The Eurogroup is set to conclude its third review of Greece’s bailout programme. The country could exit the programme this summer.Eight years after it first requested financial assistance from its European and international partners in April 2010, Greece has never been so close to a ‘clean exit’ from its bailout programme(s). The economy has shown more convincing signs of improvement, with real GDP recovering since mid-2016 and fall in unemployment accelerating in 2017. Macro imbalances have started to correct and the primary budget surplus that Greece has managed to generate is expected to be sustained in the coming years.True, the preliminary State Budget figures of primary surplus for 2017 were slightly weaker than expected (EUR1.97bn in 2017 after EUR 2.78bn in 2016), but fiscal

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: Greek primary surplus, Greek recovery, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The Eurogroup is set to conclude its third review of Greece’s bailout programme. The country could exit the programme this summer.

Eight years after it first requested financial assistance from its European and international partners in April 2010, Greece has never been so close to a ‘clean exit’ from its bailout programme(s). The economy has shown more convincing signs of improvement, with real GDP recovering since mid-2016 and fall in unemployment accelerating in 2017. Macro imbalances have started to correct and the primary budget surplus that Greece has managed to generate is expected to be sustained in the coming years.

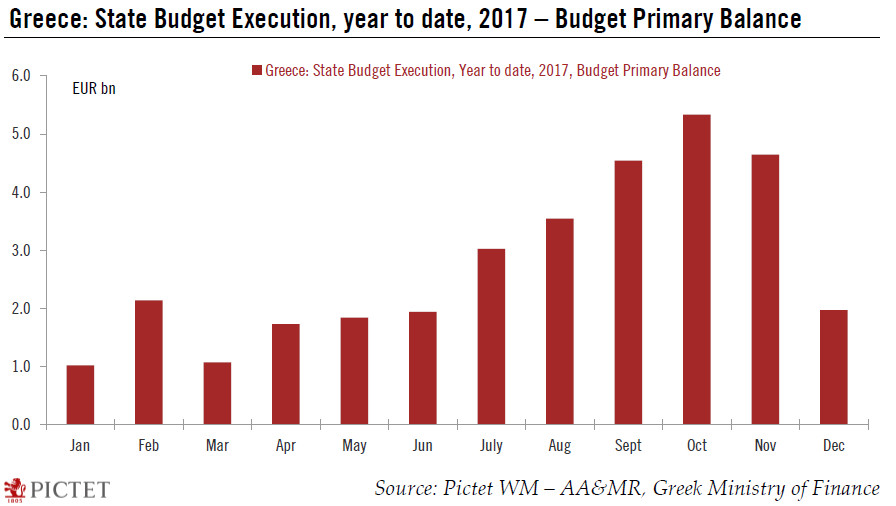

True, the preliminary State Budget figures of primary surplus for 2017 were slightly weaker than expected (EUR1.97bn in 2017 after EUR 2.78bn in 2016), but fiscal spending remained well contained and the improved economic momentum should help eventually.

This week, the Greek parliament approved a series of laws that should pave the way for the conclusion of the third bailout review at the 22 January Eurogroup, followed by the disbursement of the next bailout tranche of EUR6bn-7bn (out of a programme total of EUR86bn). The discussion has already shifted to the type of post-bailout agreement creditors are willing to grant Greece. Greek officials have so far ruled out asking for a precautionary credit line as they plan to accumulate a capital buffer of around EUR19bn. These discussions may still create tensions with the creditors before August, but they are unlikely to derail the bailout-exit process, in our view. In the end, whether a post-bailout credit line will be needed or not will depend on market access, including a possible new debt issue next month, as well as the shape of any additional debt relief.