At next week’s meeting, the Fed may well debate recent criticism of it by President Trump, but we continue to see the central bank tightening rates each quarter.The Federal Reserve’s next regular, two-day policy meeting will take place on 31 July-1 August. The Fed is very unlikely to raise rates and the post-meeting statement should contain limited news since Chairman Jerome Powell gave a good overview of his latest thinking before Congress only last week. Although uneventful in appearance, next week’s Fed meeting is likely to see an intense debate among policymakers (how intense will emerge in minutes from the meeting, to be released on 22 August) on issues such as the ongoing escalation of trade threats (President Trump recently threatened to tax all Chinese imports) and on the US

Topics:

Thomas Costerg considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

At next week’s meeting, the Fed may well debate recent criticism of it by President Trump, but we continue to see the central bank tightening rates each quarter.

The Federal Reserve’s next regular, two-day policy meeting will take place on 31 July-1 August. The Fed is very unlikely to raise rates and the post-meeting statement should contain limited news since Chairman Jerome Powell gave a good overview of his latest thinking before Congress only last week. Although uneventful in appearance, next week’s Fed meeting is likely to see an intense debate among policymakers (how intense will emerge in minutes from the meeting, to be released on 22 August) on issues such as the ongoing escalation of trade threats (President Trump recently threatened to tax all Chinese imports) and on the US president’s recent criticism of Fed tightening.

President Trump said on 19 July that he was “not thrilled” about the Fed’s rate hikes. He accused the Fed of undermining the fiscal boost provided by his administration. But we believe the Fed is quite unlikely to react or change anything to its rate hike plans in response to this criticism. Fed policy-makers have a longer-term perspective than politicians. They know that their reputations would suffer a huge blow if the result of bowing to President Trump’s wishes was a sudden upward lurch in inflation.

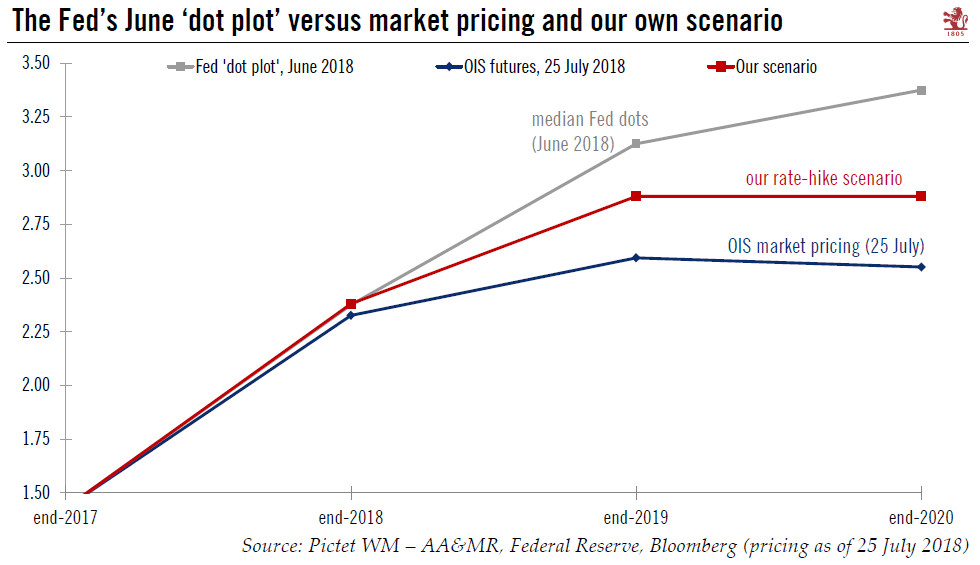

The statement at the end of next week’s meeting (there will no press conference nor new economic or rate projections) should be little changed from the one released in June, although it might strike a more upbeat tone on the US economy given that the Q2 GDP print, out on 27 July, is likely to be strong (above 4.0% q-o-q SAAR). The Fed’s statement is unlikely to explicitly signal a rate hike in September, although this still remains the most likely scenario in our view and in the view of market participants. The market is seeing a 91% probability of a rate hike on 26 September, according to Bloomberg market data.