Swiss Franc The Euro has risen by 0.18% at 1.1178 EUR/CHF and USD/CHF, June 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The implications of President Trump’s assessment that there has not been “nearly enough” progress in negotiations with Mexico that would avert the tariff on June 10 competing for investors’ attention, which had been squarely today’s ECB...

Read More »FX Daily, December 13: Greenback Quiet Ahead of Five Central Bank Meetings

Swiss Franc The Euro has fallen by 0.06% to 1.1633 CHF. EUR/CHF and USD/CHF, December 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge GBP / CHF Since the end of August the pound has been making inroads against the Swiss Franc and recovering from the dramatic drop in exchange rates since the Brexit vote over 18 months ago. GBPCHF has gained 8 cents in 4 months. To put this into...

Read More »FX Daily, September 13: Sterling Shines While Euro Stalls in Front of $1.20

(The next leg of the business trip takes me to Frankfurt. Sporadic updates will continue) Swiss Franc The Euro has fallen by 0.14% to 1.147 CHF. EUR/CHF and USD/CHF, September 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates We have been identifying the $1.3430 area is a reasonable technical target for sterling. It represents the 50% retracement of sterling’s losses...

Read More »FX Daily, June 14: FOMC and upcoming SNB

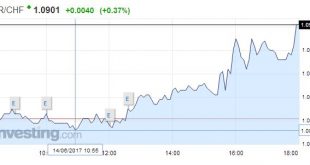

Swiss Franc The Euro has risen by 0.37% to 1.0901 CHF. This is a typical movement ahead of the SNB meeting tomorrow. This movement is probably unrelated to the Fed rate hike, given that the USD/JPY has fallen. It makes sense to go long CHF against JPY, if you bet on an inactive SNB. Inactive SNB would mean that the central bank will not speak about stronger FX Interventions or about lower rates. EUR/CHF - Euro Swiss...

Read More »FX Daily, September 13: Much Noise, Weak Signal

Swiss Franc The last ECB meeting and Dragh’s hawkish comments is for us the main reason of the euro strength, this despite stronger Swiss GDP growth. We see a mismatch between the weak ISM Non-Manufacturing PMI and the St. Louis and Atlanta Fed GDP trackers. Click to enlarge. Federal Reserve Our approach to Fed-watching is clear: Among the cacophony of voices, the Troika of Fed leadership, Yellen, Fischer and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org