Late 2014/early 2015 will perhaps be the closest to a real recovery from the Great “Recession” we shall see in this cycle. Q1 2015 marked the peak year over year growth rate of GDP in this recovery at 3.76%. That rate compares quite unfavorably with even the feeble post dot com crash recovery high of 4.41% in Q1 2004. It doesn’t even come close to the routine 4-5% year over year growth rates we saw in the late 90s. YOY GDP growth from Q2 1996 to Q3 2000 never dipped below 4% and for the last two years of that expansion stayed near 5%. It isn’t in the same ballpark with the 8.5% snapback from the double dip recessions of the early 1980s. That’s not to say that such growth will never return. We believe it is a

Topics:

Joseph Y. Calhoun considers the following as important: Alhambra Research, Bank of Japan, crash of 1929, economic growth, English Posts on SNB, Featured, Federal Reserve, Greenspan put, Investing, market cap to gdp, Markets, Monetary Policy, newslettersent, QE3, Quantitative Easing, S&P 500, S&P 500, SNB balance sheet, stock buybacks, Stock market crash, stocks, Swiss National Bank, valuations

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Late 2014/early 2015 will perhaps be the closest to a real recovery from the Great “Recession” we shall see in this cycle. Q1 2015 marked the peak year over year growth rate of GDP in this recovery at 3.76%. That rate compares quite unfavorably with even the feeble post dot com crash recovery high of 4.41% in Q1 2004. It doesn’t even come close to the routine 4-5% year over year growth rates we saw in the late 90s. YOY GDP growth from Q2 1996 to Q3 2000 never dipped below 4% and for the last two years of that expansion stayed near 5%. It isn’t in the same ballpark with the 8.5% snapback from the double dip recessions of the early 1980s.

That’s not to say that such growth will never return. We believe it is a foregone conclusion that it will, largely because humanity, despite all its flaws, abhors stagnation. We just don’t buy the secular stagnation thesis; we have not reached the end of innovation. Something will change. The only questions are when and how, preferring, of course, a benign transformation while acknowledging that a more chaotic version may be the more likely outcome.

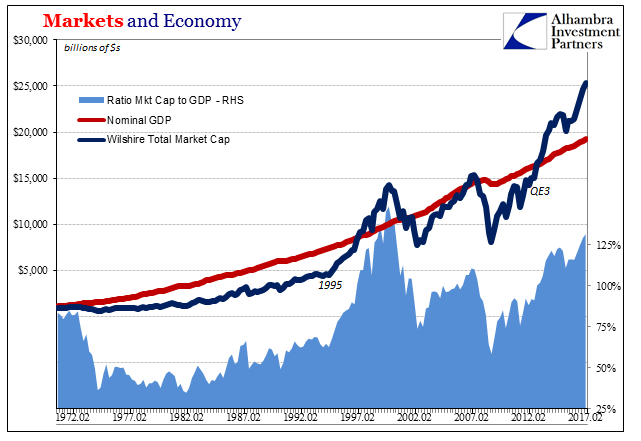

In early 2015 the growth outlook was at its sunniest, with thoughts of lost decades pushed out of mind, the global economy widely perceived to be finally breaking free of the post crisis lethargy. It had been a tough few years, but many, maybe most, people believed central bankers had done their job. Here in the US QE3 appeared to have the economy on the way to full restoration or as close as one might expect after the cataclysm of 2008.

Certainly stock prices were anticipating that end result, surging after the introduction of QE3 in 2012. By late 2014, even as other indicators started to sour, robust earnings were reckoned to be right around the corner, the robust economy of QE3 just over the horizon. The appeal of using forward earnings to justify today’s investment is that the market can always appear cheap as long as you have something – apparently anything – to hang your future economic growth hat on. QE3 served that purpose well.

In November 2014 David Letterman told a self-deprecating joke that speaks a plain truth about investing.

Stocks are at an all-time high today. I don’t have any money in the stock market. I don’t have the stomach for the ups and downs. So about 20 years ago I put all of my money and liquid assets into videotape rewind machines.

| Current valuations are a reflection of the perceived risk and reward of the investment considered. Those perceptions are handicapped by our utter inability to see the future clearly. In 1994, even on the verge of a digital revolution, the idea that the VCR would be supplanted by not one but two innovations in the next 5 years might have seemed absurd. The DVD was introduced in 1995 and by 1999 was rendered obsolete by Tivo. Now every set top box produced has a DVR built in with near infinite storage. Perceived safety or risk is only distantly related to the real thing.

The economy is not the market and the market is not the economy but they are surely related. Our collective perception of the future, of the pace of innovation in this case, is reflected in the valuations we place on videotape rewind machines today. Just as in the micro case of an individual investment, the valuation we place on the market as a whole should reflect our collective estimation of future economic growth. |

Markets and Economy 1972 - 2017 |

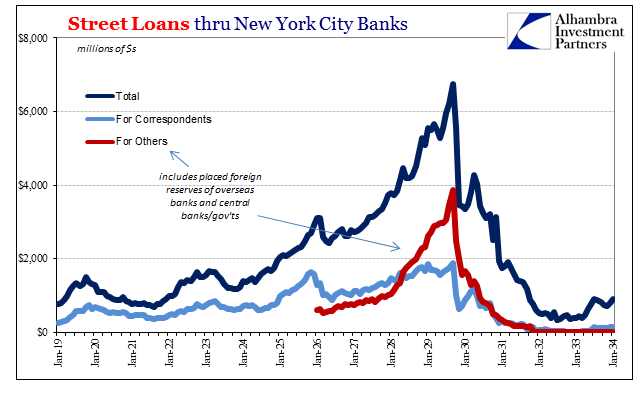

Twain probably wasn’t thinking of investors when he wrote that but it is apt to this discussion for several reasons. Investors routinely become overconfident in their assessment of economic and market conditions, often making assumptions that just are not true to justify their actions. It is assumed, for instance, by many stock market participants, that there is a direct link between monetary policy and stock prices. The idea of the Greenspan put (or the Bernanke put or now the Yellen put) makes this link explicit, almost as if money moves straight from the Fed’s balance sheet into the NASDAQ. And that assumption appears to be well founded at times. It is plain that QE3 unleashed a massive stock market rally. Quantitative easing is money printing and that money obviously ended up in the stock market, QED. Well, yeah, except no, not even close. There was once a direct link between money and the stock market but it hasn’t been that way for generations. Before the Great Depression, it was true that money and stock prices were immediately and directly connected. Correspondent banks held large idle deposit balances for banks in the tiers below them (small, rural banks would deposit funds with a reserve city bank to address payment needs, while reserve city banks would deposit funds with a central reserve city bank in New York, Chicago, or St. Louis). Banks in central reserve cities like New York and Chicago used these deposits to lend into the call money market.

|

Street Loans Thru New York Sity Banks 2019 - 2034 |

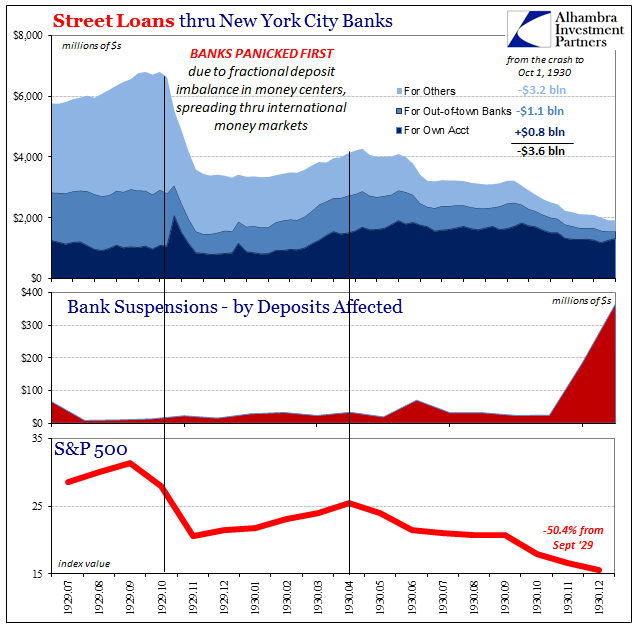

| Call money, or street loans, were overnight and collateralized because these correspondent reserve balances needed to be highly liquid and temporary should they be called upon in the payment system. New York reserve city banks, however, also began holding the international equivalent of correspondent balances on behalf of foreign institutions, either banks, central banks, or foreign governments. In the later 1920’s, especially after 1927, these balances given to street loans exploded. That drove the stock market bubble and set the stage for the Crash of ’29.

Thus, when the market crashed it threatened the entire national payment system. Those rural bank deposits at the big city banks would eventually be needed in the real economy. The city banks thought the loans were well collateralized because stock prices had been rising for so long. Imagine if banks in the late 1990s had used monetary float as the basis for lending to investment houses on pets.com collateral. After the 1930’s, these activities were simply and properly delinked. When the market crashed in 1987, for example, it threatened nothing in the real economy apart from nerves. There was no danger of depression – though Alan Greenspan acted as if there was – because monetary conditions (eurodollars) were by then long distinct from share prices. There remain, of course, some channels for monetary circumstances to affect asset prices such as 2008 or even August 2015 and January 2016, but by and large the monetary system is a separate matter. QE’s impact is primarily psychological. Investors are less apt to sell, and more likely to deploy their other savings, when they believe QE will succeed in the real economy to at some point in the future produce the innovative death of videotape rewind machines. |

|

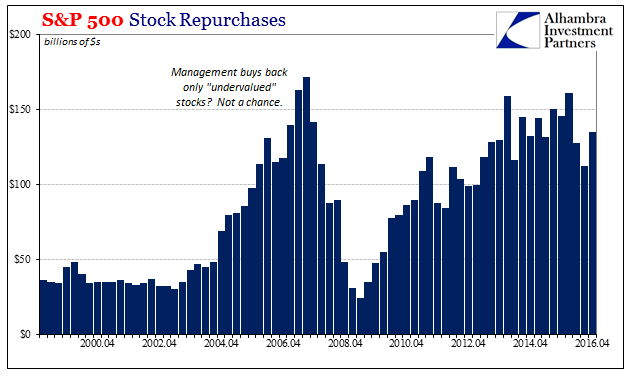

| While many investors obviously believed that QE would have a positive impact on economic growth it is ironic that corporate America seemed to take the opposite view. They have, since the middle 2000’s bought back their own shares at unbelievable rates, largely because the real economy has increasingly presented little in the way of productive investment opportunities.

In this sense, stock investors believed QE would work while at the same time the companies whose stock they bought knew very well it wasn’t and both ended up doing the same thing at the same time for very different reasons – buying stock. |

S&P 500 Stock Repurchases 2000-2017(see more posts on S&P 500, ) |

|

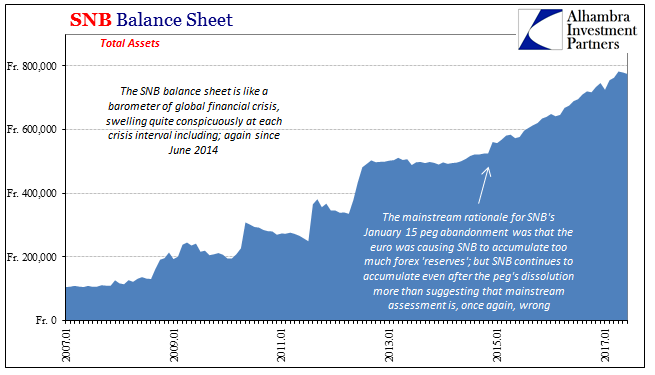

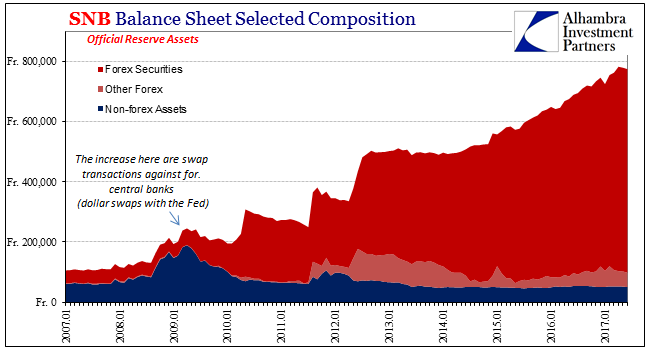

While the Fed’s monetary machinations don’t include using their balance sheet to buy shares, the same can’t be said for other central banks around the world. The Hong Kong monetary authority bought HK stocks after the Asian crisis in the late 90s. The Bank of Japan is the third largest holder of Japanese stocks behind the Japan Government Pension fund and BlackRock. The Swiss National Bank has since 2009 swelled in size trying to keep the Franc stable. It buys US and European shares (and bonds) to keep the Franc from rising as capital flows into the perceived safe haven. They are not economic buyers, anticipating economic growth; fundamentals at the macro level or the corporate level are not a consideration. They are merely using newly conjured Swiss Francs to buy Euros and US dollars. The assets they buy with those Dollars and Euros is irrelevant to their monetary aims. |

SNB Balance Sheet 2007-2017(see more posts on SNB balance sheet, ) |

|

The rise of US stock prices since 2012 has been driven by a combination of things investors and central bankers think they know. Investors think there is a direct link between Fed policy and the stock market. Central banks think that if they can push up asset prices it will have a positive impact on economic growth. Other central banks believe that if they can control the value of their currency they can tame capital flows. Which brings us to valuations, which reflect this collection of strongly held beliefs in things that just aren’t so. How can this combination of ill-informed, non-economic savings and investment possibly yield a rational result? |

SNB Balance Sheet Selected Composition 2007-2017(see more posts on SNB balance sheet, ) |

|

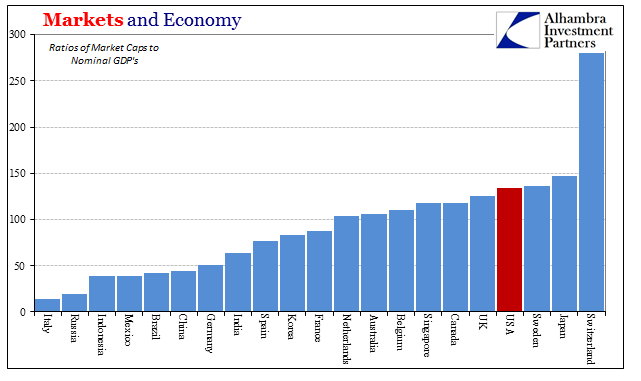

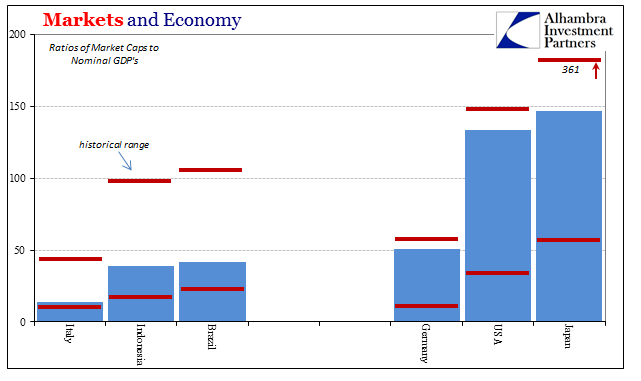

We know by any number of techniques that valuations today in the US are only comparable to those of the dot-com bubble era. The reasons are similar in one crucial aspect; after 1995, as after QE3, investors expected earnings to catch up to prices no matter how far and fast prices flew. They believed the economy and markets had entered a new paradigm, one in which the broad adoption of the internet and computers would unleash unquantifiable economic benefits. Obviously, our economy has been affected – positively and negatively we believe – by the rise of the digital economy. But there is no amount of productivity growth that can justify lunacy. There has developed over the last few years a global pecking order. Valuations in the US and a few other countries are historically high. But in many other places, valuations are historically low. The difference? The US had the exorbitant privilege of the US dollar, corporate stock buybacks, petrodollars and a widely held belief in the infallibility of central banks. Brazil had an economy dependent on commodity prices and the kindness of strangers (“dollars”) put off by a spectacularly corrupt government. Some of this has started to correct itself over the last year but the valuation divide is still wide. |

Markets and Economy |

|

The other markets with high valuations had their own means of support. Abe’s Three Arrows reforms in Japan along with a BOJ and government pension fund buying everything that wasn’t nailed down made Japanese stocks a good bet. Germany was supported by its continued dominance of the EU. Switzerland benefitted from a safe haven bid from Europeans concerned about the long term viability of the Euro. Indeed, much of the northern half of Europe benefitted from fear of a break up. The markets that are cheap are vulnerable in various ways. Latin America and much of the developing world is dependent on the whims of dollar availability. The southern cone of Europe is handicapped by the common currency and a lack of real reform that is constantly deferred by the ECB’s bond buying. Much of the rest of the world, to some degree or another, is also at the mercy of the market’s perception of US monetary policy. Valuations reflect the collective judgment of the public about the risk of the market in question. Ironically, it is when the perceived risks are the least that investors are most vulnerable. Humans are social animals with a need for the comfort of the crowd and so they invest based on the accepted wisdom of the herd. But there is no way to know the future. About the only thing we can say for sure is that it will probably look a lot different than we expect. There will be unexpected events – the invention of Tivo – that render our quaint notions about risk and reward obsolete. |

Ratios of Market Caps to Nominal GDP |

If the risks of the “safe” markets are higher than perceived then the opposite might be said about the cheap markets of the world. The US economy has not recovered as was expected after QE3 and the rest of the world hasn’t fallen apart. Emerging markets suffered during the rising dollar period but are now getting some relief.

The risks of investing in global stocks these days appears to us to be quite asymmetric. If you pay up for US shares and risks are greater than currently perceived, the downside is considerable. If you buy the cheap markets and the risks are less than currently perceived the upside is considerable. We’ve chosen the latter option for over a year now and while there may be setbacks along the way, we believe it is the more prudent course.

Markets tend to reflect a certainty by investors that is rarely warranted. Accepted truth is often not truth at all. The Twain quote above cannot be found in anything written by Samuel Clemens because he never said it. As best I can tell it comes from Josh Billings, a contemporary of Twain. But it sounds like something Twain would say so it is accepted as his. Don’t make that mistake when analyzing markets or central bank actions. Things that seem obviously true often aren’t. Question everything. And don’t do the comfortable thing. There’s no money in it.

Tags: Alhambra Research,Bank of Japan,crash of 1929,economic growth,Featured,Federal Reserve,Greenspan put,Investing,market cap to gdp,Markets,Monetary Policy,newslettersent,QE3,Quantitative Easing,S&P 500,SNB balance sheet,stock buybacks,Stock market crash,stocks,Swiss National Bank,valuations