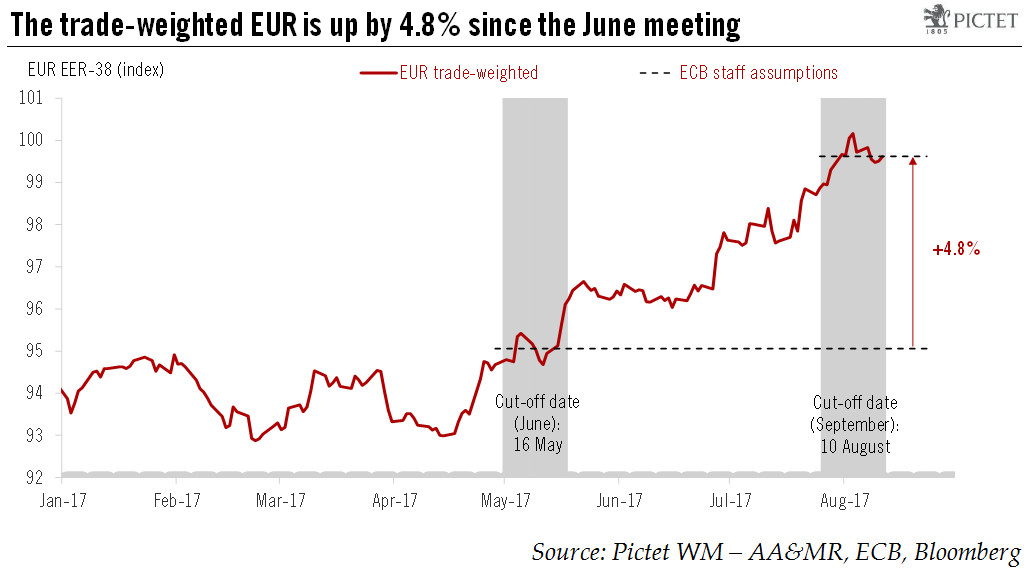

The threat to the ECB’s inflation targets posed by the appreciation of the euro is being offset by strengthening growth in the euro area. The ECB should pursue its cautious exit strategy.The trade-weighted EUR has appreciated by 4.8% since the ECB’s June meeting. ECB models and Mario Draghi’s rule of thumb suggest that a stronger currency could lower euro area inflation by about 30-40bp in 2018-2019, all else being equal.But all else is not equal, and the euro area economy is in a very different shape than three years ago, when Draghi hinted at implicit FX targeting in Amsterdam. His speech in Sintra this year marked a decisive shift in the ECB’s assessment of economic conditions, with more emphasis on confidence, patience, prudence and persistence.Indeed, the main question the ECB will

Topics:

Frederik Ducrozet considers the following as important: ECB exit strategy, ECB inflation projections, ECB monetary policy, euro appreciation, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The threat to the ECB’s inflation targets posed by the appreciation of the euro is being offset by strengthening growth in the euro area. The ECB should pursue its cautious exit strategy.

The trade-weighted EUR has appreciated by 4.8% since the ECB’s June meeting. ECB models and Mario Draghi’s rule of thumb suggest that a stronger currency could lower euro area inflation by about 30-40bp in 2018-2019, all else being equal.

But all else is not equal, and the euro area economy is in a very different shape than three years ago, when Draghi hinted at implicit FX targeting in Amsterdam. His speech in Sintra this year marked a decisive shift in the ECB’s assessment of economic conditions, with more emphasis on confidence, patience, prudence and persistence.

Indeed, the main question the ECB will have to answer ahead of the September meeting: to what extent will stronger growth offset a stronger EUR and make the region more resilient to small shocks? Or, in more technical terms, will the output gap close fast enough to offset downside risks from second-round effects on wages and hysteresis due to headline inflation being lower for even longer?

We continue to expect the ECB to reduce the intensity of its monetary stimulus with great caution and flexibility, extending its QE programme, but at a slower pace in H1 2018 (EUR40bn per month instead of EUR60bn). A detailed announcement is more likely to be made at its 26 October meeting.

In the event that financial conditions tighten further and that there is little the ECB can do to talk down the EUR, the risk is that there are further delays in the ECB’s exit strategy, or at least a more gradual tapering. We continue to expect asset purchases to be fully wound down by the end of 2018. But in an extreme case of sustained EUR appreciation above USD1.20-1.25, one cannot rule out an extension of QE into 2018 at its current pace of EUR60bn per month.