Summary:

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationWe retain a slight overweight in DM equities owing to good fundamentals, but it is especially important at present to be well protected against downside risk.Markets appear unduly complacent, and volatility could rise in the coming months. This will create opportunities for tactical trading and especially hedge funds.Low correlations and a pick-up in disruptive M&A are already creating an improved environment for active management.EM assets have rebounded but a recovery in the USD could check EM assets’ performance. It may still make more sense for the moment for risk-averse investors to play EM through DM – investing in DM multinationals with a large EM footprint.CommoditiesBarring a geopolitical

Topics:

Perspectives Pictet considers the following as important: asset allocation, Macroview, market stance, Pictet positioning, Pictet strategy

This could be interesting, too:

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationWe retain a slight overweight in DM equities owing to good fundamentals, but it is especially important at present to be well protected against downside risk.Markets appear unduly complacent, and volatility could rise in the coming months. This will create opportunities for tactical trading and especially hedge funds.Low correlations and a pick-up in disruptive M&A are already creating an improved environment for active management.EM assets have rebounded but a recovery in the USD could check EM assets’ performance. It may still make more sense for the moment for risk-averse investors to play EM through DM – investing in DM multinationals with a large EM footprint.CommoditiesBarring a geopolitical

Topics:

Perspectives Pictet considers the following as important: asset allocation, Macroview, market stance, Pictet positioning, Pictet strategy

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: The Cure For High Prices

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Pictet Wealth Management’s latest positioning in fast-evolving markets.

- We retain a slight overweight in DM equities owing to good fundamentals, but it is especially important at present to be well protected against downside risk.

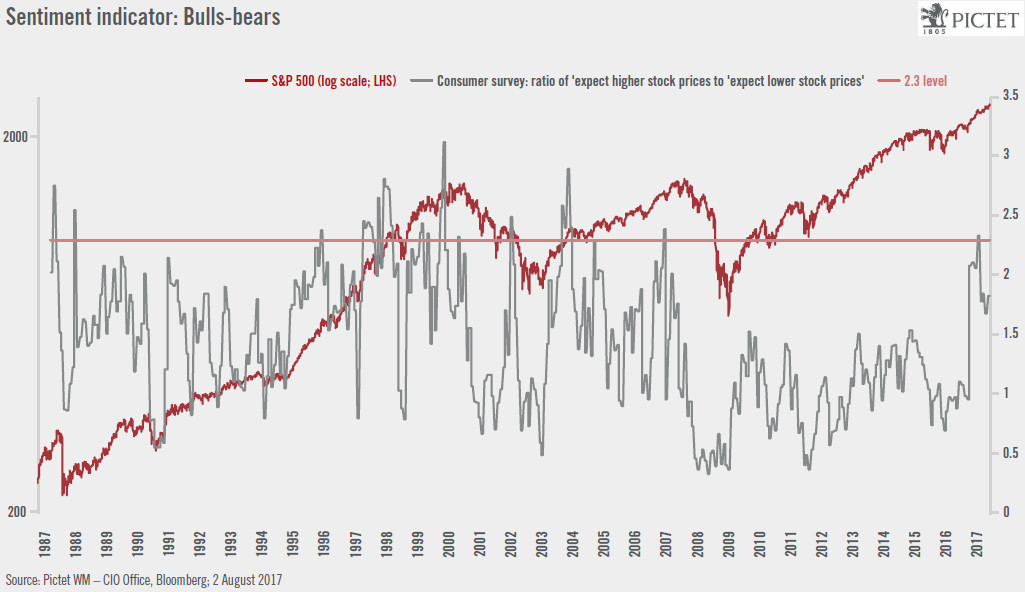

- Markets appear unduly complacent, and volatility could rise in the coming months. This will create opportunities for tactical trading and especially hedge funds.

- Low correlations and a pick-up in disruptive M&A are already creating an improved environment for active management.

- EM assets have rebounded but a recovery in the USD could check EM assets’ performance. It may still make more sense for the moment for risk-averse investors to play EM through DM – investing in DM multinationals with a large EM footprint.

Commodities

- Barring a geopolitical shock, our base scenario is for an equilibrium oil price of not far above USD50/b over the next 12 months.

Equities

- A robust earnings season has helped to support equity markets, but with good 2017 earnings already priced in, currency trends dominated markets in July, with the weaker dollar boosting the S&P 500. However, solid economic and earnings growth should continue to support European equities.

- The Trump trade has faded, and valuations are high, but we remain positive on prospects for DM equities.

Currencies

- We continue to expect the dollar to strengthen in the next six months, and think the pace of CHF weakening against the EUR should abate.

- We maintain our target for a 10-year Treasury yield of 2.8-3.0% by the end of 2017, although we recognise there is scope for rates to undershoot.

- In Europe, there are upside risks to our Bund yield target of 0.7%, encouraging us to remain underweight duration in euro accounts.

- Credit has become progressively more expensive as spreads sink. USD high-yield looks especially exposed to a rise in volatility, which pushed us to sell part of our exposure in June.

Alternatives

- We remain constructive on the opportunity set for active management in the second half of 2017, as correlations remain low. Equity-focused strategies could continue to benefit from an improving economic environment.

- Valuations, competition and capital inflows remain high in Private Equity (PE), but there are still good opportunities for attractive returns. China is becoming increasingly hard to ignore in the PE space.