Swiss Franc The Euro has risen by 0.01% to 1.0883 CHF. EUR/CHF - Euro Swiss Franc, June 01(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar is mostly firmer against the major currencies. It is consolidating yesterday’s losses more than staging much of a recovery. Even sterling, where a YouGov poll has the Tory lead at three percentage points, down from seven previously, is above yesterday’s lows. On the other hand, even strong data from Japan did not drive the yen higher. The dollar is holding in yesterday’s range against the yen. If it does not rise through yesterday’s high (~JPY111.25), it will be the sixth consecutive session of lower highs, since poking briefly though above JPY112 in

Topics:

Marc Chandler considers the following as important: $CNY, China Caixin Manufacturing PMI, EUR, EUR/CHF, Eurozone Manufacturing PMI, Featured, France Manufacturing PMI, FX Daily, FX Trends, GBP, Germany Manufacturing PMI, Italy Gross Domestic Product, Italy Manufacturing PMI, Japan Manufacturing PMI, JPY, newslettersent, Spain Manufacturing PMI, Switzerland Gross Domestic Product, Switzerland retail sales, Switzerland SVME PMI, U.K. Manufacturing PMI, U.S. ADP Nonfarm Employment Change, U.S. Crude Oil Inventories, U.S. Initial Jobless Claims, U.S. ISM Manufacturing Employment, U.S. ISM Manufacturing PMI, U.S. Manufacturing PMI, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has risen by 0.01% to 1.0883 CHF. |

EUR/CHF - Euro Swiss Franc, June 01(see more posts on EUR/CHF, ) |

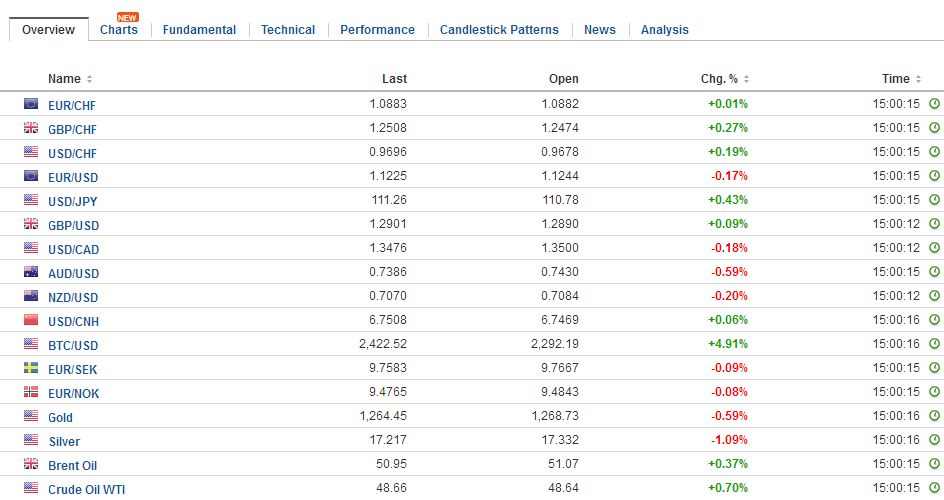

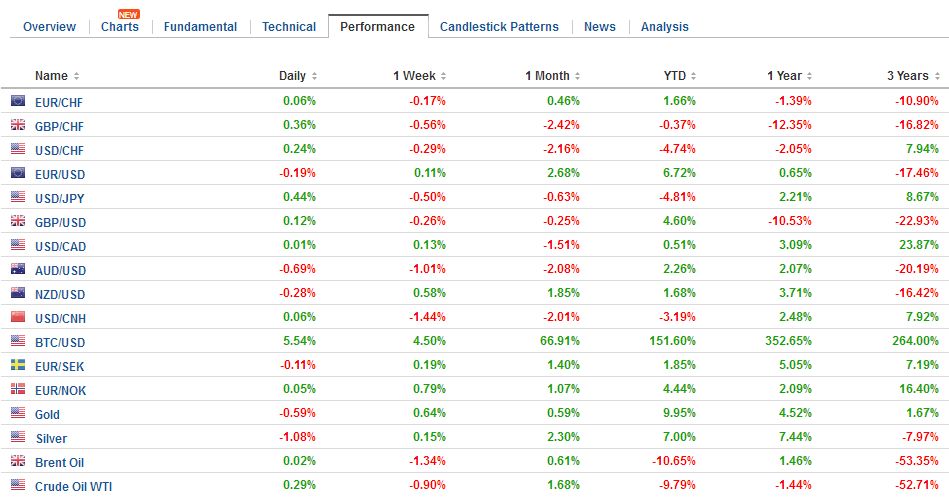

FX RatesThe US dollar is mostly firmer against the major currencies. It is consolidating yesterday’s losses more than staging much of a recovery. Even sterling, where a YouGov poll has the Tory lead at three percentage points, down from seven previously, is above yesterday’s lows. On the other hand, even strong data from Japan did not drive the yen higher. The dollar is holding in yesterday’s range against the yen. If it does not rise through yesterday’s high (~JPY111.25), it will be the sixth consecutive session of lower highs, since poking briefly though above JPY112 in the middle of last week. |

FX Daily Rates, June 01 |

| The yuan’s strength has continued today, into a fourth session. It is the strongest four-day run in more than a decade. The yuan had been trading in a narrow range in a low vol market, until this week. Following Moody’s downgrade, which simply matched what Fitch had already done, many expected continued steady trading against the softening dollar. While the move began as a liquidity squeeze in the offshore market, the onshore yuan took charge today. It rose 0.17%, while the offshore yuan has softened by nearly the same amount. The strengthening yuan did little for equities, where the Shanghai Composite slipped almost 0.5%, and the Shenzhen Composite dropped 1.9%.

The euro briefly extended yesterday’s gain and peaked just shy of $1.1260 before drifting lower in the European morning. Initial support was seen near $1.1220, which was the lower end of the range in the US yesterday after the equity market opened. The market does not appear to have exhausted the upside. Sterling peaked near $1.2920 yesterday and is not showing the same resilience as yesterday. It posted an outside up day yesterday, but there has been not follow through buying today. Yesterday’s low was near $1.2770, and it may have to be re-tested. Pressure is also evident on the crosses, with the euro pushing near GBP0.8750 that has capped it in recent days but appears headed toward GBP0.8800 around the mid-March high. The high for the year was in mid-January near GBP0.8855. |

FX Performance, June 01 |

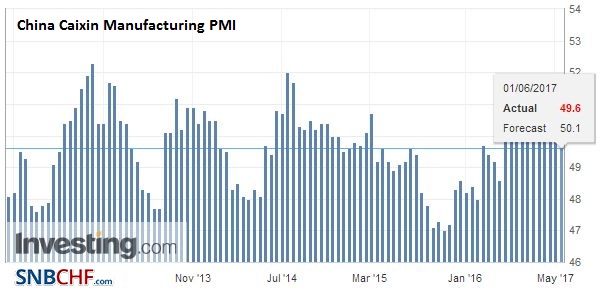

ChinaChina’s Caixin manufacturing PMI slipped below the 50 boom/bust level for the first time in nearly a year. The headline fell to 49.6 from 50.3. Output, however, held just above 50 at 50.2, down from 51.0 This differs from the official measure in a smaller sample and a focus on smaller businesses. Still, the sense the economy has lost some momentum after Q1 is not easily shaken, and the fact that input and output prices well are consistent with the pause in the reflation story of the start of the year. |

China Caixin Manufacturing Purchasing Managers Index (PMI), May 2017(see more posts on China Caixin Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

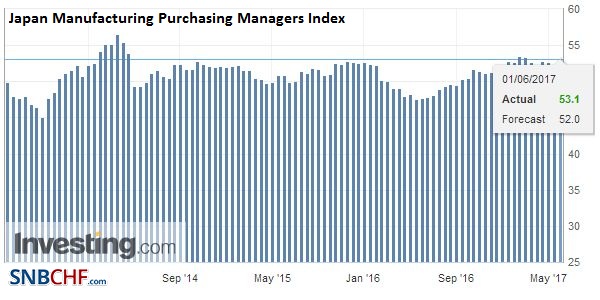

JapanJapanese reported stronger than expected capital expenditures that point to the upside risks to the Q1 GDP estimate of 1.2%. Capex rose 4.5% year-over-year rather than 4% as expected. Separately, it was reported that corporate profits surged 26.6% on the back of a 5.6% increase in sales Even if the yen did not respond positively, Japanese stocks did. After rallying 2.4% in May, the Topix rose 1.1% today to start June. The Topix has advanced in seven of the past eight months and nine of the past eleven. Stocks in the region rose as the MSCI Asia Pacific Index added 0.3%. It was up nearly 2.6% last month. It has risen even month this year. |

Japan Manufacturing Purchasing Managers Index (PMI), May 2017(see more posts on Japan Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

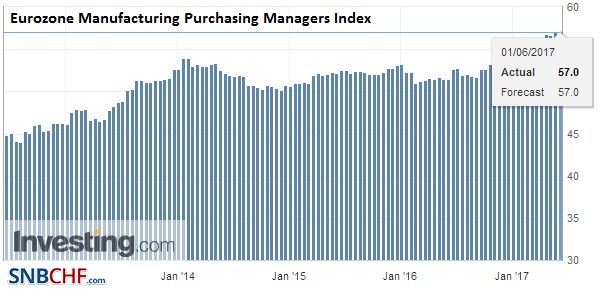

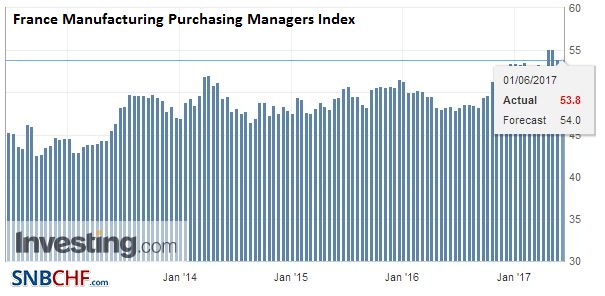

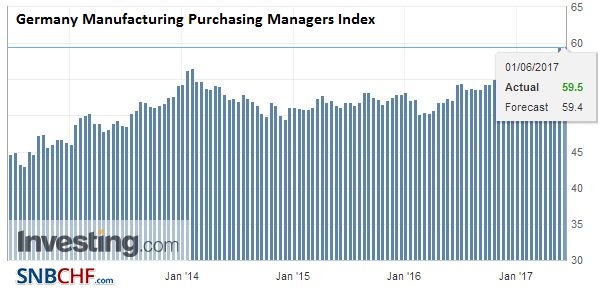

EurozoneThe eurozone manufacturing PMI matched the flash reading of 57.0, which is an improvement over April’s 56.7. The composition was a little different. The German flash was tweaked higher to 59.5 from 59.4, the highest in five years. Exports, new orders, and employment are all at multi-year highs. The French PMI was revised to 53.8 from the flash reading of 54. |

Eurozone Manufacturing Purchasing Managers Index (PMI), May 2017(see more posts on Eurozone Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

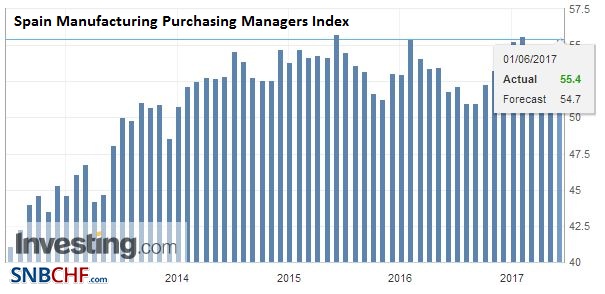

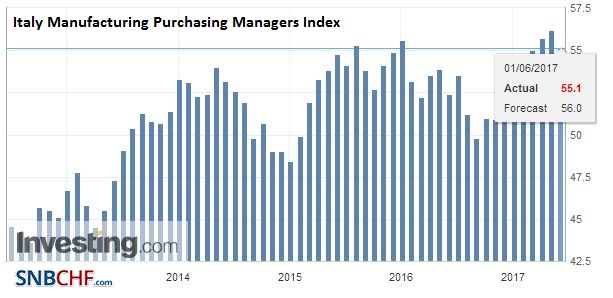

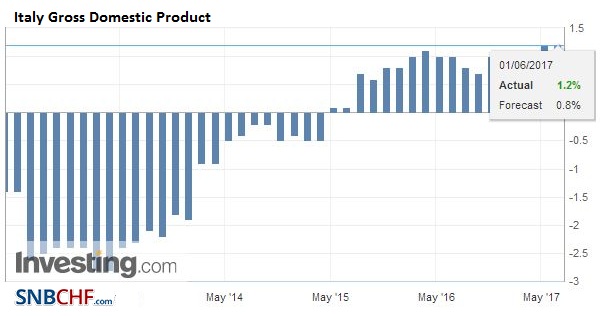

SpainSpain’s manufacturing PMI rose to 55.4 from 54.5. This was stronger than expected and brings it back to near the year’s high in January at 55.6. Italy’s PMI disappointed. It eased to 55.1 from 56.2. Nevertheless, it is above the Q1 average of 54.6 and above last year’s average of 52.3. Also helping blunt the disappointment was the upward revision in Q1 GDP to 0.4% from 0.2%. This appears to be the fastest quarterly pace since early 2011. It brings the year-over-year pace to 1.2% from 0.8%. |

Spain Manufacturing Purchasing Managers Index (PMI), May 2017(see more posts on Spain Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

France |

France Manufacturing Purchasing Managers Index (PMI), May 2017(see more posts on France Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

Germany |

Germany Manufacturing Purchasing Managers Index (PMI), May 2017(see more posts on Germany Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

Italy |

Italy Manufacturing Purchasing Managers Index (PMI), May 2017(see more posts on Italy Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

Italy Gross Domestic Product (GDP) YoY, Q1 2017(see more posts on Italy Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

|

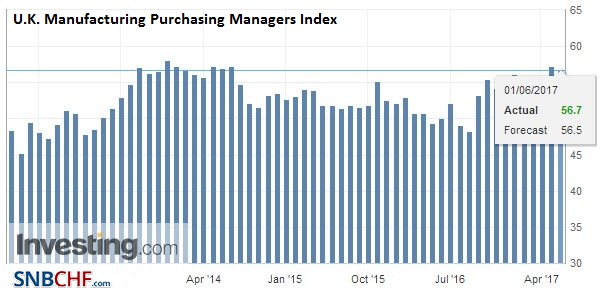

United KingdomThe UK’s PMI did not fall as much as expected. It slipped from 57.3 in April to 56.7 in May. The April reading was the best for at least three years, and the pullback in May is minor. The past decline in sterling may still be helping the tradeable goods sector. Meanwhile, the focus is on next week’s election. Although the Tories’ lead has narrow over the past month, five of the six best known UK pollsters reportedly see it majority growing to at least 40 seats. The first-past-the-post system allows for a discrepancy between the percentage of the popular vote overall and the number of seats in Parliament. |

U.K. Manufacturing Purchasing Managers Index (PMI), May 2017(see more posts on U.K. Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

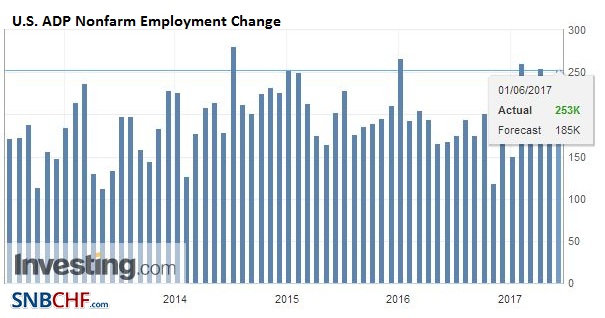

United StatesThe ADP job estimate and auto sales are the most important US reports today. |

U.S. ADP Nonfarm Employment Change, May 2017(see more posts on U.S. ADP Nonfarm Employment Change, ) Source: Investing.com - Click to enlarge |

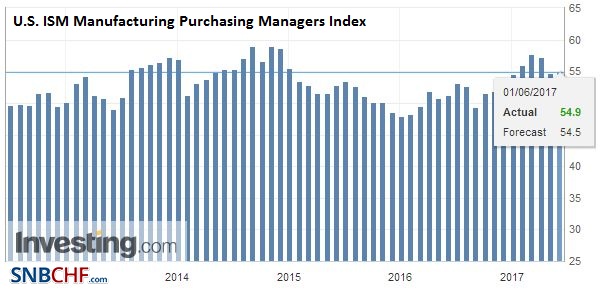

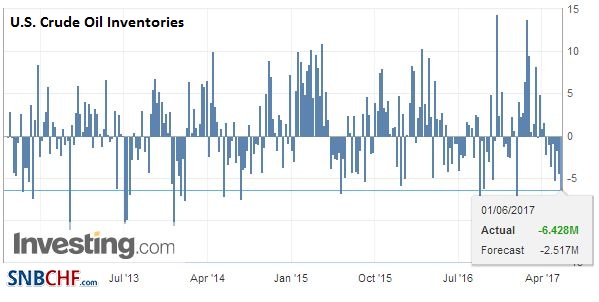

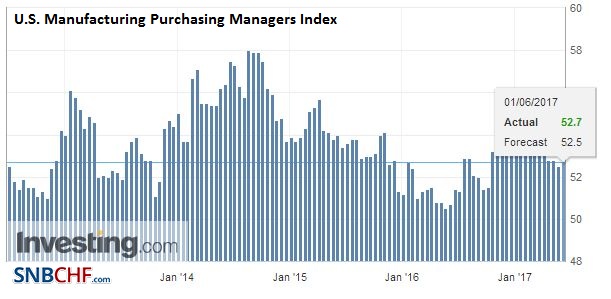

| A negative surprise here is more important than a negative surprise on the manufacturing ISM. A rise in construction spending would also help underpin expectations for a rebound in Q2 growth. However, the key takeaway this week from some Fed officials, including Governor Brainard, and the Beige Book, is that after the presumed hike on June 14, there is a sense of caution. It does not so much steam from the growth side or the labor market. It is about core inflation and whether it is still moving toward the target. Also, after the big draw down in the API estimate of US stocks, the DOE’s estimate today will be closely watched. |

U.S. ISM Manufacturing Purchasing Managers Index (PMI), May 2017(see more posts on U.S. ISM Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

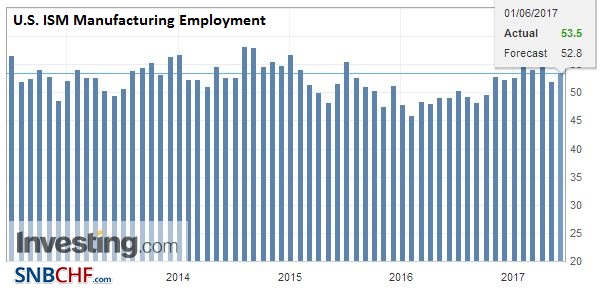

U.S. ISM Manufacturing Employment, May 2017(see more posts on U.S. ISM Manufacturing Employment, ) Source: Investing.com - Click to enlarge |

|

| Oil prices have steadied today after the July light sweet contract fell 2.7% yesterday. |

U.S. Crude Oil Inventories, May 2017(see more posts on U.S. Crude Oil Inventories, ) Source: Investing.com - Click to enlarge |

U.S. Manufacturing Purchasing Managers Index (PMI), May 2017(see more posts on U.S. Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

|

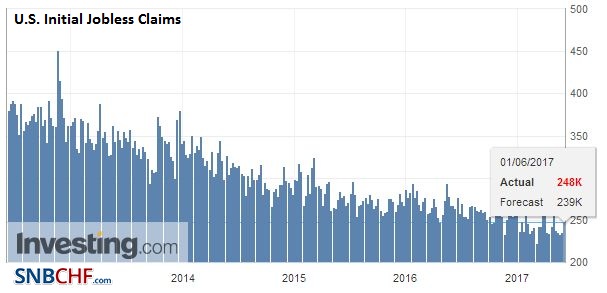

U.S. Initial Jobless Claims, May 2017(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

|

Switzerland |

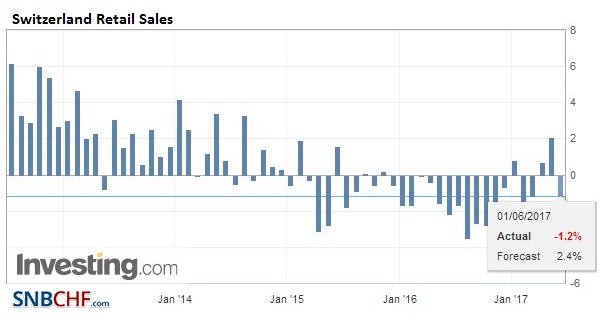

Switzerland Retail Sales YoY, April 2017(see more posts on Switzerland Retail Sales, ) Source: Investing.com - Click to enlarge |

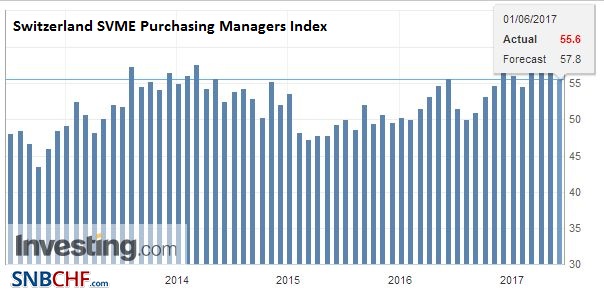

Switzerland SVME Purchasing Managers Index (PMI), May 2017(see more posts on Switzerland SVME PMI, ) Source: Investing.com - Click to enlarge |

|

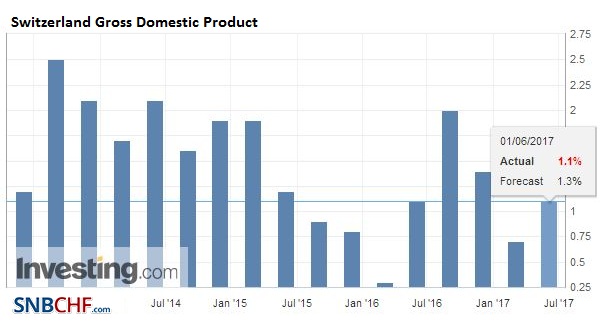

Switzerland Gross Domestic Product (GDP) YoY, Q1 2017(see more posts on Switzerland Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$CNY,$EUR,$JPY,China Caixin Manufacturing PMI,EUR/CHF,Eurozone Manufacturing PMI,Featured,France Manufacturing PMI,FX Daily,Germany Manufacturing PMI,Italy Gross Domestic Product,Italy Manufacturing PMI,Japan Manufacturing PMI,newslettersent,Spain Manufacturing PMI,Switzerland Gross Domestic Product,Switzerland Retail Sales,Switzerland SVME PMI,U.K. Manufacturing PMI,U.S. ADP Nonfarm Employment Change,U.S. Crude Oil Inventories,U.S. Initial Jobless Claims,U.S. ISM Manufacturing Employment,U.S. ISM Manufacturing PMI,U.S. Manufacturing PMI