Swiss Franc The Euro has risen by 0.09% at 1.13 EUR/CHF and USD/CHF, December 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities have stabilized after US equities recovered yesterday, with the NASDAQ 100 staging its biggest reversal in eight months and the S&P 500 recouped almost three percent to close 0.15% lower. Asia Pacific equities were mostly higher. Hong Kong shares, including the mainland shares that trade there, were the notable exception. European shares are rebounding as well. With every sector higher, the Dow Jones Stoxx 600 is up about 1.3%, which it sustained, would be the biggest gain since the end of October. US stocks are trading

Topics:

Marc Chandler considers the following as important: 4) FX Trends, AUD, CAD, EUR, EUR/CHF, Featured, FX Daily, GBP, JPY, MXN, newsletter, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

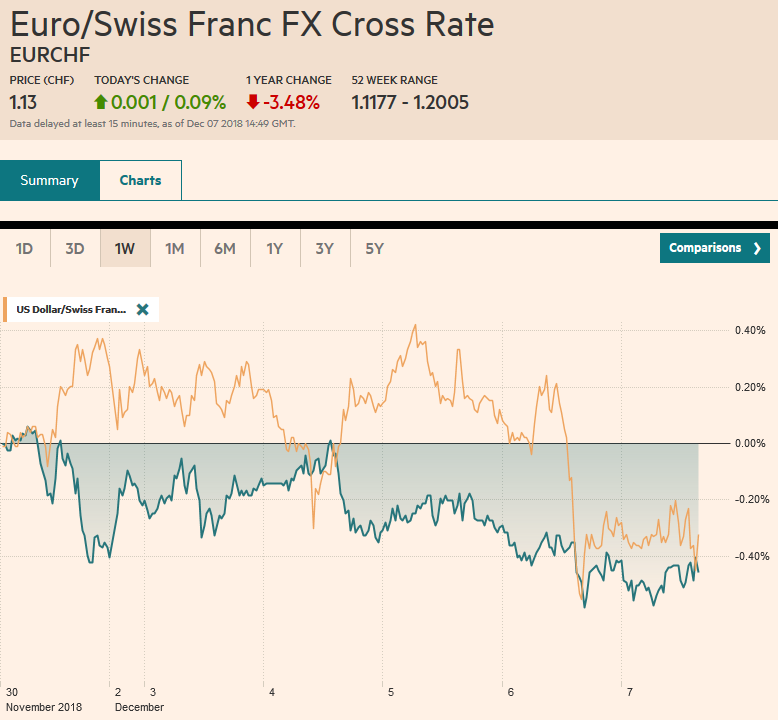

Swiss FrancThe Euro has risen by 0.09% at 1.13 |

EUR/CHF and USD/CHF, December 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

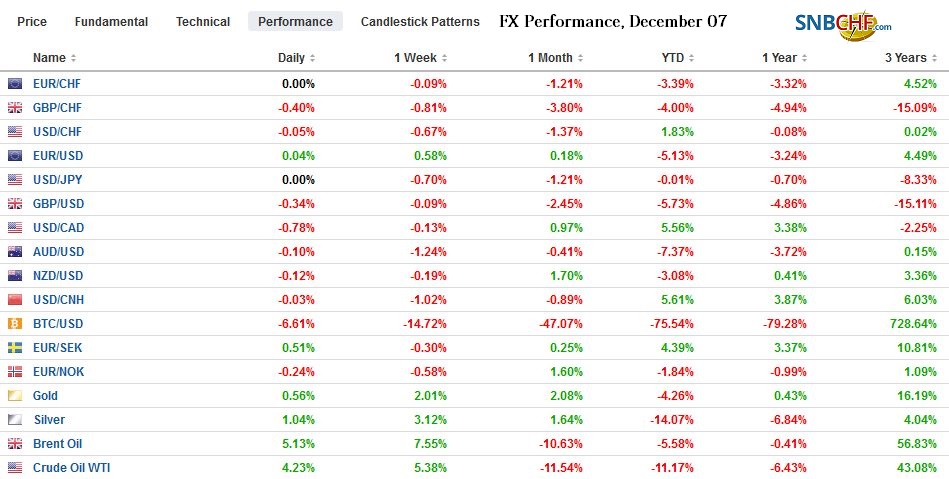

FX RatesOverview: Global equities have stabilized after US equities recovered yesterday, with the NASDAQ 100 staging its biggest reversal in eight months and the S&P 500 recouped almost three percent to close 0.15% lower. Asia Pacific equities were mostly higher. Hong Kong shares, including the mainland shares that trade there, were the notable exception. European shares are rebounding as well. With every sector higher, the Dow Jones Stoxx 600 is up about 1.3%, which it sustained, would be the biggest gain since the end of October. US stocks are trading heavier (~0.6%), but the employment data will be reported an hour before the market opens and is bound to change it. Core bonds yields in Europe are slightly firmer, while peripheral yields are softer, left by a five basis point decline Italy’s benchmark yield to leave it nearly flat on the week. The US dollar is slightly firmer against the major currencies, with the New Zealand dollar is resisting the pressure. An announcement for OPEC+ is still awaited, leaving crude prices little changed. |

FX Performance, December 07 |

Asia Pacific

Many traders saw the arrest of Huawei CFO in Canada as a threat to the still unclear US-China trade agreement. Not only have the US and China made separate claims, but the US officials have different spins themselves. Canada’s Prime Minister Trudeau says he had a few days notice of the arrest. President Trump says he did not know by National Security Adviser Bolton said that he knew. The question is not so much of the veracity of Trump’s claim, but if President Xi knew. Given the security apparatus, Wanzhou’s arrest was probably not a total surprise. Her arrest makes for bad optics, for sure, but we suspect that it does not change the bigger game. The sanctions earlier against ZTE, which ended up paying $1 bln, offers a recent precedent. The absence of much more than a perfunctory response suggests China is trying to calibrate its response so not to antagonize the mercurial American president or jeopardize strategic goals.

Japan reported some disappointing data that takes the shine off the recovery that is underway after the Q3 contraction. Recall that October industrial production jumped 2.9% as rebuilding efforts from the earthquake took hold. However, consumption did not recover. October household spending was expected to rebound after contracting 1.6% in September. Instead, it fell again (-0.3%). The poor consumption report comes despite labor cash earnings doubling the year-over-year gain (1.5% vs. 0.8% in September).

China reported an unexpected increase in its November reserves. The dollar value of China’s reserves rose from $3.053 trillion in October to $3.061 trillion in November. Even though the yuan snapped a seven-month losing streak in November, many economists had expected reserves to fall. Still, the $8.6 bln increase is little more than a rounding error. With the euro flat in November, valuation adjustments from the investments (bonds rallied in November) could account for the marginal increase.

The dollar fell about 1.2% against the Chinese yuan this week. It is the largest weekly decline since January. Many see it as a signal of Chinese willingness not to antagonize the US after the G20 meeting. However, the yuan’s high for the week was seen on Tuesday, but it has since pulled back. The US dollar saw almost CNY6.83 earlier in the week before rebounding to the CNY6.88-CNY6.90 area. The dollar is snapping a two-week advance against the Japanese yen. At JPY112.80, it is off about 0.75% on the week. The greenback recovered from yesterday’s push toward JPY112.20. A $1.2 bln option at JPY112.50 and a $1.1 bln option at JPY113.00 expire today, and although the US jobs data will likely inject some volatility, it would not be surprising for the greenback to spend most of the session within that range. The Australian dollar is the weakest of the majors, falling 1.1% over the past five sessions as disappointing GDP data took a toll. There are large (A$6.5 bln) struck in the $0.7250-60 range that expires today that may help cap it.

Europe

Brexit developments continue. The simply binary scenario (the current Withdrawal Bill or an exit with no agreement) has been complicated this week. The odds of the UK not leaving has apparently risen. Now it is not clear that the Parliament vote will take place next week. Following reports that the chief Tory Whip told the Prime Minister that the government would lose the vote, there is speculation that May could delay the vote to 1) try to persuade EC to make a few concessions and 2) continue to try to persuade Parliament. Presently the vote is scheduled for December 1.

After an unexpected rise in German October factory orders reported yesterday, investors were hopeful about today’s industrial production report. They were disappointed. Industrial output fell 0.5%, offsetting the small gains in August and September. Indeed the September 0.2% gain was halved in the revision. Later today, the CDU will choose Merkel’s successor. The two leading candidates are Merz and Kramp-Karrenbaur. Both are seen fiscal conservatives. From the outside, the differences are stylistic and tactical. Merz is seen more likely to tact right to counter the rise of the AfD, while Kramp-Karrenbaur is seen more inclined to stake out a strong centrist position.

The euro rose in one week in October and one week in November. Ahead of the US jobs data, it is holding on to a little less than a 0.5% gain this week. It has been confirmed to a little more than a one cent range this week (~$1.1310-$1.1420). It has been trapped in less than a quarter-cent range today (~$1.1360-$1.1380). There is an expiring $1.1350 option for roughly 585 mln euros today and another at $1.14 for 1.9 bln euros. Sterling was sold as it approached $1.28 today. It also seems stuck in a range, mostly $1.27-$1.28. At $1.2745, sterling is practically flat on the week, after falling for the past three weeks.

North America

The US and Canadian jobs data and Mexico’s CPI are the remaining data highlights for the week. The ADP estimate disappointed yesterday but Fed Chair Powell’s comments late yesterday about the strength of the labor market suggest that any weakness will likely be shrugged off as noise. Residual recovery from the hurricanes in September and October may help lift non-farm payrolls. Given the focus on inflation, the focus has shifted from job growth to earnings growth. The base effect is difficult as last November average hourly earnings rose 0.3%. They have to rise 0.3% this November to maintain the 3.1% year-over-year pace. Some economists are pinning their forecasts for an increase to Amazon and some other companies that increase wages on November 1.

The median forecasts call for Canada to have created 10k new jobs in November while wage growth for permanent workers may slow to 1.8% from 1.9%. It peaked in May near 4%. Mexico’s is expected to report softer price pressures in November, with the CPI moderating to 4.6% from 4.9%. Still, the central bank is widely expected to hike rates again (to 8.25%) when it meets again in two weeks.

The US dollar is firmer against the Canadian dollar for the fourth consecutive session. The US dollar has risen against the Canadian dollar every week save one since the end of September. Yesterday’s US dollar high near CAD1.3440 is this year’s high. The US dollar reversed lower against the Mexican peso yesterday. The MXN20.50 area remains sticky. Support is seen near MXN20.30.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,EUR/CHF,Featured,FX Daily,MXN,newsletter,USD/CHF