Overall, June saw a halt to recent declines in euro area business sentiment survey. The final reading for the euro area composite Purchasing Managers’ Index (PMI) rose from 54.1 in May to 54.9 in June, slightly higher than the initial estimate of 54.8. However, the manufacturing PMI fell further, to an 18-month low of 54.9, due to weakness in France and Germany. Growth remains decent in the sector but, as Markit...

Read More »Euro area: a slight rebound

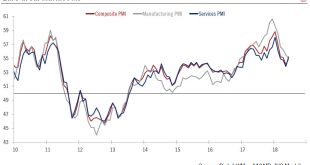

Overall, June saw a halt to recent declines in euro area business sentiment survey.The final reading for the euro area composite Purchasing Managers’ Index (PMI) rose from 54.1 in May to 54.9 in June, slightly higher than the initial estimate of 54.8. However, the manufacturing PMI fell further, to an 18-month low of 54.9, due to weakness in France and Germany. Growth remains decent in the sector but, as Markit noted, the decline in business optimism “reflects rising trade worries, political...

Read More »PMIs point to downside risk to near term euro area growth

Euro area flash PMI indices failed to stabilise in May. Details were somewhat less worrying than headline numbers and overall still consistent with a broad-based economic expansion, if only at a slower pace than last year. Our forecast of 2.3% GDP growth in 2018 still holds, but the balance of risks is now clearly tilted to the downside in sharp contrast with the situation prevailing a few months ago. The deterioration...

Read More »PMIs point to downside risk to near term euro area growth

Following another disappointing set of business sentiment indicators, speculation over a longer extension of QE is rising.Euro area flash PMI indices failed to stabilise in May. Details were somewhat less worrying than headline numbers and overall still consistent with a broad-based economic expansion, if only at a slower pace than last year. Our forecast of 2.3% GDP growth in 2018 still holds, but the balance of risks is now clearly tilted to the downside in sharp contrast with the...

Read More »Europe chart of the week – Business surveys

There was a broad-based setback in euro area business surveys in February, whether in terms of country or of sector. The Flash composite PMI slipped to 57.5 in February from 58.8 in January. The month-to-month dip was the biggest since 2014. National business surveys painted a similar picture. In Germany, the Ifo business climate index dropped by 2.2 points to 115.4 in February, from an all-time high of 117.6 in...

Read More »Europe chart of the week – Business surveys

Latest business surveys surprise on the downside, but still indicate that economic expansion remains strong.There was a broad-based setback in euro area business surveys in February, whether in terms of country or of sector. The Flash composite PMI slipped to 57.5 in February from 58.8 in January. The month-to-month dip was the biggest since 2014.National business surveys painted a similar picture. In Germany, the Ifo business climate index dropped by 2.2 points to 115.4 in February, from an...

Read More »Euro area: The sky is the limit

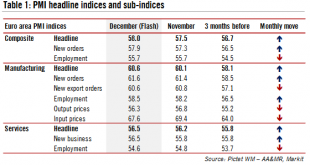

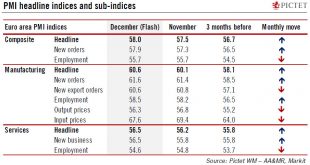

Momentum in the euro area picked up further at the end of the year. The flash composite purchasing managers’ index (PMI) increased to 58.0 in December, from 57.5 in November, above consensus expectations (57.2). The improvement was once again broad-based across sectors. Both the manufacturing (+0.5 to 60.6) and services (+0.3 to 56.5) indices improved in December, with the former reaching its highest level since the...

Read More »Euro area: The sky is the limit

The latest flash purchasing managers index surveys showed robust momentum for the euro area. We maintain our GDP growth forecast of 2.3% for 2017.Flash purchasing managers’ indices (PMIs) for the euro area ended the year on a strong note. The composite PMI increased to 58.0 in December, from 57.5 in November, above consensus expectations (57.2).The robust momentum was led by a booming manufacturing sector, while services sentiment also improved.The breakdown by sub-indices was pretty strong,...

Read More »Another broad-based rise in PMI… a headache for the ECB?

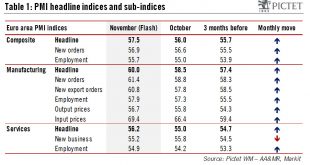

The so-called ‘Euroboom’ is showing no sign of abating as euro area PMI indices rise to new highs, making it increasingly difficult for the ECB to justify its accommodative monetary stance.The euro area composite purchasing managers index (PMI) index surged well above expectations in November amid broad-based improvements across sectors and countries and the strongest pace of job creation in 17 years.At face value, November PMIs look consistent with real GDP growth accelerating further in...

Read More »Business surveys show strong end to Q3 in euro area

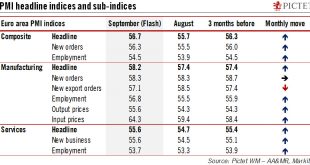

Better-than-expected Flash PMI numbers in September mean that the quarter is ending on a strong note, with some upside risks ahead.Flash PMI surveys for the euro area ended the third quarter on a strong note. The composite flash PMI increased to 56.7 in September from 55.7 in August against consensus expectations for a stable print (55.6).The breakdown by sub-indices showed pretty strong signals in most forward-looking components, with the sole weak spot manufacturing new export orders....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org