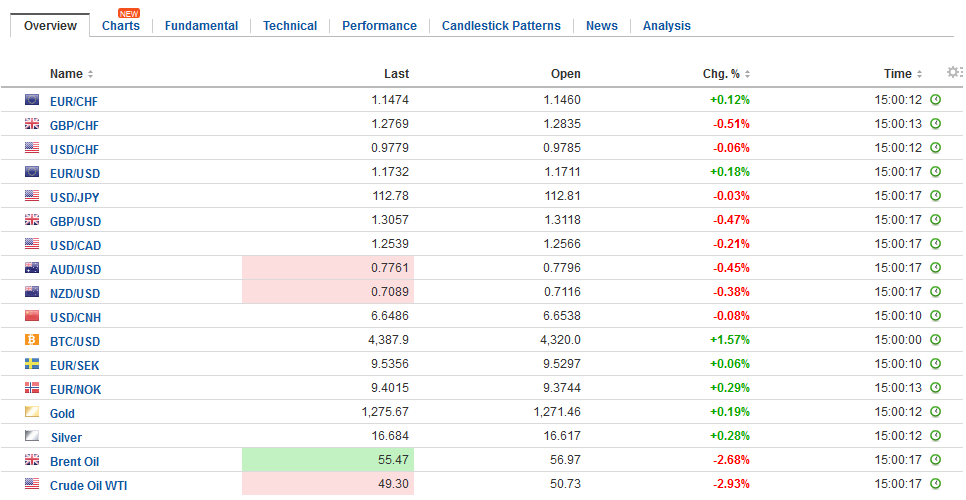

Swiss Franc The Euro has risen by 0.27% to 1.1485 CHF. EUR-CHF and USD-CHF, October 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Traders are putting the final touches on another strong weekly performance for the US dollar. Strong economic data, including the PMIs, auto sales, and factory orders have surprised to the market. The ADP report warns that the storms that flattered some high frequency data will likely skew today’s employment report (both headline and details) to the downside. Of course, investors will quickly look for the number of people who could get to work due to the weather. Nevertheless, never to get too caught up with facts, regardless of the

Topics:

Marc Chandler considers the following as important: AUD, CAD, EUR, EUR/CHF, Featured, FX Trends, GBP, Germany Factory Orders, Japan Average Cash Earnings, JPY, newsletter, Spain Industrial Production, U.S. Nonfarm Payrolls, U.S. participation rate, U.S. unemployment rate, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.27% to 1.1485 CHF. |

EUR-CHF and USD-CHF, October 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

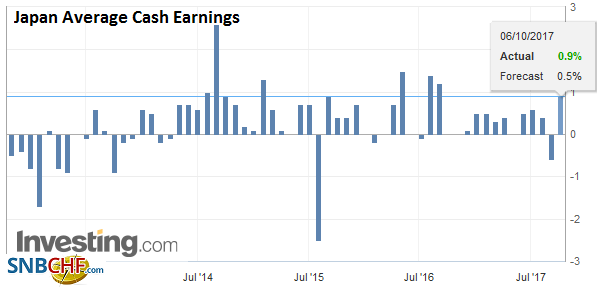

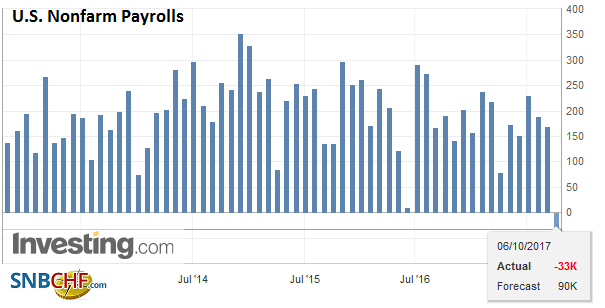

FX RatesTraders are putting the final touches on another strong weekly performance for the US dollar. Strong economic data, including the PMIs, auto sales, and factory orders have surprised to the market. The ADP report warns that the storms that flattered some high frequency data will likely skew today’s employment report (both headline and details) to the downside. Of course, investors will quickly look for the number of people who could get to work due to the weather. Nevertheless, never to get too caught up with facts, regardless of the actual report, investors will look through the report. It is an unusual set of circumstances that allow us to say the non-farm payroll is unlikely to have much impact on expectations for Fed policy. The market is going into the report having assessed about a 74% chance according to our calculations, which is similar to Bloomberg’s estimate, but below the 80% in the CME’s analysis. It is not simply a strong dollar story, but it is a weaker sterling and euro as well. The tensions between Catalonia and Madrid remain intense. A declaration of independence would likely force Madrid to suspend the local government and govern the region directly. Many years ago, Montreal was the financial center of Canada, but the threat of Quebec secession saw a shift towards Toronto. Already one of the large banks in Catalonia has raised this possibility in Spain. The Constitutional Court suspended next week’s the regional parliament session next week in Catalonia, where independence could be declared. |

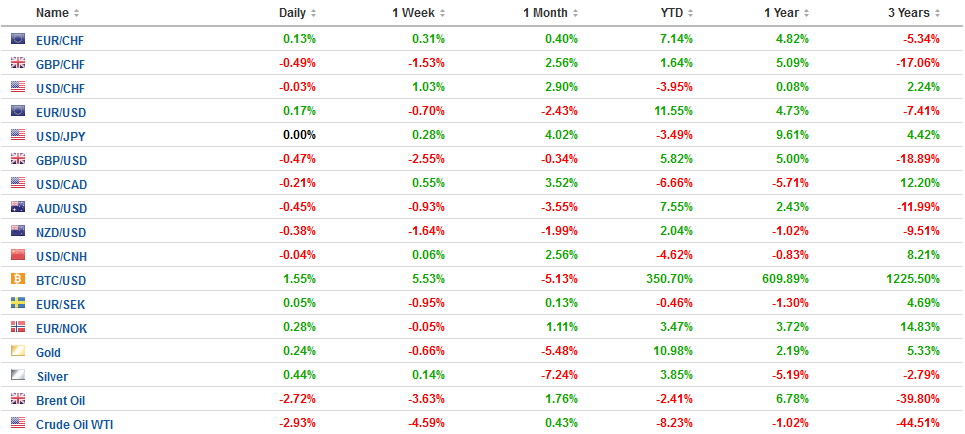

FX Daily Rates, October 06 |

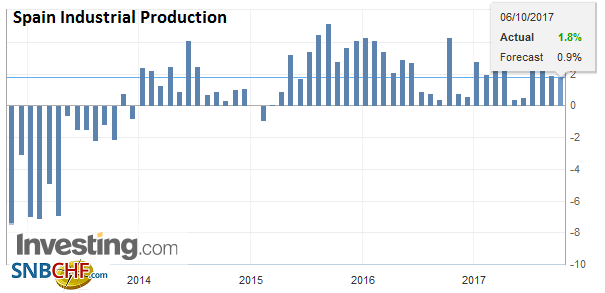

| Spanish assets continue to underperform. Spain’s 10-year yield is up nearly five basis points today to 1.73%, which is essentially the move for the week. The premium over Germany widened this week to five-month highs near 130 bp. Two months ago, Spain’s premium was less than 100 bp. Spain’s bourse is off 2.2% this week, while the Dow Jones Stoxx 600 is up about 0.6% this week. Moreover, the economy is doing well. The strength in the recent PMI has been followed by a better than expected industrial output report. The 1.0% rise in August snapped a two-month decline. The median forecast from the Bloomberg survey was for a 0.2% gain.

Sterling’s slide has accelerated this week. In fact, sterling is having its worst week in a year shedding about 2.5%. It is not due to a shift in interest rate expectations. The implied yield on December short sterling futures contract has eased single a basis point. Sterling fell by more than three cents. It was recovering from the losses spurred the face of weaker than expected manufacturing and construction PMIs, when May gave a milquetoast speech at her party’s conference. Recall too that as of last September, speculators had a net long sterling position in the futures market for the first time in two years. The late longs were in weak hands. There is a rebellion within the Tory Party. Shapp, the former Tory Party Chair reportedly has a list of colleagues who want a new leader. Reports suggest there are presently around 30 Tory MPs on the list, including several former cabinet officials and cuts across the Brexit divide. |

FX Performance, October 06 |

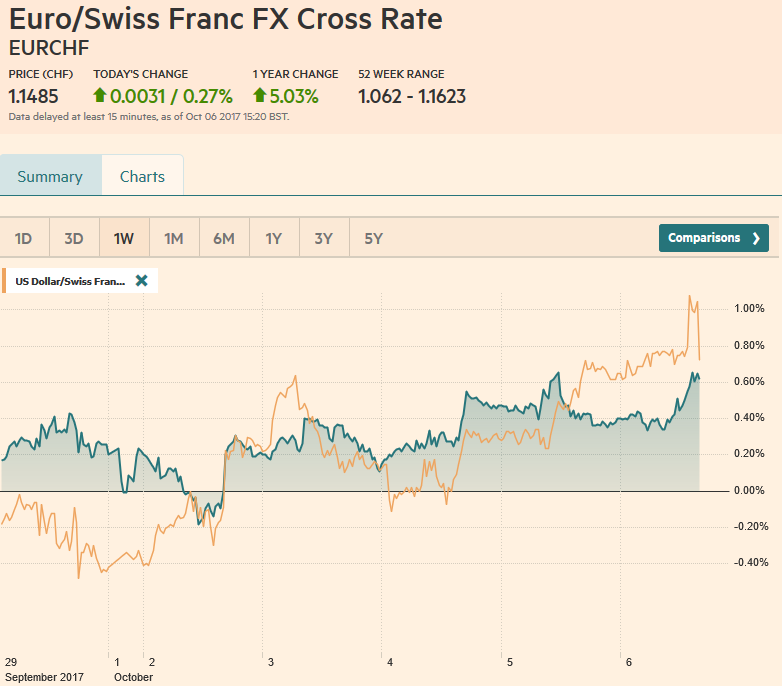

JapanAs the snap-election draws near (October 22), Japanese politics also comes into focus. Today, the Party of Hope unveiled more of its economic program. It was already known to oppose the retail sales tax increase slated for 2019, and for phasing out nuclear power (by 2030). What is new today is the possibility of taxing cash reserves of Japanese companies, which are estimated at around $2.7 trillion. It sought to reassure investors that it would retain the extremely easy monetary policy, and work with the BOJ for a smooth exit. Japanese shares closed higher today, and the Topix has extended its advancing streak for a fourth consecutive week. It is the longest such rally since May. Separately, the MOF reported that foreigners were buyers of Japanese equities last week for the first time in three months. |

Japan Average Cash Earnings YoY, October 2017(see more posts on Japan Average Cash Earnings, ) Source: Investing.com - Click to enlarge |

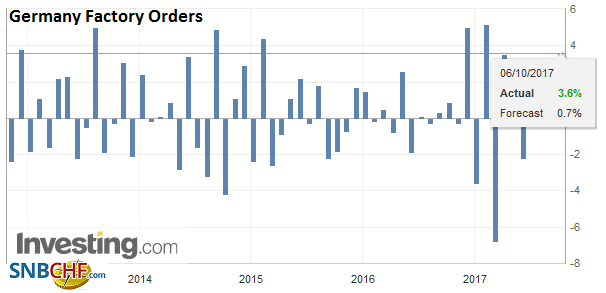

Germany |

Germany Factory Orders, Aug 2017(see more posts on Germany Factory Orders, ) Source: Investing.com - Click to enlarge |

Spain |

Spain Industrial Production YoY, Aug 2017(see more posts on Spain Industrial Production, ) Source: Investing.com - Click to enlarge |

United States |

U.S. Nonfarm Payrolls, Sep 2017(see more posts on U.S. Nonfarm Payrolls, ) Source: Investing.com - Click to enlarge |

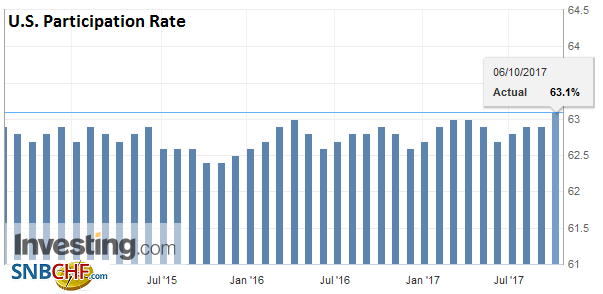

U.S. Participation Rate, Sep 2017(see more posts on U.S. Participation Rate, ) Source: Investing.com - Click to enlarge |

|

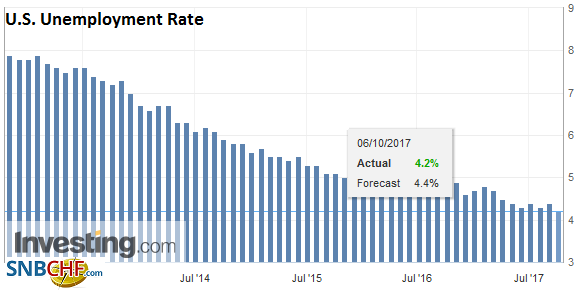

U.S. Unemployment Rate, Sep 2017(see more posts on U.S. Unemployment Rate, ) Source: Investing.com - Click to enlarge |

After sterling, the Australian dollar is the weakest of the major currencies today, following comments from RBA board member Harper who explicitly refused to rule out another rate cut. The recent string of Australian data, including this week’s retail sales report, have been disappointing, The Aussie’s losses extend the downdraft for the fourth consecutive week. It is trading near three-month lows to flirt with the 50% retracement objective of the rally in since the May low of about $0.7330. The retracement is seen near $0.7725. The 61.8% retracement is a cent lower, while the measuring objective of the potential double top is nearer $0.7500.

Barring a strong rally in North America, the euro will finish lower for the second consecutive week. It would be the first back-to-back decline in six months. The price action confirms our suspicions that the short-term market has changed to sell euro bounces rather than buy dips. If the euro finish the week below $1.17, it would be the first time since late July. The mid-August lows were recorded near $1.1660, and we have suggested that a potential head and shoulders pattern projects toward $1.1600.

To be sure, barring the lowflation, the eurozone economic activity remains elevated. That was the takeaway from the PMIs. Germany reported a surge in August industrial order today. The 3.6% rise is the strongest in three years. This is a seasonally and inflation adjusted. The strength was broad-based, with domestic orders increasing 2.7% and export orders rising 4.3%. Today’s report suggests upside risk to news week’s industrial output report, where the median is expecting a little less than a 1% increase.

Like the US, Canada will also report its September employment figures today. The median forecast expects Canadian job growth to slow to 12k after a 20k increase in August. In the first eight months of the year, Canadian employment rose an average of 27.4k a month. Last year’s average was 19k. Wage growth, of course, is also important, but the bottom line is that barring a surprisingly strong report, expectations for a hike later this month (Oct 25) are unlikely to rebuild.

Over past few weeks, expectations for another rate hike have fallen but also pushed from this month to the Dec 6 meeting. Consider, extrapolating from the OIS, Bloomberg estimates that there is an 18% chance of an Oct hike and a 65% chance of a hike before the end of the year. Three weeks ago, the market was pricing in a nearly 50% chance of a hike this month and a 68.5% chance of a hike before the end of the year. The US dollar recovery against the Canadian dollar continues, and this has been the fourth consecutive weekly advance. This is the longest such streak since last November.

Several large options are set to expire today, which may impact activity. Struck at $1.17, there are 1.3 bln euro options that roll-off today, and between $1.1735 and $1.1750, there are options for another three bln euros. On the downside, there are nearly 1.7 bln euros struck between $1.1650 and $1.1665. There is a $765 mln option struck at JPY113 that will be cut today. There is an A$1.4 bln option struck at $0.7800 that may be fading of importance as the Aussie breaks down. There is a nearly GBP300 bln option struck at $1.3090 that is now in the money, with sterling falling to around $1.3060 earlier.

Lastly, note that the rating agencies will be busy today. DBRS is set to update its assessment of Spain. Moody’s is expected to provide a new assessment of Italy, and S&P reviews France and Saudi Arabia.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,EUR/CHF,Featured,Germany Factory Orders,Japan Average Cash Earnings,newsletter,Spain Industrial Production,U.S. Nonfarm Payrolls,U.S. Participation Rate,U.S. Unemployment Rate,USD/CHF