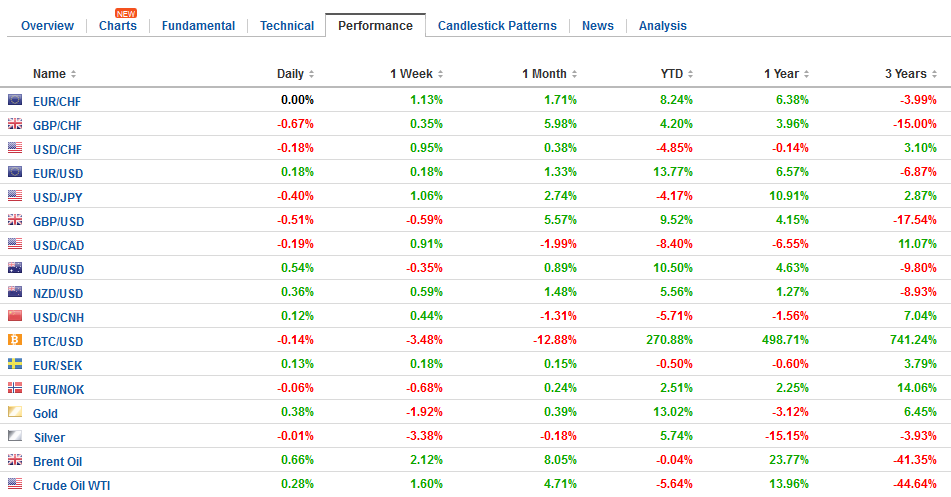

Swiss Franc The Euro has risen by 0.05% to 1.1595 CHF. EUR/CHF and USD/CHF, September 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The cycle of sanctions, recriminations, and provocative actives continues as the Trump Administration leads a confrontation with North Korea. The US announced yesterday new round of sanctions on North Korea. Reuters reported that the PBOC has instructed its banks not to take on new North Korean clients and to begin unwinding existing relationships. While the implementation and enforcement will be scrutinized, the measures are very much supportive of the US efforts. Still, there are serious doubts, which some other countries have

Topics:

Marc Chandler considers the following as important: AUD, CAD, Canada, Canada consumer price index, EUR, EUR/CHF, Eurozone Manufacturing PMI, Eurozone Markit Composite PMI, Eurozone Services PMI, Featured, FX Trends, GBP, Germany Composite PMI, Germany Manufacturing PMI, Germany Services PMI, newsletter, U.S. Manufacturing PMI, U.S. Services PMI, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.05% to 1.1595 CHF. |

EUR/CHF and USD/CHF, September 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

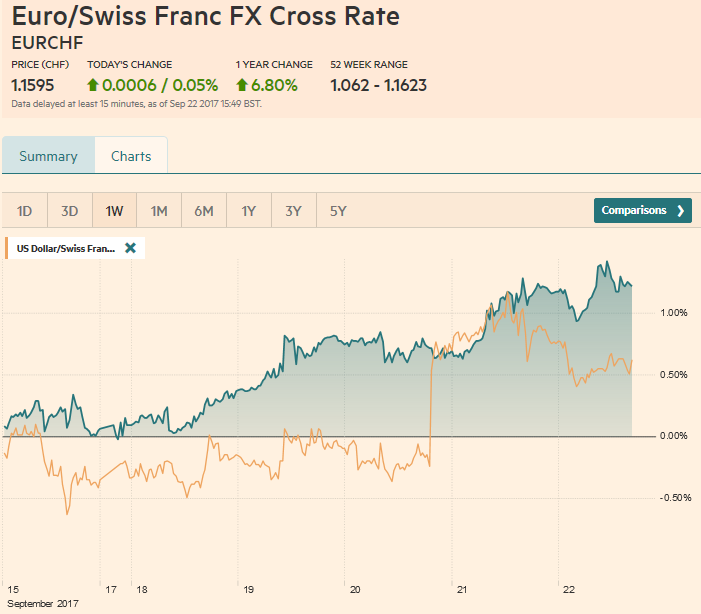

FX RatesThe cycle of sanctions, recriminations, and provocative actives continues as the Trump Administration leads a confrontation with North Korea. The US announced yesterday new round of sanctions on North Korea. Reuters reported that the PBOC has instructed its banks not to take on new North Korean clients and to begin unwinding existing relationships. While the implementation and enforcement will be scrutinized, the measures are very much supportive of the US efforts. Still, there are serious doubts, which some other countries have already expressed, that sanctions and economic and financial depravity will get North Korea to abandon its nuclear efforts. For North Korea, this is an existential issue. If it were not from credible deterrence, it fears, not completely unfounded, that there be a more sustained effort to topple his regime. We have suggested that a credible deterrence requires not only first strike capability, but also the ability to unleash a second strike if it is hit first. Up until now, North Korea has tested its hydrogen bomb on its territory. On the escalation ladder, there are many rungs. One of them is to detonate a hydrogen bomb beyond its territory, like in the Pacific, like the US has done in the past. This appears to be what North Korea is now threatening. As we have noted before, treating the confrontation with North Korea like version of the Cuban Missile Crisis, which requires urgent action, is not the only precedent on which to draw. The other one would be the Iranian experience. Sanctions were part of what brought Iran’s nuclear ambitions to the negotiating table, but the key point was that there were negotiations, in part because a military confrontation could have been so devastating. Churchill once famously quipped that the Americans can be trusted to do the right thing after they have exhausted all the other alternatives. North Korea has, it would appear, convincingly and credibly demonstrated that it will sacrifice the well-being of its people to preserve its regime. |

FX Daily Rates, September 22 |

| Still, the newest round of hyperbolic claims, sanctions, and threat of provocative actions is a modest market force today. Gold and the yen are paring this week’s losses. US Treasury yields have lost the upside momentum that lifted the 10-year yield from nearly 2.0% on September 8 to almost 2.29% on September 20, after the FOMC meeting. It is now a little above 2.25%. Gold is up about 0.5% on the day, which trims its loss for the week to 1.75% (@ ~$1297).

The correlation between the percent change in US yields and the percent change in the dollar-yen exchange rate is near not only the highs for the year, but is at the upper end of where it has been since 2000 (~0.80). The yen is recouping about a third of this week’s losses today. The 0.5% gain today leaves it a little more than 1.0% lower on the week. It is the strongest major currency today, but the weakest on the week. There are several large dollar-yen options that expire in NY today. There is $1.5 bln struck at JPY111.00. There is $1.7 bln struck at JPY112, and another $540 mln struck at JPY112.50. We would peg initial support for the dollar near JPY111.50, which corresponds to the 38.2% retracement of the rally from last Friday’s low near JPY109.55. New Zealand goes to the polls tomorrow, with the National Party expected to beat Labour to form the next government. The continuity and anticipated policy mix is understood as investor friendly. For today, the risk off push is being blunted by the heavier tone for the greenback. The Aussie’s gains are notable insofar as they come in the face of dovish comments by RBA Governor Lowe and continued weakness in industrial metals, including a 1% fall in iron ore today (which brings the weekly loss to nearly 8.5%). The entire industrial metals complex is lower today and rebar and coil steel are also extended their losses. |

FX Performance, September 22 |

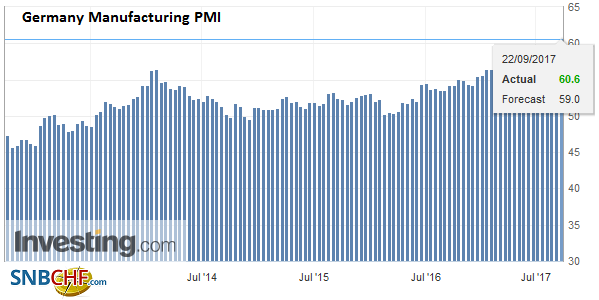

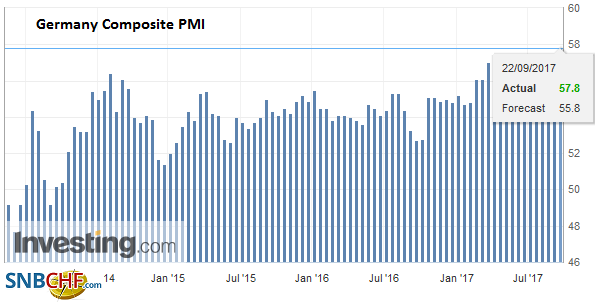

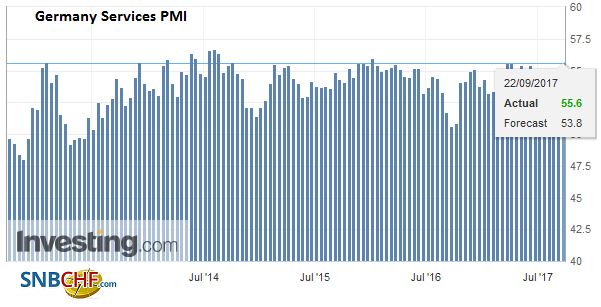

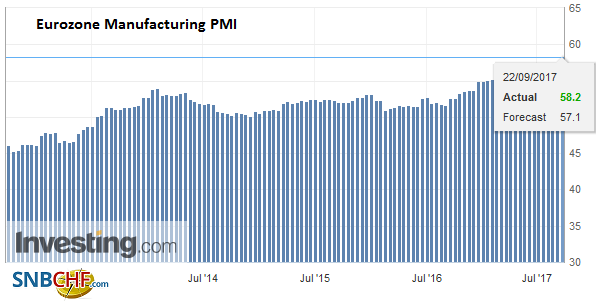

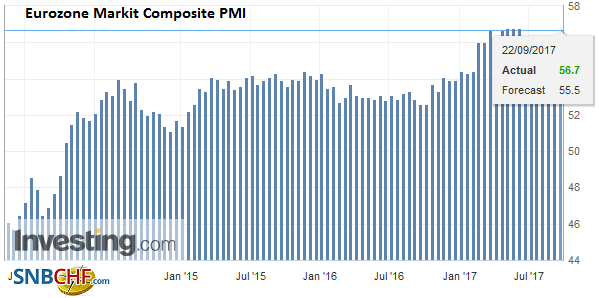

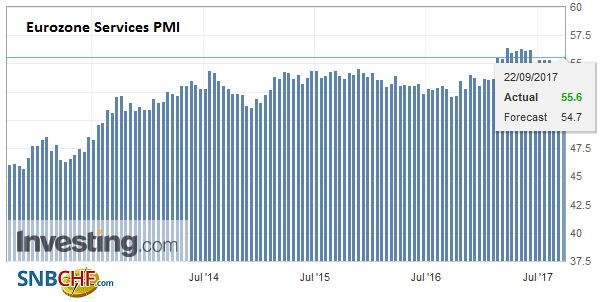

GermanyThe stronger than expected ZEW survey earlier in the week may have given a hint of today’s flash PMI reading. Germany’s flash PMI was stronger than expected and the composite reading rose to 57.2 from 55.0, a new cyclical high. France’s September flash PMI was also stronger than expected, with the composite rise to 57.2 from 55.2. The composite reading for the region as a whole rose to 56.7, returning toward the cyclical peak recorded at the end of Q1 and the start of Q2. |

Germany Manufacturing PMI, Sep 2017(see more posts on Germany Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

Germany Composite PMI, Sep 2017(see more posts on Germany Composite PMI, ) Source: Investing.com - Click to enlarge |

|

Germany Services PMI, Sep 2017(see more posts on Germany Services PMI, ) Source: Investing.com - Click to enlarge |

|

EurozoneWhat appears to be new acceleration of activity is unlikely to play a significant role the ECB asset purchases decision that will be unveiled next month. The main challenge facing the ECB, as with several other central banks, including the Federal Reserve, lies not so much with the real economy as it does with the low-price pressures, leaves it to close to deflation for officials. The euro extended its recovery after falling to nearly $1.1860 in response to the FOMC meeting, where the 11 of 16 Fed officials continue to see a hike in December as appropriate and anticipate three hikes next year. The euro reached almost $1.20 in the European morning. In the three episodes beginning in late August, when the euro pops above $1.20, there seems to be unsourced comments that seem designed to knock it back. Also, there are euro options struck at $1.1950 (1.0 bln euros) and $1.20 (1.4 bln euros) that expire in NY today, which could be in play. |

Eurozone Manufacturing PMI, Sep 2017(see more posts on Eurozone Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

| The German election does not appear to be a market factor. There seems to be little doubt that Merkel will be reelected Chancellor and that Schaeuble will likely retain the Finance Ministry. Although the CDU may have preferred a coalition with the center-right Free Democrats, it does not look like it will secure sufficient support. There may be little alternative than a return of the Grand Coalition.

UK Prime Minister speech in Florence is awaited. The EU negotiations over Brexit were delayed in hopes that her speech gives new impetus to the talks. She is expected to make some concessions on funds and EU migrants, while formally seeking a “standstill” transition period. Sterling spent this week largely consolidating last week’s gains spurred by a more hawkish sounding central bank. |

Eurozone Markit Composite PMI, Sep 2017(see more posts on Eurozone Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

Eurozone Services PMI, Sep 2017(see more posts on Eurozone Services PMI, ) Source: Investing.com - Click to enlarge |

|

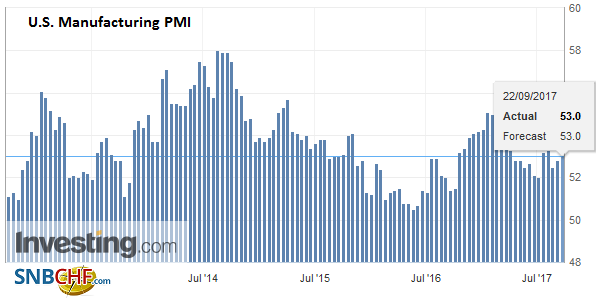

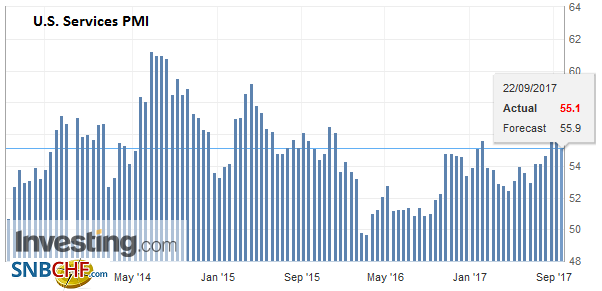

United StatesThe North American session features the Markit PMI preliminary September report for the US, which is typically not a market mover. Several Fed officials will speak today too. We suspect that it was Fed President George that cast the dot plot indicating that two rate hikes this year would be appropriate. She is one of the most vocal hawks on the Fed and is concerned that the persistence of low interest rates distorts economic signaling and risks financial instability. If that is her dot, it does not mean that she is forecasting two hikes this year, as the media suggests, but that it is her way of putting forth her argument that the Fed is slipping behind the curve. |

U.S. Manufacturing PMI, Sep 2017(see more posts on U.S. Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

U.S. Services PMI, Sep 2017(see more posts on U.S. Services PMI, ) Source: Investing.com - Click to enlarge |

|

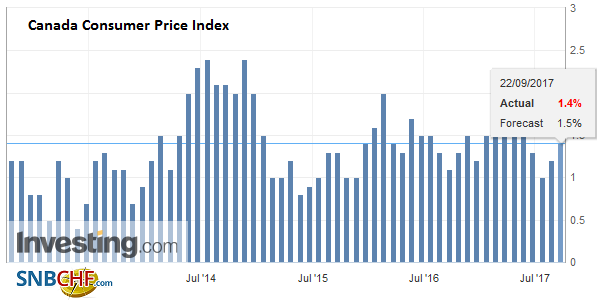

CanadaCanada reports August CPI and July retail sales. Today’s reports are unlikely to have much impact on expectations for Bank of Canada policy. After taking back the two rate cuts from 2015, the Bank of Canada is not in a hurry to move again. Comments by Deputy Governor Lane earlier in the week encouraged the market to think again about the likelihood that it would deliver three hikes in three consecutive meetings. The signals from the Bank of Canada do not appear that aggressive. The implied yield of the December BA futures has fallen a few basis points this week and coming into today’s session is 10-12 bp above the low seen after the employment report on September 8. Since then the US dollar has recovered from near CAD1.2065 to nearly CAD1.2400. Initial support for is now pegged by CAD1.22. |

Canada Consumer Price Index (CPI) YoY, Aug 2017(see more posts on Canada Consumer Price Index, ) Source: Investing.com - Click to enlarge |

China

Yesterday, S&P cut China’s sovereign debt rating (first time since 1999), expressing concerns over its debt. It followed up today by taking away Hong Kong’s AAA rating. The reason for the HK move was the potential for spillover from deleveraging on the mainland. Note that when Moody’s downgraded China four months ago, it also followed up by cutting Hong Kong’s rating as well. Incidentally, of the eleven sovereigns that S&P still sees as AAA, only Australia has a negative outlook.The Hang Seng is surrendering most of the week’s gains today, but more broadly, the MSCI Asia Pacific Index is recorded its second consecutive losing session for the first time in nearly a month. The regional benchmark is extending its advance for a sixth consecutive week. It has fallen once in the past 11 weeks.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,Canada,Canada Consumer Price Index,EUR/CHF,Eurozone Manufacturing PMI,Eurozone Markit Composite PMI,Eurozone Services PMI,Featured,Germany Composite PMI,Germany Manufacturing PMI,Germany Services PMI,newsletter,U.S. Manufacturing PMI,U.S. Services PMI,USD/CHF