Summary:

Swiss National Bank leaves expansionary monetary policy unchanged The Swiss National Bank (SNB) is maintaining its expansionary monetary policy, with the aim of stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB is to remain at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration. Since the last monetary policy assessment, the Swiss franc has weakened against the euro and appreciated against the dollar. Overall , this development is helping to reduce, to some extent, the significant

Topics:

Swiss National Bank considers the following as important: Featured, newsletter, SNB, SNB Press Releases, Switzerland inflation

This could be interesting, too:

Swiss National Bank leaves expansionary monetary policy unchanged The Swiss National Bank (SNB) is maintaining its expansionary monetary policy, with the aim of stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB is to remain at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration. Since the last monetary policy assessment, the Swiss franc has weakened against the euro and appreciated against the dollar. Overall , this development is helping to reduce, to some extent, the significant

Topics:

Swiss National Bank considers the following as important: Featured, newsletter, SNB, SNB Press Releases, Switzerland inflation

This could be interesting, too:

investrends.ch writes SNB schreibt 2024 definitiven Gewinn von über 80 Milliarden Franken

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Swiss National Bank leaves expansionary monetary policy unchangedThe Swiss National Bank (SNB) is maintaining its expansionary monetary policy, with the aim of stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB is to remain at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration.

Since the last monetary policy assessment, the Swiss franc has weakened against the euro and appreciated against the dollar. Overall , this development is helping to reduce, to some extent, the significant overvaluation of the currency. The Swiss franc nevertheless remains highly valued, and the situation on the foreign exchange market is still fragile. The negative interest rate and the SNB’s willingness to intervene in the foreign exchange market as necessary therefore remain essential in order to reduce the attractiveness of Swiss franc investments and thus ease pressure on the currency.

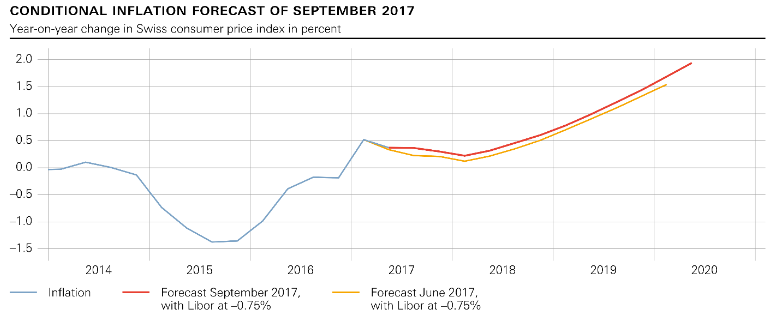

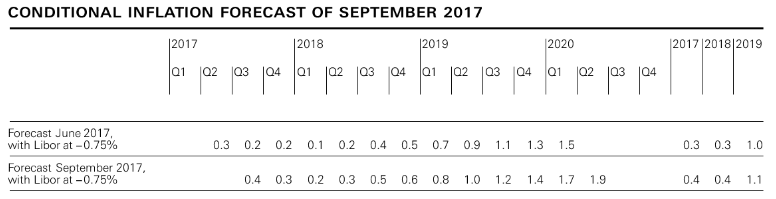

Owing to the exchange rate situation, the conditional inflation forecast has been revised upwards slightly compared to June. For the current year, t he forecast has risen marginally to 0.4%, from 0.3% in the previous quarter. For 2018, too, the SNB anticipates an inflation rate of 0.4%, compared to 0.3% last quarter. For 2019, it now expects inflation of 1.1%, compared to 1.0% last quarter. The conditional inflation forecast is based on the assumption that the three-month Libor remains at –0.75% over the entire forecast horizon.

The past few months have seen further improvements in the international environment. The global economy exhibited strong, broad-based growth in the second quarter. In the advanced economies, GDP continued to expand above potential, in some cases exceeding expectations. One exception was the UK, where uncertainty over Brexit is weighing on growth. In the emerging economies, too, economic activity was positive overall. In its baseline scenario, the SNB continues to anticipate favourable developments in the global economy for the quarters ahead.

|

SNB Switzerland Conditional Inflation Forecast(see more posts on Switzerland inflation, ) |

|

Despite the improved situation in the real economy, inflation has so far remained modest in most advanced economies. Against this backdrop, leading central banks are likely to maintain their expansionary monetary policy and embark only gradually on a normalisation path.

The positive baseline scenario for the global economy continues to be subject to risks. In particular, geopolitical factors and uncertainty regarding the future course of monetary policy at leading central banks could cloud the outlook.

In Switzerland, an analysis of the available economic indicators suggests that the moderate recovery is continuing. The Swiss economy is benefiting from the consolidation of global economic activity. Renewed momentum in goods exports is supporting industrial activity. Capacity utilisation is thus on the rise and companies are also becoming increasingly willing to invest. The situation on the labour market is gradually improving.

The recovery is less evident in the quarterly GDP estimates. Owing to weak GDP momentum in late 2016/early 2017, the current year is likely to see growth of just under 1.0%. At its monetary policy assessment in June, the SNB was still expecting growth of roughly 1.5%. The lower forecast is attributable to the weak GDP figures for the previous quarters.

Overall, imbalances on the mortgage and real estate markets persist. While growth in mortgage lending remained relatively low in the second quarter, risks in the residential investment property segment increased. In addition, following a period of stabilisation, prices in the owner-occupied residential property segment rose again slightly. The SNB will continue to monitor developments on these markets closely, and will regularly reassess the need for an adjustment of the countercyclical capital buffer.

|

Switzerland Inflation and Inflation Forecast(see more posts on Switzerland inflation, ) |

Tags: Featured,newsletter,Switzerland inflation