All eyes will be on the Fed policy meeting this week. We believe thoughts of immediate action are premature, but the Fed will push through ‘insurance’ rate cuts in the coming months.The Fed should remain on hold on 19 June, but Chairman Powell is likely to mention the possibility of cutting rates in the coming months, especially if trade tensions continue. Potential monetary easing would be framed as ‘insurance’ rate cuts, similar to those pushed through in 1995 and 1998, mostly to backstop...

Read More »Taking the Fed’s dots at face value

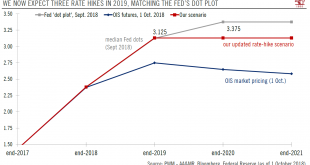

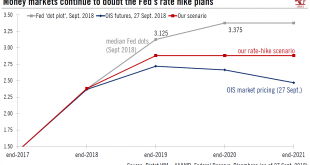

We now expect the Fed to raise rates three times next year instead of two.The Federal Reserve (Fed) is subtly turning more hawkish, mostly due to its increased confidence in the US outlook. While the Fed’s ‘dot plot’ chart (which illustrates the central bank’s rate hike projections) was unchanged in September from June, we think the chart’s message that there will be three Fed rate hikes next year should be taken more seriously by the market.Consequently, we are revising up the number of...

Read More »Fed rate hikes well into 2019 may be on the cards

Fed sticks to routine of one hike per quarter, with growing chance of extra rate increase next year.As widely expected, the Fed hiked rates another 25bps on 26 September, continuing its routine of raising rates by 25bps each quarter.The Fed displayed optimism about US growth prospects. Chairman Powell said that the US was in a bright spot that was expected to last. This optimistic tone was echoed by a rise in the Fed’s GDP growth forecasts, including for next year – even as higher trade...

Read More »Fed meeting confirms our forecast for tightening

Fed rate hikes this year are on auto pilot. But things could change in 2019.As widely expected, on 13 June the Federal Reserve raised its fed funds target rate range by 25bps (and the interest rate on excess reserves by 20bps), bringing the range to 1.75-2.0%. The ‘dot plot’ median (Fed members’ forecasts of future rate hikes) rose from three rate hikes in 2018 to four. Fed members still expected three additional hikes next year.A fed funds rate of up to 2% is new territory for the Fed,...

Read More »Fed policy meeting preview

Policy makers’ forecast for rate hikes this year likely to be raised, but central bank will be much more cautious on view further out.The Federal Reserve’s 12-13 June meeting takes place amid a strong economic backdrop at home, and the Fed is unlikely to hesitate about hiking rates by another quarter-point to a range of 1.75-2.00% this week. The US labour market is particularly solid: the unemployment rate dropped to 3.8% in May, the lowest rate since April 2000. The three-month average gain...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org