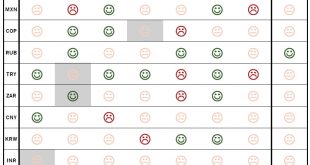

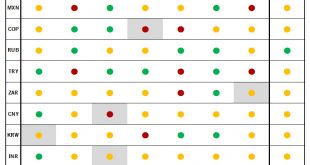

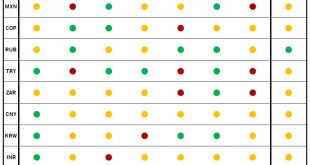

Scorecard shows resilience of EM currencies in recent months.Our Emerging Market (EM) FX scorecard, designed to assess the attractiveness of a given currency over the coming 12 months, ranks 10 EM currencies according to key criteria such as growth and vulnerability to external shocks.There have been few changes over the past month. EM currencies have been resilient thus far in 2018, despite higher risk aversion and higher US funding costs. However, taking into account the decline in carry,...

Read More »The Brazilian real and Russian rouble are still the most attractive EM currencies

Our EM currencies scoreboard shows valuation factors driving the Chinese renminbi turning negative, while idiosyncratic factors behind the South Africa rand have improved.Our Emerging Market (EM) FX scorecard, designed to assess the attractiveness of a given currency over the coming 12 months, ranks 10 EM currencies according to key criteria such as growth and vulnerability to external shocks.There have been only few changes over the past month. Our EM FX scorecard still shows the Brazilian...

Read More »Our emerging market currencies scorecard gives good marks to real and rouble

The scope of this note is to present a score card for Emerging Market (EM)currencies, designed to assess the attractiveness of a given currency over the coming 12 months. The scorecard (see chart), constructed using a rules – based methodology, suggests that the Russian rubble and the Brazilian real are currently among the most attractive EM currencies. EM FX scorecard - Click to enlarge Construction of the EM FX...

Read More »Our emerging market currencies scorecard gives good marks to real and rouble

Our EM currencies scorecard suggests that the Russian rubble and the Brazilian real are currently among the most attractive EM currencies.Our Emerging Market (EM) FX scorecard, designed to assess the attractiveness of a given currency over the coming 12 months, ranks 10 EM currencies according to key criteria. The indicators we singled out to analyse the relative attractiveness of EM currencies are growth, inflation, valuation, carry, vulnerability to external shocks, trade and idiosyncratic...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org