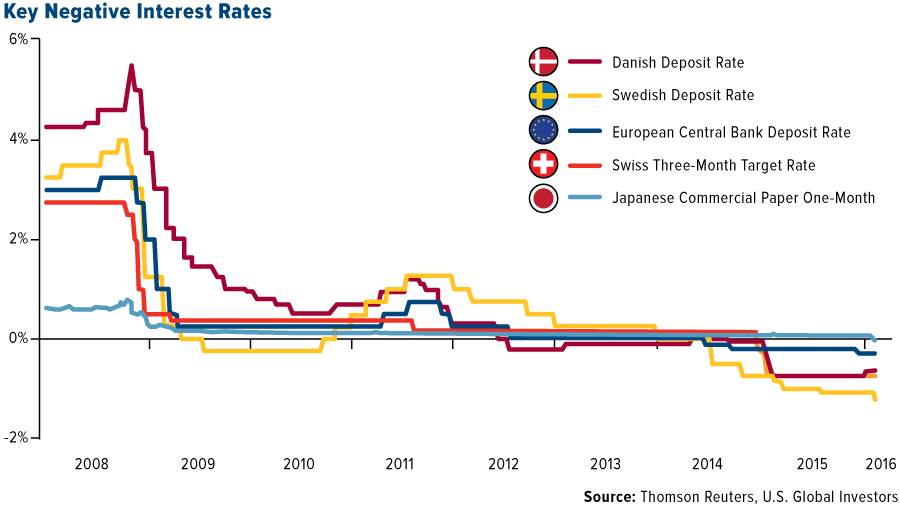

Reader Questions on Negative Interest Rates Our reader L from Mumbai has mailed us a number of questions about the negative interest rate regime and its possible consequences. Since these questions are probably of general interest, we have decided to reply to them in this post. The NIRP club – negative central bank deposit rates – click to enlarge. Before we get to the questions, a few general remarks: negative interest rates could not exist in an unhampered free market. They are an entirely artificial result of central bank intervention. The so-called natural interest rate is actually a non-monetary phenomenon – it simply reflects time preferences. Time preferences are an inviolable category of human action and are always positive. Market interest rates consist of the natural interest rate plus two additional components: a price (or inflation) premium that reflects the expected decline in money’s purchasing power, and a risk premium or entrepreneurial profit premium that reflects the perceptions of lenders of a borrower’s creditworthiness and generates an entrepreneurial profit for those engaged in lending. One often reads that interest is the “price” of money, but that is actually not quite correct. It is really a price ratio, the difference between the valuation of present against that of future goods.

Topics:

Pater Tenebrarum considers the following as important: Central Banks, Monetary Metals, On Economy

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Marc Chandler writes Consolidation Featured

Marc Chandler writes Fragile Turn Around Tuesday

Adam Button writes SNB’s Jordan: I’m not sure whether if the terminal rate has been reached

Reader Questions on Negative Interest Rates

Our reader L from Mumbai has mailed us a number of questions about the negative interest rate regime and its possible consequences. Since these questions are probably of general interest, we have decided to reply to them in this post.

The NIRP club – negative central bank deposit rates – click to enlarge.

The NIRP club – negative central bank deposit rates – click to enlarge.

Before we get to the questions, a few general remarks: negative interest rates could not exist in an unhampered free market. They are an entirely artificial result of central bank intervention. The so-called natural interest rate is actually a non-monetary phenomenon – it simply reflects time preferences. Time preferences are an inviolable category of human action and are always positive.

Market interest rates consist of the natural interest rate plus two additional components: a price (or inflation) premium that reflects the expected decline in money’s purchasing power, and a risk premium or entrepreneurial profit premium that reflects the perceptions of lenders of a borrower’s creditworthiness and generates an entrepreneurial profit for those engaged in lending.

One often reads that interest is the “price” of money, but that is actually not quite correct. It is really a price ratio, the difference between the valuation of present against that of future goods. An apple one can obtain today will always be worth more than a similar apple one can obtain at some point in the future. If time preferences were to decline to zero, people would stop consuming altogether. All efforts would be directed toward providing for the future, but they would never see that future, because they would starve to death before it arrives.

In theory, time preferences can rise almost to infinity: for instance, if an asteroid were to hit Earth in two week’s time and we knew for sure that it would destroy the planet, it would no longer make sense to provide for the future. Saving, investment and production would stop, and everybody would confine himself to consumption. But the opposite can never happen, since we cannot just stop consuming. As long as time passes and there is a “sooner” and a “later”, there simply cannot be zero or negative interest.

A far more detailed explanation of the topics summarized in the introductory remarks above can be read in Human Action by Ludwig von Mises.

A far more detailed explanation of the topics summarized in the introductory remarks above can be read in Human Action by Ludwig von Mises.

Fiduciary Media vs. Covered Money Substitutes

Now let us look at L’s questions. He writes:

I am interested in knowing more about negative interest rates. I feel at some stage it might lead to people pulling out their cash out of the bank. I am trying to figure out what happens when they do it en masse (Let us forget how they are going to store it for the moment).

Can it bring a bank down? Since banks seem to have a lot of deposits, no loans to make, it ends up as excess reserves, on which they have to pay negative interest rate to the CB (in Europe now) and thus they do not want it. In fact RBS I read somewhere refused a big deposit from an Institutional Investor. In such a case I am not able to understand how pulling deposits out of a bank can bring a bank down. Does it mean even if the bank has excess reserves a bank run can bring it down?

In a fractionally reserved system, any withdrawals from bank deposits will in theory create a “reverse multiplier effect”. Hypothetically speaking, if a banking system were to operate under a 10% minimum reserve requirement and was “fully loaned up”, having created $90 in additional money for every $10 on deposit, it would be forced to call in loans if people started withdrawing money from their deposits.

The banks in our example can only be “fully loaned up” under the assumption that all newly created deposit money was kept within the banking system, that all banks extended loans to the full capacity allowed by the reserve requirement, and that any imbalances between banks were canceled out via interbank lending of reserves. In that case the credit multiplier is simply given by the formula d/r (d=deposits, r=reserve ratio).

In reality, reserve requirements haven’t played a role in the banking systems of developed economies for a long time, in the sense that have not represented an obstacle to credit expansion. As a result, the vast majority of deposit money extant prior to the 2008 financial crisis consisted of fiduciary media, i.e., uncovered money substitutes.

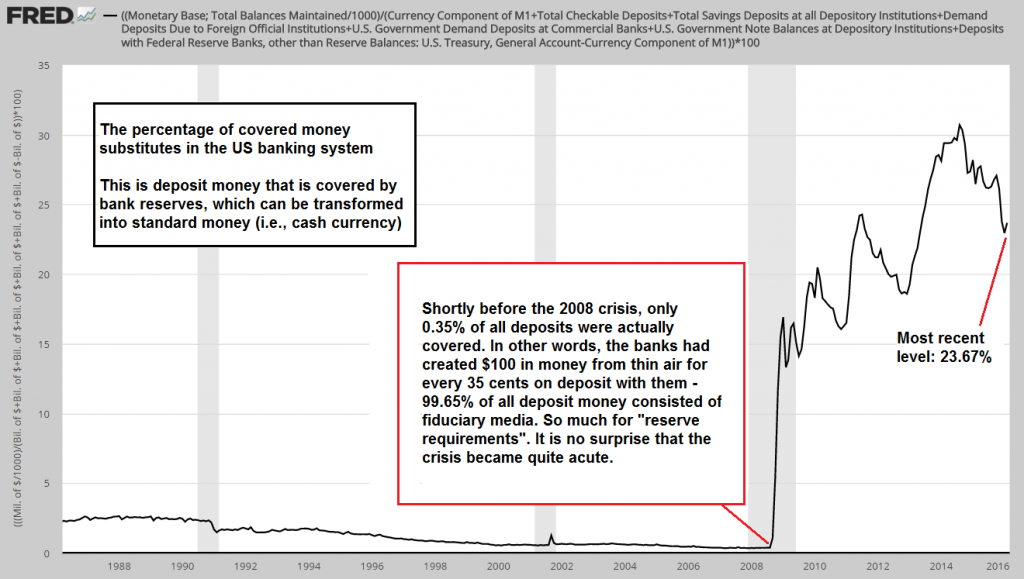

People had numbers in their accounts, but there was almost no standard money held in reserve covering these numbers. This has changed dramatically since 2008 as a result of “QE”. While the percentage of covered money substitutes in the US banking system was a mere 0.35% on the eve of the 2008 crisis, it stood at 23.67% at the end of February 2016. The true money supply has expanded enormously, but the percentage that consists of fiduciary media is far smaller than previously:

The percentage of covered money substitutes in the US banking system (calculated as the ratio between total bank reserves and TMS-2 excl. currency). Note that in the annotation it should actually say “the banks had created almost $100 per 35 cents on deposit” – one must deduct the 35 cents… :) – click to enlarge.

The percentage of covered money substitutes in the US banking system (calculated as the ratio between total bank reserves and TMS-2 excl. currency). Note that in the annotation it should actually say “the banks had created almost $100 per 35 cents on deposit” – one must deduct the 35 cents… :) – click to enlarge.

In other words, nowadays the large percentage of uncovered money substitutes is no longer such a big problem. Bank reserves can always be transformed into cash currency when customers are withdrawing money from demand deposits. Still, deposits are an important funding source for many banks, so we don’t think they would be very happy if people started emptying their deposits en masse.

More importantly though, while banks haven’t been constrained by reserve requirements for a long time (e.g. in the euro area official reserve requirements ystand at a mere 1%, while in the US reserve requirements have been circumvented through sweeps since the mid 1990s), they are definitely constrained by new regulations regarding capital requirements and leverage ratios (details on the Basel III regulations and the EU’s new capital rules can be easily found via Google).

So a bank run could certainly still not be shrugged off as a non-event. After all, bank reserves deposited with the central bank represent the cash assets of commercial banks. It obviously makes a difference whether or not they have those. It has to be assumed though that central banks will do whatever it takes to mitigate such an event, just as they have done in 2008.

Lastly, negative interest rates on bank reserves do represent a problem for banks. In Germany they are referred to as “penalty rates”, since they are an additional cost for commercial banks that they cannot really escape (since QE continues to create more and more reserves, whether they like it or not). The low interest rate environment has also had a sizable negative impact on their net interest margins.

Why central bankers ever thought that this was a good idea is completely beyond us. But then again, the last time a central banker said or did anything that made sense was probably in the 1950s.

Hoarding of Cash Currency

There is not enough currency to go around, so what is likely to happen, do CBs start printing them? What else could they do? Also what could be its effect as they may not be able to print it as fast as people want to pull it out and that could cause serious panic and panic can bring the system down.

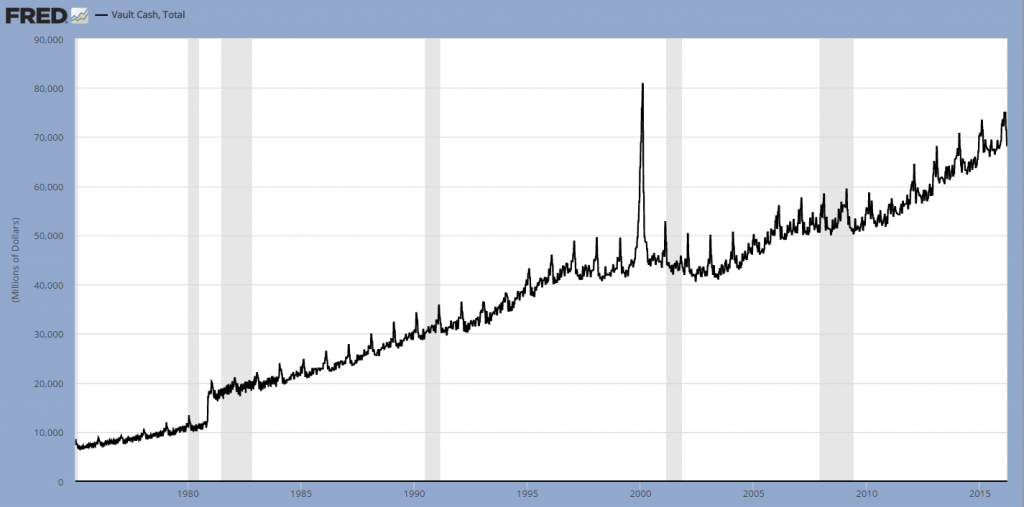

We don’t believe this would be a big problem. Yes, a lot of currency would indeed have to be printed, but there exists a fairly large stock of vault cash that could be used to satisfy those at the head of the queues, so there would presumably be enough time to print sufficient amounts of new currency.

In extremis, the authorities will per experience impose restrictions on withdrawals or declare what is euphemistically called a “bank holiday”, i.e, they’ll simply order the banks to close. This has recently happened in Cyprus and Greece, and before that in Argentina. It is usually the precursor to the outright confiscation of bank deposits. This is nowadays called a “haircut”, as if one were just visiting a hair-stylist (formerly known as a barber).

Vault cash held by US banks – currently approx. $72 billion. Note the big spike in vault cash after the WTC attack – this shows that large amounts of additional cash can indeed be mobilized quite quickly – click to enlarge.

Vault cash held by US banks – currently approx. $72 billion. Note the big spike in vault cash after the WTC attack – this shows that large amounts of additional cash can indeed be mobilized quite quickly – click to enlarge.

Stemming the Tide

When $500 billion was pulled out from money market funds in 2008, the Fed woke up to the fact that there was something amiss and did a lot of things. What are the possible measures they are likely to take now? What happens if it does not stem the tide?

First of all, we would note here that ever since negative interest rates on bank reserves have been imposed, there has been a concerted media campaign with assorted statist bien pensants arguing in favor of a cash ban under a multitude of pretexts (apart from breathing air, criminals use cash, and we have to make central bank intervention more effective). These were the usual suspects, such as e.g. Mr. Summers and Mr. Rogoff in the US (representing the two main wings of establishment-approved statist economic thought, namely Keynesianism and Monetarism) and their counterparts in other countries.

Consider that in spite of having to pay penalty rates on reserves, commercial banks have as a rule not passed negative rates on to their customers, precisely because they fear that this could lead to a run on deposits. Obviously, if our vaunted central planners continue to try to force people to increase their spending and consumption (putting the cart before the horse is their idea of creating “economic growth”), the idea of simply making cash withdrawals impossible must seem tempting. For obvious reasons, banks would also not be averse to this. And lastly, a cash ban would utterly destroy financial privacy, installing a system of total control.

However, as we have previously discussed, extending negative interest rates beyond the realm of bank reserves would hasten the arrival of a profound crisis, as it would lead to widespread capital consumption. The complex latticework of the economy’s structure of production would become increasingly fragile as entrepreneurs would withdraw their capital to consume it or to render it inert (by e.g. buying gold) in order to wait for better times.

Apart from this campaign to either ban cash or make its use beyond certain amounts illegal (cash payments exceeding certain thresholds have already been banned in several European countries), we can be fairly certain that there are no limits to the creativity of central bankers when it comes to fighting a crisis of confidence. But there are other limits: whatever they decide to do will only work as long as confidence in state-issued fiat money itself doesn’t evaporate.

Government Bonds vs. Cash

How can government bonds be better investment than physical cash in such an environment? Cash becomes a interest earner in a deflationary environment. Thus why will not Institutional Investor not hold cash instead of buying bonds (Munich Re has started doing this in a small way)? Then what happens to the bond market?

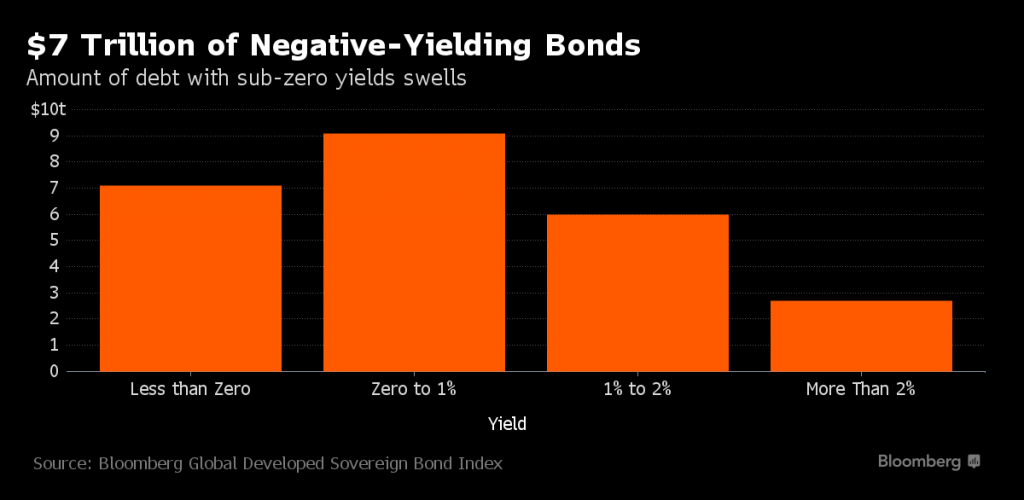

Assuming confidence in state-issued fiat money as such remains strong, it seems obvious that cash should be preferred over bonds sporting negative yields. So why are these bonds still in demand, given that they generate a guaranteed loss if held to maturity?

For one thing there are speculative reasons – some buyers expect to sell them at still higher prices and even more deeply negative yields. Apart from that though, there are a numerous other reasons why government bonds remain in demand.

For instance, financial repression is imposed via various government regulations: the same capital and solvency rules that constrain the activities of banks in many ways these days also give them a strong incentive to hold government bonds, which have been assigned a risk-weighting of zero.

Insurers are also subject to regulatory pressures with respect to capital, liquidity and the assets they may hold. Government bonds are also widely used as collateral in repo transactions so many financial institutions need to have an inventory of such bonds in order to be able to operate in these markets.

As of February, approx. $7 trillion in government bonds were sporting negative yields-to-maturity – click to enlarge.

As of February, approx. $7 trillion in government bonds were sporting negative yields-to-maturity – click to enlarge.

Moreover, big investors may actually prefer to hold government bonds at a small loss rather than keeping cash on deposit with banks, because short term government bonds are considered less risky. Large deposits could come under threat if a bank becomes insolvent and its losses are too large to be absorbed by its shareholders and bondholders – especially under the new “bail-in” regime.

Government bonds are usually highly liquid, and can be sold at any time if cash is needed. Short term bills of highly rated government debtors are actually akin to secondary media of exchange, since they are widely accepted as collateral in financial transactions. Many may consider storing cash in a vault as problematic in terms of flexibility, as it cannot be deployed quickly. T-bills on the other hand can be sold at a mouse click.

Germany’s 5 year government bond yield: minus 33 basis points – click to enlarge.

Germany’s 5 year government bond yield: minus 33 basis points – click to enlarge.

What Munich Re. has done is of course under consideration by a number of other insurers and pension funds as well. After all, the more deeply government bond yields fall into negative territory, the more competitive the costs of storing and insuring large amounts of cash will become. However, as we know e.g. from Switzerland, the authorities are actively discouraging institutional investors from taking such steps, even though they would be perfectly legal (see “The War on Cash Migrates to Switzerland” for details on this).

We actually don’t think the government bond market is under much of a threat from an increase in cash hoarding. What represents the biggest potential threat to the bond market would be a crisis of confidence focused on state-issued money itself – but that would be bad for cash as well. This is the kind of crisis our central planners are likely to eventually provoke, for the simple reason that they fail to take the very long term effects of their radical ad hoc policies into account.

Naturally monetary bureaucrats believe such a thing is impossible, because they are convinced they will be able to maintain confidence in fiat money by taking certain measures such as raising interest rates, draining liquidity from the system, and so forth. It sounds simple enough, but it ignores the economic and political pressures the authorities will probably face when the time to implement such measures comes.

It also ignores the “potential energy” harbored by the enormous amounts of money that have been created already. A loss of confidence is not a linear event. Usually, confidence appears just fine until a certain unknowable threshold is crossed – and then it is lost in a flash.

Conclusion

Negative interest rate policy is inherently self-defeating, as are more traditional forms of monetary pumping. The aim is to rescue a system that has been brought to the verge of implosion after too much unsound debt and too much malinvested capital have accumulated, by creating even more unsound debt and provoking even more capital misallocation. This, in a word, is insane. While debt continues to grow, the economy’s ability to create the wealth that will be required to repay it is concurrently undermined.

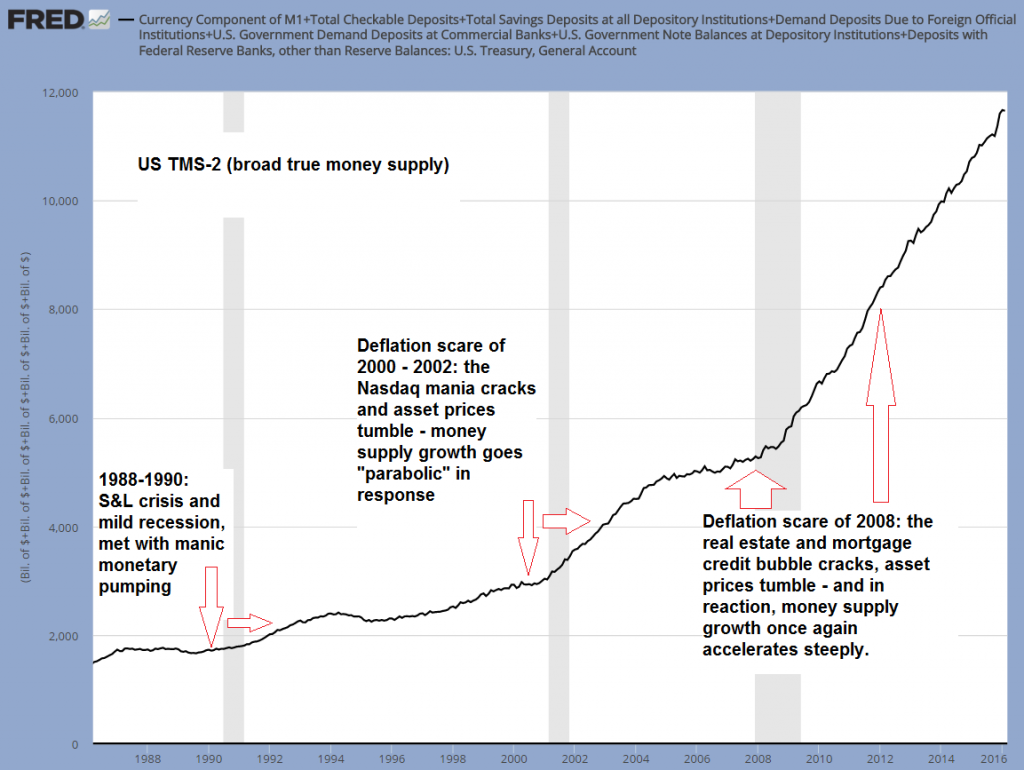

We cannot be sure what shape the next crisis will take, although it seems likely that it will be yet another “deflation scare”, mainly caused by falling asset prices. However, we do know what the last crisis of the current system will look like. It will entail a crumbling of the public’s faith in fiat money and the institutions that issue and administer it.

Ironically, repeated deflation scares are actually hastening the arrival of this long-term outcome, as they provoke ever more extreme policy responses, all of which tend to end up boosting the amount of outstanding money and credit.

US money supply TMS-2: economic downturns and “deflation scares” continually provoke money printing on an ever more breathtaking scale – click to enlarge.

US money supply TMS-2: economic downturns and “deflation scares” continually provoke money printing on an ever more breathtaking scale – click to enlarge.

Charts by: US Global Investors, St. Louis Federal Reserve Research, Bloomberg, BigCharts

Full story here