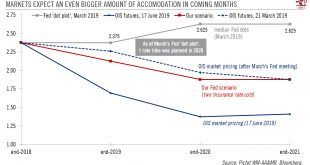

All eyes will be on the Fed policy meeting this week. We believe thoughts of immediate action are premature, but the Fed will push through ‘insurance’ rate cuts in the coming months.The Fed should remain on hold on 19 June, but Chairman Powell is likely to mention the possibility of cutting rates in the coming months, especially if trade tensions continue. Potential monetary easing would be framed as ‘insurance’ rate cuts, similar to those pushed through in 1995 and 1998, mostly to backstop...

Read More »Fed meeting confirms our forecast for tightening

Fed rate hikes this year are on auto pilot. But things could change in 2019.As widely expected, on 13 June the Federal Reserve raised its fed funds target rate range by 25bps (and the interest rate on excess reserves by 20bps), bringing the range to 1.75-2.0%. The ‘dot plot’ median (Fed members’ forecasts of future rate hikes) rose from three rate hikes in 2018 to four. Fed members still expected three additional hikes next year.A fed funds rate of up to 2% is new territory for the Fed,...

Read More »Soft U.S. retail data conceals healthy consumer spending

Macroview Our forecasts for US GDP growth remain unchanged, and we continue to expect a 25bp rate hike in December, followed by two others in 2017. Core retail sales in the U.S. rose by ‘only’ 0.1% month on month ( m-o-m) in September, below consensus expectations. Moreover, the July number was revised down. The result was that core retail sales were almost flat (+0.3% quarter on quarter (q-o-q) annualised in Q3), much lower than the 6.9% rise seen in Q2. Nevertheless, we continue to believe...

Read More »US wages continue to rise at a gentle pace

Modest wage pressures and low inflation expectations mean we see no reason to change our forecast of a single Fed rate increase this year, probably in December The US Employment Cost Index increased by 0.6% quarter-on-quarter and by 2.3% year-on-year in the second quarter, in line with expectations.Potential domestic wage pressures in the US remain hard to analyse. The unemployment rate has fallen sharply, and most other labour market indicators have improved. Although there is much...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org