It’s gotten to the point that pretty much everyone is now aware of the risks. Public surveys, market behavior, on and on, hardly anyone outside politics thinks the economy is in a good place. Gasoline, sentiment, whatever, Euro$ #5 in total is much more than what’s shaping up inside the American boundary. Globally synchronized of which the US is proving to be a close part. The destination, or depth, really, is what’s left to argue. As noted yesterday, even President Joe Biden has taken to talking down economic expectations. . He singled out the labor market, in particular, for the reasons I discussed – making him President Phillips from here on. In consultation with the rate-hikers at the Fed, he’s been coached into the Phillips Curve – pretending that the

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, currencies, economy, employment, Featured, Federal Reserve/Monetary Policy, Joe Biden, Labor market, manufacturing, Markets, newsletter, payrolls, Unemployment

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| It’s gotten to the point that pretty much everyone is now aware of the risks. Public surveys, market behavior, on and on, hardly anyone outside politics thinks the economy is in a good place. Gasoline, sentiment, whatever, Euro$ #5 in total is much more than what’s shaping up inside the American boundary. Globally synchronized of which the US is proving to be a close part.

The destination, or depth, really, is what’s left to argue. As noted yesterday, even President Joe Biden has taken to talking down economic expectations. |

|

He singled out the labor market, in particular, for the reasons I discussed – making him President Phillips from here on.

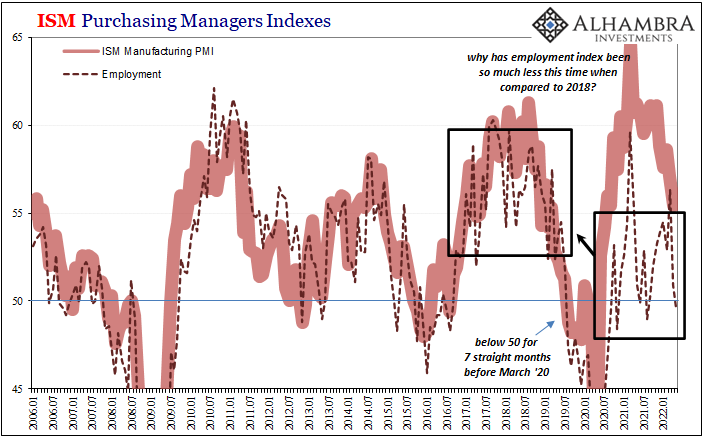

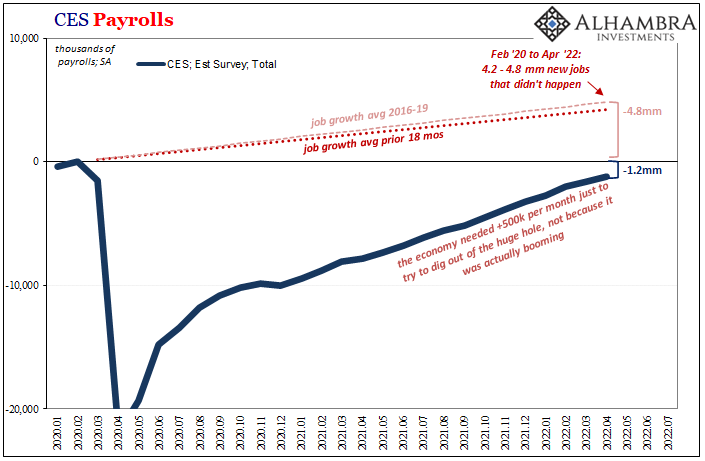

The slowdown part now inarguable, wouldn’t you know it, the prospects for serious downturn have already shown up in a variety of domestic labor data. I cited the most recent ISM figures for employment (less than 50) to go along with the first decline in the BLS Household Survey (in April) since 2020 (the May estimates will be released tomorrow, and it wouldn’t be at all surprising nor inconsistent if the HH figure rebounded). |

|

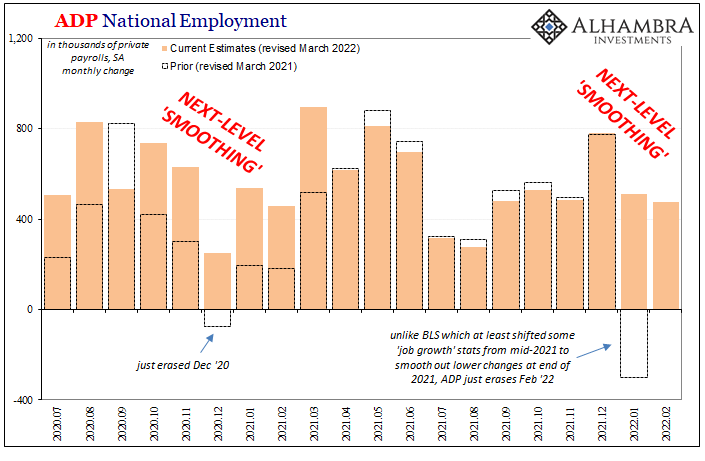

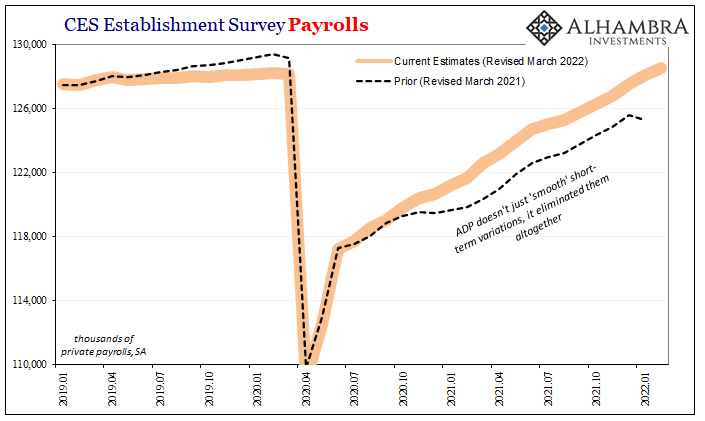

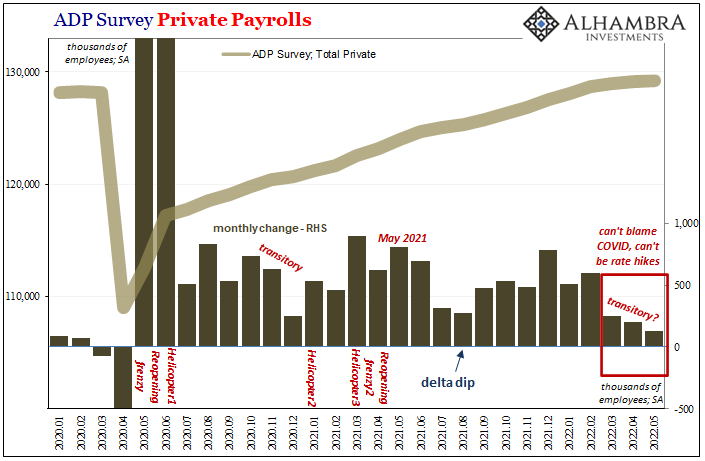

| Today we add ADP – though we do so acknowledging how we have to take it with huge grains of benchmark salt. This particular data series had done this before, pointing to a material labor market slowdown only to completely revise it away trying to catch up and stay up with discontinuities in the BLS’s CPS (you can read about those here).

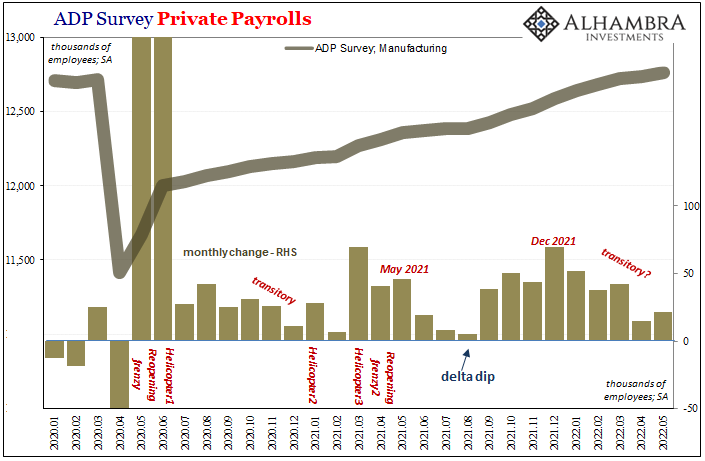

A key piece of this new slowdown in ADP data begins with, sure enough, recent revisions (not benchmarks) especially to the March 2022 estimate (reduced by more than 200,000). A similar-sized downward revision for April with now a low in May, a gain of just 128,000, lowest since April 2020, and Biden’s forecast is looking good months before he made it. Increasing uncertainty, at least, is apparent in the ADP data for manufacturing jobs, too, despite the fact the goods economy is supposed to be still on a tear. |

|

| On the contrary, manufacturing employment has struggled all along before this current downshift (blamed on a labor shortage that just doesn’t make sense). | |

| And, like Germany’s retail sales crash in April, this can’t be blamed on COVID. It will be attributed to the Putin Price Hike or in some ways tied to the Fed’s inflation-fighting rate hikes and QT, though the hikes had only been first begun back in March and balance sheet runoff yet to commence (they’ll absurdly claim monetary policy tightening “sentiment” and forward guidance had been working from late last year).

But even the reason (Euro$ #5), to some degree, is now beside the point. Instead, as the chances of this downside approach certainty, any leftover consideration is, as I started, about how far down. The official political view is that any slowdown is a good thing, a necessary development to Phillips Curve the crap out of inflation while starting the fight from a good place. |

|

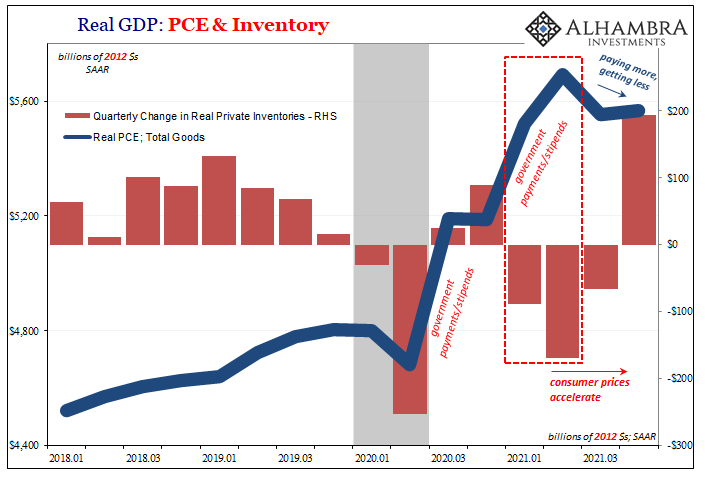

All the actual data, however, shows that “inflation” instead had played a central role in keeping the economy’s rebound from doing any better than insufficient.

Currently, analysts are expecting Establishment Survey payrolls to have downshifted, too, though not quite all the way to the 150,000 per month pace President Phillips had cited. Updated data, including, provisionally, ADP, suggests that’s just the best-case scenario and not all that probable of one. |

Tags: currencies,economy,employment,Featured,Federal Reserve/Monetary Policy,Joe Biden,Labor Market,manufacturing,Markets,newsletter,payrolls,Unemployment