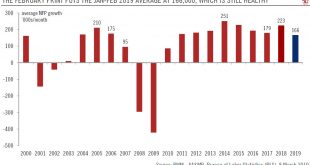

Despite a weaker than expected February employment report, the three-month average remains robust and we would tend to dismiss this weak print as a mere ‘blip’.With only 20,000 job additions, the US employment report for February was weak. However, with the three-month average remaining robust at 186,000, we would tend to dismiss this weak print as a mere ‘blip’. Furthermore, the weak reading is inconsistent with other labour market data and indicators, including recent consumer and business...

Read More »US jobs report shows recession risk is limited

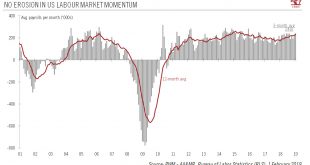

In spite of the federal shutdown and the loss in growth momentum in other countries, the US continues to churn out jobs, while a dovish Fed may prolong the economic cycle.US employment rose by a solid 304,000 in January (+1.9% year on year, y-o-y), compared with 222,000 in December. The three-month average was a healthy 241,000/month. Meanwhile, the ISM manufacturing survey rose to a robust 56.6 in January from 54.3 in December.Overall, these two pieces of data suggest that US macro momentum...

Read More »Stagnant US trucker wages raise questions about macro theory

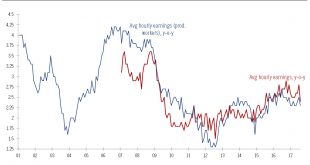

In spite of a thriving economy and driver shortages, wage growth in US haulage have been lagging, leaving economists (and Fed officials) scratching their headsDespite a huge shortage of drivers and soaring transportation costs as a result, wages in the US haulage sector have remained stuck. This illustrates the ongoing chasm between macro theory (which would suggest much stronger wages) and reality (still-tepid wage growth).While microeconomic dynamics specific to the sector might be at play...

Read More »US employment and wage growth continue to shine

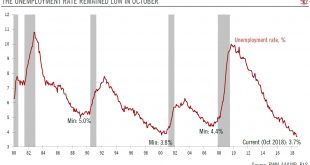

Latest data indicates the US business cycle is in good shape and sets the stage for rate hike next month.US employment grew by 250,000 in October (+1.7% y-o-y); the 3-month average is now a solid 218,000/month, and strong October payroll results were strong, which bodes well for US GDP growth in Q4. It appears therefore that the US’ heated rhetoric towards China is having little effect so far on the US economy.The mere fact that the US economy continues to generate such job growth is an...

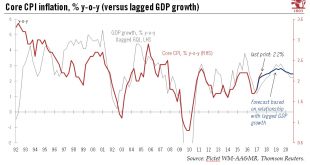

Read More »Consumer inflation is still tame in the US

Leaving aside energy prices, there was only modest upward pressure on inflation in May.Rising energy prices continued to push up US inflation in May, but excluding this volatile category, underlying inflationary pressures remained tame, in contrast with the very solid labour market and above-potential GDP growth. This modest inflation picture is echoed by still-soft wage growth (below 3% y-o-y) and well-anchored consumer inflation expectations. In other words, there are still no signs that...

Read More »US jobs momentum remains robust

The May nonfarm report shows the labour market remains in fine fettle, even though wage gains are still not broad based.The May employment report showed that the US labour market – and the US economy more broadly – remains in great shape, with non-farm payrolls growing by 223,000 last month. The 2018 year-to-date average, at 207,000, is above last year’s 182,000. This strength is reassuring news, especially given the erratic course of US trade policy. The US labour market’s strength was...

Read More »US chart of the week – Benefits vs wages

Subdued wage growth disguises rising cost of total compensation.The next US monthly employment report (published this Friday) will once again be scrutinised for signs that wage growth is on the rise. While wage growth has been improving in recent years, the pace has remained glacial. Average hourly earnings were up 2.6% y-o-y in February, a relatively subdued pace when taking into account near full employment (the unemployment rate was 4.1% in February).There are many factors explaining the...

Read More »US employment—Goldilocks again

After a solid February job report, we continue to expect four Fed rate hikes this year (and two in 2019).There are two main conclusions to be drawn from the February US employment report. First, the US economy’s underlying momentum is particularly robust, consistent with our view that GDP growth will pick up to 3.0% this year, from 2.3% in 2017. Second, while the labour market is tight, there is still some slack left; in other words, the US labour market is not (yet) overheating.That...

Read More »US employment—It’s Goldilocks!

October non-farm payrolls provided another sign of the US economy’s strength. But tepid wage growth means the Fed will likely remain cautious.October payrolls showed the US economy remains in fine fettle, as underlying payroll growth remained firm. Robust labour-market signals echo recent solid business surveys, strong job opening data, and very low levels of initial jobless claims.Payrolls rose 261,000, reversing some hurricane-related weakness (payroll growth was only 18,000 in September)....

Read More »Underlying momentum in US employment remains intact

After a jobs report seriously distorted by extreme weather, the Fed remains on track to raise rates again in December.Nonfarm payrolls fell 33,000 in September, with data affected by hurricanes in the southern US. These aside, labour market signals – especially when looking at the household survey – remain solid. After a drop of 74,000 in August, employment rose 906,000 in the household survey, leading to a sharp fall in unemployment to 4.2%, the lowest rate since February 2001.The bottom...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org