Donald Trump’s poll numbers were looking increasingly unhealthy at the time of writing, but at least the cocktail of drugs administered to the coronavirus-stricken President appears to have worked. This is encouraging news in the fight against the virus and a considerable achievement for Regeneron, whose founders increased their stake in the company after a French pharma group pulled back earlier this year. At this point, markets are increasingly taking on board...

Read More »House View, September 2020

Macroeconomy A surge in new covid-19 cases in a number of countries has interrupted progress towards normality, yet the effects of the virus are becoming more manageable and positive world H2 growth is achievable. Prospects for the US economy hinge on the ability of Washington to agree a new fiscal support package. While we have raised out 2020 GDP projection for the US we remain prudent. We expect the Fed to provide more stimulus via increased asset purchases,...

Read More »House View, June 2019

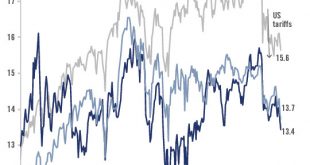

Pictet Wealth Management's latest positioning across asset classes and investment themesAsset allocationWe have turned tactically underweight on global equites, including US equities, given elevated valuations, mixed economic data and rising trade tensions. We remain neutral on euro area equities, where valuations are generally more reasonable than in the US. We have also moved from an overweight to neutral stance on Asian emerging-market equities.At the same time as we remain focused on...

Read More »House View, May 2019

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationThere were no changes to our asset allocation in April. While we are encouraged by better-than-expected Q1 earnings and some improvement in earnings expectations, we remain neutral on global equities as we await new catalysts to justify current valuations. At the same time, we have a positive view of Chinese and Indian equities.We remain underweight government bonds given low yields,...

Read More »House View, April 2019

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationAlthough we expect the economic picture to brighten and the decline in earnings expectations to end, we have a prudent stance on global equities, as expressed in our decision to book some profits on global equities and to invest in put options on large-cap European and small-cap US equities.At the same time, our willingness to take on reasonable risk means that the reduction in equities...

Read More »House View, November 2018

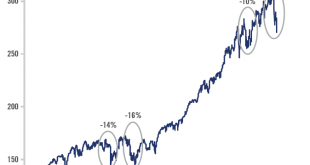

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationWhile the recent sell-off might have been overdone in view of fundamentals that remain basically sound, market gyrations and our expectation of further volatility mean we remain neutral equities overall. The current environment favours active management and a tactical allocation approach, exemplified by the partial sale of equity options we acquired to protect portfolios in early...

Read More »House View, October 2018

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationWe remain underweight or neutral across a number of risk asset classes and overweight liquidity in light of enduring uncertainties, but stand ready to deploy cash as tactical opportunities present themselves.We are neutral DM equities, but pockets of opportunity still exist (in the UK and Japan, for example). EM equities are becoming interesting, but with the risk of further earnings...

Read More »House View, September 2018

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationWe maintain our neutral stance on equities overall on a rolling three-to-six month basis. We do have a more upbeat assessment further out, but the autumn is shaping up to be a sensitive time for risk assets overall.Recent sell-offs validate our cautiousness regarding emerging-market (EM) assets in general. But valuations are becoming more interesting and we do have a bullish short-term...

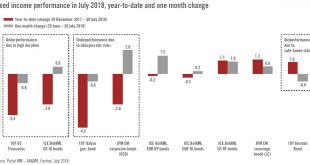

Read More »House View, August 2018

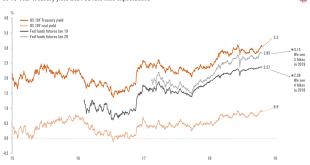

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationOn a tactical, rolling three-to-six- month basis we are maintaining our neutral stance on developed-market equities in general in light of increasing trade and political frictions, but we remain more upbeat on their prospects further out.We have a bullish short-term stance on Asian (ex-Japan) equities given their increasingly attractive valuations but we are paying close attention to...

Read More »House View, July 2018

Pictet Wealth Management’s latest positioning across asset classes and investment themes. Asset Allocation On a tactical, rolling three-to-six-month basis, we are tilting away from a bullish to a neutral stance on developed-market equities as trade and political frictions are rising. That said, we remain more upbeat on their prospects after the summer. Recent sell-offs have vindicated our cautiousness regarding...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org