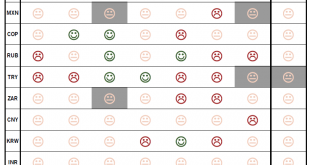

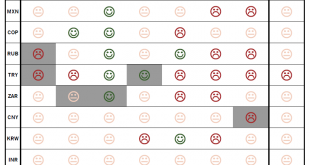

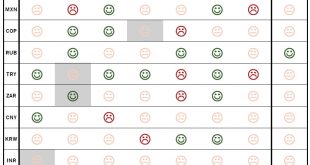

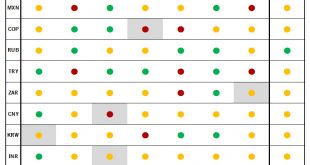

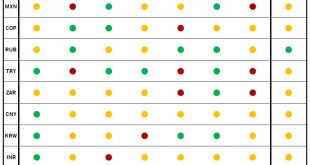

Up to now, emerging market (EM) currencies have been resilient in the face of market turmoil.Our EM FX scorecard, which ranks 10 EM currencies according to key criteria (such as growth and vulnerability to external shocks) saw few changes over the past month. The Fed’s current hawkish attitude remains a headwind for EM currencies, at it increases funding costs. That being said, the weakest EM currencies have seen some stabilisation, particularly for the Turkish lira and the Argentinian peso....

Read More »Sombre scorecard for EM currencies

A challenging global environment has sapped the appeal of all the EM currencies we track.There have been few changes in our emerging market (EM) currencies scorecard over the past month. Currently, it suggests that no EM currency at present is particularly attractive on a 12-month horizon.August was a particularly harsh month for EM currencies, with the Argentinian peso and the Turkish lira both dropping 25% against the US dollar. While these two currencies were particularly vulnerable to a...

Read More »Russian rouble: significantly undervalued but quite risky

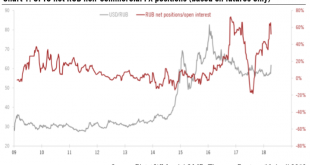

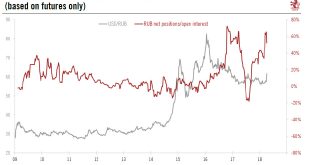

On 6 April, the Trump Administration announced additional and more severe sanctions against Russia “in response to the totality of the Russian government’s ongoing and increasingly brazen pattern of malign activity around the world”. US sanctions target seven Russian oligarchs, 12 companies controlled by them, and 17 high-ranking government officials. The measures freeze any US assets held by those targeted and cut them...

Read More »Russian rouble: significantly undervalued but quite risky

The Russian rouble is now undervalued – but risky - following a sharp drop in the wake of the Trump Administration’s announcement of new sanctions.On 6 April, the Trump Administration announced additional and more severe sanctions against Russia “in response to the totality of the Russian government’s ongoing and increasingly brazen pattern of malign activity around the world”. These sanctions confirm a tougher stance of the US Congress against Russia.Following the announcement, the Russian...

Read More »The Brazilian real and Russian rouble are still the most attractive EM currencies

Scorecard shows resilience of EM currencies in recent months.Our Emerging Market (EM) FX scorecard, designed to assess the attractiveness of a given currency over the coming 12 months, ranks 10 EM currencies according to key criteria such as growth and vulnerability to external shocks.There have been few changes over the past month. EM currencies have been resilient thus far in 2018, despite higher risk aversion and higher US funding costs. However, taking into account the decline in carry,...

Read More »The Brazilian real and Russian rouble are still the most attractive EM currencies

Our EM currencies scoreboard shows valuation factors driving the Chinese renminbi turning negative, while idiosyncratic factors behind the South Africa rand have improved.Our Emerging Market (EM) FX scorecard, designed to assess the attractiveness of a given currency over the coming 12 months, ranks 10 EM currencies according to key criteria such as growth and vulnerability to external shocks.There have been only few changes over the past month. Our EM FX scorecard still shows the Brazilian...

Read More »Our emerging market currencies scorecard gives good marks to real and rouble

The scope of this note is to present a score card for Emerging Market (EM)currencies, designed to assess the attractiveness of a given currency over the coming 12 months. The scorecard (see chart), constructed using a rules – based methodology, suggests that the Russian rubble and the Brazilian real are currently among the most attractive EM currencies. EM FX scorecard - Click to enlarge Construction of the EM FX...

Read More »Our emerging market currencies scorecard gives good marks to real and rouble

Our EM currencies scorecard suggests that the Russian rubble and the Brazilian real are currently among the most attractive EM currencies.Our Emerging Market (EM) FX scorecard, designed to assess the attractiveness of a given currency over the coming 12 months, ranks 10 EM currencies according to key criteria. The indicators we singled out to analyse the relative attractiveness of EM currencies are growth, inflation, valuation, carry, vulnerability to external shocks, trade and idiosyncratic...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org