Swiss Franc The Euro has fallen by -0.03% to 1.167 CHF. EUR/CHF and USD/CHF, December 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The swoon in equities, perhaps sparked by a rotation spurred by potential US tax changes, is continuing today. It is providing a risk-off mood, which is expressed in the foreign exchange market as a stronger yen. The most compelling answer of yen strength is not that investors are buying yen as a haven. Japanese stocks are among the worst of the major markets over the past five days, ensured by today’s nearly 2% drop by the Nikkei. Nor, of course, are Japanese interest rates attractive. Rather the yen’s strength reflects unwinding

Topics:

Marc Chandler considers the following as important: AUD, Australian GDP, CAD, EUR, Eurozone Retail PMI, Featured, FX Trends, GBP, newsletter, SPY, TLT, U.S. ADP Nonfarm Employment Change, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

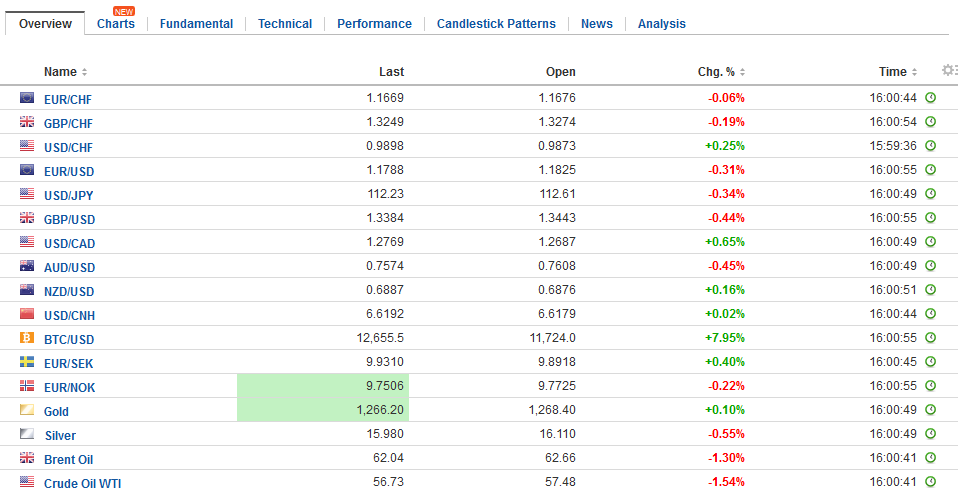

Swiss FrancThe Euro has fallen by -0.03% to 1.167 CHF. |

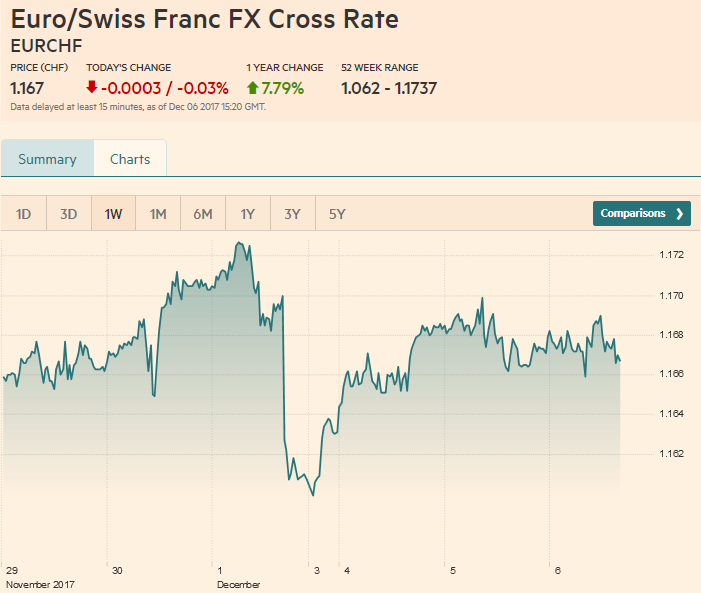

EUR/CHF and USD/CHF, December 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe swoon in equities, perhaps sparked by a rotation spurred by potential US tax changes, is continuing today. It is providing a risk-off mood, which is expressed in the foreign exchange market as a stronger yen. The most compelling answer of yen strength is not that investors are buying yen as a haven. Japanese stocks are among the worst of the major markets over the past five days, ensured by today’s nearly 2% drop by the Nikkei. Nor, of course, are Japanese interest rates attractive. Rather the yen’s strength reflects unwinding trades use the yen to finance the purchase of other assets, like equities. As the equities are sold, the yen is bought back. We see the speculative directional plays as secondary in importance. Speculators in the CME futures had accumulated the largest gross short yen position in a decade in the middle of last month and were already reducing it, though the dollar pushed through JPY113 at the start of the week, the high since November 17. |

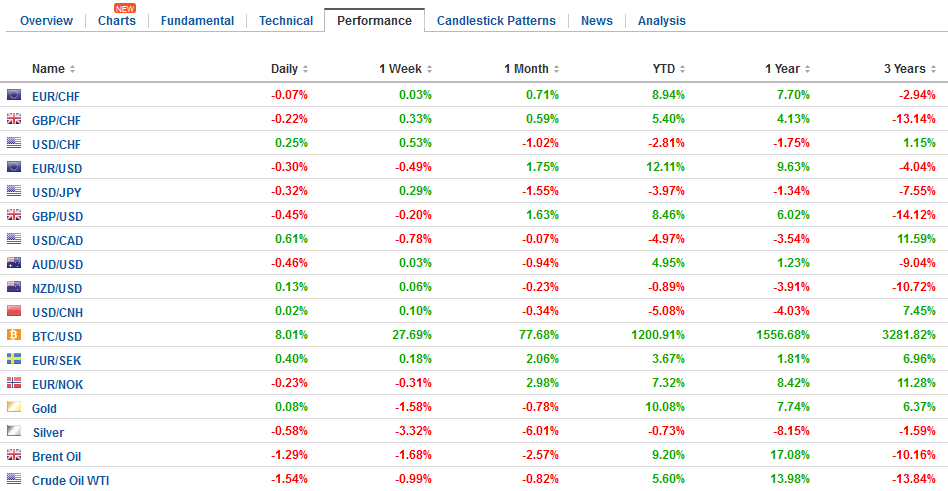

FX Daily Rates, December 06 |

| The S&P 500 fell for the second day in a row yesterday and closed on its lows, just above the support we noted near 2628. It will likely push through there in the early going today and test the 2600 area, which marks the low from the end of last week, the 20-day moving average and congestion from the end of last month. Below there an unfilled gap from the higher opening on November 21 may draw prices. The bottom of the gap is near 2585.

The sell-off in Asian equities gained momentum. The MSCI Asia Pacific Index fell 1.25%, matching its largest drop of the year. It is the eighth consecutive loss, the longest losing streak in a couple of years. Chinese shares were mixed, with the Shanghai Composite off 0.3% and the Shenzhen Composite up almost 0.7%. However, the high-flying Hang Seng China Enterprise Index (H-shares) shed 2.8%, which took a tool of the Hang Seng Index, which fell a little more than 2%. |

FX Performance, December 06 |

EurozoneEuropean shares are also being hit by profit-taking. The Dow Jones Stoxx 600 is off nearly 0.75%. This could be the largest loss in a month. Information technology and materials are the largest drags. The weakness in these sectors are global. With extensive supply chains, the tech sector often seems highly correlated across countries. Copper is stabilizing after it suffered its biggest single-day drop in more than two years. However, other industrialized metals, including iron ore, aluminum, and zinc remain under pressures ostensibly due to concerns about demand from China next year. The energy complex is lower amid concern about the US industry association seeing a build in gasoline inventories. Gold is recovering after dipping below $1260 for the first time since August. The greenback is testing support near JPY112.00. A convincing break could signal a move toward JPY111.40, and possibly even a test on the late-November low near JPY110.85. Note that the five-day average is set to move below the 20-day average for the first time since the middle of last month. The euro has moved in about a third of a cent today but remains at the lower end of yesterday’s range. The $1.1800 area, were several technical levels coincide, remains intact. News of stronger than expected German data (factory orders rose 0.5% increased of falling 0.2% as many economists expected and the September series was revised to 1.2% from 1.0%) failed to impress traders. |

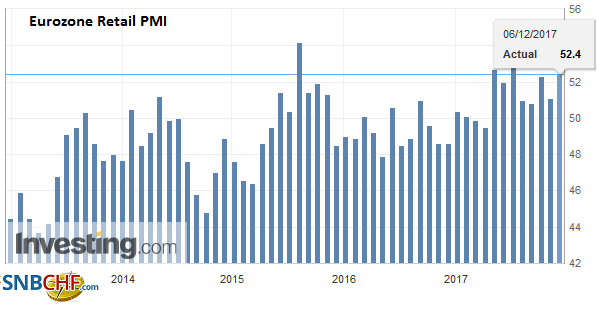

Eurozone Retail PMI, November 2017(see more posts on Eurozone Retail PMI, ) Source: investing.com - Click to enlarge |

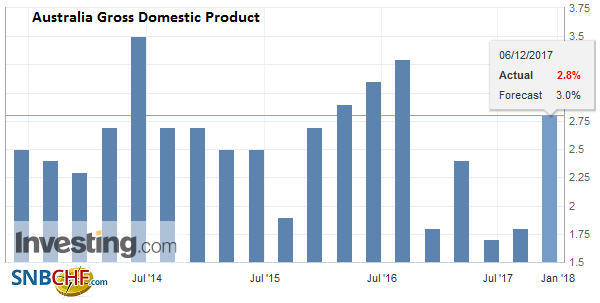

AustraliaOn the other hand, disappointing Q3 GDP (0.6% vs. expectations for 0.7% and weak consumption) saw the Australian dollar surrender the remainder of the retail sales inspired gains that were not unwound in North America yesterday. The Aussie had tested the $0.7655 resistance area we cited, but back to $0.7600 in the North American afternoon yesterday. It sold off further, reaching almost $0.7570 before recovering in the European morning back toward $0.7600. Australian bonds rallied strongly, with the 10-year yield dropping 9 bp to 2.50%, and the two-year yield is off six basis points to 1.77%, to once again slip below US yields. |

Australia Gross Domestic Product (GDP) YoY, Q3 2017(see more posts on Australian GDP, ) Source: investing.com - Click to enlarge |

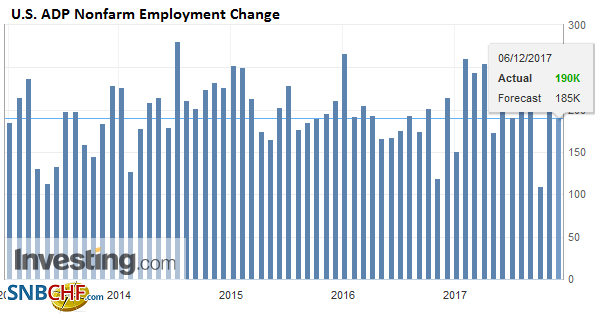

United StatesThe US dollar is retesting that support now, ahead of the Bank of Canada meeting. Central bank officials have indicated the desire to remove more accommodation over time, but are not in a hurry given the two hikes in Q3, the apparent slowing of the economy, and risks emanating from abroad (see US and NAFTA). The data highlight from the US is the ADP jobs estimate, ahead of Friday’s government report. Outside of headline risk, the data is unlikely to distract investors from the other stories. These include the approaching December 8 deadline for spending authorization, which if not remedied, can see parts of the government shutter. The Republicans seem divided between as very short extension (December 22) a short extension (December 30) and the Democrats remain on the sidelines. Also, news that President Trump will announce later today that the US officially recognizes Jerusalem as the capital of Israel has already spurred warnings of the antagonism that it entails, and without moving the US embassy, little appears to be gained. It can add to investor uncertainty and volatility. Meanwhile progress on US tax reform is on hold as the Senate members of the reconciliation committee must be named. There is some risk that the compromises that made passage of the Senate version possible are unwound in the reconciliation process. |

U.S. ADP Nonfarm Employment Change, November 2017(see more posts on U.S. ADP Nonfarm Employment Change, ) Source: investing.com - Click to enlarge |

United Kingdom

After being rebuffed by her junior coalition partner while she was at lunch with Juncker, UK Prime Minister May exposed her other flank and reports suggest that the hardliner Brexit cabinet members, Johnson and Gove are nipping at her heels again. May is in a bind. The more she tries to meet the new deadline to get to the next stage of talks, the more her domestic vulnerabilities are clear. May cannot deliver the kind of movement that the EU wants. The DUP threatened to force elections, despite the fact that Labour, who is ahead in most polls, would sacrifice their interests. A compromise on the European Court of Justice or even offering to stay close to the EU regulatory regime risks dividing her cabinet.

Sterling is extending its losses for a second session. It is off about 0.5% at $1.3380. It had been testing $1.3550 a few days ago, Initial support is seen now near $1.3350, and below there $1.3300. Canada followed up last week’s strong employment report with news of a smaller than expected trade shortfall and a rise in non-oil exports. The US dollar frayed support near CAD1.2660 before rebounding session highs in sympathy with its gains against the euro and sterling.

Lastly we note that Brazil is widely expected to cut its Selic rate by 50 bp today after the markets close. The rate cutting cycle began last year when the Selic was above 14%. The cut today completes the round turn and brings the Selic rate blow where it bottomed in 2012-2013. indeed today’s cut would bring it to a record low since its was introduced in the late 1990s.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$TLT,Australian GDP,Eurozone Retail PMI,Featured,newsletter,SPY,U.S. ADP Nonfarm Employment Change