The recent rise in wage growth is positive for consumption and puts pressure on inflation.Wage growth in Japan accelerated further in March. Nominal cash earnings rose by 2.1% y-o-y, the fastest growth since mid-2003. Base salaries increased by 1.3% y-o-y, the highest in nearly two decades, and the strong rise in bonuses (up 12.8% y-o-y) also contributed significantly to wage growth in March.Rising wage growth in Japan likely reflects the increasing labour market constraints in Japan. Since Shinzo Abe came to office in early 2013, employment in Japan has been climbing steadily. Total employment rose to 66.9 million in March 2018, the highest level in Japan’s history, and 6.9% higher than at the end of 2012. During the same period of time, the unemployment rate in Japan dropped by 1.8

Topics:

Dong Chen considers the following as important: Japan household consumption, Japan wage force, Japanese wage growth, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The recent rise in wage growth is positive for consumption and puts pressure on inflation.

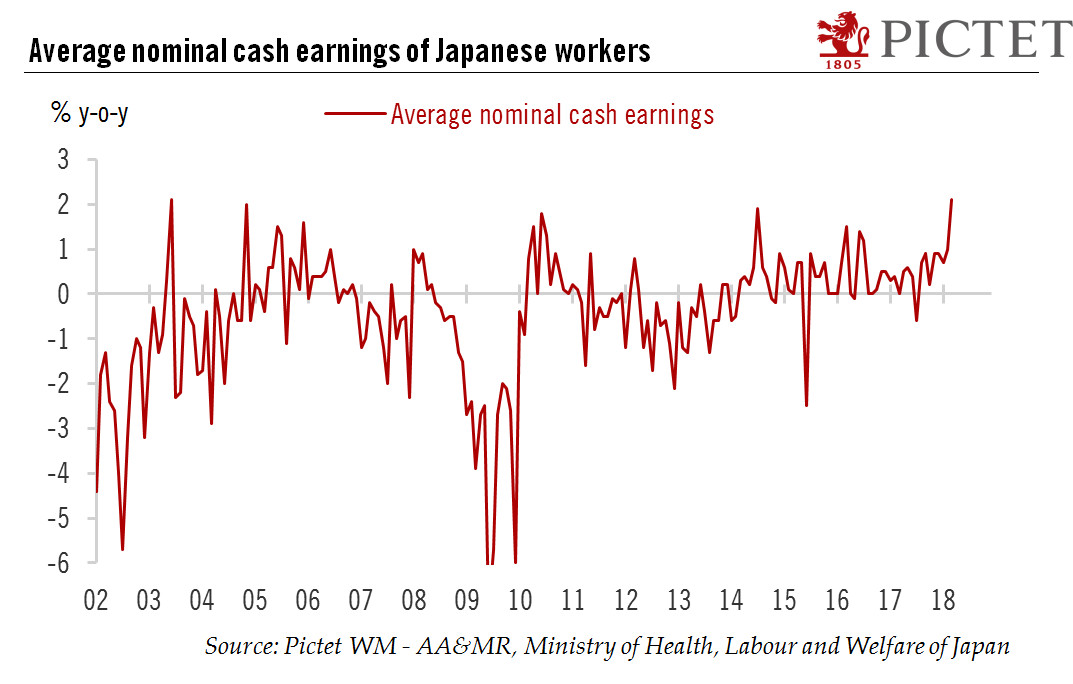

Wage growth in Japan accelerated further in March. Nominal cash earnings rose by 2.1% y-o-y, the fastest growth since mid-2003. Base salaries increased by 1.3% y-o-y, the highest in nearly two decades, and the strong rise in bonuses (up 12.8% y-o-y) also contributed significantly to wage growth in March.

Rising wage growth in Japan likely reflects the increasing labour market constraints in Japan. Since Shinzo Abe came to office in early 2013, employment in Japan has been climbing steadily. Total employment rose to 66.9 million in March 2018, the highest level in Japan’s history, and 6.9% higher than at the end of 2012. During the same period of time, the unemployment rate in Japan dropped by 1.8 percentage points (to 2.5% in March).

With wage growth gaining momentum, we expect consumption in Japan to pick up again after showing some softness in the first quarter of 2018.

The strong wage growth in Japan adds some upside risk to our inflation forecast, especially for 2019. However, we also recognise that some offsetting factors are at play that may dampen price pressure, at least in the short term, such as the strong trend to replace human labour with new technologies and a certain inertia in Japanese labour relations.

With these factors in mind, we have decided to keep our inflation forecast unchanged and we continue to expect the Bank of Japan (BoJ) to maintain its monetary easing without any policy adjustment throughout 2018.