Stock Markets In the EM equity space as measured by MSCI, China (+4.1%), South Africa (+3.2%), and Hungary (+2.4%) have outperformed this week, while Egypt (-2.8%), Qatar (-2.7%), and Mexico (-1.7%) have underperformed. To put this in better context, MSCI EM rose 1.9% this week while MSCI DM rose 0.6%. In the EM local currency bond space, Argentina (10-year yield -13 bp), Nigeria (-5 bp), and Thailand (-4 bp) have outperformed this week, while Mexico (10-year yield +20 bp), Brazil (+17 bp), and Poland (+14 bp) have underperformed. To put this in better context, the 10-year UST yield rose 4 bp to 2.38%. In the EM FX space, CLP (+0.8% vs. USD), CZK (+0.4% vs. EUR), and ILS (+0.3% vs. USD) have outperformed this

Topics:

Win Thin considers the following as important: emerging markets, Featured, Laszlo Botka, newsletter, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

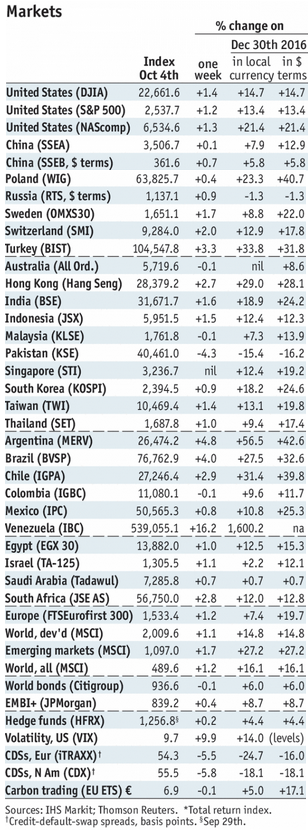

Stock MarketsIn the EM equity space as measured by MSCI, China (+4.1%), South Africa (+3.2%), and Hungary (+2.4%) have outperformed this week, while Egypt (-2.8%), Qatar (-2.7%), and Mexico (-1.7%) have underperformed. To put this in better context, MSCI EM rose 1.9% this week while MSCI DM rose 0.6%.

In the EM local currency bond space, Argentina (10-year yield -13 bp), Nigeria (-5 bp), and Thailand (-4 bp) have outperformed this week, while Mexico (10-year yield +20 bp), Brazil (+17 bp), and Poland (+14 bp) have underperformed. To put this in better context, the 10-year UST yield rose 4 bp to 2.38%.

In the EM FX space, CLP (+0.8% vs. USD), CZK (+0.4% vs. EUR), and ILS (+0.3% vs. USD) have outperformed this week, while MXN (-1.6% vs. USD), TRY (-1.6% vs. USD), and ZAR (-1.3% vs. USD) have underperformed. |

Stock Markets Emerging Markets, October 07 Source: economist.com - Click to enlarge |

IndiaIndia cut taxes on gasoline and diesel to help slow inflation. The Finance Ministry said the basic excise duty on gasoline and diesel will be cut by 2 rupees per liter. It added that the government will lose about INR130 bln in revenues for the current FY2017/18 ending March 31 because of the cut.

IndonesiaBank Indonesia signaled that the easing cycle is nearing an end. It said its sees little room for further rate cuts, but added that it can take other measures to stimulate the economy. Assistant Governor Waluyo said “It depends again on the data even though until last week we see the situation up until the end of this year or probably next year, the room for cutting the policy rate is not much.”

HungaryHungarian Socialist candidate Laszlo Botka quit the race after failing to unite the opposition. The opposition remains in disarray six months ahead of elections. Polls show support for the Socialists dropping to less than 10%. With such poor polling numbers, Botka was unable to gain the backing of the other opposition parties. Several of these parties recently announced plans to run their own candidates for prime minister.

RomaniaRomania’s central bank started a tightening cycle. While the bank left the base rate unchanged at 1.7%, it narrowed the interest rate corridor around that rate to 1.25 percentage points from 1.5 previously. Governor Isarescu said another adjustment to the corridor may come at the next meeting on November 7, adding “The period with very low interest rates is over, and not only in Romania.”

MexicoMexico’s government will likely adjust its 2018 budget for 2018 due to the impact of the earthquakes last month. Finance Minister Meade said that even though the government had presented its 2018 budget in early September, “the

context had changed.” No details on what the adjustments will be, but we think this is a sensible move in light of the need for infrastructure and reconstruction spending stemming from the earthquakes. |

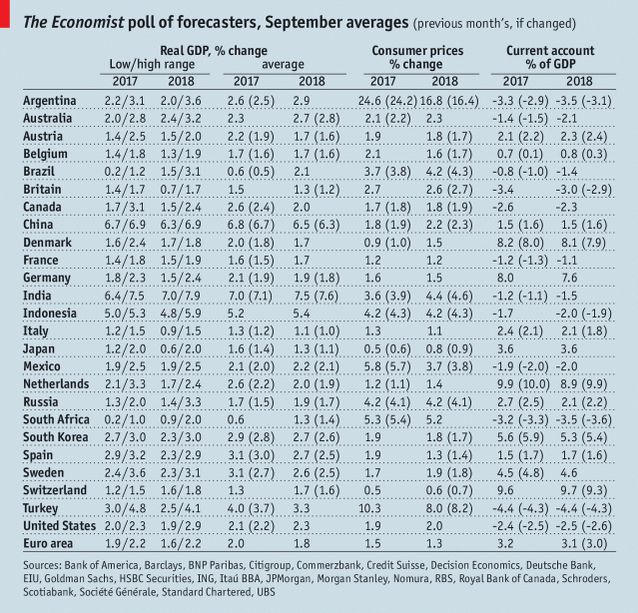

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, September 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,Laszlo Botka,newsletter,win-thin