the day, straddling $1.4200. Yesterday’s high was near $1.4235, which is the high for the week thus far. The week’s low was set near $1.3980. The technical indicators, like the MACDs and Slow Stochastics, suggest the upside may be limited.

Canada reports the January manufacturing PMI and its December leading economic indicator. The US dollar fell to its lowest level since September yesterday near CAD1.2250. It is flat near CAD1.23 now. A move above CAD1.2340 is needed to suggest a false breakdown yesterday.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$AUD,$CAD,$EUR,$JPY,China Caixin Manufacturing PMI,EUR/CHF,EUR/GBP,Eurozone Manufacturing PMI,Featured,Germany Manufacturing PMI,Italy Manufacturing PMI,Japan Manufacturing PMI,newsletter,Spain Manufacturing PMI,U.K. Manufacturing PMI,U.S. Initial Jobless Claims,U.S. ISM Manufacturing Employment,U.S. ISM Manufacturing PMI,U.S. Manufacturing PMI,U.S. Nonfarm Productivity,USD/CHF