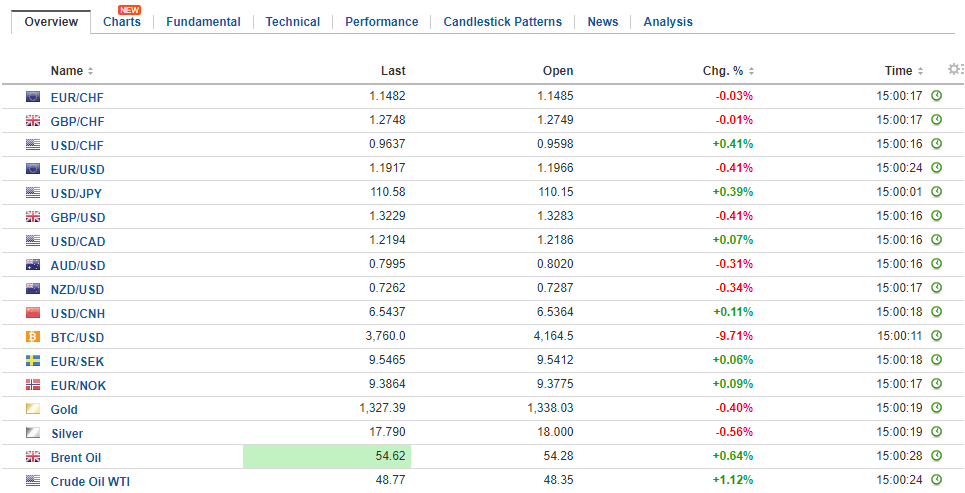

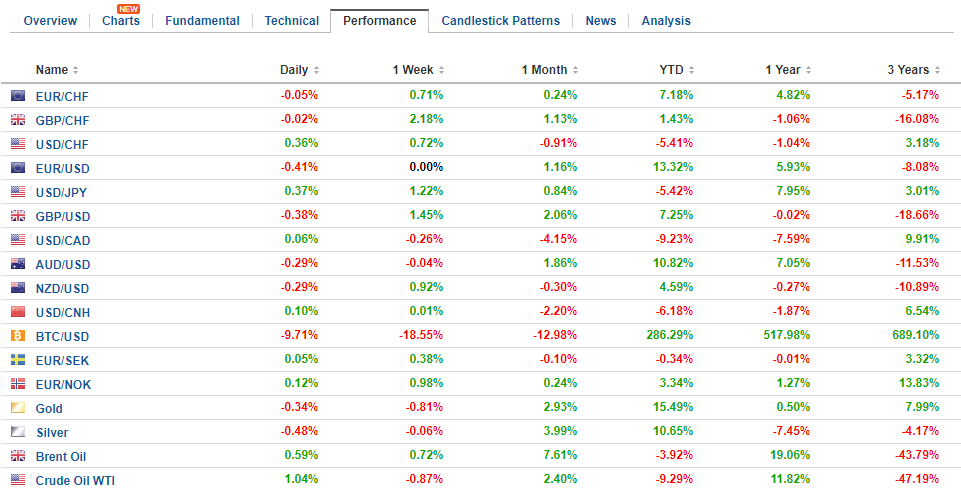

(The next leg of the business trip takes me to Frankfurt. Sporadic updates will continue) Swiss Franc The Euro has fallen by 0.14% to 1.147 CHF. EUR/CHF and USD/CHF, September 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates We have been identifying the .3430 area is a reasonable technical target for sterling. It represents the 50% retracement of sterling’s losses since the day of the referendum June 2016 when it briefly traded .50. Also helping sterling is the unwinding of short cross positions against the euro. The prospects that the ECB tappering, which some participants had seen as urgent due to the self-imposed rule on the asset purchases, now appears to be a

Topics:

Marc Chandler considers the following as important: EUR, EUR/CHF, Eurozone Employment Change, Eurozone Industrial Production, Featured, FX Trends, GBP, Germany Consumer Price Index, Japan Producer Price Index, JPY, newslettersent, TLT, U.K. Average Earnings ex Bonus, U.K. Average Earnings Index +Bonus, U.K. Unemployment Rate, U.S. Crude Oil Inventories, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

(The next leg of the business trip takes me to Frankfurt. Sporadic updates will continue)

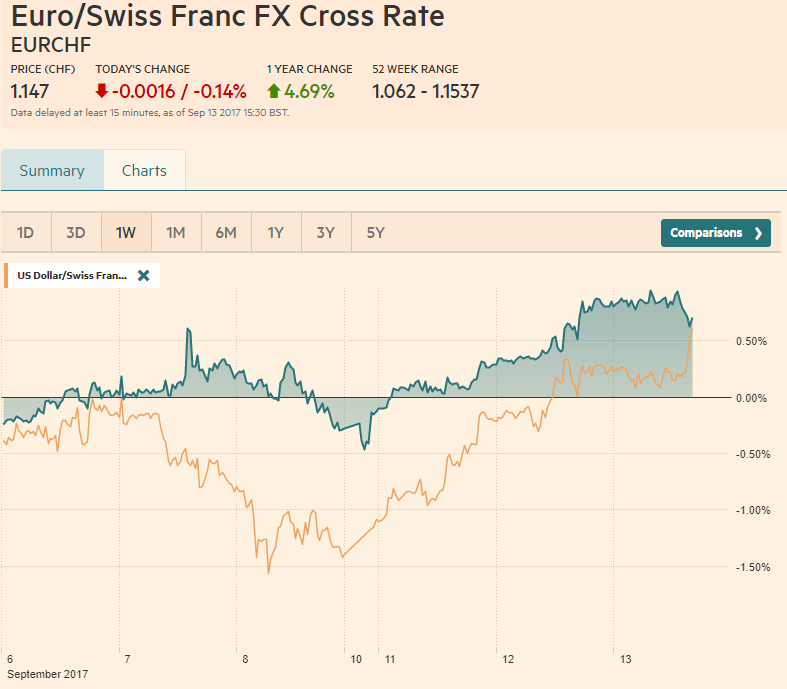

Swiss FrancThe Euro has fallen by 0.14% to 1.147 CHF. |

EUR/CHF and USD/CHF, September 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesWe have been identifying the $1.3430 area is a reasonable technical target for sterling. It represents the 50% retracement of sterling’s losses since the day of the referendum June 2016 when it briefly traded $1.50. Also helping sterling is the unwinding of short cross positions against the euro. The prospects that the ECB tappering, which some participants had seen as urgent due to the self-imposed rule on the asset purchases, now appears to be a more prolonged process that could persist well into 2018, may have encouraged some profit-taking. The euro poked through GBP0.9300 in late August amid calls from many investment houses for a move to parity. At the peak, it had moved beyond its upper Bollinger Band (two standard deviations above the 20-day moving average). In the first part of September, the euro has pulled back 3.5% against sterling and is now moving below its lower Bollinger Band. The low for the cross this year was reached before the French elections in April near GBP0.8315. The GBP0.8930 area represents a 38.2% retracement of the four-month rally. In addition to the violation of the lower Bollinger Band, the slow Stochastics are showing preliminary signs of a bullish divergence for the euro. |

FX Daily Rates, September 13 |

| The rise of yields had helped lift the dollar from JPY107.30 that had been approached before last weekend above JPY110. However, with yields stalling, the dollar is trading in narrow ranges as the momentum eases. The high from late August was seen near JPY110.65 and this offer a nearby cap. We peg initial support near JPY109.40.

The euro recovered from its push toward $1.1925 yesterday to trade nearly $1.20 in Asia. Although it has stalled there in early European turnover, the market does not appear to have given up. We suspect that it can push toward $1.2020 before some of yesterday’s bottom pickers take some quick profits. The next key technical objective we have noted is found near $1.2165, the 50% retracement of the euro’s slide from the mid-2014 high. |

FX Performance, September 13 |

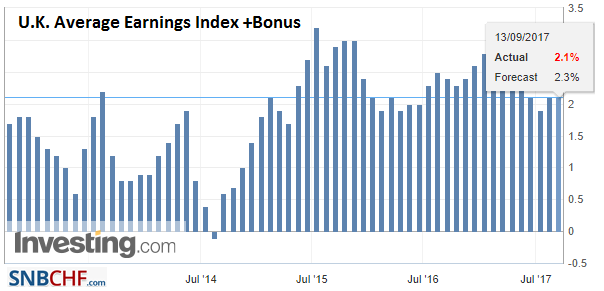

United KingdomSterling has extended yesterday’s gains scored in response to the slightly higher than expected August CPI. |

U.K. Average Earnings Index +Bonus, Jul 2017(see more posts on U.K. Average Earnings Index +Bonus, ) Source: Investing.com - Click to enlarge |

| It is trading at its best levels since last September. Chancellor Hammond’s suggest that the UK will seek a transition period that is essentially an extension of the status quo fans hopes of a softer Brexit and this is also seen as supportive for sterling. |

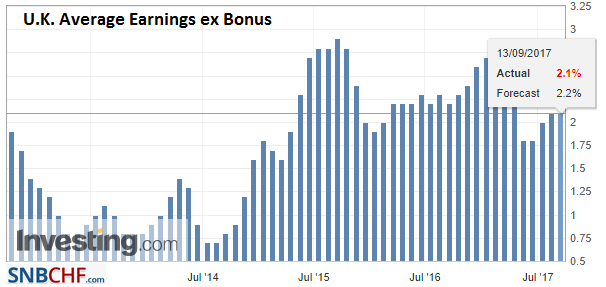

U.K. Average Earnings ex Bonus, Jul 2017(see more posts on U.K. Average Earnings ex Bonus, ) Source: Investing.com - Click to enlarge |

|

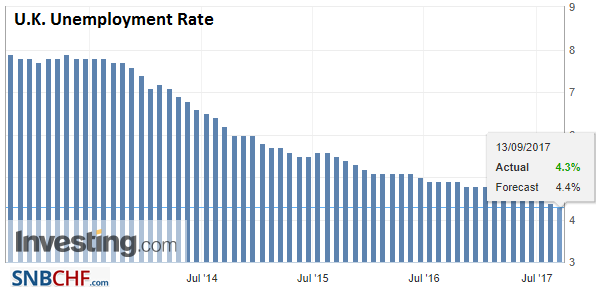

The August employment data is awaited. The main issue here is not job growth per se. As has been the case in the US and Japan too, job creation in the UK appears fairly healthy. The problem is the limited wage growth. This is arguably a more acute issue in the UK because of the rise in inflation, which saps the purchasing power of households. The Bank of England’s Monetary Policy Committee meets tomorrow. At full force, now that a new Deputy has been named, a 7-2 vote is expected in favor of standing pat. |

U.K. Unemployment Rate, Jul 2017(see more posts on U.K. Unemployment Rate, ) Source: Investing.com - Click to enlarge |

United StatesUS 10-year Treasuries fell for the second session yesterday, lifting the yield to a two-week high near 2.17%. Before last week end, the yield brief traded near 2.03%. Similarly, the 10-year German bund yield jumped from about 29 bp before the weekend, a two-month low, to over 40 bp yesterday, a three-week high. It stalled there and is slipping a little today. |

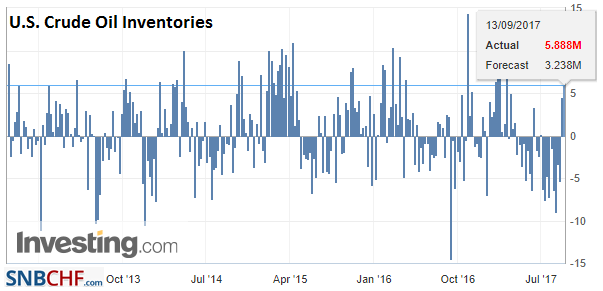

U.S. Crude Oil Inventories, September 2017(see more posts on U.S. Crude Oil Inventories, ) Source: Investing.com - Click to enlarge |

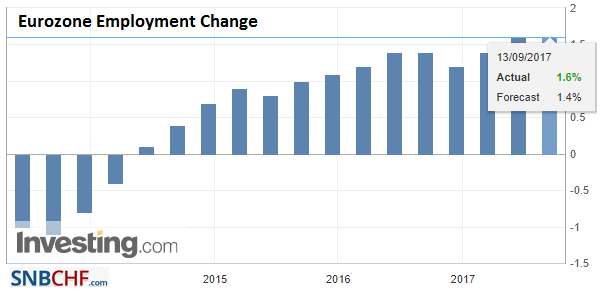

EurozoneTechnically, this suggests the euro’s stronger than anticipated recovery this year is still well within the parameters one would expect in a correction, rather than a new trend. Having talked with many people attending the TradeTech Europe FX conference in Barcelona, we remain struck with extreme negativity to the dollar, with some participants suggesting potential toward $1.30-$1.50. |

Eurozone Employment Change YoY, Q2 2017(see more posts on Eurozone Employment Change, ) Source: Investing.com - Click to enlarge |

| The pessimism toward the US is palpable. The possibility that Yellen gets reappointed, that the Fed raises rates again over the next 15 months, or that tax reform is delivered are seen as extremely low. We suspect the source of volatility will come from one or more of these events taking place. |

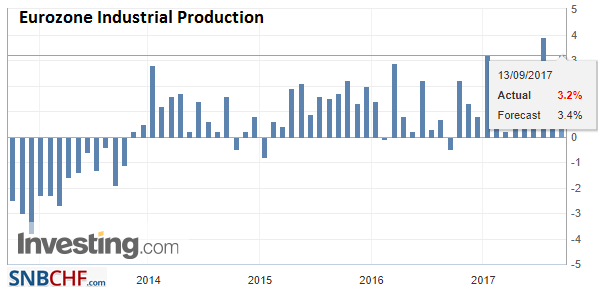

Eurozone Industrial Production YoY, Jul 2017(see more posts on Eurozone Industrial Production, ) Source: Investing.com - Click to enlarge |

Japan |

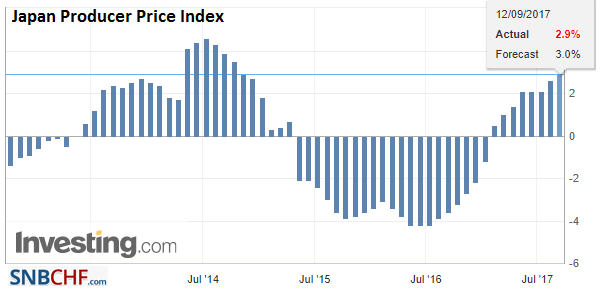

Japan Producer Price Index (PPI) YoY, Aug 2017(see more posts on Japan Producer Price Index, ) Source: Investing.com - Click to enlarge |

Germany |

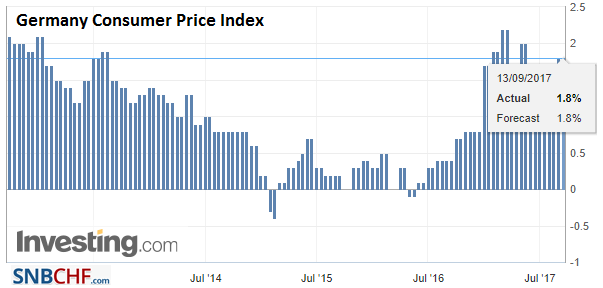

Germany Consumer Price Index (CPI) YoY, Aug 2017(see more posts on Germany Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$EUR,$JPY,$TLT,EUR/CHF,Eurozone Employment Change,Eurozone Industrial Production,Featured,Germany Consumer Price Index,Japan Producer Price Index,newslettersent,U.K. Average Earnings ex Bonus,U.K. Average Earnings Index +Bonus,U.K. Unemployment Rate,U.S. Crude Oil Inventories,USD/CHF